Real World Evidence Solutions Market Size Analysis

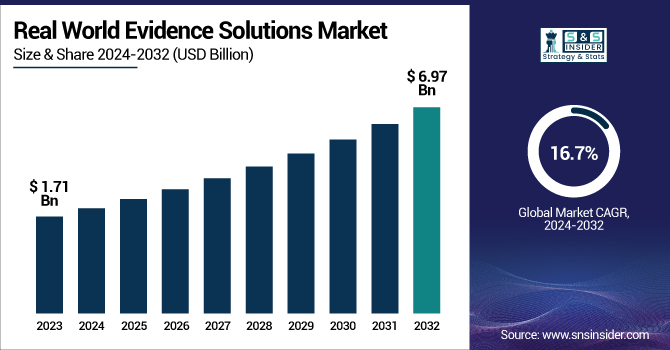

The Real World Evidence Solutions Market was valued at USD 1.71 Billion in 2023 and is expected to reach USD 6.97 Billion by 2032, growing at a CAGR of 16.7% over the forecast period 2024-2032.

The Real World Evidence (RWE) Solutions Market report provides key statistical insights and trends shaping the industry. Content includes incidence and prevalence data for key therapeutic areas along with regional prescription trends demonstrating the impact of evidence-based decisions on drug utilization. In addition, the report also explores drug volume, highlighting shifts in production and use fueled by RWE adoption.

To Get more information on Real World Evidence Solutions Market - Request Free Sample Report

It also breaks down health care spending by government, private insurance, and out-of-pocket. Understanding RWE Adoption by Pharma/Biotech highlights the increasing impact of RWE on drug development and post-market surveillance. It reviews data convergence trends and compliance parameters such as developing frameworks from the FDA, EMA, HIPAA, and GDPR that will impact global market penetration for RWE solutions. The Real World Evidence Solutions Market is experiencing significant growth driven by increasing regulatory support and the shift towards value-based healthcare systems.

Real World Evidence Solutions Market Dynamics

Drivers

-

Adoption of AI enhances RWE output and accelerates insights for pharmaceutical and biotech companies.

Artificial intelligence (AI) innovation with the real-world evidence (RWE) solutions traditionally offered by pharma and biotechnology companies. AI-powered tools facilitate patient recruitment, enabling a 30% reduction in enrollment time and saving close to $1.3 billion per year by decreasing delays in clinical trials. And, importantly, these tools have expanded patient diversity in studies by 15%, resulting in larger and more representative data sets. AI has a big impact on drug discovery. A more recent example includes GSK's partnership with Relation Therapeutics, a UK-based biotech, to utilize machine learning approaches to develop treatments for osteoarthritis and fibrotic diseases in a collaboration that could be worth as much as $300 million. Likewise, Advanced Micro Devices Inc. (AMD) announced a $20 million investment operation in startup Absci Corp., gaining exposure to AI-based drug discovery while also reducing the costs of creating biologics with the expenditure.

The use of AI in pharma has been gaining recognition, and 75% of leading pharma companies currently investing in AI to optimize clinical trial workflows. As such, companies are already starting to adopt AI in their drug development processes to make their processes more efficient and cost-effective. AI-powered algorithms can process massive amounts of data to find candidate drugs, forecast how molecules will behave, and create increasingly effective clinical trials, speeding up making new therapies available to patients.

Restraint

-

Data quality and standardization challenges hinder the effective utilization of RWE.

The issues faced with data quality as well as standardization have a significant impact on the efficient usage of Real World Evidence (RWE) in the life sciences industry. In a 2023 survey by eClinical Solutions, 50% of respondents estimated data variety (26%) and standardization (24%) as the number-one hindrances to integrating external data in clinical trials. A 2024 study conducted by Komodo Health to understand RWE teams revealed that life sciences teams spend, on average, seven months working with four data vendors and four consultants to source and sanitize data for RWE analyses. Data wrangling challenges come from the heterogeneity of data sources (e.g., electronic health records, claims data, or wearable devices) with varying formats and standards. The absence of standardization requires significant data cleaning and harmonization, which creates a burden on time and resources. Inconsistent data management and storage practices further aggravate integration processes and cause potential inaccuracies in analyses. These issues can be addressed by adopting universal data standards and properly evaluating data governance frameworks. Conceptualizing these steps not only would enable easier integration of different types of data but also contribute to making RWE more trustworthy and, eventually, translating real-world insights more efficiently into actionable healthcare solutions.

