Robotics Market Size & Trends:

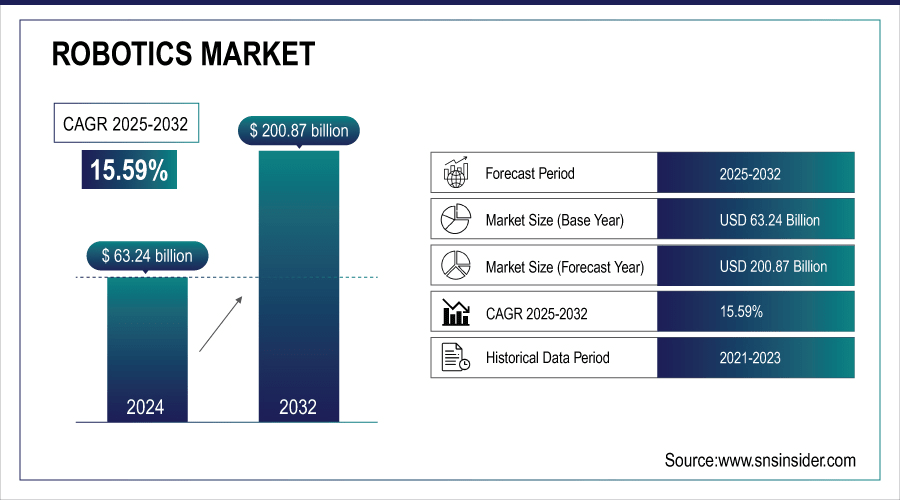

The global Robotics Market size was valued at USD 63.24 billion in 2024 and is expected to reach USD 200.87 billion by 2032 and grow at a CAGR of 15.59% over the forecast period of 2025-2032. The global robotics market analysis covers detailed market size, segmentation, regional performance, key drivers, restraints, opportunities, and challenges for the robotics market. Growth of global market is driven by growing adoption of automation in industrial, healthcare, and logistics sectors and rapid advancement in technology such as AI, IoT, and robotics software solutions. These trends are establishing phenomenal growth pathways and exciting investment opportunities in different regions across the globe.

For instance, over 60% of newly deployed industrial robots are AI-enabled.

To Get more information on Robotics Market - Request Free Sample Report

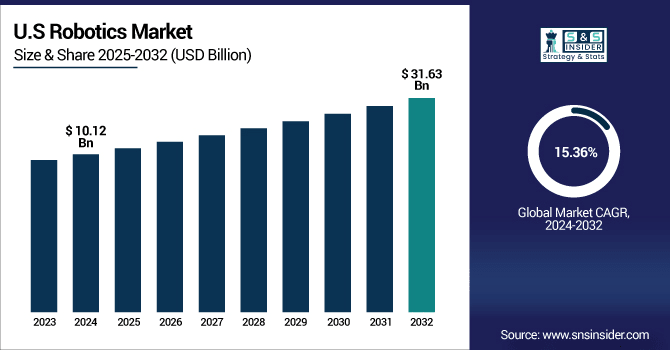

The U.S. Robotics Market size was USD 10.12 billion in 2024 and is expected to reach USD 31.63 billion by 2032, growing at a CAGR of 15.36% over the forecast period of 2025–2032.

The U.S. market is the leading country in Robotics Market mainly due to increasing industrial automation, supportive government policies to adopt robotics and increasing demand in manufacturing, healthcare and logistics sectors. The rapid growth of artificial intelligence (AI) technologies, integration of the Internet of Things (IoT), and deployment of smart robotics solutions are expected to drive significant growth opportunities, supported by concurrent investments in research and development. All of these initiatives improve productivity and operational efficiency, safety, and places the U.S. as one of the leading markets for robotics and technology adoption and innovation.

For instance, over 60% of robotics systems deployed in U.S. manufacturing and healthcare incorporate AI or IoT technologies.

