Automotive Connector Market Key Insights:

Get more information on Automotive Connector Market - Request Free Sample Report

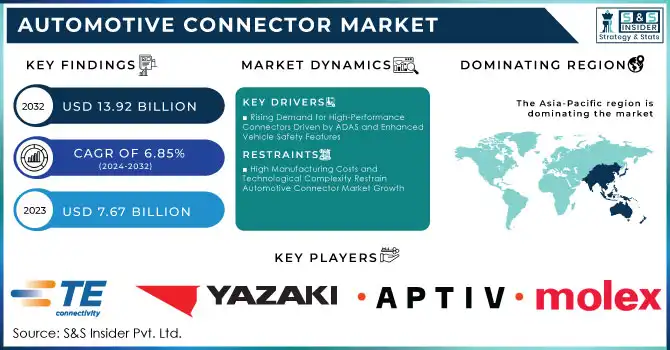

The Automotive Connector Market Size was valued at USD 7.67 Billion in 2023 and is expected to grow to USD 13.92 Billion by 2032 and grow at a CAGR of 6.85% over the forecast period of 2024-2032.

The automotive connector market is growing significantly, driven by the shift towards electric vehicles (EVs) and the increasing trend of vehicle electrification. As the automotive industry moves toward EVs and hybrids, there is a rising demand for durable, high-voltage connectors that meet the needs of battery management systems, electric drivetrains, and safety features. The push for standardized connector interfaces, such as Tesla's Low-Voltage Connector Standard (LVCS), aims to simplify EV charging and improve compatibility across different brands. Tesla's system uses just six connectors, in contrast to the 200+ connections found in many current EVs, contributing to efficiency and cost savings without compromising performance. This initiative also aligns with growing government incentives and infrastructure investments in regions like Europe and North America, further driving the need for reliable connector solutions. In the U.S., federal grants are supporting the expansion of EV charging stations, underscoring the importance of connectors that ensure efficient energy transfer in diverse environmental conditions.

Additionally, the increasing focus on advanced safety features and ADAS (Advanced Driver Assistance Systems) is fueling demand for connectors that support these technologies. Tesla’s LVCS is seen as a sustainable, cost-effective choice for the future of electrified vehicles, with potential benefits for both automakers and consumers. As the market for EVs continues to expand, the automotive connector market is poised for further growth, driven by innovations in connector technologies and increasing demand for efficient, high-performance components.

Automotive Connector Market Dynamics

Drivers

-

Rising Demand for High-Performance Connectors Driven by ADAS and Enhanced Vehicle Safety Features

The growing adoption of Advanced Driver-Assistance Systems (ADAS) is a major driver of demand for high-performance connectors in the automotive industry. As ADAS technologies like automatic emergency braking, lane-keeping assistance, and adaptive cruise control become more integrated into vehicles, the need for reliable connectors that support these complex systems is increasing. ADAS technologies are crucial for enhancing road safety, reducing accidents, and meeting consumer expectations for smarter, safer vehicles. This shift is particularly noticeable in markets like India, where SUVs equipped with ADAS features are becoming increasingly popular, especially models priced under INR 35 lakh (USD 42,000), signaling a broad consumer shift towards advanced safety features In the U.S., safety remains a critical concern, pushing both regulators and automakers to prioritize the integration of ADAS into mainstream vehicles Advancements in vehicle safety technologies, such as those championed by Volvo, are not only improving safety but also aligning with sustainability initiatives that will shape the future of the automotive sector. The broader movement toward autonomous driving is also influencing this shift, as automakers work to minimize human error through artificial intelligence (AI) and advanced sensor systems. This technological evolution is creating significant growth opportunities for the high-performance connector market, particularly as vehicles become more electrified and connected. As the demand for ADAS grows globally, the automotive industry's push for safer and more intelligent vehicles will likely lead to an increasing need for durable and versatile electronic components that ensure the effective operation of these systems. As a result, the automotive connector market is poised for substantial growth, driven by the rise of ADAS and the increasing complexity of vehicle safety and automation systems.

Restraints

-

High Manufacturing Costs and Technological Complexity Restrain Automotive Connector Market Growth

The automotive connector market is encountering significant obstacles, primarily driven by high manufacturing costs and the increasing technological complexity of modern vehicles. The integration of advanced systems like ADAS (Advanced Driver Assistance Systems), electric propulsion, and autonomous driving requires connectors with precise engineering and high-quality materials. These advanced systems increase production costs, making it difficult for manufacturers to balance performance and affordability. For instance, in 2024, Volkswagen had to initiate a USD 4.3 billion cost-cutting plan to address the rising production expenses amidst slowing demand in markets like China, underscoring the financial pressures caused by these rising costs. The technological complexity of modern vehicles exacerbates the challenges faced by connector manufacturers. As the industry moves toward autonomous and electric vehicles, connectors are required to handle higher power loads, faster data transmission, and more compact designs. This drives manufacturers to produce connectors that are not only more robust but also more complex, which increases the risk of design failures and production delays. The shift towards electrification and smart technologies means that connectors must meet stringent requirements for data transfer and power management, which adds another layer of complexity.