Opportunity

-

Partnerships and collaborations drive innovation and expand RWE applications across therapeutic areas.

The Real World Evidence (RWE) Solutions Market is rapidly growing due to strategic partnerships and collaborations between key players that improve innovative solutions to expand the use of RWE for finding innovative solutions across a range of therapeutic areas. In 2024, around 92% of life sciences executives said implementing real-world evidence (RWE) would be among their strategic top priorities, highlighting how essential this component has become in healthcare strategies. A notable example is the Data Analysis and Real-World Interrogation Network (DARWIN EU), which, as of March 2024, expanded its capacity for real-world data (RWD) studies by incorporating 10 new data partners, bringing its network to 20 institutions across 13 European countries. This broadened access encompasses data from about 130M patients and allows for strong RWE generation. The impact of such collaborations is magnified by advances in technology. One of the most prominent trends in RWD data analysis today is the application of artificial intelligence (AI) and machine learning Furthermore, the availability of wearables and Internet-connected (IoT) devices for data gathering has improved with real-time patient data, which can enrich RWE studies. These collaborations and technology integrations are critical to driving drug development and regulatory decision-making forward. For example, in July 2023, Johnson & Johnson received clearance for the fluoroscopy-free use of certain cardiac ablation devices based on RWE from a prospective, observational, registry study. This example highlights how partnerships and the strategic use of RWE can lead to innovative healthcare solutions and improved patient outcomes.

Challenge

-

Lack of standardization in regulatory, legal, and ethical requirements poses significant threats to market growth.

The major factor that hampers the growth of the real-world evidence (RWE) solutions market is that there are no regulatory, legal, and ethical frameworks for real-world evidence solutions. A recent environmental scan identified 46 RWE-related documents from various regulatory and health technology assessment (HTA) agencies worldwide, revealing considerable variation in scope and content. The need for strong RWD to underpin decision-making is widely accepted, but differences of opinion remain on methods of analytics and operationalization. This heterogeneity forces manufacturers to devise complex strategies to prepare simultaneously for several submissions, in both regulatory and HTA landscapes globally. Furthermore, research conducted among 300 senior leaders in life sciences indicated that organizations spend an average of an additional seven months working across multiple data vendors and consultants to get data and prepare it for RWE analyses. Such lengthy procedures are a manifestation of confusion coming from the lack of uniform guidelines. Concerns regarding the integration of Real-World Evidence (RWE) into healthcare decision-making also arise from ethical dimensions such as patient consent and data confidentiality which differ from one jurisdiction to another. We need global cooperation to develop common standards to realise more efficient and more ethically, acceptable use of RWE in healthcare.

Real World Evidence Solutions Market Segmentation Analysis

By Component

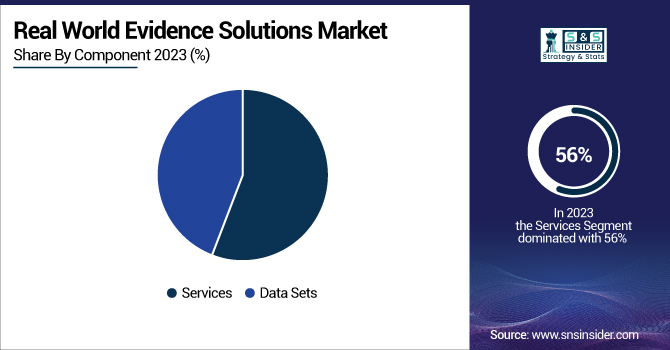

In 2023, the services segment held the largest revenue share of over 56% within the market. Several factors contribute to this dominance, including the growing adoption of RWE services and solutions among pharmaceutical and medical device companies, as well as a rising shift towards value-based healthcare models. This space is driven largely by the U.S. FDA's commitment to improving the quality and acceptance of RWE-based methodologies, as detailed in the Prescription Drug User Fee Act VII. Additionally, the services segment is growing owing to the presence of subscription-assisted advanced analytical tools for data output analysis. These tools allow for the more rapid processing, analysis, and interpretation of real-world data, which means RWE services are becoming increasingly valuable to the healthcare ecosystem. The FDA's emphasis on leveraging RWE for supporting new labelling claims and the approval of new applications for existing medical products has created strong demand for specialized RWE services. In addition, the rise in healthcare data complexity and the need for advanced analytics has resulted in growing demand for end-to-end RWE solutions. It is no longer a trend; it has spread even to the pharmaceutical industry, where organizations are stylistically using RWE to guide therapeutic development plans, safety monitoring of marketed drugs, and regulatory applications.