Robotics Market Dynamics:

Key Drivers:

-

Increasing Adoption of Robotics Across Industrial and Manufacturing Sectors is Driving Market Growth Rapidly

There has been an increase in robotics for industry and manufacturing, driving the need for more productivity, accuracy, and efficient operations. It eliminates human errors and labor efforts while setting the stage for continuous production cycles. Process Robotics is used for assembly, welding, packaging, inspection, as well. The adoption is also propelled to the rise in the demand for smart factories and full Industry 4.0 integration. The market for robotics is directly driven by rising government & private sector funds in robotic solutions, to improve competitive advantages & operate in an efficient manner that meets the growing demand in the market place.

For instance, over 55% of new factories integrate AI-powered robotics for assembly and inspection.

Restraints:

-

Shortage of Skilled Workforce for Robotics Operation and Maintenance Restrains Market Growth

Training programs are needed to create a workforce to operate, program and maintain the advanced robotics systems that are being rapidly adopted. But there is lack of trained professionals who have proper knowledge of computer technology, AI, machine learning, and robotic technology which directly affect its implementation process. Companies struggle to recruit, train and retain qualified personnel. Lack of availability increases the operational risk and decreases efficiency, which might lead to delays in the project. The significant restraint causing slow deployment of robotics technologies, especially in the small and emerging markets, is the lack of skilled technicians and engineers.

Opportunities:

-

Growing Demand for Collaborative Robots in Healthcare and Logistics Creates Expanding Market Potential

Collaborative robots that can safely work alongside humans are increasingly being adopted in the healthcare and logistics or e-commerce sectors. In hospitals, such robots assist in surgeries, patient care, and diagnostics, hence enabling enhanced operational efficiency. In warehouses and shipping centers, cobots support and streamline the handling of materials and packaging. The projects or collaborations between cobot and companies open market opportunities for specialized solutions of particular applications, for example, in the healthcare sector. The enterprises create and offer such innovative products that cater to the productivity needs of the industry, making services safer and more precise. This trend is one of the expected to accelerate market growth during the forecast period.

For instance, collaborative robots have decreased workplace injuries by 25% in logistics operations.

Challenges:

-

Complex Integration and Interoperability Issues Pose Challenges for Robotics Market Growth

Integrating state-of-the-art robotics systems into current processes and legacy infrastructure is intricate and typically involves heavy customization. This lack of interoperability among robotic platforms, software and hardware components gives rise to compatibility issues, resulting in high costs and delays in implementation. Organizationally, many executives find it difficult to map robotic solutions to operational workflows. Interoperability issues Many deployment scenarios are still in progress, where different tech stacks are being involved further leading to lack of common protocols and framework that leads to problem of ease of deployment. This integration becomes a key challenge for companies, as seamless and efficient integration is key to unlocking the full potential of robotics and enabling the expected global robotics market growth.

Robotics Market Segmentation Insights:

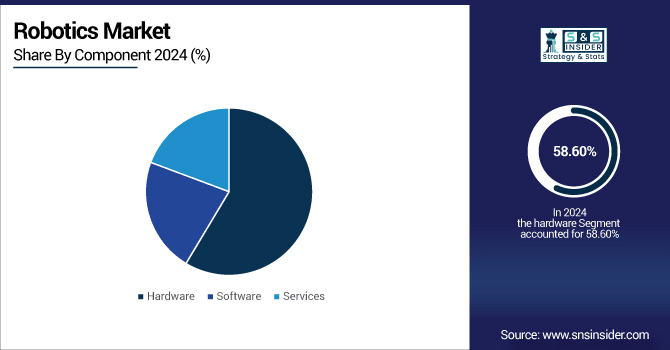

By Component

In 2024, hardware segment emerged as the largest revenue-generating segment in the Robotics Market, accounting for over 58.60% share. Its ubiquity is due to its necessity in sensors, actuators, controllers, and mechanical systems involved in robotics. This component controls powerful and robust hardware solutions in industrial robots to enable reliability across sectors, which is essential in dominating sectors such as manufacturing, logistics, healthcare, and even defense.

