Laser Technology Market Size Analysis:

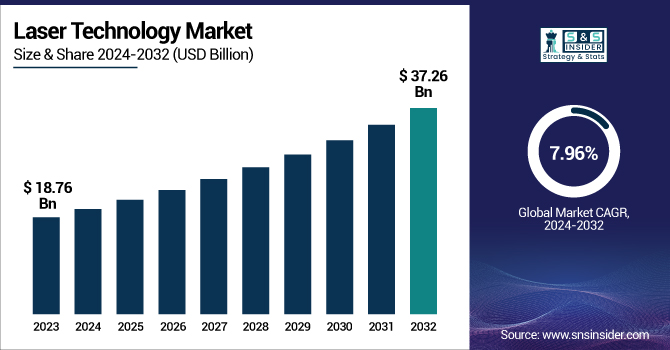

The Laser Technology Market Size was valued at USD 18.76 Billion in 2023 and is expected to reach USD 37.26 Billion by 2032 and grow at a CAGR of 7.96% over the forecast period 2024-2032.

To Get more information on Laser Technology Market - Request Free Sample Report

Advancements in laser technology have driven the market, with fab capacity utilization continuing to rise as foundries optimize the efficiency of production. The laser power segment is becoming more diverse, with high-power lasers finding more applications in tasks such as industrial cutting, welding, and medical. Lasers are fast becoming the manufacturing technology of choice across automotive, electronics, and aerospace industries as precision and efficiency learn from our differences.

Furthermore, it is rapidly expanding into a variety of other areas with new applications such as quantum computing, biomedical diagnostics, and environmental monitoring. The U.S. laser technology market witnessed significant advancements across multiple sectors. The U.S. Army deployed and utilized its laser weapons to combat drones in the Middle East, which is a significant improvement in terms of defense applications.

The U.S. Laser Technology Market is estimated to be USD 3.49 Billion in 2023 and is projected to grow at a CAGR of 8.30%. The U.S. laser technology market has been expanding because of improvements in accuracy manufacturing, increased usage of laser-based medical solutions, growing usage of military defense systems, and an increase in uses in telecommunication and autonomous vehicles.

Laser Technology Market Dynamics

Key Drivers:

-

Revolutionizing Industries with Laser Technology Advancements Driving Growth in Manufacturing Healthcare and Telecommunications

Factors such as the increasing demand for high-precision manufacturing, growing adoption of industrial applications, and rising investments in advanced technologies are expected to drive the growth of the global laser technology market. Industrial laser cutting, engraving, and marking applications in automotive, aerospace, electronics, and other industries. Along with this, the telecommunications sector is witnessing a growth in fiber optics, and the rising use of LiDAR in self-driving cars is also contributing to the growth of the market. Another driver is the expansion of the semiconductor industry, which utilizes lasers in wafer fabrication and photolithography. Moreover; increasing use of laser technology in medical imaging, surgeries, and cosmetics in the healthcare sector. The laser miniaturization and efficiency and power output innovations are also expanding their applicability for various industries.

Restrain:

-

Challenges in Laser Technology Market Precision Integration Safety Regulations and Environmental Sensitivity Concerns

Integration of the laser system is one of the hurdles observed in the laser technology market as laser systems are complex and require precision. For example, highly specialized laser systems are required in industries such as healthcare, aerospace, and semiconductor manufacturing, and these lasers tend to require careful calibrating and maintenance. Lasers can be highly sensitive to environmental conditions that can impact their efficiency and life, making them hard to integrate into many applications. Moreover, safety risks associated with laser radiation emissions create regulatory challenges in the form of stringent guidelines and certifications for use in medical, industrial, and defense domains.

Opportunity:

-

Industry 4.0 Automation and Smart Manufacturing Driving Growth and Opportunities in Laser Technology Market

The growing focus on Industry 4.0, automation, and smart manufacturing is creating ample opportunities in the laser technology market. Laser-based additive manufacturing (3D printing) is expected to provide attractive development opportunities, mainly due to the growing demand for aerospace and healthcare applications. Furthermore, increasing applications of laser-based sensors for environmental monitoring and defense purposes offer new opportunities for market growth. Asia-Pacific is anticipated to further bolster revenue owing to growing industrialization in several developing nations within the region; China and India are set to present significant growth opportunities due to rapid industrialization coupled with governmental measures promoting advanced manufacturing technology in terms of funding–which should proliferate end-use adoption over the forecast period.

