Automotive Front End Module Market Report Scope & Overview:

Get More Information on Automotive Front End Module Market - Request Sample Report

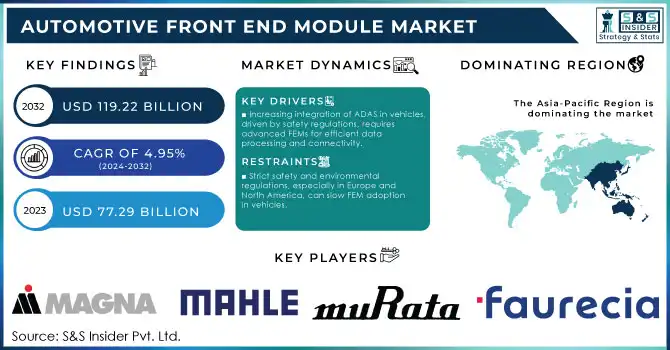

The Automotive Front End Module Market Size was valued at USD 77.29 billion in 2023 and is expected to reach USD 119.22 Billion by 2032, growing at a CAGR of 4.95% from 2024-2032.

The Front End Module (FEM) market is experiencing strong growth due to the rising demand for connected and autonomous vehicles, along with the need for advanced driver-assistance systems (ADAS). These modules incorporate critical components like antennas, sensors, and radar that support communication, safety, and connectivity features essential in modern vehicles. For example, the integration of 5G technology has heightened demand for high-frequency antennas within FEMs, enhancing vehicle-to-everything (V2X) communication for real-time data transfer and vehicle automation.A primary growth driver is the rapid adoption of ADAS in both passenger and commercial vehicles. In 2023, over 60% of newly manufactured vehicles in North America and Europe were equipped with ADAS, driven by safety mandates and consumer demand for advanced vehicle features. These systems require FEMs capable of handling high-speed data for functionalities such as lane-keeping assistance, emergency braking, and adaptive cruise control.

The growth of the electric vehicle (EV) market further propels the FEM industry. EV manufacturers seek lightweight FEMs to improve energy efficiency, with reduced component weight directly enhancing vehicle efficiency and battery performance. Companies like Continental AG have pioneered compact, lightweight FEM designs tailored for EVs—a vital advancement, According to the reports, global EV sales are projected to reach 30 million units by 2027. Moreover, FEMs are increasingly constructed with materials that enhance thermal management and durability, meeting the demands of autonomous and connected vehicles that require reliability in diverse environments. Industry leaders, such as Denso and LG Electronics, are prioritizing R&D to create robust FEMs that support reliable data inputs, a necessity as vehicles become more interconnected. These innovations position the FEM market as a cornerstone in the automotive industry’s shift toward smarter, sustainable, and autonomous transportation solutions.

Automotive Front End Module Market Dynamics

Drivers

-

Increasing integration of ADAS in vehicles, driven by safety regulations, requires advanced FEMs for efficient data processing and connectivity.

-

Electric vehicle growth is boosting demand for lightweight FEMs that enhance energy efficiency and extend battery life.

-

Increased consumer demand for connected car features promotes the need for FEMs that support multiple wireless and sensor functions.

The growing consumer demand for connected car features is significantly boosting the Front End Module (FEM) market, as these modules are essential for supporting the wireless and sensor-driven functionalities that modern smart vehicles rely on. As connectivity becomes a top priority, manufacturers are integrating advanced technologies like ADAS, V2X communication, and in-car infotainment systems, all of which require seamless data flow and high-speed connections. FEMs house the critical sensors, antennas, and radar needed to enable these functions, making them integral to vehicle safety and performance.

Connected cars depend on continuous data transfer to enable real-time features such as GPS navigation, traffic updates, remote diagnostics, and over-the-air software updates. FEMs are designed to handle these data-intensive tasks, often incorporating 5G technology to enhance connectivity, ensuring faster data rates and lower latency. This facilitates the smooth operation of applications like remote parking and system updates, which are becoming standard in many vehicles. The rising demand for safety features, driven by both regulatory requirements and consumer expectations, is further accelerating FEM development. ADAS functions, including lane-keeping assist, emergency braking, and adaptive cruise control, rely on advanced FEMs capable of managing complex sensor data. With regulations pushing for higher ADAS installation rates, particularly in North America and Europe, FEMs are increasingly being optimized to support these systems.

In the electric vehicle (EV) market, FEMs are being designed with a focus on energy efficiency. Manufacturers are using lightweight materials to enhance overall vehicle performance and extend battery life. As EV adoption grows—expected to reach approximately 18 million units by 2025 (International Energy Agency)—the need for lightweight, energy-efficient FEMs continues to rise. This growth is driving innovation in FEM technology, as these modules must meet the challenges of durability, sustainability, and performance to support the future of connected, autonomous, and electric vehicles.