The software segment is projected to fastest CAGR of 17.08% during the forecast period of 2024-2032. AI-based algorithms, analytics, and cloud computing are powerfully adding to robotic smarts, a fact driving growth. ABB has robot software platforms that delivers operational performance and predictive maintenance, enhancing functionality and seamless adaptability across industrial and service applications, and is commanding rapid growth across the market.

By Product Type

In 2024, Articulated Robots held the largest revenue share in the Robotics Market at around 34.90%. They are dominant due to their flexibility in design, range of motion and adaptability in all industrial applications such as assembly, welding, and material handling. ABB manufacturer of robotics, is a main provider of articulated robots for industrial automation and their market leadership in this area is bolstered by their contribution. These types of robots are high precision robots that do many complex tasks, which is why they are the go-to robots for manufacturing and logistics.

The Humanoids Robots segment is expected to grow at the fastest CAGR of approximately 21.33% during the forecast period of 2024-2032. The sector is powered by increasing applications of humanoid robots in healthcare, research, and service sectors, including surgery, patient care, and social role of humanoid robots. Humanoid robots such as Pepper from SoftBank Robotics to act as touch points for humans are busting the adoption across industrial and service environment edge making it possible through AI and robotics technologies.

By Application

Material Handling segment held the top position, with the largest revenue share, 27.10 %, in 2024 respectively. Robots are critical for operation in warehouses, manufacturing units, and logistics operations, which is why it dominates share. Advanced industrial robots used in most of the industries to meet the demand needs and achieve improved efficiency, lower operating labour costs, faster, cost effective and error-free operations, KUKA Robotics is one of the known material handling robot suppliers and hence top listed under this application segment of industrial robotics market.

The fastest CAGR of around 16.39% during 2024-2032 for the Medical Devices segment. The mounting healthcare automation and surgical robotics adoption, along with technological advancements in patient care, continue to accelerate growth. Robotics in surgical Assist: Intuitive surgical with its da Vinci surgical systems continues to fuel the robotic assisted surgeries adoption, cutting down time required for surgery and recovering period. Demand for minimally invasive procedures is driving fast growth in this segment.

By Technology

The highest revenue share of approximately 28.20% in 2024 was held by AI-powered Robots in the Robotics Market. This will propel their supremacy by giving them intelligent decision-making capabilities, adaptability, and optimization of industrial processes. Integrating AI technologies into autonomous robots from FANUC enables practical applications to produce autonomous robotics productivity, efficiency, and automated error reduction in the manufacturing industry, and in logistics and health care.

IoT Robots segment will grow at the fastest CAGR of roughly 16.88%. Smart manufacturing environments involve connectivity, real-time monitoring, predictive maintenance and integration, which support and drive growth. Key players, such as Siemens are deploying robots for a high degree of industrial automation which are IoT-enabled for data driven insights and operational optimization, further accelerating the adoption of this segment and its scale globally.

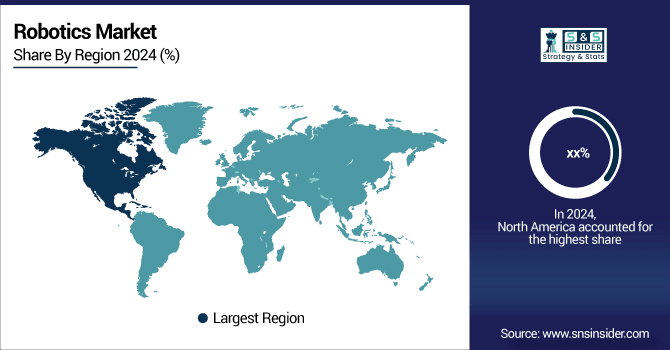

Robotics Market Regional Analysis:

The Robotics Market in North America is expanding quickly, especially in the United States, due to the increased use of industrial automation, advanced manufacturing, and logistical processes. Growing integration of Artificial Intelligence, IoT, and smart robotics solutions it makes way for greater operational efficiency and productivity. The market is rapidly growing and has become a leading region for robotics innovation owing to the strong government support, investments in R&D, and increasing demand for robots in healthcare and manufacturing industries.