Automotive Connector Market Segment Analysis

by Product

In 2023, PCB connectors dominated the automotive connector market, capturing 36% of the revenue share. This is due to their crucial role in automotive systems, such as ADAS, safety features, infotainment, and powertrains, where they ensure efficient electrical connections and handle higher power and data requirements. As electric vehicles (EVs) and autonomous vehicles grow in popularity, the demand for compact, reliable PCB connectors increases, supporting complex systems with higher data transfer rates. Companies like LEMO and TE Connectivity are advancing in this space, with LEMO launching high-voltage connectors for EVs and TE expanding its offerings for autonomous vehicles. This innovation is crucial for the continued growth of the automotive connector market.

by Vehicle Type

In 2023, passenger cars held the largest share of the automotive connector market, accounting for about 70% of total revenue. This dominance is driven by the widespread integration of connectors in essential systems like ADAS, infotainment, powertrains, and electric vehicle (EV) technologies. As more passenger cars adopt electric and autonomous features, the demand for reliable, high-performance connectors continues to rise. Passenger cars increasingly require connectors that manage high data transfer rates and power needs, particularly with the shift toward electrification. Companies like TE Connectivity and Amphenol are advancing their product lines to meet these demands. TE Connectivity recently launched connectors for EV charging, while Amphenol developed connectors tailored for autonomous vehicles, ensuring support for complex electrical systems.

Automotive Connector Market Regional Overview

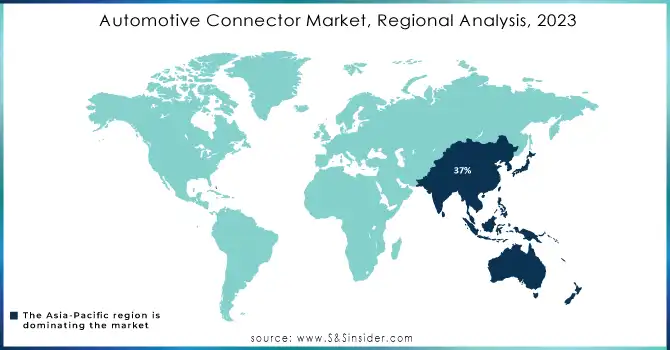

In 2023, the Asia-Pacific region captured 37% of the global automotive connector market, driven by its strong automotive manufacturing base and rapid adoption of electric vehicles (EVs). Leading countries like China, Japan, South Korea, and India are pushing forward with both traditional and electric vehicle production. China, as the largest automotive market, is driving demand for connectors needed in electric powertrains and charging systems. Japan continues to innovate in autonomous driving, requiring connectors for high-speed data and sensor integration. Meanwhile, India’s automotive sector is focusing on EVs, boosting the demand for connectors. Major companies such as TE Connectivity, Amphenol, and Molex are responding with new product offerings. TE launched connectors for EV charging stations, while Amphenol introduced products for safety systems and electric propulsion. Molex expanded its portfolio to support high-voltage and high-speed data transfer in EVs and autonomous systems. Asia-Pacific’s ongoing innovation and EV adoption will sustain its market dominance.

North America is the fastest-growing region in the automotive connector market, largely driven by the rise in electric vehicle (EV) adoption and advancements in autonomous driving technologies. Government incentives, improvements in infrastructure, and an increase in electric mobility are boosting the demand for high-performance connectors, especially in countries like the U.S. and Canada. Additionally, the widespread adoption of ADAS (Advanced Driver Assistance Systems) is increasing the need for connectors that support high-speed data transfer and efficient power management. Major automakers' investments further fuel this growth, making North America a key player in the expansion of the automotive connector market. Europe is experiencing moderate growth. Countries such as Germany, France, and the UK are leading in EV adoption, driven by stringent environmental regulations. However, Europe’s more mature automotive industry results in slower growth, although continued innovation in automotive electronics ensures steady demand for connectors in the region.

