Rugged Tablet Market Size

Get E-PDF Sample Report on Rugged Tablet Market - Request Sample Report

The Rugged Tablet Market Size was valued at USD 0.96 Billion in 2023 and is expected to reach USD 1.66 Billion by 2032 and grow at a CAGR of 6.28% over the forecast period of 2024-2032.

The rugged tablet market is experiencing significant growth driven by increasing demand across various industries such as manufacturing, logistics, healthcare, and construction. Rugged tablets have become essential for businesses aiming to enhance operational efficiency and streamline workflows, especially in tough environments where durability and reliability are critical.These devices are designed to withstand harsh conditions, including exposure to dust, moisture, extreme temperatures, and drops, making them ideal for outdoor and industrial use. For instance, in industrial maintenance, rugged tablets are transforming how businesses manage maintenance operations by providing real-time data, enabling predictive maintenance, and reducing downtime, which leads to cost savings.

The healthcare sector is also benefiting from rugged tablets, using them for field diagnostics, patient care management, and integration with other digital healthcare systems. With the rise of remote work and mobile workforces, companies are increasingly deploying rugged tablets to support field operations, providing a portable and reliable solution for data collection, inventory management, and communication. This growing demand is further fueled by technological advancements that enhance the processing power, battery life, and connectivity of rugged tablets, such as 5G integration and IoT compatibility, making them even more effective for diverse applications.

Additionally, the increasing focus on safety and compliance standards, such as MIL-STD-810G, is pushing industries like defense and public safety to invest in rugged tablets that meet rigorous durability requirements.

Rugged Tablet Market Dynamics

Drivers

-

Technological Advancements and Industry-Specific Applications Drive Growth in the Rugged Tablet Market

The rugged tablet market is witnessing substantial growth, driven by increasing demand from industries such as manufacturing, logistics, healthcare, construction, and defense, where operational efficiency and durability are critical. Rugged tablets, designed to withstand extreme conditions like dust, moisture, high and low temperatures, and impacts, have become essential for workers in demanding environments. For example, in logistics, these devices streamline inventory management and ensure real-time communication in warehouses and remote locations, enhancing productivity.

In industrial maintenance, rugged tablets provide predictive maintenance solutions, reducing downtime and achieving cost savings. Healthcare professionals leverage rugged tablets for field diagnostics, patient care management, and seamless integration with digital healthcare systems, ensuring uninterrupted service in challenging conditions. Devices such as Getac Technology’s ZX80 exemplify these innovations with features like MIL-STD-810H and IP67 certifications, a 1,000-nit screen for outdoor visibility, hot-swappable batteries, dual SIM design, and compatibility with AI use cases. This tablet’s ability to operate in temperatures from -29°C to 63°C demonstrates its utility across diverse environments, from warehouses to outdoor facilities. The incorporation of advanced connectivity options like Wi-Fi 6E, Bluetooth 5.2, and 4G/5G LTE ensures seamless operations, while AI engines enable complex tasks like unmanned aircraft control and machine learning applications. The growing focus on safety and compliance standards further solidifies rugged tablets' adoption in defense and public safety sectors. As industries increasingly adopt mobile computing and leverage technological advancements, the rugged tablet market is poised for continued expansion, offering solutions that enhance productivity, reduce costs, and ensure reliability in even the most demanding environments.

Restraints

-

Rugged tablet market faces constraints due to high costs, reduced portability, and slower technological advancements.

High initial costs also constrain market growth. The specialized materials and components necessary for rugged designs drive up production costs, making these devices significantly more expensive than consumer alternatives. This price gap often deters small and medium-sized enterprises (SMEs) and budget-conscious organizations from adopting them. Moreover, the slower pace of technological innovation in rugged tablets compared to consumer devices is a disadvantage. Features like biometric security, edge-to-edge displays, and advanced connectivity are often missing, leaving rugged tablets less competitive.

Limited software compatibility and customization challenges further impede adoption. Issues with integrating rugged tablets into modern enterprise software or adapting them for specific use cases discourage businesses. To sustain growth, manufacturers must address these restraints by balancing durability with affordability, technological advancements, and user-centric features.

