Scaffold Technology Market Report Scope & Overview:

Get More Information on Scaffold Technology Market - Request Sample Report

The Scaffold Technology Market was valued at USD 1.88 Bn in 2023 and is expected to reach USD 6.05 Bn by 2032 and grow at a CAGR of 13.82% Over the Forecast period of 2024-2032.

The scaffold technology market is experiencing rapid expansion, driven primarily by the surging demand for regenerative medicine and tissue engineering. This is mainly due to its increasing application in biological studies and translational research. The shift towards 3D cellular models is also driven by the limitations of traditional 2D cell culture methods in accurately simulating in vivo conditions. The COVID-19 pandemic further accelerated the adoption of scaffold technology as researchers utilized tissue engineering to study the virus, develop in vitro models, and explore potential therapeutic solutions. A study published in the Advanced Healthcare Materials Journal in October 2021 highlighted the potential of biomaterial scaffolds in vaccine development. Researchers successfully created a COVID-19 vaccine candidate that utilized these scaffolds to attract and activate immune cells, leading to the development of adaptive immunity.

The scaffold technology market is characterized by a diverse range of players, including established medical device companies, biotechnology firms, and academic research institutions. Key players are investing heavily in research and development to create innovative scaffold materials and technologies. For instance, companies like Organovo and Cellink have developed 3D bioprinters that can create customized scaffolds for various tissue types.

The U.S. Food and Drug Administration (FDA) has established the 3D Printing Focus Group to facilitate the development and regulation of 3D-printed medical devices, including scaffolds. Similarly, the European Union's Horizon Europe program provides funding for research projects related to regenerative medicine and tissue engineering.

The development of biocompatible, biodegradable, and customizable scaffold materials is expanding their applications. For example, researchers have developed scaffolds made from natural materials like collagen and chitosan, which provide a more favorable environment for cell growth and differentiation. The potential benefits of scaffold technology have attracted significant research and development investments from both the public and private sectors. This has led to advancements in scaffold design, fabrication, and functionalization. The increasing burden of chronic diseases and the associated healthcare costs the search for innovative and cost-effective treatment options. Scaffold technology offers the potential to reduce healthcare costs by providing long-lasting solutions to various medical conditions. Public awareness and acceptance of regenerative medicine and tissue engineering are increasing, leading to greater demand for scaffold-based therapies. As more successful clinical trials and case studies are reported, the public's confidence in scaffold technology is expected to grow.

Key funding agencies like the NIH are allocating substantial resources to projects related to tissue engineering, stem cells, and biomaterials, which are integral components of scaffold technology. Additionally, regulatory bodies such as the FDA are actively working to establish guidelines and standards for medical devices, including tissue engineering products, signaling a growing recognition of their potential and a commitment to ensuring their safety and efficacy overall fuels the market growth in coming years.

Scaffold Technology Market Dynamics

Drivers

-

Rising Demand for 3D Cell Culture Models and Regenerative Therapies Drives Market Growth

The scaffold technology market is driven by several factors, including advancements in regenerative medicine, the increasing prevalence of chronic diseases, the adoption of 3D cell culture models, the need for more efficient drug development, and the growing demand for cosmetic applications. The rising demand for regenerative therapies to treat chronic diseases and injuries has created a significant market for scaffolds, which offer promising solutions for tissue repair and regeneration. Moreover, the shift from traditional 2D cell culture to 3D models is gaining traction, as 3D environments provide a more accurate representation of in vivo conditions. Scaffolds are instrumental in creating these 3D structures, enabling researchers to study cellular interactions and drug efficacy more effectively. Additionally, the growing popularity of minimally invasive cosmetic procedures has increased the demand for scaffolds to enhance facial features and rejuvenate skin. Governments worldwide are also actively supporting the development and adoption of scaffold technology through research funding, regulatory approvals, and reimbursement policies, fostering a favorable environment for market growth.

Restraints

-

Cost and Reimbursement

The cost of scaffold-based therapies can be high, potentially limiting their accessibility. Reimbursement challenges can also hinder the adoption of these technologies, as healthcare payers may be reluctant to cover innovative treatments.

