Routing Market Report Scope & Overview:

Get more information on Routing Market - Request Sample Report

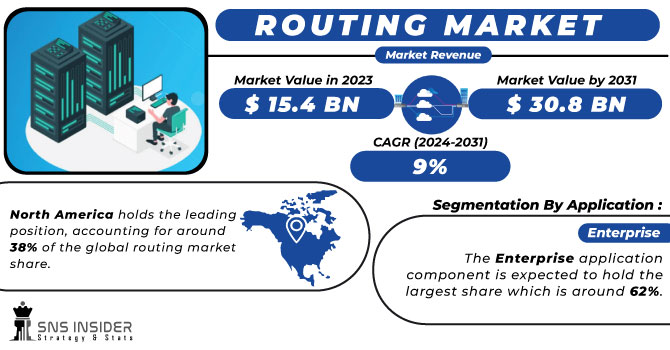

The Routing Market Size was valued at USD 15.4 billion in 2023, and is expected to reach USD 33.44 billion by 2032, and grow at a CAGR of 9 % over the forecast period 2024-2032.

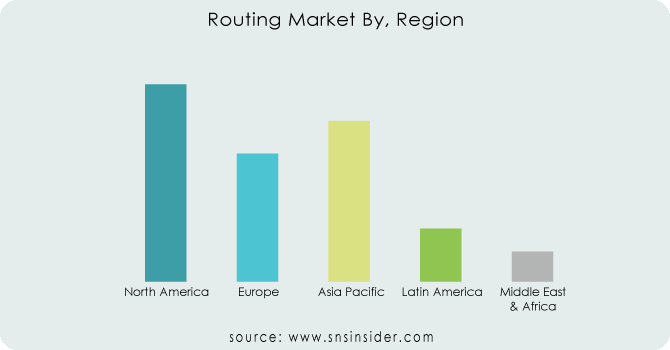

The routing market is experiencing significant growth, driven by the increasing demand for reliable and efficient data transmission across various sectors, including telecommunications, cloud computing, and enterprise networking. As businesses shift towards digital transformation and the adoption of Internet of Things (IoT) technologies, the need for advanced routing solutions has surged. Key players in the market are focusing on enhancing their offerings through innovations in software-defined networking (SDN) and network functions virtualization (NFV), which allow for greater flexibility and scalability. Furthermore, the proliferation of high-bandwidth applications, such as video streaming and online gaming, is pushing service providers to upgrade their routing infrastructure to manage traffic efficiently and improve user experience. In addition, the rise of 5G technology is revolutionizing the routing landscape by enabling faster data speeds and lower latency, further intensifying competition among providers. Geographically, North America holds a dominant position in the routing market, owing to its technological advancements and robust telecommunications infrastructure, while the Asia-Pacific region is projected to witness the fastest growth due to increasing internet penetration and investment in smart city projects. Overall, the routing market is poised for robust growth, driven by technological advancements and evolving consumer demands.

The routing market is poised for significant growth, driven by technological advancements and strategic acquisitions that enhance the capabilities of key players. Juniper Networks, following its acquisition of Mist in 2019, has positioned itself at the forefront of AI-driven networking with its advanced Marvis solution, which integrates seamlessly with its switching and routing portfolio. This strategic integration has attracted attention from major players like Walmart and Amazon, giving Juniper a competitive edge and a notable advantage over rivals such as Cisco and HPE Aruba. The latter, having struggled with its previous data center solutions, now benefits from Juniper’s robust data center switching line and the powerful Junos operating system, enabling a more coherent cloud-based management and monitoring approach. Moreover, with Juniper generating approximately USD 2 billion in annual revenue from the service provider market, HPE aims to leverage this foothold to bolster its presence in the burgeoning 5G space, particularly following its acquisition of Silver Peak and Athonet. The acquisition also strengthens HPE’s security portfolio by integrating Juniper’s enterprise firewall and threat intelligence capabilities, although the future of Juniper's "Connected Security" strategy within HPE remains uncertain. This dynamic environment compels competitors like Arista Networks, which may capitalize on the operational focus stemming from other vendors’ complexities. As the routing market continues to evolve, companies must adapt swiftly to leverage AI capabilities and cloud integrations to stay competitive and address the growing demands of enterprise and service provider networks.

