Radiation Oncology Treatment Planning Software Market Report Scope & Overview:

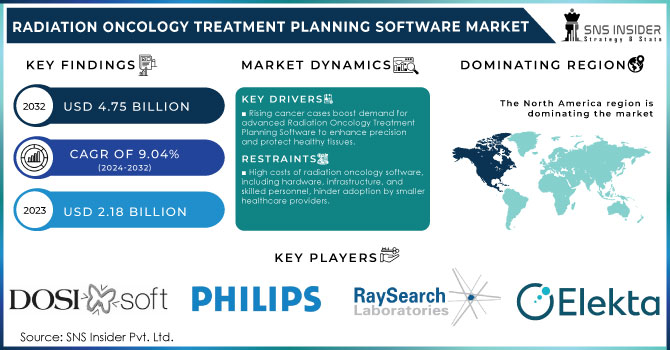

The Radiation Oncology Treatment Planning Software Market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 4.75 billion by 2032 at a CAGR of 9.04% during the forecast period of 2024-2032.

The Radiation Oncology Treatment Planning Software Market is expected to see a huge surge in growth. The growth is mainly due to advancements in technology, the increasing number of cancer cases, and the increasing adoption rate of precision medicine. The most recent statistics imply that approximately 18 million new cancer cases are diagnosed each year worldwide and more than 30% of the patients need radiation therapy as part of their treatment. This high requirement for effective and proper treatment is propelling the growth in the market for radiation oncology treatment planning software. The development of AI within these planning technologies and ML is a key growth factor. AI is utilized by treatment planning software to better irradiate radiation therapy by analyzing complex data and facilitating the delivery of optimized and priority plans specifically for individual patients. AI algorithms of this sort can substantially decrease planning time up to a maximum of 50% and improve the dosage of radiation. In reality, studies suggest that the use of AI systems can improve the accuracy rate of irradiation up to 20%, which can dramatically affect cancer care.

Get More Information on Radiation Oncology Treatment Planning Software Market - Request Sample Report

Furthermore, the demand for personalized treatment plans is becoming increasingly important. However, the demands for such software are expected to grow due to the further utilization of artificial intelligence and machine learning. Moreover, patient-specific imaging and genetic requirements are becoming increasingly important in planning treatment for cancer. Plans of this sort ensure that radiation therapy is tailored specifically to the tumor features of each individual patient, in line with the overarching trend of personalized medicine. Proton therapy is another, similar case since it is an extremely precise method of irradiation. It is growing in popularity and adoption rate, notably among child patients with cancer. This, in turn, is fueling the development of various types of specialized oncology treatment planning software.

MARKET DYNAMICS

DRIVERS

The growing global incidence of cancer drives demand for advanced Radiation Oncology Treatment Planning Software, as the increasing number of patients necessitates precise and effective treatment solutions to improve outcomes and minimize harm to healthy tissues.

The growing worldwide prevalence of cancer contributes to the demand for sophisticated Radiation Oncology Treatment Planning Software. As the number of people suffering from cancer increases, healthcare systems come under pressure to provide accurate and effective care. In this context, the discussed software solution is designed to help radiation oncologists plan and perfect treatment accurately. This type of software ensures that the planned doses of radiation that will need to be exposed to the patient are calculated accurately and that the beam is targeted at the cancerous tissue. As a result, this plan features minimal exposure to active tissues, leading to the minimization of risks and side effects. The software involves complexity due to the modern requirements for treatment together with the need for personal approaches. It relies on advanced imaging tools and advanced algorithms for dose calculations. The discussed tools are adequate for demand because in addition to the worldwide growing prevalence of cancer, they are associated with the developing trend of personalized medicine. It means that in relation to the modern tool, it is oriented at the individual approach to each patient’s cancer through the efficient planning of each step of the treatment; the characteristics are possible how to improve given the opportunity. Overall, the growing worldwide prevalence alongside the development of modern technologies are the key forces driving the demand for these software solutions.

Technological advancements in radiotherapy, including IMRT, SBRT, and VMAT, necessitate advanced planning software that utilizes AI and machine learning to enhance precision, streamline calculations, and optimize treatment plans.

Advanced technologies in radiotherapy, including Intensity-Modulated Radiation Therapy, Stereotactic Body Radiation Therapy, and Volumetric Modulated Arc Therapy, require planning software with AI and machine learning functions. The complexity of the new methods and associated technology demands advanced tools to manage the staggering amount of data and to make the precision of calculations necessary for developing accurate treatment plans a reality. AI-powered software both enhances precision and enables efficiency by evaluating large amounts of data about previous patients to determine optimal doses of radiation and corresponding angles. In such a way, tumors are better targeted while adjacent healthy tissues sustain minimal damage. Meanwhile, machine learning algorithms make it possible to automize various steps of the planning and to improve the accuracy of dose evaluation based on the data from previous treatments. Overall, the integration of AI and machine learning into radiotherapy planning improves the precision and efficiency of the treatments, as well as patient safety and corresponding outcomes.

RESTRAIN

The high costs of implementing and maintaining radiation oncology treatment planning software, including expenses for hardware, software, infrastructure, and skilled personnel, pose a significant barrier to adoption, especially for smaller or underfunded healthcare providers and clinics.