Challenges:

-

Technological Advancements Skilled Workforce Shortage and Innovation Challenges in the Evolving Laser Technology Market

One more important challenge is the constant demand for technological innovations to match the changing industrial needs. The high-speed of innovation in fields such as semiconductor manufacturing, optical communication, and medical treatments, and, thus, the frequent upgrading of laser technologies, put R&D-limited companies at a disadvantage. In addition, the shortage of skilled professionals to operate and maintain sophisticated laser systems limits market growth. For this reason, advancements are being researched to improve the applicability of lasers in industrial applications, with issues such as material compatibility, heat generation, and beam quality control, all of which affect the efficiency and adoption of lasers. The ability of laser manufacturers to overcome these obstacles, and deliver reliability and performance over time, is a critical challenge.

Laser Technology Industry Segment Analysis

By Type

Solid-state lasers in 2023, were a leader in the laser technology market with a 33.7% market share due to their wide use in industrial, medical, and defense applications. They are specialized, high-efficiency, virtually free from laser failure, and can work at different wavelengths, making them suitable for precision manufacturing, cutting, welding, and medical operations. Application-wise, solid-state lasers have witnessed robust demand in material processing, and military application CLMIRs (for target designation and range finding).

The semiconductor lasers segment of the laser market is expected to achieve the highest CAGR during the forecast period from 2024 to 2032 due to their growing use in telecommunication, LiDAR, and consumer electronics applications. Their small footprint, energy efficiency, and low cost have made them critical for use in fiber-optic communication, 3D sensing, and automotive applications. A surge in the use of LiDAR in self-driving cars, along with developments in quantum computing and optical communication, is predicted to propel the growth of semiconductor lasers in the next few years.

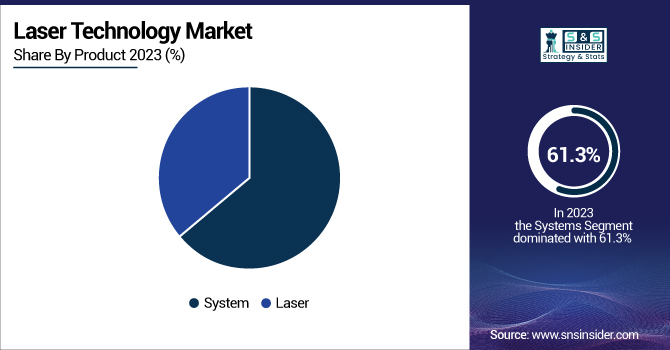

By Product

In 2023, systems held the largest share of the laser technology market, with a market share of 61.3%. This dominance was driven by the extensive use of integrated circuits in industrial, healthcare, defense, and semiconductor manufacturing applications. Integrated systems that combine cutting with welding, marking, and medical applications; laser systems are vital to high-precision processing. They are in high demand in automotive, aerospace, and other sectors that require material processing and quality control to be highly accurate and efficient.

From 2024 to 2032, Lasers are anticipated to be the fastest-growing segment. This growth is driven by the wider adoption of fiber and semiconductor lasers in telecommunications, LiDAR, and consumer electronics. With optical technologies also miniaturizing and becoming more efficient, we can use lasers in new and exciting arenas, like additive manufacturing, quantum computing, and biomedical research. Increasing applications in scientific and industrial applications, and rising demand for hyperpower and ultra-fast lasers are further contributing to market growth.

By Application

Optical communications led the laser technology market in 2023, accounting for 31.5% of the market driven by accelerating demand for high-speed data transmission over fiber-optic networks. Our product powered by laser-based optical communication systems is one of the keys to meeting the growing demand for, cloud and data-center hyperscale data transfer! Optical communication relies heavily on semiconductor lasers, and, in particular, VCSELs and fiber lasers to minimize signal loss and maximize bandwidth.

Laser processing is anticipated to experience the highest growth rate between 2024 and 2032, as the field of applications is growing in industrial manufacturing, electronics, and medical areas. One of the major driving factors for this market is the growing use of lasers in cutting, welding, engraving, and marking in the automotive, aerospace, and semiconductor industries. Meanwhile, the hybridization of ultrafast and high-power lasers is enabling higher precision and production efficiency, accelerating the adoption of laser processing solutions in other sectors as well.

By Vertical

The industrial sector accounted for a 30.8% share in the global laser technology market in 2023, owing to their high relevance for material processing including cutting, welding, marking, and engraving. The increasing penetration of automation and smart manufacturing will continue to drive the need for industrial lasers in automotive, aerospace, and semiconductor manufacturing. Given their precision, efficiency, and the low waste of processing diverse materials, fiber, and solid-state lasers have found their way into a wider range of applications.