Routing Market Dynamics

Drivers

- Increasing use of cloud computing is driving growth in the routing market.

The rising use of cloud computing services is a key factor in driving the routing market forward, as companies move towards cloud-based solutions that provide improved flexibility and scalability. This change requires a strong routing system that can effectively handle data transfer between systems on premises and cloud environments. As companies adopt cloud services to enhance efficiency and promote teamwork, the need for advanced routing technologies significantly increases. The IDynamic routing predicts that worldwide expenditures on cloud services will exceed $1 trillion by 2024, highlighting the need for efficient routing solutions to accommodate this significant expansion. Efficient routing is crucial to optimize data flow, ensure low latency, and uphold high performance in hybrid and multi-cloud environments. Moreover, with the rapid increase in cloud adoption, organizations are encountering more challenges in handling network traffic and maintaining smooth connectivity between different services and applications. This level of intricacy necessitates sophisticated routing solutions that can adjust to changing workloads and offer oversight and regulation over data routes. As a result, suppliers are updating their routing services with additions such as software-defined networking (SDN) and improved security measures in order to cater to the changing needs of businesses focusing on cloud technology. With the increasing adoption of cloud computing by businesses, the routing market is expected to experience significant growth. This growth is fueled by the demand for reliable, scalable, and resilient networking solutions that can easily work with cloud infrastructures.

- The Impact of 5G Technology on the Routing Market

The arrival of 5G technology is completely changing the routing terrain by requiring more advanced routing capabilities to accommodate its faster speeds and decreased latency. 5G networks are essential for ensuring smooth connectivity across various applications, such as smart cities and autonomous vehicles, due to their capability to manage larger amounts of data. With the adoption of 5G technology, industries need advanced routing solutions to handle intricate data streams effectively, guaranteeing dependable performance for vital applications. The FCC has acknowledged the significance of 5G and designated a large amount of funding to aid in its implementation, demonstrating a firm government dedication to strengthening telecommunications infrastructure. This investment is crucial because it establishes the foundation for future connectivity, enabling businesses and service providers to take advantage of the advantages offered by 5G technology. Consequently, there is a growing need in the routing market for creative solutions to address the specific obstacles brought by 5G, such as network slicing, real-time data processing, and enhanced security measures. The growing incorporation of 5G in daily activities highlights the importance of advanced routing infrastructure, propelling the routing market towards substantial expansion as businesses aim to enhance their networks for this revolutionary technology.

Restraints

- Challenges in Transitioning to Virtualized Routing Solutions

Reluctance to transition from legacy systems to virtualized environments poses a significant restraint in the routing market. Many internet service providers (ISPs) and telecommunications companies continue to rely on complex legacy systems, which, while familiar, incur high maintenance costs and are often incompatible with modern platforms. These older systems present challenges in management and performance, limiting their ability to support new services demanded by an expanding customer base. As the industry moves towards more agile and efficient routing solutions, the need for customized virtual router software that integrates seamlessly with existing architecture becomes paramount. However, the integration of new virtual router applications with legacy systems is fraught with challenges; it requires significant investment and careful planning to avoid disruptions in service. Many service providers are hesitant to undertake this transition due to fears of incomplete integration, which could lead to service outages or degraded performance. Furthermore, traditional systems lack the capabilities to support emerging services, thereby restricting ISPs' ability to meet growing customer expectations for speed and reliability. Despite these challenges, there is a gradual shift occurring in the industry as service providers begin to recognize the long-term benefits of virtualized routing solutions. By implementing these advanced systems, ISPs can accelerate their time-to-market for new services, reduce infrastructure maintenance costs, and ultimately enhance their returns on investment. This slow but steady movement towards virtualization reflects a broader industry trend towards modernization, enabling providers to remain competitive in a rapidly evolving digital landscape. The journey from legacy systems to virtualized solutions is undoubtedly complex, but it is a necessary step towards achieving greater operational efficiency and adaptability in the routing market.

