Industrial Services Market Report Scope & Overview:

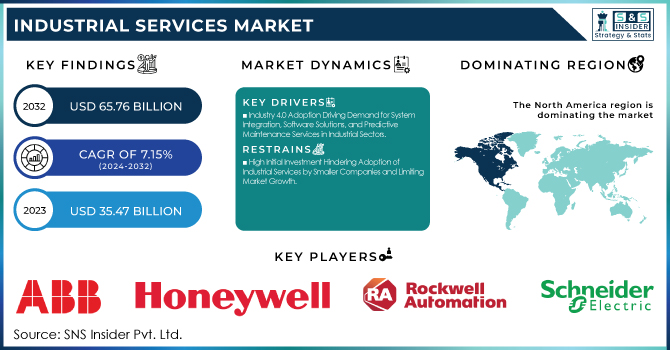

The Industrial Services Market was valued at USD 35.47 billion in 2023 and is expected to reach USD 65.76 billion by 2032, growing at a CAGR of 7.15% from 2024-2032. This report includes insights on the adoption rate of new technologies, industrial service cost analysis, service efficiency metrics, and customer preference trends. The market is driven by increasing digitalization, automation, and the need for cost-effective maintenance solutions. Companies are investing in advanced analytics and AI-driven service models to enhance operational efficiency. Additionally, shifting customer preferences toward predictive maintenance and integrated service solutions are shaping the market’s future.

To get more information on Industrial Services Market - Request Free Sample Report

Industrial Services Market Dynamics

Drivers

-

Industry 4.0 Adoption Driving Demand for System Integration, Software Solutions, and Predictive Maintenance Services in Industrial Sectors

As industries transforming quickly through digitalization, services that facilitate effortless integration of sophisticated technologies are in greater demand. System integration services to link different digital platforms, devices, and sources of data are being required more. Software applications such as enterprise resource planning solutions and cloud solutions are being asked for to maximize processes as well as enhance data management. Furthermore, predictive maintenance services are becoming essential, allowing industries to proactively monitor and maintain equipment to reduce downtime and operational costs. This shift toward Industry 4.0 solutions is driving the need for specialized industrial services that support smarter, more efficient operations across manufacturing, logistics, and other industrial sectors.

Restraints

-

High Initial Investment Hindering Adoption of Industrial Services by Smaller Companies and Limiting Market Growth

The cost of implementing new-age technologies and retrofitting old industrial infrastructure is still a major obstacle for most firms, especially small and medium-sized enterprises. Such firms usually struggle to make investments in automation, system integration, and high-end maintenance solutions, thereby slowing down their digital transformation journey. The upfront cost to invest in technology enhancements, training, and support services might appear daunting, particularly if the advantages of these solutions are far from immediate. This market entry barrier will hinder SMEs from embracing critical industrial services, which in turn will limit the growth of the overall market. Consequently, organizations might resist investing in long-term solutions, which will have an impact on the speed of innovation and modernization in the industrial economy.

Opportunities

-

Growing Demand for Data Analytics and AI Services to Optimize Operational Efficiency in the Industrial Services Market

As industries increasingly prioritize data-driven decision-making, the need for advanced analytical tools and AI technologies is growing rapidly. Businesses are turning to big data analytics, machine learning, and predictive modeling to optimize processes, reduce operational costs, and enhance decision-making capabilities. By leveraging vast amounts of data, companies can uncover valuable insights, predict future trends, and identify potential risks before they arise. This increased usage of data technology creates massive opportunities for analytics specialists, AI solution providers, and data infrastructure services. As businesses concentrate on streamlining processes for better efficiency, eliminating waste, and increasing productivity, these services are becoming fundamental to staying competitive in the continually changing industrial economy.

Challenges

- Global Supply Chain Disruptions Impacting Component Procurement, Service Delivery, and Growth in the Industrial Services Market

Global supply chain disruptions remain a major obstacle for the industrial services market. Procurement delays for key components and materials may cause project delay and cost escalation for service providers. Disruptions usually impact the timely delivery of services like system integration, equipment maintenance, and infrastructure upgrade. When the global logistics networks are disrupted, it is increasingly hard to deliver client orders within time, which decreases customers' satisfaction and constrains business opportunities. Besides, businesses can also incur increasing costs as the material shortage causes a problem, and indirectly affect businesses' competitiveness. These persistent problems create a stumbling block to market operations smoothly, and may impede growth and innovation in the industrial services sector.

Industrial Services Market Segment Analysis

By Type

The Operational Improvement & Maintenance segment dominated the Industrial Services Market in 2023, capturing the highest revenue share of about 47%. This dominance can be attributed to the critical need for industries to minimize downtime, optimize operations, and extend the life of machinery. As businesses focus on efficiency and cost reduction, maintenance and continuous operational improvements become essential, driving sustained demand for these services across sectors.

The Installation & Commissioning segment is expected to grow at the fastest CAGR of about 8.64% from 2024 to 2032. This rapid growth is driven by the increasing demand for the integration of advanced technologies and new systems across industries. As companies adopt automation, IoT, and digital solutions, the need for professional installation and seamless commissioning services becomes crucial for ensuring optimal functionality and system performance.

By Application

The Distributed Control System segment led the Industrial Services Market in 2023 with the largest revenue share of approximately 27%. DCS systems play a vital role in industries needing accurate, ongoing control of complicated processes, e.g., chemical and power plants. Their potential to enhance efficiency, guarantee safety, and deliver real-time monitoring and control renders them indispensable, fueling broad use and market leadership.

The Manufacturing Execution System segment is also anticipated to grow at the fastest CAGR of approximately 9.96% during 2024-2032. Due to the industries' growing importance on real-time production data, MES solutions are essential for driving operational efficiency, quality, and supply chain performance. Their function to streamline the production process, minimize lead time, and align with regulatory guidelines is driving organizations to adopt these solutions, fuelling the sector's high growth in the subsequent years.