-

The U.S. dominates North America due to advanced industrial automation, strong AI and robotics technology adoption, significant R&D investments, and robust manufacturing and logistics sectors, making it the largest and most technologically advanced robotics market in the region.

Asia Pacific held the largest share of revenue consumed in the Robotics Market, nearly 44.20% in 2024, and is anticipated to grow at a fastest CAGR of approximately 16.23% through 2024-2032. Increasing Industrialization, Adoption of Mass Production Techniques and Growing Government Support for Automation Technologies in the Region are Contributing to the Formidable Position of the Region in this Market. Mitsubishi Electric delivers robotics solutions to major regional industrial sectors, most notably automotive, electronics, and healthcare, resulting in considerable shares of the total market.

-

China leads the Asia Pacific robotics market owing to rapid industrialization, large-scale manufacturing adoption, government support for automation, and high investment in AI and smart factory technologies, positioning it as the largest and fastest-expanding robotics hub in the region.

Europe’s Robotics Market is witnessing significant growth, driven by increasing industrial automation, smart factory adoption, and government initiatives supporting robotics deployment. Countries including Germany, France, and Italy are leading in automotive, electronics, and manufacturing automation. Advancements in AI, IoT, and collaborative robots are enhancing productivity, efficiency, and safety, making Europe a key region for robotics innovation and investment across diverse industries.

-

Germany dominates Europe’s robotics market due to its strong industrial base, particularly in automotive and manufacturing, high adoption of automation, advanced R&D, and government support for Industry 4.0, making it the region’s largest and most technologically advanced robotics hub.

In the Middle East & Africa, the UAE leads the robotics market due to strong investments in industrial automation and smart infrastructure, while Saudi Arabia and Qatar show growing adoption. In Latin America, Brazil dominates with its large manufacturing base and increasing automation, while Argentina and other countries are gradually integrating robotics solutions.

Robotics Companies are:

Major Players in Global Robotics Market are ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Comau S.p.A., Kawasaki Heavy Industries Ltd., Universal Robots A/S, Denso Corporation, Epson Robots, Intuitive Surgical, Inc., Omron Corporation, Boston Dynamics, Adept Technology, Inc., Rethink Robotics, Staubli International AG, Hyundai Robotics, Siemens AG, SoftBank Robotics and Nachi-Fujikoshi Corp and others.

Recent Developments:

-

In May 2025, Kawasaki featured the BA006L, a high-precision welding robot, at the MACHAUTO Expo 2025, highlighting its capabilities in industrial automation.

-

In April 2024, Mitsubishi Electric launched the MELFA RV-12CRL vertical articulated robot, offering a 1504 mm reach and 12 kg payload capacity, suitable for various industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 63.24 Billion |

| Market Size by 2032 | USD 200.87 Billion |

| CAGR | CAGR of 15.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Articulated Robots, Cartesian Robots, Humanoids Robots, Delta Robots and SCARA Robots) • By Application (Entertainment, Logistics, Manufacturing Production, Material Handling and Medical Devices) • By Technology (AI-powered Robots, Autonomous Robots, IoT Robots, Remote Controlled Robots and Others) • By Component (Hardware, Software and Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Comau S.p.A., Kawasaki Heavy Industries Ltd., Universal Robots A/S, Denso Corporation, Epson Robots, Intuitive Surgical, Inc., Omron Corporation, Boston Dynamics, Adept Technology, Inc., Rethink Robotics, Staubli International AG, Hyundai Robotics, Siemens AG, SoftBank Robotics and Nachi-Fujikoshi Corp. |