-

Clinical Evidence

-

Ethical Considerations

-

Manufacturing Challenges

Scaffold Technology Market Segment Analysis

By Type

Hydrogels emerged as the leading segment in the market, capturing a significant 41.69% revenue share in 2023. Advances in microfabrication techniques have fueled the segment's growth, enabling the development of innovative hydrogels for applications such as cell transplantation, drug delivery, and restenosis prevention. For instance, Bio-Techne Corporation's introduction of Cultrex UltiMatrix BME in 2021, a hydrogel designed for culturing stem cells, showcases the segment's potential for personalized medicine and drug discovery.

Meanwhile, nanofiber-based scaffolds are poised for rapid expansion, projected to achieve a CAGR of 14.56% from 2024 to 2032. The increasing adoption of these scaffolds in tissue engineering and regeneration applications is driving their growth. Researchers are exploring new avenues, such as utilizing nanofiber scaffolds to support nerve tissue engineering. Electrospinning, a versatile technique, is instrumental in creating the nano-sized structures essential for these applications. Its ease of use, affordability, and adaptability further contribute to the segment's promising outlook.

By Disease Type

Orthopedics, Musculoskeletal, and Spine were dominant segments, accounting for 52.98% of the market in 2023. The high prevalence of musculoskeletal surgeries, with an estimated 34 million procedures performed annually in the U.S., has fueled the demand for regenerative medicines. These therapies offer low-risk alternatives to allograft surgery, driving the market growth. Biomaterials like silk fibroin, known for their cytocompatibility and slow biodegradability, are ideal for scaffold engineering and contribute to the segment's expansion.

Neurology is anticipated to experience the fastest growth, with a CAGR of 16.57% from 2024 to 2032. The increasing adoption of stem cell therapy and regenerative medicine for neurodegenerative disorders is a key driver. Additionally, advancements in scaffold development for nerve regeneration contribute to the segment's growth. For example, researchers in 2021 developed a bioactive scaffold composed of polycaprolactone/chitosan nanofibers to enhance cell attachment and nerve cell growth.

By Application

Stem Cell Therapy, Regenerative Medicine, and Tissue Engineering dominated the market, capturing a 66.45% share in 2023. The increasing adoption of scaffold technology in various applications, including aesthetic and reconstruction surgeries, soft tissue repair, tumor repair, periodontology, and colorectal procedures, drove this dominance. Moreover, the extensive use of scaffold technology in regenerative medicine research has gained significant momentum in recent years.

The Drug Discovery segment is anticipated to experience substantial growth, with a CAGR of 13.75% from 2024 to 2032. The demand for versatile and portable tools in biomedical research, including drug discovery and development, has fueled the adoption of scaffold technology. Compared to traditional methods, scaffold technology offers a more efficient way to elucidate the underlying factors influencing the activity of drug candidates during toxicity screening. Such applications are expected to enhance the market prospects for scaffold technologies.

By End-Use

Biotechnology and Pharmaceutical Organizations emerged as the dominant segment, accounting for 46.51% of the market share in 2023. The segment's growth is driven by the widespread applications of scaffold technology in tissue engineering fields, including cartilage development, periodontal regeneration, nasal and auricular malformation repair, bone formation, tendon repair, and heart valve development. Biotechnology companies are also actively involved in developing new scaffolding structures. For instance, Systemic Bio's new lab in Texas focuses on hydrogel scaffold manufacturing and research for organ-on-a-chip technology, aiming to enhance drug discovery and development.

Hospitals & Diagnostic Centers is projected to experience the fastest growth, with a CAGR of 14.32% from 2024 to 2032. The increasing number of grafting procedures and rising incidence of road accidents and related injuries are key factors driving segment growth. The availability of advanced scaffold materials that are mechanically stable and highly biocompatible further contributes to the segment's rapid expansion.