By End Use

The Oil and Gas segment dominated the Industrial Services Market in 2023, capturing the highest revenue share of about 34%. This dominance is due to the sector’s large-scale infrastructure, complex operational needs, and ongoing demand for maintenance, repair, and efficiency improvement services. The oil and gas industry’s critical role in the global economy, alongside its emphasis on safety, automation, and cost reduction, drives continuous investment in industrial services.

The Pharmaceuticals segment is expected to grow at the fastest CAGR of about 9.43% from 2024 to 2032. This rapid growth is driven by the increasing demand for high-quality, precision manufacturing processes, along with the need for regulatory compliance in drug production. The rising emphasis on biotechnology, personalized medicine, and advanced manufacturing technologies is further fueling demand for specialized industrial services in the pharmaceutical sector.

Regional Analysis

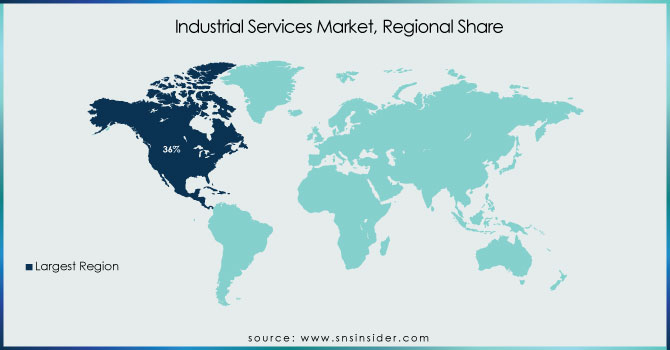

North America dominated the Industrial Services Market in 2023, holding the highest revenue share of about 36%. This dominance is largely driven by the region’s advanced industrial infrastructure, strong demand for automation, and the significant adoption of Industry 4.0 technologies. North America also benefits from a robust manufacturing sector, high levels of investment in R&D, and a favorable regulatory environment, which creates sustained demand for operational improvements, maintenance, and technology-driven industrial services.

Asia Pacific is expected to grow at the fastest CAGR of about 8.81% from 2024 to 2032. The rapid industrialization in emerging markets, such as China and India, is driving this growth. The increasing adoption of automation, IoT, and smart technologies in manufacturing processes, along with investments in infrastructure and energy, is fueling demand for industrial services. Additionally, the region’s large labor force and cost-effective production models contribute to the accelerated market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ABB (Robotic Automation Solutions, Process Control Systems)

-

Honeywell International Inc. (Industrial Cybersecurity, Building Automation Solutions)

-

Rockwell Automation (Industrial Control Systems, Manufacturing Execution Systems)

-

Schneider Electric (Energy Management Solutions, Industrial Automation Software)

-

Siemens (SCADA Systems, Digital Twin Technology)

-

General Electric (Predictive Maintenance Solutions, Power Automation Systems)

-

Emerson Electric Co. (Flow Control Solutions, Industrial IoT Solutions)

-

Yokogawa Electric Corporation (Process Automation Systems, Industrial AI Solutions)

-

Eaton (Power Quality Solutions, Industrial Energy Management)

-

Mitsubishi Electric Corporation (Factory Automation Systems, Servo Motors)

-

Metso (Mining Automation Solutions, Valve Control Systems)

-

Samson (Industrial Valves, Process Control Equipment)

-

SKF (Predictive Maintenance Solutions, Asset Management Systems)

-

John Wood Group PLC (Engineering Consulting, Industrial Asset Optimization)

-

ATS Automation Tooling Systems Inc. (Automated Assembly Systems, Industrial Robotics)

-

Dynamysk Automation Ltd. (Process Automation Engineering, Control System Integration)

-

Wunderlich-Malec Engineering, Inc. (SCADA Integration, Industrial Automation Design)

-

Yaskawa America, Inc. (Motion Control Systems, Robotics Solutions)

-

Fuji Electric Co., Ltd. (Industrial Power Electronics, Factory Automation Solutions)

-

Genpact (Industrial Analytics Solutions, Digital Process Transformation)

-

ICONICS, Inc. (HMI/SCADA Software, Industrial IoT Solutions)

Recent Developments:

-

In February 2025, ABB and Bilfinger formed a partnership to enhance operational efficiency in industries like energy, chemicals, and pharma by offering advanced instrumentation and digital technologies. The collaboration focuses on sustainable energy solutions, including hydrogen and carbon capture, to drive industry performance and sustainability improvements.

-

In November 2024, Rockwell Automation and Microsoft expanded their strategic collaboration to accelerate industrial transformation by providing advanced cloud and AI solutions that enhance data insights, streamline operations, and improve scalability for manufacturers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.47 Billion |

| Market Size by 2032 | USD 65.76 Billion |

| CAGR | CAGR of 7.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Engineering & Consulting, Installation & Commissioning, Operational Improvement & Maintenance) • By Application (Distributed Control System (DCS), Programmable Controller Logic (PLC), Supervisory Control and Data Acquisition (SCADA), Electric Motors & Drives, Valves & Actuators, Manufacturing Execution System, Others) • By End Use (Oil and Gas, Chemicals, Automotive, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Honeywell International Inc., Rockwell Automation, Schneider Electric, Siemens, General Electric, Emerson Electric Co., Yokogawa Electric Corporation, Eaton, Mitsubishi Electric Corporation, Metso, Samson, SKF, John Wood Group PLC, ATS Automation Tooling Systems Inc., Dynamysk Automation Ltd., Wunderlich-Malec Engineering, Inc., Yaskawa America, Inc., Fuji Electric Co., Ltd., Genpact, ICONICS, Inc. |