Digitally Controlled Attenuators Market Size & Growth:

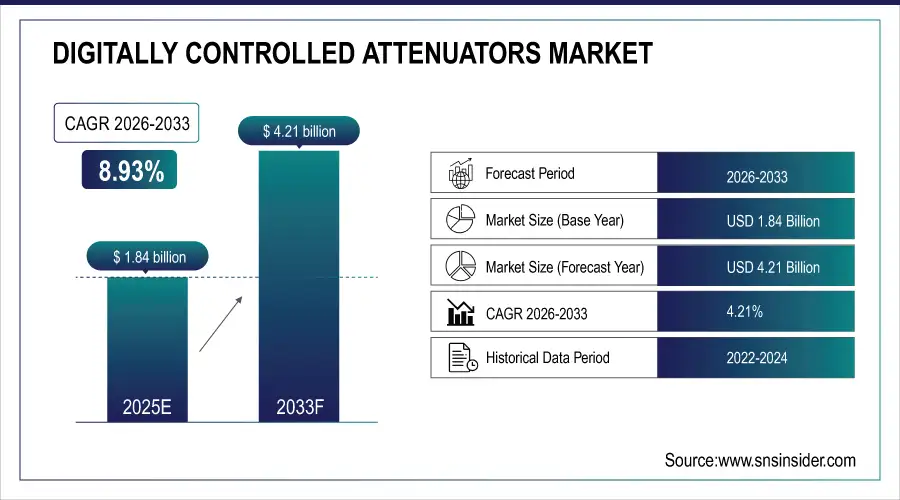

The Digitally Controlled Attenuators Market Size was valued at USD 1.84 Billion in 2025E and is expected to reach USD 4.21 Billion by 2033, growing at a CAGR of 10.88% over the forecast period of 2026-2033.

The Digitally Controlled Attenuators Market is witnessing robust growth, driven by expanding adoption in 5G networks, satellite communications, and advanced test equipment. Rising demand for precise RF signal control and compact, programmable components is accelerating market expansion. Technological advancements, automation, and integration into telecommunication and defense systems are enhancing performance, reliability, and efficiency.

Digitally Controlled Attenuators Market Size and Forecast:

-

Market Size in 2025E: USD 1.84 Billion

-

Market Size by 2033: USD 4.21 Billion

-

CAGR: 10.88% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Digitally Controlled Attenuators Market - Request Free Sample Report

Key Digitally Controlled Attenuators Market Trends

-

Growing deployment of 5G and advanced wireless networks is driving demand for high-precision RF attenuation solutions.

-

Increasing integration of digitally controlled attenuators in test and measurement equipment enhances signal accuracy and repeatability.

-

Rising adoption in defense and aerospace applications for radar, electronic warfare, and satellite communication systems.

-

Miniaturization and surface-mount technology advancements are enabling compact, energy-efficient attenuator designs.

-

Shift toward programmable and software-defined RF components is promoting flexibility and system automation.

-

Expanding R&D investment in high-frequency (mmWave) and broadband applications supports innovation across telecom and IoT sectors.

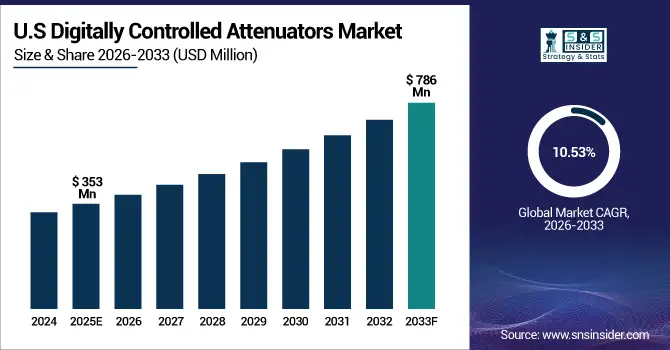

U.S. Digitally Controlled Attenuators Market Insights

The U.S. Digitally Controlled Attenuators Market size was USD 353 million in 2025 and is expected to reach USD 786 million by 2033 growing at a CAGR of 10.53% over the forecast period of 2026-2033. The market growth is driven by the surge in 5G infrastructure, aerospace advancements, and automated test systems is boosting adoption of digitally controlled attenuators. As telecom and defense sectors demand higher signal accuracy and frequency flexibility, manufacturers are investing in miniaturized, high-performance RF components to enhance communication reliability and operational efficiency.

