Sensor Market Size & Trends:

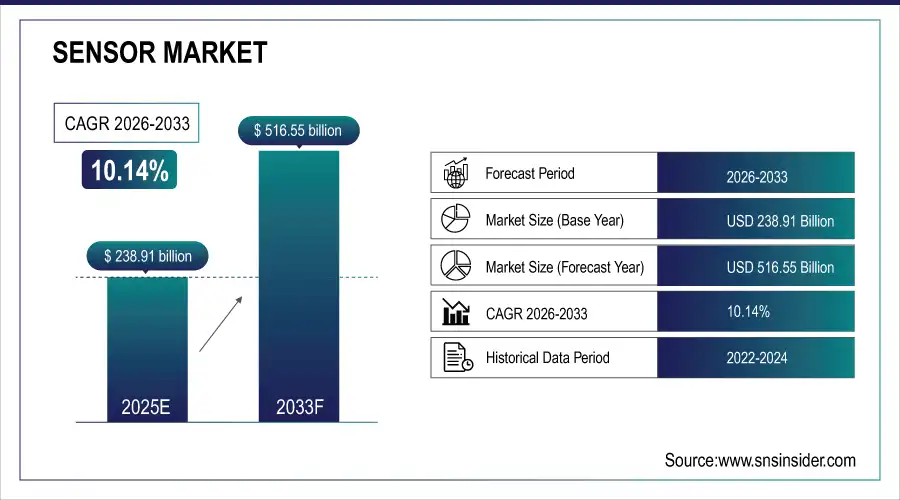

The Sensor Market size was valued at USD 238.91 Billion in 2025E and is projected to reach USD 516.55 Billion by 2033, growing at a CAGR of 10.14% during 2026-2033.

The Sensor Market analysis highlights the technological developments and rising adoption of IoT-connected devices. The dominant manufacturing process is the CMOS, MEMS and NEMS Most in demand are biosensors, image sensors. Growing health consciousness and integration of smart devices are escalating the market growth. Sales channels are changing and online and direct sales are growing the fastest. Product development is more and more influenced by regulations and certifications; quality is a must-have rather than a tick box exercise. Manufacturers are also investing to stay competitive in R&D and innovation.

By 2025, over 85% of new biosensors for wearables and point-of-care diagnostics will comply with ISO 13485 and FDA Class II standards, reflecting stricter regulatory emphasis on medical device quality. CMOS image sensors are projected to account for 70% of all image sensor shipments in 2025, driven by demand from smartphones, automotive ADAS, and industrial machine vision systems.

Market Size and Forecast:

-

Market Size in 2025E: USD 238.91 Billion

-

Market Size by 2033: USD 516.55 Billion

-

CAGR: 10.14% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Sensor Market - Request Free Sample Report

Sensor Market Trends

-

Growing adoption of IoT devices is driving demand for smart sensors across industrial, automotive, healthcare, and consumer electronics applications.

-

MEMS and NEMS sensor technologies are expanding rapidly due to miniaturization, higher performance, and integration into wearable and portable devices.

-

Automotive sensors, including LiDAR, radar, and motion sensors, are increasingly adopted for ADAS, autonomous vehicles, and electric mobility solutions.

-

Rising health awareness and biomedical applications are fueling growth of biosensors for diagnostics, wearable health monitoring, and personalized medicine.

-

Digitalization of distribution channels, e-commerce, and direct-to-consumer strategies is accelerating sensor sales and market penetration globally.

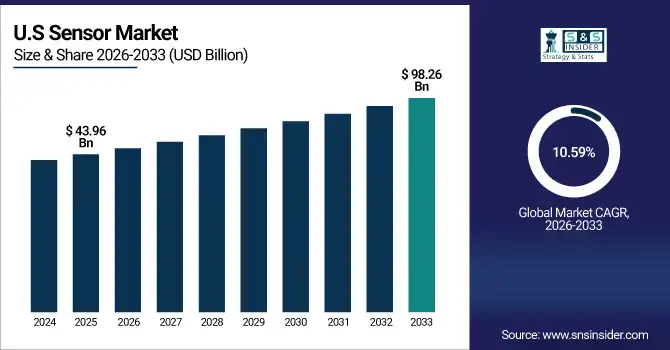

The U.S. Sensor Market size was valued at USD 43.96 Billion in 2025E and is projected to reach USD 98.26 Billion by 2033, growing at a CAGR of 10.59% during 2026-2033. Sensor Market growth is driven by rising penetration of IoT and other connected devices, surge in demand for sensors in automotive & healthcare industry, and technological advancements in sensors such as MEMS, CMOS and NEMS. Rising adoption for automation, safety systems and industrial digitalization continues to induce market growth across numerous applications.

Sensor Market Growth Drivers:

-

Technological Advancements and Increasing Adoption of IoT Devices Accelerating Sensor Market Growth

The Sensor Market is rising demand due to increasing adoption of IoT-enabled devices in automotive, healthcare, industrial and consumer electronics sector will drive the market growth. Growing demand for automation, smart manufacturing and connected devices need advanced sensors for real time monitoring and recording of data. Increasing awareness among consumers for safety and optimum utilization along with performance is anticipated to drive market growth around the world.

By 2025, over 90% of new vehicles globally will integrate 20+ MEMS sensors each for ADAS, emissions control, and cabin monitoring, up from 12 per vehicle in 2020. In healthcare, wearable biosensor shipments are projected to exceed 300 million units annually by 2025, driven by remote patient monitoring and chronic disease management demand.