Scaffold Technology Market Regional Overview

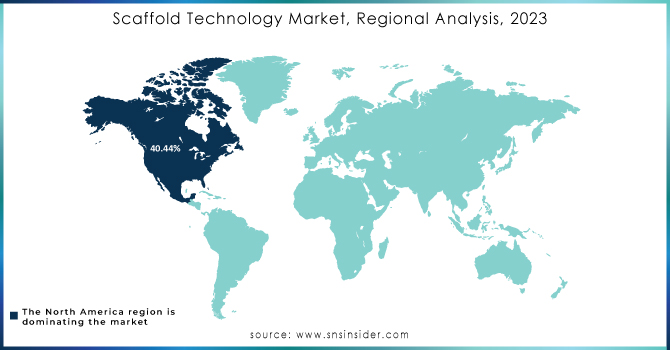

North America emerged as the dominant region in the market, holding a 40.44% revenue share in 2023. The growth is fueled by the presence of prominent players like Thermo Fisher Scientific, Akron Biotech, 3D Biotek, Molecular Matrix, Xanofi, and Corning Incorporated. Additionally, the region's focus on innovation, as evidenced by collaborations like Gelomics and Rousselot's joint effort to develop new scaffold technologies, contributes to its market leadership.

Asia Pacific is projected to experience the fastest growth, with a CAGR of 14.98% from 2024 to 2032. Government organizations in countries like India, through initiatives like the Ministry of Science and Technology's focus on stem cell research and the National Centre for Cell Science's advancements in stem cell biology, are driving the region's growth. These efforts are expected to increase the penetration of scaffold technology in the region.

Need any customization research on Scaffold Technology Market - Enquiry Now

Key Players

Avacta Life Sciences Limited, Allergan, Merck KGaA, REPROCELL Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company, Tecan Trading AG, Akron Biotech, 3D Biotek LLC, 4titude, Medtronic, Pelobiotech, Xanofi, Vericel Corporation, Molecular Matrix, Inc., Matricel GmbH, NuVasive, Inc., Corning Incorporated and others.

Recent Developments

August 2024: Tissue Regeneration Technologies announced the successful completion of Phase II clinical trials for their new scaffold-based tissue repair system designed to treat chronic wounds. The new system, which uses advanced biocompatible materials, improves wound healing rates and tissue regeneration.

July 2024: BioScaffold Solutions launched a novel 3D-printed scaffold design for cosmetic applications. This scaffold integrates with minimally invasive procedures to enhance facial features and skin rejuvenation, showing promising results in preliminary clinical studies.

May 2024: Cellular Matrix unveiled a new range of scaffolds designed for 3D cell culture applications. These scaffolds are tailored to mimic in vivo environments more accurately, offering researchers improved insights into cellular behavior and drug efficacy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.88 billion |

| Market Size by 2032 | US$ 6.05 billion |

| CAGR | CAGR of 13.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hydrogels, Polymeric Scaffolds, Micropatterned Surface Microplates, Nanofiber Based Scaffolds) • By Disease Type (Orthopedics, Musculoskeletal, & Spine, Cancer, Skin & Integumentary, Dental, Cardiology & Vascular, Neurology, Urology, GI, Gynecology, Others) • By Application (Stem Cell Therapy, Regenerative Medicine, & Tissue Engineering, Drug Discovery, Others) • By End-Use (Biotechnology and Pharmaceutical Organizations, Research Laboratories and Institutes, Hospitals and Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avacta Life Sciences Limited, Allergan, Merck KGaA, REPROCELL Inc., Thermo Fisher Scientific, Inc., Becton, Dickinson, and Company, Tecan Trading AG, Akron Biotech, 3D Biotek LLC, 4titude, Medtronic, Pelobiotech, Xanofi, Vericel Corporation, Molecular Matrix, Inc., Matricel GmbH, NuVasive, Inc., Corning Incorporated |

| Key Drivers | • Rising Demand for 3D Cell Culture Models and Regenerative Therapies Drives Market Growth |

| Restraints | • Cost and Reimbursement • Clinical Evidence • Ethical Considerations • Manufacturing Challenges |