Rugged Tablet Market Segment Analysis

by Operation System

In 2023, the Windows segment dominated the rugged tablet market, accounting for approximately 49% of the market share. This dominance can be attributed to the widespread adoption of Windows-based systems across various industries that rely on rugged tablets, such as manufacturing, logistics, healthcare, and field services. Windows operating systems offer seamless integration with existing enterprise software, making them highly attractive for businesses seeking to ensure compatibility and streamline operations. Furthermore, the familiarity and robustness of the Windows environment make it easier for organizations to deploy rugged tablets within their IT infrastructure without requiring significant training or system adjustments. The Windows platform is known for its stability, security features, and wide compatibility with business-critical applications, including enterprise resource planning and customer relationship management tools. These advantages have made Windows-powered rugged tablets the preferred choice for organizations prioritizing reliability and productivity in demanding environments.

by Type

In 2023, the Fully Rugged segment dominated the rugged tablet market, accounting for around 59% of the market share. These devices are specifically designed to withstand the harshest environments, making them ideal for industries such as manufacturing, construction, logistics, and military applications. Fully rugged tablets are built with reinforced exteriors, enhanced durability, and the ability to endure extreme conditions like dust, water, shocks, and temperature fluctuations. Their robust construction ensures reliability in demanding situations, where standard devices might fail. This segment's popularity is driven by their ability to enhance productivity and operational efficiency in challenging environments, offering high performance and stability. As industries continue to prioritize durability and long-term use, the Fully Rugged segment is expected to maintain a strong market presence.

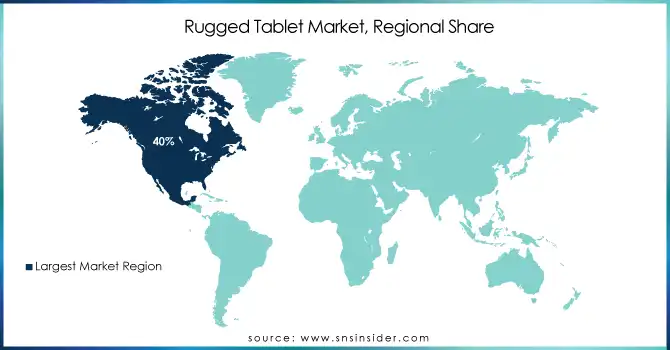

Rugged Tablet Market Regional Outlook

In 2023, North America dominated the rugged tablet market, accounting for approximately 40% of global revenue. This dominance is driven by the widespread adoption of rugged tablets in key sectors such as manufacturing, healthcare, logistics, and defense. The U.S. is driving this trend, with its robust infrastructure and tech-centric industries investing more in durable mobile solutions for field operations, maintenance, and real-time data collection. Additionally, North America benefits from the presence of leading manufacturers and innovators in rugged tablet solutions. Technological advancements, such as 5G integration and IoT compatibility, further enhance the region's market position. The region’s emphasis on safety, compliance standards, and expanding industries like renewable energy and defense ensures continued growth in the rugged tablet market.

Asia-Pacific is the fastest-growing region in the rugged tablet market during the forecast period of 2024-2032. This growth is fueled by rapid industrialization, increasing infrastructure development, and the rising demand for durable mobile devices in sectors like manufacturing, logistics, defense, and construction. Countries such as China, India, Japan, and South Korea are investing heavily in technological advancements and smart solutions, driving the demand for rugged tablets. Additionally, the region’s expanding healthcare, transportation, and mining sectors contribute to this surge in adoption. The region benefits from cost-effective manufacturing, making rugged tablets more accessible to a wider range of businesses. The growing focus on operational efficiency, mobility, and data collection in harsh environments further accelerates market growth across Asia-Pacific.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in the rugged tablet market, with their associated products listed:

-

Panasonic: (Toughpad FZ-G1, Toughbook series)

-

Getac: (Getac F110, Getac T800)

-

Zebra Technologies: (ET80/ET85, TC series)

-

Dell Technologies: (Latitude 7220 Rugged Extreme Tablet)

-

Microsoft: (Surface Go 3 for Business)

-

Xplore Technologies: (Xplore Bobcat, Xplore iX104C6)

-

Honeywell: (RT10, Dolphin CT40)