Routing Market Segment Analysis

By Type

In 2023, the routing market is significantly driven by the wireless router segment, which captured a remarkable 65.78% share of the total revenue. This dominance can be attributed to the increasing demand for high-speed internet connectivity, driven by the growing number of connected devices and the rising adoption of smart home technologies. Major players in the market have responded to this trend with innovative product launches and developments. For instance, TP-Link launched its latest Archer AXE75 wireless router, which boasts Wi-Fi 6E technology, providing faster speeds and better performance for multiple devices simultaneously. Similarly, Netgear introduced the Nighthawk RAXE500, a tri-band router designed to support heavy internet usage in large households or small businesses, further solidifying its market presence. These advancements in wireless technology not only cater to consumer demand for enhanced connectivity but also facilitate the increasing reliance on cloud services and online gaming, both of which require robust routing solutions. Moreover, the emphasis on integrating advanced security features in wireless routers has become paramount, with companies like ASUS enhancing their AiProtection services to provide users with real-time threat detection. This growth in the wireless router segment underscores its pivotal role in the overall routing market, as it enables seamless connectivity and supports the rapid evolution of digital infrastructure across various sectors, from residential to commercial applications. Consequently, the ongoing innovations and product enhancements in wireless routers are essential for maintaining the momentum of growth in the routing market.

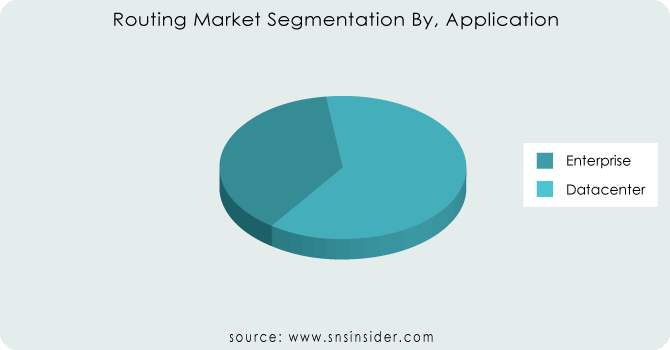

By Application

In 2023, the enterprise segment led the routing market, capturing an impressive 63.78% share of total revenue. This dominance is driven by the increasing demand for robust networking solutions that support complex business operations and the growing need for enhanced security measures. Companies are increasingly investing in advanced routing technologies to improve network efficiency, scalability, and reliability. Notable product developments in this segment include Cisco's launch of the Catalyst 9000 Series, which offers advanced features like automation, security, and analytics, specifically designed to meet the needs of enterprise environments. Similarly, Juniper Networks introduced its MX Series 5G Universal Routing Platform, enabling enterprises to manage high volumes of data traffic seamlessly while supporting the transition to 5G. Furthermore, HPE Aruba enhanced its Aruba CX Switching portfolio to deliver improved performance and cloud-native management capabilities, catering to the increasing shift towards hybrid cloud environments in enterprises. The emphasis on integrating artificial intelligence (AI) and machine learning (ML) into routing solutions is also transforming how enterprises manage their networks, enabling predictive analytics and automated troubleshooting. Overall, the robust growth of the enterprise segment underscores its critical role in the routing market, as organizations seek reliable and innovative solutions to support their digital transformation initiatives.

Get a Customized Report as per your Business Requirement - Request For Customized Report

Routing Market Regional Analysis

The Asia-Pacific region took the lead in the routing market in 2023, representing a significant 37.56% portion of the total revenue. The main reasons for this expansion are the quick digital advancements in different sectors and the rising internet usage in nations like China, India, and Japan. Big telecommunications firms in the area are making significant investments in cutting-edge routing technologies to sustain their growing networks. As an example, Huawei introduced the NetEngine 8000 series to boost the capacity and effectiveness of routing solutions, addressing the specific needs of 5G and cloud computing. Moreover, Cisco increased its footprint in India by launching new routing solutions designed for local businesses, with a focus on enhancing connectivity and security during their digital transformation journey.

Countries such as South Korea are also making substantial progress by incorporating smart city projects that rely on strong routing capabilities to handle the massive amounts of data produced by IoT gadgets. Moreover, the Australian government has pledged significant funding for telecommunications infrastructure, which will increase the need for advanced routing solutions. In general, the Asia-Pacific region's emphasis on technological progress and government actions is driving its expansion in the routing market, positioning it as a significant player worldwide.

