Connected Device Analytics Market Report Scope & Overview:

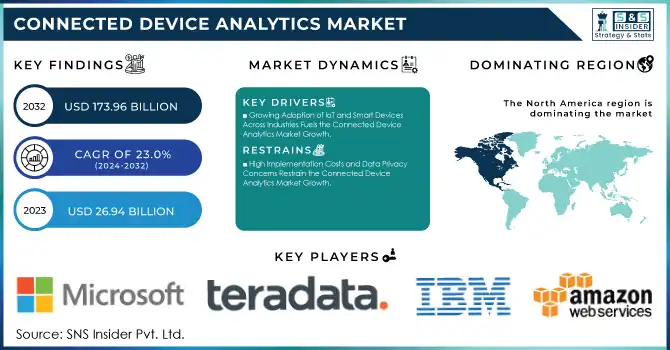

The Connected Device Analytics Market Size was valued at USD 26.94 Billion in 2023 and is expected to reach USD 173.96 Billion by 2032 and grow at a CAGR of 23.0% over the forecast period 2024-2032.

To Get More Information on Connected Device Analytics Market - Request Sample Report

The Connected Device Analytics Market is experiencing rapid growth, driven by the increasing adoption of Internet of Things (IoT) devices, big data analytics, and artificial intelligence (AI) across industries. Organizations are leveraging connected device analytics to extract valuable insights from vast amounts of real-time data generated by smart devices, sensors, and edge computing systems. The ability to analyze this data effectively helps businesses improve operational efficiency, enhance customer experiences, optimize asset management, and enable predictive maintenance.

This expansion is fueled by the increasing focus on remote monitoring, the adoption of smart payment technologies, and the need for businesses to build digital infrastructures for large-scale deployments. In the United States, the federal government has recognized the importance of securing connected devices, leading to the introduction of the U.S. Cyber Trust Mark Initiative. This voluntary program allows manufacturers to label their products, such as baby monitors and home security cameras, with a distinctive shield logo and QR codes if they meet federal cybersecurity standards, helping consumers identify devices that are less vulnerable to hacking. The initiative aims to enhance consumer confidence in connected devices and encourage manufacturers to improve their cybersecurity practices. As the number of internet-connected devices in American households continues to rise, with the average household now having 21 such devices, the demand for robust analytics solutions to manage and secure these devices is expected to grow, further propelling the connected device analytics market.

Connected Device Analytics Market Market Dynamics

Key Drivers:

-

Growing Adoption of IoT and Smart Devices Across Industries Fuels the Connected Device Analytics Market Growth

The rapid proliferation of Internet of Things (IoT) devices across various industries is a significant driver of the Connected Device Analytics Market. Businesses are integrating IoT-enabled solutions to enhance operational efficiency, improve decision-making, and optimize asset performance. Industries such as manufacturing, healthcare, retail, and transportation are deploying smart sensors, connected wearables, and industrial IoT (IIoT) devices to collect and analyze vast amounts of real-time data. With enterprises generating massive datasets from these devices, there is an increasing demand for advanced analytics solutions to process, interpret, and derive actionable insights. Additionally, IoT-powered remote monitoring systems enable companies to track assets, predict maintenance needs, and enhance security measures, thereby reducing downtime and improving business outcomes.

According to Research, the number of IoT-connected devices worldwide is projected to reach 30.9 billion by 2025, demonstrating the immense potential for connected device analytics. As organizations continue to digitize their operations and leverage data-driven intelligence, the demand for real-time analytics, cloud-based solutions, and AI-powered insights will further propel the Connected Device Analytics Market forward.

-

Rising Need for Predictive Maintenance and Remote Monitoring Accelerates the Connected Device Analytics Market Expansion

The increasing need for predictive maintenance and remote monitoring solutions is significantly driving the growth of the Connected Device Analytics Market. Industries such as energy, manufacturing, transportation, and healthcare rely on real-time analytics to monitor the performance of connected assets and prevent system failures. Predictive maintenance solutions use AI, machine learning, and big data analytics to analyze data from connected sensors and detect potential issues before they lead to costly breakdowns. This proactive approach minimizes downtime, reduces maintenance costs, and enhances operational efficiency. Remote monitoring, another crucial application, enables organizations to track machinery, optimize supply chains, and ensure regulatory compliance without the need for physical inspections.

For instance, in the healthcare sector, remote patient monitoring devices equipped with analytics capabilities help doctors track vital signs, detect abnormalities, and provide timely medical interventions. Similarly, smart grid systems use connected device analytics to monitor electricity distribution and detect faults in power lines, improving energy efficiency.

As businesses prioritize cost-saving measures and automation, the demand for connected device analytics solutions in predictive maintenance and remote monitoring is expected to witness substantial growth in the coming years.