Need any customization research on Automotive Connector Market - Enquiry Now

Key Players

Some of the major players in Automotive Connector market with product:

-

TE Connectivity (PCB Connectors, High-Performance Terminals)

-

Yazaki Corporation (Wire Harness Connectors, EV Charging Connectors)

-

Aptiv PLC (High-Speed Data Connectors, Smart Connectors)

-

Amphenol Corporation (Fiber Optic Connectors, RF Connectors)

-

Molex Incorporated (Multi-Port Connectors, Power Connectors)

-

Sumitomo Electric Industries (High-Voltage Connectors, Shielded Connectors)

-

Hirose Electric Co., Ltd. (Miniature Connectors, Signal Connectors)

-

Rosenberger GmbH (Automotive RF Connectors, Coaxial Connectors)

-

Korea Electric Terminal Co. Ltd. (Battery Connectors, Signal Connectors)

-

Fujikura Ltd. (Optical Fiber Connectors, Wire Harness Solutions)

-

JAE (Japan Aviation Electronics Industry, Ltd.) (Board-to-Board Connectors, USB Connectors)

-

Lear Corporation (Power Distribution Connectors, Vehicle Interconnect Solutions)

-

Luxshare Precision Industry Co., Ltd. (High-Speed Data Connectors, Charging Connectors)

-

Harting Technology Group (Ethernet Connectors, Modular Connectors)

-

Panasonic Corporation (Waterproof Connectors, Automotive Relay Connectors)

-

Leoni AG (Cable Harness Connectors, Sensor Connectors)

-

Kyocera Corporation (Miniature Connectors, Automotive Terminals)

-

Samtec, Inc. (Micro Connectors, Flex Stack Connectors)

-

Schneider Electric (Battery Management Connectors, Sensor Connectors)

-

Delphi Technologies (Engine Control Connectors, Autonomous Vehicle Connectors)

List of suppliers companies that supply raw materials for automotive connectors:

-

DuPont

-

BASF

-

Celanese Corporation

-

Dow Inc.

-

SABIC

-

Covestro

-

DSM Engineering Materials

-

Solvay

-

Evonik Industries

-

Lanxess

-

Mitsubishi Chemical Corporation

-

LyondellBasell

-

Toray Industries, Inc.

-

ExxonMobil Chemical

-

3M Company

-

Asahi Kasei Corporation

-

Momentive Performance Materials

-

Teijin Limited

-

Henkel AG & Co. KGaA

-

Sumitomo Chemical

Recent News

-

on October 29, 2024 Tesla introduced its new Low-Voltage Connector Standard (LVCS). The LVCS features six connectors and a cable, aiming to simplify internal electrical and data connections in vehicles, with the goal of gaining widespread industry adoption, following the success of its North American Charging Standard (NACS).

Recent Development

-

In January 2024, Amphenol Corporation, a global leader in interconnect, sensor, and antenna solutions, announced the acquisition of PCTEL. This strategic acquisition aims to strengthen both companies' growth prospects by leveraging their combined expertise in wireless and connectivity solutions.

-

On September 5, 2024, TE Connectivity launched a new guide on automotive connector space reduction strategies. The paper explores how miniaturized connectors can improve electrical power, signaling, and data transfer while maintaining automotive-grade durability, and addresses challenges such as small-wire crimp quality and metallic whisker growth in high-density PCB connections.

-

In November 2023, Molex Incorporated, a prominent name in electronics and connectors, expanded its production capabilities by opening a new manufacturing campus in Poland. This move is part of Molex's strategy to increase its global footprint and meet growing demand in various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.67 Billion |

| Market Size by 2032 | USD 13.92 Billion |

| CAGR | CAGR of 6.85 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (PCB, IC, RF, Fiber Optic, Other) • By Vehicle Type (Passenger Car, Commercial Vehicle) • By Connectivity (Wire to Wire, Wire to Board, Others) • By Application (CCE, Powertrain, Safety & Security, Body Wiring & Power Distribution, Navigation & Instrumentation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity, Yazaki Corporation, Aptiv PLC, Amphenol Corporation, Molex Incorporated, Sumitomo Electric Industries, Hirose Electric Co., Ltd., Rosenberger GmbH, Korea Electric Terminal Co. Ltd., Fujikura Ltd., JAE (Japan Aviation Electronics Industry, Ltd.), Lear Corporation, Luxshare Precision Industry Co., Ltd., Harting Technology Group, Panasonic Corporation, Leoni AG, Kyocera Corporation, Samtec, Inc., Schneider Electric, Delphi Technologies. |

| Key Drivers | • Rising Demand for High-Performance Connectors Driven by ADAS and Enhanced Vehicle Safety Features. |

| RESTRAINTS | • High Manufacturing Costs and Technological Complexity Restrain Automotive Connector Market Growth. |