In 2023, North America has emerged as the fastest-growing region in the routing market, driven by rapid technological advancements, increasing demand for high-speed internet, and substantial investments in telecommunications infrastructure. Major companies in the region are launching innovative products to enhance connectivity and network efficiency. For instance, Cisco unveiled its Catalyst 9200 Series, which offers enhanced security features and improved performance for enterprise networks, catering to the rising need for robust routing solutions among businesses transitioning to hybrid cloud environments. Similarly, Juniper Networks introduced its Misty AI-powered routing solutions, which leverage artificial intelligence to optimize network performance and automate troubleshooting processes, addressing the growing complexity of enterprise networks.In addition to corporate developments, government initiatives in the U.S. and Canada are playing a crucial role in advancing the routing market. The Federal Communications Commission (FCC) has implemented programs aimed at improving broadband access, particularly in underserved areas, which is expected to drive demand for modern routing technologies. Furthermore, the ongoing rollout of 5G networks across the region necessitates advanced routing capabilities to support higher data traffic and enable new applications, such as smart cities and autonomous vehicles. Overall, the combination of corporate innovation and supportive government policies positions North America as a leader in the rapidly evolving routing market.

Key Players in Routing Market

-

Cisco (Catalyst 9000 Series)

-

Nokia (Nokia 7750 Service Router)

-

Juniper Networks (MX Series 5G Universal Routing Platform)

-

Arista Networks (720XP Series Switches)

-

New H3C Technologies (S5800 Series Switches)

-

Huawei Technologies (NetEngine 8000 Series)

-

Huawei Technologies (HP) (Aruba CX Switching Portfolio)

-

ASUSTeK Computer (RT-AX88U Router)

-

NETGEAR (Nighthawk AX12 Router)

-

Xiaomi (Mi Router AX6000)

-

TP-Link (Archer AX11000 Gaming Router)

-

Brocade Communications (ICX Series Switches)

-

Extreme Networks (ExtremeSwitching Series)

-

MikroTik (RouterBOARD Series)

-

D-Link (DIR-3040 Default routing2000 Router)

-

Linksys (Velop MX10 Mesh Wi-Fi System)

-

ZTE Corporation (ZXCTN 6180 Router)

-

Avaya (Ethernet Routing Switch 6000)

-

Alcatel-Lucent (Alcatel-Lucent 7750 SR)

-

Fortinet (FortiGate Secure SD-WAN)

-

Others

Recent Development in Routing Market

-

In March 14, 2024, Cisco, a major player in the routing market, announced the launch of its new Silicon One Network Routing Platform. This platform utilizes a next-generation Network Processor Unit (NPU) designed to deliver high performance, scalability, and programmability for enterprise and service provider networks.

-

In December 2021, the Aston Martin Cognizant Formula Team announced a new partnership with Juniper Networks, becoming the team's official network equipment provider. As part of the partnership, Juniper would deliver an agile and highly automated network platform for the entire team's new technology campus, which is expected to be completed in early 2023.

-

In November 2021, H3C comprehensively demonstrated its ability to facilitate the implementation of 5G networks and digital and intelligent transformation at the recently concluded China Mobile Global Partner Conference 2021 in Guangzhou, Guangdong Province, which further strengthened its close relationship with China Mobile.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.4 Billion |

| Market Size by 2031 | US$ 30.8 Billion |

| CAGR | CAGR of 9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wired Router, Wireless Router) • By Route (Default, Dynamic, Static) • By Placement (Virtual, Core, Edge) • By Application (Enterprise, Datacenter) • By Vertical (BFSI, Education, Media & Entertainment, Healthcare, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco, Nokia, Juniper Networks, Arista Networks, New H3C Technologies, Huawei Technologies, Hewlett Packard, ASUSTeK Computer, NETGEAR, Xiaomi |

| Key Drivers | • Growth of Cloud Computing and services demands dynamic routing mechanisms to adapt to fluctuating traffic patterns and geographically dispersed data centers. • The Continuous Rising Internet Traffic |

| Restraints | • Proprietary routing protocols from dominant vendors can limit interoperability and flexibility for network operators. • Traditional routing protocols lack robust security, making networks vulnerable to hijacking and data breaches. |