By Application

The drug development and approvals segment accounted for the largest revenue share in 2023. This increasingly becomes the case as RWE has found its way into the early drug development process, for example, real-world evidence incorporation in phase 1 studies to post-market drug surveillance. This trend has been significantly stimulated by the FDA's RWE program that was mandated in U.S. legislation in late 2022, which required the FDA to set up a designated RWE program within the agency. The expansion of the drug development and approvals segment is supported by RWE's potential to cut drug development expenses and accelerate the approval procedure. RWE offers useful information on drug safety and efficacy in everyday use, adding context to information obtained from randomized controlled trials. This is especially important in the context of rare diseases and oncology, where RWE can yield key insights around long-term outcomes and real-world effectiveness.

Such initiatives by the government have also really helped in growing this segment. New opportunities to tap into potentially very valuable data from the real world, along with a new commitment from the FDA to use RWE in supporting new labeling claims and new applications for existing medical products through the Advancing Real World Evidence Program announced in October 2022 are creating new potential for leveraging RWE in drug development and approvals. In addition, the growing number of clinical trials using RWE and the increasing availability of clinical trial data sets contribute to the segment growth.

By End use

In 2023, Healthcare companies accounted the largest revenue share, this dominance can be attributed to the increasing adoption of RWE solutions by pharmaceutical, biotechnology, and medical device companies for various applications throughout the product lifecycle. The FDA's emphasis on using RWE for regulatory decision-making has been a significant driver for healthcare companies to invest in RWE solutions. The healthcare companies segment's growth is further supported by the potential of RWE to inform value-based care decisions and improve patient outcomes. The shift from volume to value-based care, coupled with an increase in R&D spending, has led healthcare companies to leverage RWE for demonstrating the real-world effectiveness and value of their products.

Government initiatives have also played a crucial role in driving adoption among healthcare companies. For instance, the FDA's Advancing Real World Evidence Program, announced in October 2022, aims to enhance the quality and acceptance of RWE-based methodologies for supporting new labeling claims and approving new applications for existing medical products. This initiative has encouraged healthcare companies to invest in robust RWE capabilities.

By Therapeutic Area

In 2023, the oncology segment held the largest revenue share. This dominance can be attributed to the complex nature of cancer treatment and the need for real-world insights to complement traditional clinical trial data. The FDA's emphasis on using RWE for regulatory decision-making has been particularly impactful in oncology, where real-world data can provide critical insights into long-term outcomes and treatment effectiveness across diverse patient populations. The oncology segment's growth is further fueled by the increasing incidence of cancer globally and the rapid pace of innovation in cancer therapies. RWE plays a crucial role in understanding the real-world effectiveness of new oncology treatments, including targeted therapies and immunotherapies. The FDA's RWE program, formalized in U.S. legislation by 2022, has encouraged the use of RWE in oncology drug development and post-market surveillance.

Government initiatives have also contributed to the segment's dominance. For instance, the National Cancer Institute's Surveillance, Epidemiology, and End Results (SEER) Program provides a wealth of real-world data on cancer incidence, survival, and prevalence across the U.S. population. This data source has been instrumental in generating RWE for oncology research and drug development.

Real World Evidence Solutions Market Regional Insights

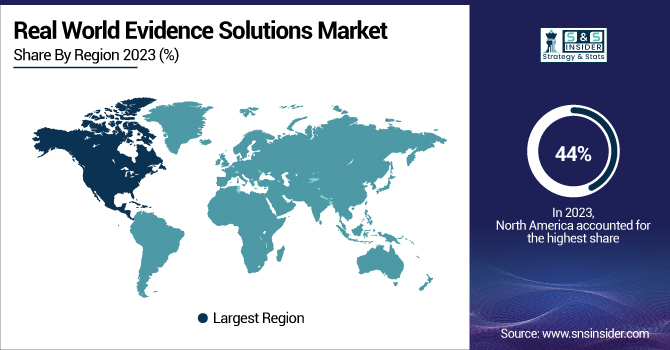

North America dominated the Real World Evidence Solutions Market in 2023, accounting for the largest revenue share of over 44%. This dominance is due to considerable regulatory support, established healthcare infrastructure, and the presence of key market players. For instance, the US has been leading RWE adoption in large part due to initiatives by the FDA and other regulatory agencies. The FDA introduced the RWE framework, further catalyzing the RWE framework in 2022 by including it in U.S. legislation, setting a foundation for RWE to play an even larger role in the development and approval of all drugs. The agency's Advancing Real World Evidence Program, launched in October 2022, also highlights the increasing role of RWE in regulatory decisions.

