Anti-wear Additives Market Report Scope & Overview:

Get E-PDF Sample Report on Anti-wear Additives Market - Request Sample Report

The Anti-wear Additives Market size was USD 736.5 million in 2023 and is expected to reach USD 936.1 million by 2032 and grow at a CAGR of 2.7% over the forecast period of 2024-2032.

The automotive industry has become a significant driver of the anti-wear additives market due to the increasing production of vehicles worldwide and the growing focus on meeting stringent emission norms. Today's engines have to contend with performance that creates an environment in which high-performance lubricants are needed to minimize friction. Anti-wear additives are one of the most important components of lubricants, especially highly-loaded automotive applications, as they improve durability and efficiency. Moreover, the regulatory bodies around the world are imposing stringent emission norms, which necessitate the use of cleaner & more effective lubricants to minimize the environmental impact. The focus on vehicle performance and sustainability will maintain demand for quality anti-wear additives in engine oils, transmission fluids, and gear oils, to support the operation and longevity of automotive industry.

In response to environmental concerns, regulatory bodies have introduced rigorous emission standards. For instance, the U.S. Environmental Protection Agency (EPA) finalized new, stringent vehicle emission standards on March 20, 2024, targeting reductions in carbon dioxide and other pollutants for model years 2027 through 2032.

The increasing focus on renewable energy is significantly driving the demand for anti-wear additives as the global energy transition accelerates. High performance lubricants are extensively used in renewable energy systems such as wind turbines, solar power plants, and hydroelectric facilities to enhance the functioning in harsh conditions. Antiwear additives are essential in improving the life and reliability of such lubricants by protecting critical components such as gears and bearings against wear. New renewable energy capacity around the world increased by 9.6% last year, according to the International Renewable Energy Agency (IRENA). The rapid growth of these industries requires modern lubrication solutions to run efficient businesses and to lower maintenance cost perspective of the huge wind turbines and solar installation form, as a termination in their functioning can result in a huge monetary loss. The growing renewable energy sector, fueled by favorable government regulations and sustainability agendas, will likely further drive the use of anti-wear additives, which are critical to the global effort to cleaner energy alternatives.

Anti-wear Additives Market Dynamics:

Drivers

-

Focus on High-Performance Synthetic Lubricants drives the market growth.

The increasing focus on high-performance synthetic lubricants is one of the primary growth factors for the anti-wear additives market. Due to their better thermal stability (high temperature), low-temperature fluidity, and higher oxidation stability, synthetic lubricants find usage in various industries. They are designed to work under the most extreme challenges of high temperature, load, and cycle use and thus are essential to automotive engines, vessels in aerospace, and other industrial uses. The antiwear additives supplement these lubricants by reducing friction and wear, resulting in a longer service life of mechanical components. This trend towards high-performance lubricants is driving the requirement for quality anti-wear additives which are needed to meet the performance demands of modern machinery.

in June 2023 the Shell Helix HX6 5W-30 and Shell Helix SUV 5W-30 are new high-performance synthetic engine oils that Shell unveiled in response to the changing demands of contemporary automobiles.

Restraint

-

High cost of advanced additives may hamper the market growth.

One of the biggest growth challenges for the market is the high cost of advanced anti-wear additives. These additives are critical for improving the performance and life span of lubricants and used in various industries such as automotive, aerospace, and industrial manufacturing. These higher end additives frequently require very specific raw materials, highly complex manufacturing processes, and even more R&D all of which can drive costs through the roof. However, in many industries, especially those where costs are sensitive or in emerging markets, the cost of these high-performance additives is prohibitive and many manufacturers choose to go for cheaper alternatives. Such cost-related hindrance may curb the market penetration of advanced anti-wear additives, hence restraining the overall growth of the industry. In addition, insufficient adoption of such additives by small and medium-sized enterprises due to its higher price might also restraining the market growth.

Anti-wear Additives Market Segmentation

By Type

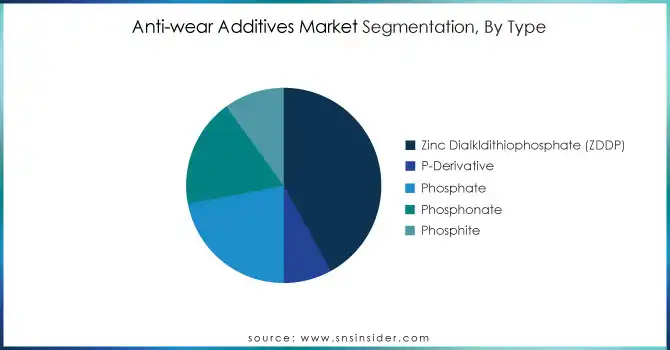

The Zinc Dialkldithiophosphate (ZDDP) segment held the largest market share around 42% in 2023. This is because of its good anti-wear performance, antioxidant performance, and corrosion performance. Over the years, it has been a core ingredient in virtually every automotive engine oil out there, providing a high level of protection for engine wear even elastomers like seal rubbers under extreme conditions such as high temperature and heavy loads. The reason it is the choice of many of the lubricant manufactures because of the effectiveness in increasing the performance and life of the engines. Although there is a growing regulatory pressure to limit the use of ZDDP because of its potential toxicity to the environment, ZDDP remains as a vast majority of the market due to its low cost and ability to perform consistently in many applications. This ubiquitous practice among automotive and industrial applications sustains ZDDP's preeminence in the marketplace, despite the increasing interest in alternative additives such as phosphates and phosphonates for their purported environmental advantage.