The healthcare sector is anticipated to grow at the fastest CAGR from 2024 to 2032 owing to the greater utilization of technology in medical diagnostics, surgical procedures, & aesthetic treatments. Dermatology, ophthalmology, and even oncology use lasers often for non-invasive techniques like laser eye surgery or the removal of tumors. An increase in the demand for minimally invasive therapeutics and technological advancements in laser-based medical devices will drive the growth of the market even further in the healthcare sector.

Laser Technology Market Regional Overview

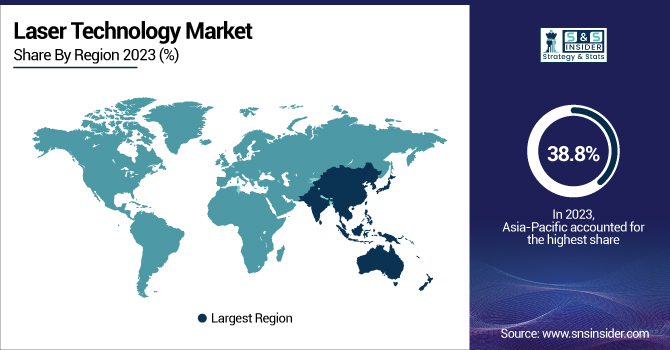

The Asia Pacific laser technology market was the leading region in 2023, holding a 38.8% market share, due to rapid industrialization, robust electronics manufacturing, and growing automation demand. China, Japan, and South Korea are leaders in semiconductor manufacturing, fiber-optic communications, and industrial laser applications. China's BOE Technology Group and Japan’s Canon Inc. have poured massive investments into laser-based applications for display manufacturing and semiconductor lithography. Moreover, the leading position of the optical communication industry is due to the massive growth of fiber-optic networks in India and China. The high density of automotive, consumer electronics, and healthcare industries in the region also substantiates the adoption of laser technology.

North America is anticipated to experience the greatest CAGR growth from 2024 to 2032. Growth is also driven by an increasing demand for laser-based medical treatments like LASIK eye surgery and laser skin treatments. For industrial applications, high-power lasers are being researched and developed by companies like IPG Photonics and Coherent Inc. In addition, the increasing deployment of LiDAR in driverless cars led by the likes of Waymo and Tesla is encouraging laser-based technologies. R&D will stay at the center of focus and technology development in defense lasers will be supported by state investments that will support the expansion of the defense laser technologies market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Laser Technology Market are:

Some of the major players in the Laser Technology Market are:

-

TRUMPF Group (TruLaser Series)

-

Coherent (Diamond CO₂ Laser)

-

IPG Photonics (YLS Series Fiber Laser)

-

Han's Laser (Laser Marking Machine)

-

ASML Holding (TWINSCAN NXE:3600D)

-

Trotec Laser (Speedy Series Engravers)

-

Jenoptik (JENOPTIK-VOTAN® BIM)

-

Mazak (OPTIPLEX 3015 NEO)

-

Prima Power (Laser Genius+)

-

Raycus Laser (Fiber Laser Source)

-

CASTECH Inc. (Nonlinear Optical Crystals)

-

II-VI Incorporated (CO₂ Laser Optics)

-

Lumentum Holdings (3D Sensing Lasers)

-

Huagong Tech (Laser Cutting Machine)

-

Bystronic Group (ByStar Fiber Laser)

Laser Technology Market Recent Trends

-

In October 2024, TRUMPF launched the TruLaser Series 1000 Lean Edition, a user-friendly and affordable laser-cutting machine designed for small-scale manufacturers, featuring advanced collision protection and Nanojoint technology for enhanced efficiency.

-

In October 2024, Coherent Corp. launched the EDGE FL fiber laser platform, offering 1.5 kW to 20 kW power levels with superior beam quality and energy efficiency, designed for precision cutting in the machine tool industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.76 Billion |

| Market Size by 2032 | USD 37.26 Billion |

| CAGR | CAGR of 7.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solid-state Lasers, Gas Lasers, Liquid Lasers, Semiconductor Lasers) • By Product (Laser, System) • By Application (Laser Processing, Optical Communications, Optoelectronic Devices, Other Applications) • By Vertical (Telecommunications, Industrial, Semiconductor & Electronics, Commercial, Aerospace & Defence, Automotive, Healthcare, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TRUMPF Group, Coherent, IPG Photonics, Han's Laser, ASML Holding, Trotec Laser, Jenoptik, Mazak, Prima Power, Raycus Laser, CASTECH Inc., II-VI Incorporated, Lumentum Holdings, Huagong Tech, Bystronic Group. |