The highest growth is expected in Asia Pacific as the fastest-growing region during the forecast period. This rapid growth can be attributed to the region's expanding healthcare landscape, growing population, rising prevalence of chronic diseases, and increasing focus on improving healthcare infrastructure. These factors are driving the growth of the clinical trial market in the region, with countries such as Japan and China having already well-established clinical trial infrastructures, strong healthcare capabilities, and strict quality standards. This is further accompanied in Asia Pacific countries by various Government initiatives related to RWE. For example, Japan’s Pharmaceuticals Medical Devices Agency (PMDA) has been advocating for RWE to support regulatory decision-making in line with the global landscape. Likewise, China's National Medical Products Administration (NMPA) has been actively seeking pathways to integrate RWE in its regulatory approach, which could provide a pathway for greater market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Real World Evidence Solutions Market

Key Service Providers/Manufacturers

-

Merative (formerly IBM Watson Health): MarketScan, Micromedex

-

Inovalon: ePASS, ScriptMed Cloud

-

Scientist.com: COMPLi, DataSmart

-

H1 Inc.: H1 Explorer, Trial Landscape

-

Cytel: East Horizon, Enforesys

-

IQVIA: Orchestrated Patient Engagement, E360

-

Syneos Health: Real World Evidence Solutions, Dynamic Assembly

-

Parexel: Real-World Data Services, Patient Data Analysis Suite

-

ICON plc: Real World Evidence Generation, ICONIK

-

PPD (Thermo Fisher Scientific): Real-World Evidence Solutions, PPD Digital

-

Covance (Labcorp Drug Development): Xcellerate Real World Evidence, Covance Market Access

-

Flatiron Health: OncoEMR, Flatiron Clinico-Genomic Database

-

Optum: Optum Clinformatics, Optum EHR Data

-

Anthem (now Elevance Health): HealthCore Integrated Research Database, Outcomes Insights

-

Premier Inc.: Premier Healthcare Database, PINC AI

-

Veradigm (Allscripts): Veradigm Real-World Data, Veradigm Health Insights

-

Cerner Corporation: Cerner Real-World Data, HealtheIntent

-

Oracle Health Sciences: Oracle Health Sciences Data Management Workbench, Oracle Real-World Evidence

-

SAS Institute: SAS Real-World Evidence, SAS Health Analytics

-

TriNetX: TriNetX Live, TriNetX Research Network

Recent Developments in RWE Solutions Market

-

In October 2022, the FDA announced its Advancing Real World Evidence Program initiative. This program aims to enhance the quality and acceptance of RWE-based methodologies for supporting new labeling claims, including approving new applications for existing medical products or meeting post-approval study obligations.

-

In February 2024, a comprehensive literature review was published in the Journal of Pharmacy & Pharmaceutical Sciences, assessing the current use and acceptance of real-world data (RWD) and real-world evidence (RWE) in health technology assessment (HTA) processes. This review highlighted the growing importance of RWE in healthcare decision-making across various countries and HTA organizations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.7 Billion |

| Market Size by 2032 | USD 6.97 Billion |

| CAGR | CAGR of 17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Data Sets) • By Application (Drug Development & Approvals, Post Market Safety & Adverse Events Monitoring, Medical Device Development & Approvals, Reimbursement/Coverage and Regulatory Decision Making) • By End-use (Healthcare Companies (Pharmaceutical, Biopharmaceutical, Medical Device), Healthcare Providers, Healthcare Payers, Others) • By Therapeutic Area (Oncology, Respiratory, Cardiology, Neurology, Diabetes, Psychiatry, Other Therapeutic Areas) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merative, Inovalon, Scientist.com, H1 Inc., Cytel, IQVIA, Syneos Health, Parexel, ICON plc, PPD (Thermo Fisher Scientific), Covance (Labcorp Drug Development), Flatiron Health, Optum, Anthem (now Elevance Health), Premier Inc., Veradigm (Allscripts), Cerner Corporation, Oracle Health Sciences, SAS Institute, TriNetX |