Digitally Controlled Attenuators Market Growth Driver

-

Rising Deployment of 5G Infrastructure Accelerates Demand for Digitally Controlled Attenuators Across Communication Networks

The rapid rollout of 5G infrastructure globally has significantly increased the need for digitally controlled attenuators (DCAs), primarily due to their essential role in optimizing signal strength and maintaining RF performance across diverse frequency bands. As telecom operators transition toward millimeter-wave (mmWave) frequencies, precise signal attenuation becomes critical for ensuring seamless connectivity and reduced interference. According to a June 2024 development, major telecom providers in the U.S. and Asia-Pacific began large-scale 5G base station upgrades integrating programmable attenuators for better power control and network efficiency. This growing trend is driving manufacturers to develop compact, broadband, and low-latency DCAs designed for 5G-enabled equipment. Consequently, the market is experiencing strong momentum driven by rising data demand, enhanced wireless communication, and technological advancements in RF component design.

For example, in June 2024, Analog Devices, Inc. launched a high-performance DCA series specifically optimized for 5G base stations, featuring fast switching speeds and improved linearity. This innovation supports advanced beamforming and multi-band operation, highlighting the critical role of DCAs in next-generation communication infrastructure.

Digitally Controlled Attenuators Market Restraint

-

High Product Development Costs and Complex Integration Processes Hinder Market Expansion

While the Digitally Controlled Attenuators market is growing steadily, the high costs associated with product development, calibration, and integration into RF systems present a significant restraint. The production of DCAs requires advanced semiconductor materials and high-precision calibration to achieve desired accuracy, which increases overall costs for manufacturers and end-users. Small and medium-scale enterprises often face barriers to entry due to the capital-intensive nature of R&D and limited access to high-frequency testing infrastructure. Moreover, integrating DCAs into complex multi-band systems requires specialized technical expertise and time, slowing product adoption across emerging sectors such as IoT and aerospace electronics. This cost and complexity imbalance often limits large-scale deployments, particularly in price-sensitive markets.

For instance, several mid-tier electronics manufacturers in Europe reported delays in their RF module production due to the extended testing and tuning cycles needed for integrating step digital attenuators, leading to increased project costs and prolonged commercialization timelines.

Digitally Controlled Attenuators Market Opportunity

-

Growing Integration of Digitally Controlled Attenuators in Aerospace and Defense Systems Creates Lucrative Growth Opportunities

The expanding application of digitally controlled attenuators in aerospace and defense is opening new avenues for market growth. The rising need for advanced radar, satellite, and electronic warfare systems is fueling demand for high-precision, low-phase distortion attenuators capable of operating in extreme conditions. As governments increase investments in modern defense communication and surveillance systems, DCAs are becoming vital for improving signal reliability, noise control, and data transmission accuracy. According to a March 2025 development, the U.S. Department of Defense collaborated with leading RF component manufacturers to integrate programmable attenuators into next-generation radar and satellite platforms, emphasizing real-time control and superior signal performance. This strategic move is expected to boost long-term market demand across military and aerospace applications.

For example, in March 2025, Qorvo, Inc. introduced a ruggedized DCA module designed for airborne and spaceborne defense applications, offering exceptional thermal stability and wideband performance. This development highlights how innovation in defense-

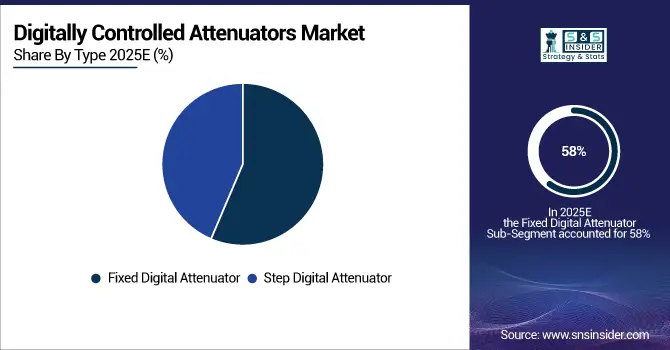

Digitally Controlled Attenuators Market Segment Highlights:

-

By Type: Fixed Digital Attenuator – 58% (largest), Step Digital Attenuator – 42%

-

By Application: Cellular Infrastructure – 45% (largest), Test Equipment – 20%, Fiber Optic Telecommunications – 15%, Satellite Set-Top Box – 12%, Others – 8%

-

By Frequency Range: Up to 6 GHz – 50% (largest), 6–18 GHz – 35%, Above 18 GHz – 15%

By Type

The Fixed Digital Attenuator segment dominates the Digitally Controlled Attenuators Market with a 58% share, attributed to its reliability, compact design, and precision in maintaining consistent attenuation levels in RF and microwave circuits. Fixed models are widely utilized in base stations, signal testing, and communication transmitters where stable signal strength is critical. Their simplicity, low insertion loss, and cost-efficiency make them ideal for large-scale 5G and telecommunication infrastructure deployments. Meanwhile, the Step Digital Attenuator segment, accounting for 42%, is witnessing growing adoption due to its flexibility in providing programmable attenuation steps, enabling dynamic signal control across multi-band frequencies. These attenuators are increasingly used in automated test equipment (ATE), radar, and satellite communication systems where high performance and adaptability are essential.