-

MobileDemand, L.C.: (xTablet T1180, xTablet T1600)

-

Advantech: (TREK-550, TREK-722)

-

TabletKiosk: (OmniTAP 10.1", PWS-8650)

-

Durabook: (R11, Z14I)

-

Winmate: (M101B, 10.1" rugged tablet)

-

Trimble Inc.: (Trimble T10, Trimble Yuma 2)

-

Unitech: (TB100, HT680)

-

Pryme: (Rugged Tablet Solutions for first responders)

-

Samsung: (Galaxy Tab Active3)

-

Logic Instrument: (Fieldbook 15, Fieldbook 12)

-

B&B Electronics: (Rugged Tablets for industrial applications)

-

RuggON: (Rextorm PX-501, PX-70)

-

Leonardo DRS: (Rugged solutions for military applications)

-

NEXCOM International Co., Ltd.: (Rugged Tablet PC)

-

AAEON: (Rugged Tablets and Industrial PCs)

-

HP Development Company, L.P.: (HP Elite x2, HP Pro Tablet 608)

-

Kontron S&T AG: (Rugged Tablets and Embedded Systems)

-

American Standard: (Rugged Tablets for industrial and military use)

List of potential customer companies that could benefit from rugged tablets across various industries:

-

Boeing (Aerospace and Defense)

-

General Electric (GE) (Manufacturing, Energy, and Power)

-

ExxonMobil (Oil and Gas)

-

Lockheed Martin (Aerospace and Defense)

-

Siemens (Industrial Equipment and Automation)

-

Caterpillar (Construction and Heavy Equipment)

-

DHL (Logistics and Transportation)

-

United Parcel Service (UPS) (Logistics and Distribution)

-

Schneider Electric (Energy and Automation)

-

Honeywell (Technology and Manufacturing)

-

Pfizer (Pharmaceuticals and Healthcare)

-

Medtronic (Medical Devices and Healthcare)

-

AT&T (Telecommunications)

-

T-Mobile (Telecommunications)

-

Macy's (Retail and Inventory Management)

-

Ford Motor Company (Automotive)

-

Chevron (Oil and Gas)

-

Raytheon Technologies (Aerospace and Defense)

-

IBM (Technology and Consulting)

-

Tesla (Automotive and Energy)

Recent Development

-

Oct 30, 2024: Getac integrates Sony Semiconductor Solutions' SORPLAS environmentally conscious plastic into its premium rugged products, including the Getac S510 laptop and K120 tablet, reinforcing their commitment to sustainability by utilizing recycled materials in manufacturing.

-

October18, 2024 Honeywell Unveils AI-Powered Mobile Computers for Enhanced Workforce Productivity. Honeywell has introduced three new AI-powered handheld computers – the CT37, CK67, and CK62 – designed to boost productivity across retail, healthcare, and warehouse environments. These devices integrate AI to optimize workflows, improve task efficiency, and enhance accuracy, making them ideal for frontline workers

-

December 10, 2024, Samsung's upcoming rugged phone, the Galaxy Xcover 8 Pro, is set to feature a user-removable battery with a higher capacity than previous Xcover models, as confirmed by Safety Korea.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.96 Billion |

| Market Size by 2032 | USD 1.66 Billion |

| CAGR | CAGR of 6.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operating System (Windows, iOS, Android, Others) • By Type (Fully Rugged, Semi Rugged) • By Distribution Channel (Online, Offline) • By End-Use Industry (Oil & Gas, Retail, Construction, Education, Government, Food & Beverage, Manufacturing, Healthcare, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Panasonic, Getac, Zebra Technologies, Dell Technologies, Microsoft, Xplore Technologies, Honeywell, MobileDemand, L.C., Advantech, TabletKiosk, Durabook, Winmate, Trimble Inc., Unitech, Pryme, Samsung, Logic Instrument, B&B Electronics, RuggON, Leonardo DRS, NEXCOM International Co., Ltd., AAEON, HP Development Company, L.P., Kontron S&T AG, American Standard. |

| Key Drivers | • Technological Advancements and Industry-Specific Applications Drive Growth in the Rugged Tablet Market. |

| Restraints | • Rugged tablet market faces constraints due to high costs, reduced portability, and slower technological advancements. |