By Application

Engine oil held the largest market share around 34% in 2023. This is due to its use in every passenger vehicle and most commercial fleets there is a constant demand for anti-wear additives including Zinc Dialkyldithiophosphate (ZDDP) to prevent engine components from excessive wear. Increasing demand for high-performance engine oils (supplemented with anti-wear additives) persists in the automotive sector, particularly in developing regions which in turn, is expected to bolster growth of the base oil market during the forecast period. Advancements in engine oils have also accelerated from increasing regulatory pressures for enhanced fuel efficiency and lower emissions, which will provide additional catalytic effect for adoption of newer generation anti-wear additives. The established dependency on engine oil for maximized vehicle performance perpetuates its supremacy in the anti-wear additive sector.

Anti-wear Additives Market Regional Analysis

North America held the largest market share around 43% in 2023. It is owing to large presence of key verticals such as automotive, aerospace and manufacturing which produce high demand for the advanced lubricants. This area has some of the biggest automotive manufacturers in the world such as General Motors, Ford, and Chrysler which necessitate high-performance engine oils with a high standard of Engine Efficiency and engine durability. Furthermore, aerospace and industrial machinery industries are mature in the U.S. and Canada, both of which use lubricants with anti-wear additives to keep sophisticated instruments running smoothly. In addition to this, the regulatory standards present in North America as well as the standards set by the EPA (Environmental Protection Agency) and some other similar organizations are driving towards the usage of high efficiency and durability of the lubricants which ends up creating a high demand of anti-wear additives. Increasing awareness of the performance and longevity of vehicles, coupled with these factors, further benefits the stronghold North America has on the global anti-wear additives market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Chemtura Corporation (Durad 620C, Reolube Turbofluid 46XC)

-

Evonik (ViscoTreat 301, Dynasylan Silanes)

-

Chevron Oronite (Paratone 855, OLOA 48027)

-

Vanderbilt Chemicals (VANLUBE 960E, MOLYPAUL 994)

-

Lubrizol (Lubrizol 7723, Estane 3D TPU M95A)

-

Infineum (Infineum P5351, Infineum V3000)

-

Tianhe Chemicals Group (T616, T4208)

-

Afton Chemical Corporation (HiTEC 1111, HiTEC 5000)

-

BASF (Keropur 3700, Irganox L57)

-

Croda International (Priolube 3970, Crodacol C90)

-

Clariant (AddWorks LXR 568, Licocene PP MA 6452)

-

Dow Chemical (UCON Fluid AP, Xiameter Silicone Fluids)

-

ExxonMobil Chemical (SpectraSyn Elite 300, Mobilgard 300)

-

TotalEnergies (Eolys PowerFlex, HydraSyn)

-

Shell Global (Gadus S2 V220, Helix Ultra)

-

Fuchs Petrolub (RENOLIN MR 520, Silkolene Pro Boost)

-

LANXESS (Additin RC 9800, Durad 220A)

-

Royal Purple (Max-Tane, Synfilm GT)

-

Petro-Canada Lubricants (Duron-E SHP 10W-30, Purity FG2)

-

Idemitsu Kosan (Zeropro 0W-20, Daphne EPI 150)

Recent Development:

-

In October 2022, Azelis finalized the acquisition of Ak-ta? as part of its long-term strategy to expand its portfolio of products and enhance its position in the global lubricant additives market.

-

In 20 June 2021, EverArc Holdings Limited reached agreement with SK Invictus Holdings S.à. purchase agreement to procure 100% of SK Invictus Intermediate S.à. r.l. to improve business processes and purchasing power.

-

In July 2022, Gold Eagle Co. acquired Lubrication Specialties Inc. to broaden its product offering and increase its market presence in the lubricant additives market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 736.5 Million |

| Market Size by 2032 | USD 936.1 Million |

| CAGR | CAGR of 2.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Zinc Dialkldithiophosphate (ZDDP), P-Derivative, Phosphate, Phosphonate, Phosphite) • By Application (Engine Oil, Automotive Gear Oil, Automotive Transmission Fluid, Metal working Fluid, Greases, Hydraulic Oil, Others) • By Sales Channel (Merchant, Captive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chemtura Corporation, Evonik, Chevron Oronite, Vanderbilt Chemicals, Lubrizol, Infineum, Tianhe Chemicals Group, Afton Chemical Corporation |

| Key Drivers | • Focus on High-Performance Synthetic Lubricants drives the market growth. |

| Restraints | • High cost of advanced additives may hamper the market growth. |