The cost of the radiation oncology treatment planning software is one of the major barriers to its adoption. Not all health care providers and clinics can install these systems because they are extremely expensive. The cost includes facilitation and installation of the systems, purchase of the hardware and software, and in most cases, development of the necessary infrastructure to keep the system operating. Furthermore, when the system is installed, the health care providers need to cover the service and maintenance expenses, which rarely some of the smaller clinics can afford. Unless accompanied by a training budget and the clinic support staff, many health care facilities and clinics cannot afford to install these systems, let alone run them effectively. Therefore, the need to develop and support specific staff trained on using the applications and the applications themselves makes it difficult for a smaller and less wealthier health care providers to invest and justify these costs. Overall, considering the start-up and maintenance costs of the radiation oncology treatment planning software, they can dissuade many smaller clinics from adopting it widely.

MARKET SEGMENTATION ANALYSIS

By Product

The Treatment Planning System segment dominated the market and accounted for 32.04% of the market revenue in 2023, as it plays a critical role in accurately designing patient-specific radiation therapy plans. Companies like RaySearch Laboratories and Elekta have developed highly sophisticated planning software that integrates AI for better dose distribution and tumor targeting. These systems allow healthcare providers to develop comprehensive treatment plans, often integrated with image-guided radiotherapy (IGRT), to minimize side effects while improving treatment efficacy.

The Consulting/Optimization Services is the fastest-growing segment by product and services, as healthcare providers increasingly seek expert guidance in optimizing the use of complex radiation therapy systems. With advancements in treatment modalities like SRS and VMAT, oncology departments require specialized consulting services to ensure seamless integration of software and hardware, as well as optimization of radiation doses.

Need any customization research on Radiation Oncology Treatment Planning Software Market - Enquiry Now

REGIONAL ANALYSIS

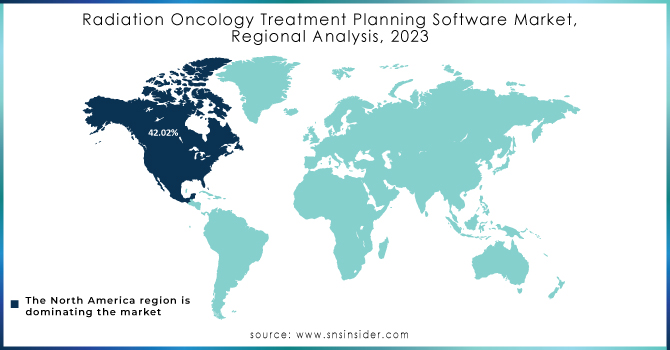

North America segment dominated the market and accounted for 42.02%% of the market revenue in 2023, driven by high investments in healthcare infrastructure, a well-established network of cancer treatment centers, and rapid adoption of advanced technologies. The U.S., in particular, has a strong presence of key industry players like Varian Medical Systems, Elekta, and Accuray, all of which have contributed significantly to market growth. The region also benefits from government support for cancer treatment programs and the implementation of value-based care model.

Asia-Pacific is the fastest-growing region, driven by rising cancer incidences, improving healthcare infrastructure, and growing awareness about advanced cancer treatments. Countries like China, India, and Japan are witnessing an increased demand for radiation oncology treatment planning software due to expanding access to cancer treatment centers and government initiatives aimed at improving cancer care.

KEY PLAYERS

The major Key Players are DOSIsoft SA, Koninklijke Philips N.V., MIM Software Inc., RaySearch Laboratories, Elekta, Brainlab AG, IBA Worldwide, `, VIEWRAY TECHNOLOGIES, INC., Varian Medical Systems, Inc., Institut Straumann AG, Nobel Biocare Services AG, CAMLOG Biotechnologies GmbH, medentis medical GmbH, BEGO Medical GmbH and others.

RECENT DEVELOPMENT

In August 2024: GE HealthCare introduced AI-enhanced radiation oncology treatment solutions at ESTRO 2024, aiming to streamline oncology care pathways and improve patient outcomes. Additionally, Elekta bolstered its Elekta ONE software suite by acquiring Philips' treatment planning patent portfolio, further strengthening its offerings in radiation therapy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.18 Billion |

| Market Size by 2032 | USD 4.75 Billion |

| CAGR | CAGR of 9.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Software, Patient Information Systems, Treatment Planning System, Professional Services, Consulting/Optimization Services, Implementation Services, Post-Sale and Maintenance Services) • By Therapy Type (Stereotactic Radiosurgery (SRS), 3-D Conformal Radiation Therapy (3D CRT), Brachytherapy, Stereotactic Body Radiotherapy (SBRT), Intensity Modulated Radiation Therapy (IMRT), Volumetric Modulated Arc Therapy (VMAT), Others) • By End-User (Hospitals and Physician’s Offices, Research Centers, Government Institutions, Cancer Treatment Centres, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DOSIsoft SA, Koninklijke Philips N.V., MIM Software Inc., RaySearch Laboratories, Elekta, Brainlab AG, IBA Worldwide, Accuray Incorporated, VIEWRAY TECHNOLOGIES, INC., Varian Medical Systems, Inc., Institut Straumann AG, Nobel Biocare Services AG, CAMLOG Biotechnologies GmbH, medentis medical GmbH, BEGO Medical GmbH |

| Key Drivers | • The growing global incidence of cancer drives demand for advanced Radiation Oncology Treatment Planning Software, as the increasing number of patients necessitates precise and effective treatment solutions to improve outcomes and minimize harm to healthy tissues. • Technological advancements in radiotherapy, including IMRT, SBRT, and VMAT, necessitate advanced planning software that utilizes AI and machine learning to enhance precision, streamline calculations, and optimize treatment plans. |

| RESTRAINTS | • The high costs of implementing and maintaining radiation oncology treatment planning software, including expenses for hardware, software, infrastructure, and skilled personnel, pose a significant barrier to adoption, especially for smaller or underfunded healthcare providers and clinics. |