Restrain:

-

High Implementation Costs and Data Privacy Concerns Restrain the Connected Device Analytics Market Growth

Despite its rapid expansion, the Connected Device Analytics Market faces challenges due to the high implementation costs and growing concerns over data privacy and security. Deploying connected device analytics solutions requires substantial investments in hardware, software, and cloud infrastructure, making it challenging for small and medium-sized enterprises (SMEs) to adopt these technologies. The need for advanced AI-driven platforms, real-time processing capabilities, and edge computing solutions further escalates costs, limiting adoption among budget-conscious businesses.

Additionally, as connected devices collect and transmit vast amounts of sensitive data, concerns regarding cybersecurity threats, data breaches, and regulatory compliance continue to hinder market growth. Industries handling critical information, such as healthcare and finance, are particularly cautious about integrating connected analytics due to strict data protection laws like GDPR and HIPAA. The risk of unauthorized access, hacking, and data manipulation further discourages companies from fully leveraging connected analytics solutions. Addressing these concerns requires robust encryption techniques, AI-driven security frameworks, and government regulations to ensure data privacy and protection. While the Connected Device Analytics Market continues to grow, overcoming cost and security challenges will be crucial for widespread adoption across industries.

Connected Device Analytics Market Segments Analysis

By Component

In 2023, the Solution segment dominated the connected device analytics Market, accounting for 64% of the revenue share. This dominance is attributed to the increasing demand for comprehensive analytics platforms that enable organizations to process and interpret vast amounts of data generated by connected devices. Companies are actively developing and launching advanced solutions to cater to this demand.

For instance, in October 2024, Oura introduced the Oura Ring 4, a smart ring equipped with enhanced health tracking capabilities, allowing users to monitor various health metrics through advanced analytics. Similarly, in August 2024, Jaguar and Vodafone demonstrated vehicles equipped with Vodafone's "smart hub," transforming cars into Wi-Fi hotspots and enhancing GPS and data capabilities, showcasing the integration of connected device analytics in the automotive sector.

The Services segment of the Connected Device Analytics Market is experiencing a significant growth trajectory, with a Compound Annual Growth Rate (CAGR) of 23.99% during the forecasted period. This rapid expansion is driven by the increasing need for specialized services that assist organizations in implementing, managing, and optimizing connected device analytics solutions. Companies are launching tailored services to meet these demands.

For example, in 2025, several firms introduced consulting and managed services aimed at helping businesses integrate advanced analytics into their operations seamlessly. These services encompass system integration, data management, and continuous support, ensuring that organizations can effectively leverage analytics tools to gain actionable insights.

By Organization Size

In 2023, the Large Enterprise segment dominated the Connected Device Analytics Market, accounting for 63% of the revenue share. Large enterprises are heavily investing in connected device analytics solutions to improve operational efficiency, enhance customer experience, and drive digital transformation. These organizations leverage advanced analytics platforms to process and analyze the massive volumes of data generated by connected devices across their operations.

For example, IBM’s Watson IoT platform helps enterprises derive actionable insights from connected devices, which leads to smarter decision-making and resource optimization.

The Small and Medium-Sized Enterprise (SME) segment is experiencing the largest Compound Annual Growth Rate (CAGR) at 24.01% within the forecasted period in the Connected Device Analytics Market. This growth is driven by the increasing availability of cost-effective, scalable analytics solutions and the digital transformation of SMEs. Companies like Google and AWS have launched cloud-based platforms that allow SMEs to deploy connected device analytics without requiring significant upfront investments in hardware or infrastructure.

For instance, AWS IoT Analytics provides SMEs with tools to process, analyze, and visualize data generated by connected devices, making it easier for smaller organizations to leverage advanced analytics without large capital expenditures.

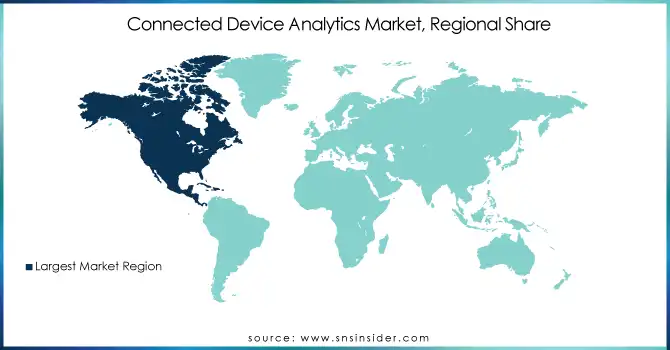

Regional Analysis

In 2023, North America dominated the Connected Device Analytics Market, accounting for a significant portion of the market share. The region is expected to continue leading in terms of market share due to its advanced technological infrastructure, high adoption rate of IoT devices, and increasing investments in digital transformation. The estimated market share for North America in the Connected Device Analytics Market is around 38%. The dominance of North America can be attributed to the presence of major players such as Microsoft, IBM, Cisco, and AWS, which have consistently innovated and developed cutting-edge solutions in IoT, big data analytics, and AI.

For example, IBM’s Watson IoT platform and Cisco’s Connected Device Analytics Solutions are widely used by enterprises in North America to streamline operations, enhance asset management, and improve predictive maintenance.