Restraints

-

The complexity of advanced technologies such as ADAS and V2X communication in FEMs leads to higher manufacturing costs, which can limit adoption, especially for smaller manufacturers.

-

Compliance with stringent safety and environmental regulations, particularly in regions like Europe and North America, can slow the adoption and deployment of FEMs in vehicles.

-

Integrating various sensor and communication technologies into a single FEM can be technically challenging and costly, hindering the development of versatile and scalable modules.

A single Front End Module (FEM) brings together diverse sensor and communication technologies, creating considerable technical and financial challenges while also increasing design complexity and development cost. Modern FEMs have to integrate multiple advanced components, including radar, cameras, antennas, and sensors, to accommodate critical vehicle functions such as Advanced Driver-Assistance Systems (ADAS), Vehicle-to-Everything (V2X) communication, and real-time data transmission. Each of them needs a different design, material selection, and integration technique to operate seamlessly in an automotive environment. When these components are combined into a unified module, they have to be designed and tested individually and then solved to work perfectly together, lengthening development times and raising costs.

The challenge of managing large volumes of data from multiple sources adds significant complexity to the integration process, and this challenge will only intensify with the wider deployment of 5G technology. As 5G rolls out, the data streams handled by Front End Modules (FEMs) are expected to grow exponentially, increasing demands on the system's ability to process and transmit information quickly and reliably, which enables higher speeds and introduces essential safety features with functions such as emergency braking and lane-keeping assistance. Since the connected and autonomous vehicle wave is still evolving, with new technologies coming in quickly, the timeline for continuous innovations that need to be built into FEM continues to get shorter; thus, adding complexity to FEM development. Moreover, the requirement of lightweight, power-saving FEMs adds to the challenge in EVs because manufacturers must contend with vehicle performance, as well as environmental sustainability. For smaller manufacturers that possess fewer resources, these technical and financial challenges can delay the creation of scalable, flexible finite-element-method (FEM)s in particular. Additionally, combining so many different technologies creates issues of the systems being compatible with each other or reliable, and that any failure could compromise vehicle safety. As a result, the FEM market is under pressure to provide low-cost, high-efficiency modules to meet increasingly stringent regulatory requirements for connected, autonomous, and electric vehicles.

Automotive Front End Module Market Segmentation Overview

By Material

The Front End Module (FEM) market is also heavily dominated by the steel segment with a revenue share of 40.23%, due to its high strength, cost-effectiveness, and durability given and its considerable employment in the production of traditional vehicles. Even under harsh environmental conditions, steel is a top choice material for structural applications—especially for vehicles equipped with advanced driver assistance systems (ADAS) and safety features. Steel demand is supported by rises in vehicle production and the subsequent requirement of sturdy modules for conventional as well as electric vehicles (EVs). But as EVs are all about efficiency in terms of weight and emission reduction, the transition to lightweight materials like opening the door for composites may contain steel's growth.

The composite segment is expected to grow at the highest CAGR of 5.58% in the FEM market. The increase in demand is primarily due to the demand for lightweight and high-strength materials in the EV industry and the automotive sector as a whole to focus on sustainability. Composites provide several major benefits that can help make EVs energy efficient, such as weight savings and increased fuel economy and performance. Besides, composites have excellent performance on impact resistance, and this is critical for FEMs to ensure safety. With stricter norms on emissions and greater adoption of electric and autonomous vehicles, the composite segment is likely to sustain high growth for the foreseeable future.

By Vehicle Type

Passenger Car (PC) segment continues to hold the largest share of 46.0% in the front-end module (FEM) market, owing to a large number of production units for passenger vehicles throughout the globe. PCs dominate the FEM demand owing to being the largest vehicle category, supported by increasing adoption of advanced driver-assistance systems (ADAS) paired with other safety technologies. FEMs for this segment are essential for providing accommodation for critical components like cameras and sensors. With continued emphasis on safety and enhancing environmental sustainability, the PC market is projected to grow at a vigorous pace propelled by rising demand for conventional vehicles as well as electric vehicles.

The Light Commercial Vehicle (LCV) segment is estimated to grow at the highest CAGR of 5.68% in the FEM market. The expansion is primarily driven by the increasing need for LCVs in sectors such as logistics, e-commerce, and transportation. The high-techization of LCVs for safer, fuel-efficient, and less polluting vehicles increases the sophistication and cost of FEMs. Global e-commerce growth, the trend toward electric LCVs for last-mile transportation, and their adaptability to urban and rural environments are some of the primary factors driving this rapid segment expansion. With sustainability becoming a key focus, the number of Light Commercial Vehicles (LCVs) is projected to see significant growth in the coming years.