By Application

The Cellular Infrastructure segment leads the market with a 45% share, driven by the rising deployment of 4G and 5G networks that demand precise power and signal control to optimize network performance and reduce interference. Telecom equipment manufacturers rely heavily on digitally controlled attenuators for base station calibration and antenna tuning. The Test Equipment segment holds 20%, supported by the growing use of automated testing platforms requiring high repeatability and accuracy. Fiber Optic Telecommunications, representing 15%, benefits from increasing demand for high-speed data transmission and optical link balancing. The Satellite Set-Top Box segment, with 12%, gains traction due to enhanced satellite broadcasting and DTH services, while Others (8%), including aerospace, defense, and industrial applications, utilize these attenuators for advanced RF signal conditioning and measurement tasks.

By Frequency Range

The Up to 6 GHz segment dominates with a 50% share, owing to its widespread use in cellular communication, Wi-Fi, and industrial wireless systems. This frequency range supports most commercial telecom and test applications, making it a preferred choice for mass-market equipment. The 6–18 GHz range, capturing 35%, is expanding rapidly due to the growing demand for radar, satellite communication, and defense systems that operate at higher frequencies requiring accurate attenuation control. The Above 18 GHz segment, accounting for 15%, is emerging as a key niche in millimeter-wave and high-frequency 5G applications, where advanced materials and compact component design are essential for maintaining signal integrity and reducing distortion across ultra-wideband systems.

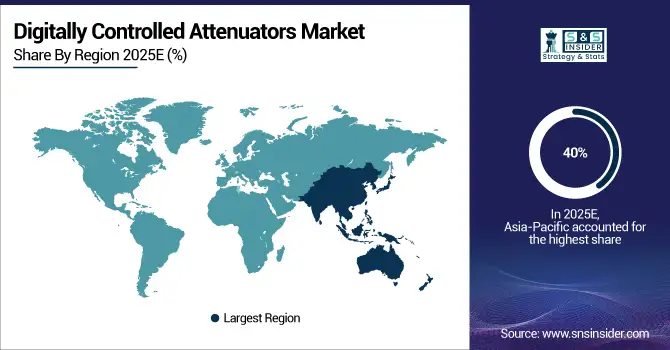

Digitally Controlled Attenuators Market Regional Analysis

Asia-Pacific Digitally Controlled Attenuators Market Insights

Asia-Pacific dominates the Digitally Controlled Attenuators Market with a 40% share in 2025, making it both the largest and fastest-growing regional segment. The region’s growth is driven by the rapid expansion of 5G infrastructure, significant investments in broadband and fiber-optic networks, and increasing demand for high-speed data transmission in countries such as China, Japan, South Korea, and India. The rise of smart manufacturing, IoT integration, and digital transformation initiatives across telecom and industrial sectors further support market momentum. Additionally, strong government policies promoting local semiconductor production and technological collaborations with international firms are strengthening Asia-Pacific’s role as a major hub for digitally controlled attenuator manufacturing and export.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Digitally Controlled Attenuators Market Insights

North America holds a 25% share of the Digitally Controlled Attenuators Market in 2025, driven by the widespread implementation of high-performance communication systems and advanced defense technologies. The U.S. remains the key contributor, supported by established telecom networks, rapid 5G rollout, and growing adoption in aerospace and satellite communication. The presence of leading manufacturers and continuous R&D efforts to enhance RF signal integrity and precision are boosting innovation. Furthermore, the demand for data center expansion and fiber-to-the-home connectivity is providing additional growth avenues across the region.

Europe Digitally Controlled Attenuators Market Insights

Europe captures 20% of the global market share in 2025, supported by robust digitalization efforts, industrial automation, and advancements in optical networking infrastructure. Key countries such as Germany, France, and the U.K. are witnessing rising integration of digitally controlled attenuators into telecommunication and broadcasting systems to improve data transfer efficiency and minimize signal loss. The European Union’s initiatives promoting energy-efficient, sustainable communication networks and funding for next-generation infrastructure projects are enhancing regional competitiveness. Moreover, ongoing research in RF and microwave technologies is accelerating product innovation across the continent.