The Asia Pacific (APAC) region is the fastest-growing market for connected device analytics, with an estimated CAGR of 25.58% during the forecasted period. This rapid growth is driven by the increasing adoption of IoT devices, the expansion of smart cities, and the ongoing digital transformation initiatives across countries like China, Japan, India, and South Korea.

For instance, China has become a global leader in smart manufacturing and IoT applications, with the government actively promoting smart factory initiatives under the Made in China 2025 plan. Companies in India are also increasingly leveraging connected device analytics to optimize operations in sectors like agriculture, logistics, and healthcare, where real-time data monitoring is crucial for enhancing productivity and efficiency.

Additionally, Japan's technological advancements in robotics and smart healthcare devices are contributing to the growing demand for connected device analytics. The rise of the smartphone and wearable device markets is also boosting demand for connected device analytics solutions in the APAC region, as consumers and businesses seek real-time health tracking and predictive analytics. The significant investments from both governments and private organizations in IoT infrastructure and cloud computing technologies are expected to propel APAC to maintain its position as the fastest-growing region in the connected device analytics market.

Do You Need any Customization Research on Connected Device Analytics Market - Enquire Now

Key Players

Some of the major players in the Connected Device Analytics Market are:

-

Microsoft (US) (Azure IoT, Power BI)

-

Oracle Corporation (US) (Oracle IoT Cloud, Oracle Analytics Cloud)

-

IBM Corporation (US) (IBM Watson IoT, IBM Cognos Analytics)

-

SAP SE (Germany) (SAP Leonardo IoT, SAP Analytics Cloud)

-

PTC (US) (ThingWorx, Kepware)

-

Cisco (US) (Cisco Kinetic, Cisco Jasper)

-

Google (US) (Google Cloud IoT Core, Google BigQuery)

-

SAS Institute (US) (SAS IoT Analytics, SAS Visual Analytics)

-

Adobe (US) (Adobe Analytics, Adobe Sensei)

-

Teradata (US) (Teradata Vantage, Teradata IoT Analytics)

-

AWS (US) (AWS IoT Analytics, Amazon QuickSight)

-

HPE (US) (HPE Edgeline, HPE Vertica)

-

Hitachi (Japan) (Hitachi Lumada, Pentaho)

-

Software AG (Germany) (Cumulocity IoT, TrendMiner)

-

GE (US) (GE Digital Predix, GE APM (Asset Performance Management))

-

Cloudera (US) (Cloudera DataFlow, Cloudera Machine Learning)

-

Guavus (US) (Guavus AI-based Analytics, Guavus Reflex)

-

Splunk (US) (Splunk Industrial IoT, Splunk Enterprise)

-

TIBCO Software (US) (TIBCO Spotfire, TIBCO Streaming)

-

Qlik (US) (Qlik Sense, Qlik Data Integration)

-

Salesforce (US) (Salesforce IoT Cloud, Tableau)

-

Infor (US) (Infor IoT, Infor Birst)

-

Mnubo (Canada) (Mnubo SmartObjects, Mnubo Data Science Studio)

-

Arundo Analytics (US) (Arundo Edge, Arundo Analytics Platform)

-

Iguazio (Israel) (Iguazio Data Science Platform, Iguazio Nuclio)

-

Striim (US) (Striim Real-time Streaming, Striim Cloud)

Recent Trends

-

In January 24, 2023, Microsoft announced the acquisition of Aquantive, a provider of connected device analytics Component. The acquisition will help Microsoft to expand its offering in the connected device analytics market.

-

In January 2025, ServiceNow announced an integration with Oracle's Autonomous Database and Oracle Database 23ai. This collaboration enhanced ServiceNow's Workflow Data Fabric capabilities by enabling zero-copy data sharing and bi-directional data exchange, connecting real-time data between Oracle's databases and the ServiceNow platform. The integration aimed to improve intelligent decision-making and operational efficiency for enterprises.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 26.94 Billion |

| Market Size by 2032 | US$ 173.96 Billion |

| CAGR | CAGR of 23.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Application (Sales and Customer Management, Security & Emergency Management, Remote Monitoring, Predictive Maintenance Asset Management, Inventory Management, Energy Management, Building Automation, Others) • By Organization Size (Large Enterprise, Small and Medium Size Enterprise) • By Deployment Mode (On-premises, Cloud) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Oracle, IBM, SAP, PTC, Cisco, Google, SAS Institute, Adobe, Teradata, AWS, HPE, Hitachi, Software AG, GE, Cloudera, Guavus, Splunk, TIBCO Software, Qlik, Salesforce, Infor, Mnubo, Arundo Analytics, Iguazio, Striim. |

| Key Drivers | • Growing Adoption of IoT and Smart Devices Across Industries Fuels the Connected Device Analytics Market Growth • Rising Need for Predictive Maintenance and Remote Monitoring Accelerates the Connected Device Analytics Market Expansion |

| Restraints | • High Implementation Costs and Data Privacy Concerns Restrain the Connected Device Analytics Market Growth |