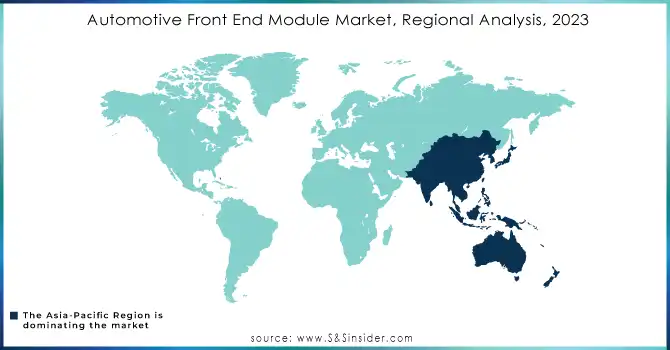

Automotive Front End Module Market Regional Analysis

The Asia-Pacific (APAC) region already holds the status of the global leading supplier of Front End Module (FEM) market, due to its prominent vehicle production activities, especially in the Middle East and its automotive manufacturing countries, including China, Japan and India, where passenger cars and Commercial vehicles are mass produced. Accelerated electric vehicle (EV) expansion and demand for advanced FEMs underpin greater leadership of the region. The availability of leading automotive manufacturers, a developed automotive industry, and favorable government policies towards sustainable transportation have supported the growth of APAC. As electric mobility and ADAS becomes paramount, APAC is likely to remain its premier region in the FEM market.

On the other hand, the highest compound annual growth rate (CAGR) in the FEM market is expected to be recorded in North America. The burgeoning demand is largely attributed to the rising adoption of light commercial vehicles (LCVs), both traditional and electrical, in logistics, e-commerce, and transportation industries. The output demand for advanced FEMs will gain traction with a focus in North America on sustainability, EV adoption incentives, and strong emissions reduction targets. The growing trend towards electric LCVs, the rise of e-commerce, and especially the trend towards urbanization are key factors driving the projected growth in the region. North America has a large growth scope soon led by sustainability.

Need Any Customization Research On Automotive Front End Module Market - Inquiry Now

Key Players in Automotive Front End Module Market

The major key players are

-

Magna International Inc. - Radiator support assemblies

-

MAHLE GmbH - Condensers and cooling modules

-

Murata Manufacturing Co., Ltd. - Electronic control units (ECUs) for front end modules

-

Faurecia S.A. - Active grille shutters

-

Denso Corporation - Radiators and cooling fans

-

Calsonic Kansei Corporation - Bumper brackets

-

HBPO Group - Front end modules (including radiator and cooling systems)

-

Plastic Omnium - Front bumpers and fenders

-

Hyundai Mobis - Radiator grills and cooling systems

-

Samvardhana Motherson Group - Lighting modules and brackets

-

Valeo - Radiator fans and front-end modules

-

Flex-N-Gate Corporation - Front-end bumper systems

-

RTP Company - Glass fiber reinforced plastics for front-end module components

-

SL Corporation - Horn assemblies and other front end components

-

Montaplast GmbH - Plastic components for front-end modules

-

Inteva Products - Front-end carriers

-

Minda Vast Access Systems Pvt. Ltd. - Automotive front end carriers

-

Hanon Systems - Thermal systems, including condensers

-

Brose Fahrzeugteile GmbH & Co. - Electric and mechanical motor solutions for front-end systems

-

Aisin Seiki Co. Ltd. - Active grille shutters and front-end systems

Recent Developments

-

In May 2024, Plastic Omnium introduced new front-end modules designed to integrate advanced lighting technologies, aiming to enhance safety and vehicle aesthetics. This move is in response to increasing demand for high-tech automotive solutions and environmentally friendly components

-

Magna launched a new, lightweight front-end module for electric vehicles in April 2024. This module is designed to reduce the overall weight of EVs, which is a crucial factor for enhancing performance and efficiency

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 77.29 Billion |

| Market Size by 2032 | USD 119.22 Billion |

| CAGR | CAGR of 4.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Radiator, Motor, Fan Condenser, Internal Air Cooler, Radiator Core Support, Oil Cooler, Headlight, Front Grill, Front Active Grill, Bumpers,others) • By Material (Steel,Composite, Hybrid, Plastic) • By Vehicle (PC, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Magna International Inc., MAHLE GmbH, Murata Manufacturing Co., Ltd., Faurecia S.A., Denso Corporation, Calsonic Kansei Corporation, HBPO Group, Plastic Omnium, Hyundai Mobis, Samvardhana Motherson Group, Valeo, Flex-N-Gate Corporation, RTP Company, SL Corporation. |

| Key Drivers | • Increasing integration of ADAS in vehicles, driven by safety regulations, requires advanced FEMs for efficient data processing and connectivity. • Electric vehicle growth is boosting demand for lightweight FEMs that enhance energy efficiency and extend battery life. |

| RESTRAINTS | • The complexity of advanced technologies such as ADAS and V2X communication in FEMs leads to higher manufacturing costs, which can limit adoption, especially for smaller manufacturers. • Compliance with stringent safety and environmental regulations, particularly in regions like Europe and North America, can slow the adoption and deployment of FEMs in vehicles. |