Middle East & Africa Digitally Controlled Attenuators Market Insights

The Middle East & Africa region accounts for 8% of the market in 2025, showing gradual growth driven by expanding digital transformation programs and the modernization of telecom and defense communication systems. Countries like the UAE and Saudi Arabia are investing in high-speed broadband infrastructure and smart city projects, creating new opportunities for signal management technologies. The increasing focus on establishing regional data centers and improving satellite communication networks is further contributing to regional demand.

Latin America Digitally Controlled Attenuators Market Insights

Latin America holds a 7% share of the global market in 2025, with growth fueled by the ongoing development of broadband networks, digital inclusion initiatives, and expansion of the telecom sector. Brazil and Mexico are leading adopters, driven by rising investments in fiber-optic infrastructure and broadcasting modernization. Collaborations with international telecom providers and increased government support for 5G deployment are enhancing market accessibility and technological readiness across the region.

Competitive Landscape for Digitally Controlled Attenuators Market:

Corning Incorporated

Corning Incorporated is a global leader in optical communications and advanced glass technologies, offering high-performance fiber-optic components and connectivity solutions for telecommunications, data centers, and industrial applications.

-

In May 2025, Corning launched its UltraSplit-X Passive Digitally Controlled Attenuators Series, delivering 35% improved signal precision and reduced insertion loss. This innovation is designed to support dense 5G backhaul networks and large-scale FTTH deployments across Asia-Pacific and North America, strengthening Corning’s position in high-speed broadband infrastructure.

CommScope Holding Company, Inc.

CommScope Holding Company, Inc. designs and manufactures cutting-edge communication infrastructure solutions supporting broadband, enterprise, and wireless connectivity systems.

-

In March 2025, CommScope introduced its Active ProLine Digitally Controlled Attenuators, engineered for hybrid fiber-coaxial (HFC) and DOCSIS 4.0 networks. The product features adaptive signal calibration and remote monitoring, enhancing performance and reliability in metropolitan broadband and enterprise communication networks.

Prysmian Group

Prysmian Group is a global leader in energy and telecom cable systems, offering comprehensive connectivity and signal management solutions for industrial and communication infrastructures.

-

In January 2025, Prysmian unveiled its OptoFlex Hybrid Digitally Controlled Attenuators, combining optical and electronic attenuation for ultra-long-distance data transmission. This development aims to optimize bandwidth performance in smart city projects and industrial IoT communication systems across Europe and Asia-Pacific.

Furukawa Electric Co., Ltd.

Furukawa Electric Co., Ltd. specializes in advanced electrical and optical technologies, providing innovative components for next-generation communication and energy systems.

-

In July 2025, Furukawa Electric launched its EcoFiber Passive Digitally Controlled Attenuators, designed using sustainable materials with enhanced low-loss performance. The product supports Japan’s 5G network expansion and sustainable fiber infrastructure initiatives across Southeast Asia.

Digitally Controlled Attenuators Market Key Players

-

Analog Devices, Inc.

-

Qorvo, Inc.

-

Murata Manufacturing Co., Ltd.

-

pSemi Corporation

-

Atlantic Microwave Ltd.

-

Pulsar Microwave Corporation

-

Qualwave Technology Inc.

-

JFW Industries, Inc.

-

Planar Monolithics Industries

-

API Technologies Corp.

-

Fairview Microwave, Inc.

-

Vaunix Technology Corporation

-

Pasternack Enterprises, Inc.

-

Weinschel Associates

-

RF-Lambda

-

Renaissance Electronics

-

Akon Inc.

-

Mini-Circuits

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.84 Billion |

| Market Size by 2033 | USD 4.21 Billion |

| CAGR | CAGR of10.88% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Digital Attenuator, Step Digital Attenuator) • By Application (Cellular Infrastructure, Test Equipment, Satellite Set-Top Box, Fiber Optic Telecommunications, Others) • By Frequency Range (Up to 6 GHz, 6–18 GHz, Above 18 GHz) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., MACOM Technology Solutions Holdings, Inc., Qorvo, Inc., Murata Manufacturing Co., Ltd., pSemi Corporation, Skyworks Solutions, Inc., Atlantic Microwave Ltd., Pulsar Microwave Corporation, Qualwave Technology Inc., JFW Industries, Inc., Planar Monolithics Industries, API Technologies Corp., Fairview Microwave, Inc., Vaunix Technology Corporation, Pasternack Enterprises, Inc., Weinschel Associates, RF-Lambda, Renaissance Electronics, Akon Inc., Mini-Circuits. |