Sensor Market Restraints:

-

High Manufacturing Costs and Supply Chain Challenges Limiting Sensor Market Expansion

The high cost of advanced sensor technologies and raw materials, as well as complex fabrication processes limit market growth. Lead times are further elongated through a complex chain of supply network disruptions, component shortages and regional logistic waste. And strict regulatory mandates, difficulties with product standardization and interoperability – which are still major barriers for new entrants and non-massive vendors results in the spillover of its widespread use due to slow penetration even in growing markets.

Sensor Market Opportunities:

-

Growing Demand for Smart Devices and Healthcare Sensors Driving Market Expansion

The Sensor Market is presented with immense opportunities on account of growing demand for wearable health monitoring devices, smart home and city projects and industrial automation. By bringing AI and IoT together with sensor technologies, predictive maintenance, real-time monitoring, and safety are all improved. Developing markets with expanding technology infrastructure, and investment in R&D for new generation sensors creates opportunities for innovation as well as long-term revenue generation in various applications worldwide.

Smart home sensor shipments covering occupancy, air quality, and security are projected to exceed 1.2 billion units annually by 2025, with 65% integrated into IoT ecosystems like Alexa and Google Home.

Sensor Market Segment Analysis

-

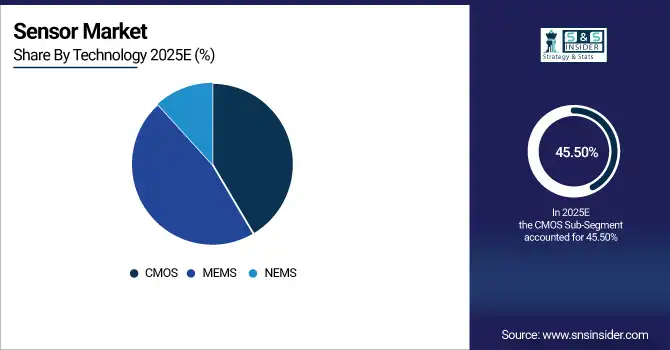

By technology, CMOS sensors led the market with 45.50% share in 2025, while NEMS sensors were the fastest-growing segment with a CAGR of 11.20%.

-

By application, automotive dominated with 38% share in 2025, whereas biomedical and healthcare applications grew fastest with a CAGR of 10.80%.

-

By type, biosensors led the market with 42.30% share in 2025, and image sensors recorded the fastest growth with a CAGR of 12.10%.

-

By distribution channel, distributors held 50.21% share in 2025, while direct sales were the fastest-growing channel with a CAGR of 9.50%.

By Technology, CMOS Leads Market While NEMS Registers Fastest Growth

CMOS sensors are lead the market, because of their high integration degree, reliability and extensive usage in consumer electronics industry, in industrial processes and amongst automotive systems. The advantage of cost-effective and scalablity has made them the most suitable that is already known. While, NEMS sensors are experiencing the largest growth due to interest in ultra-compact, high-performance sensors for medical devices, wearables and advanced IoT applications. Rising R&D spending and advances in NEMS technology led to new applications, including wider use in equipment and increase of the global distribution.

By Application, Automotive Dominate While Biomedical and Healthcare Shows Rapid Growth

In 2025, Sensor market dominated by automotive applications with increasing preferences for ADAS, autonomous vehicles, electric vehicles, and intelligent safety devices. Sensors have become an essential part in detecting motion, monitoring nature and vehicular performance management. While, Biomedical is a fastest growing segment such as biosensing devices, health-monitoring wearables and diagnostics tools. Increasing health consciousness, elderly population growth and advancement in medical sensor technology are driving demand in this segment.

By Type, Biosensors Lead While Image Sensors Registers Fastest Growth

The biosensors segment has the highest market share, as they have numerous applications extending from healthcare diagnostics to food safety and environmental monitoring. These signal transducers offer superb sensitivity, real time analysis, and precise measurement for medical use as well as industrial applications. Image sensors are now the fastest-growing segment, as demand is increasing for use in smartphones, cameras, automotive ADAS (Driver Assistant System) and industrial machine vision applications. Technical advances in CMOS imaging, high-resolution detection and miniaturization are driving commercial, consumer and industrial growth worldwide.

By Distribution Channel, Distributors Lead While Direct Sales Grow Fastest

The distribution channel is led by Distributors segment due to a big reach of manufacturers, strong supply and volume business models related to industrial, automotive and consumer segments. Their ties to the simplest of meat and potato end users create strong penetration. Meanwhile, Direct Sales are growing most strongly relying on growth of IoT solutions, B2B digital platforms and customized sensor solutions. Manufacturers are also focusing on direct-to-consumer and direct-to-business channels to recover margin, create a deeper connection with customers, and increase adoption of new sensor technologies.

Sensor Market Regional Analysis:

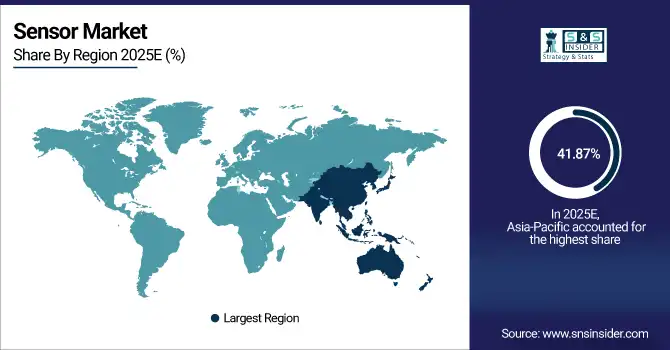

Asia-pacific Sensor Market Insights

In 2025 Asia-Pacific dominated the Sensor Market and accounted for 41.87% of revenue share, this leadership is due to the fast pace of industrialization, urbanization and technological advancement. Growing popularity of IoT and smart manufacturing projects drives demand. R&D subsidies and government investment enhance demand side presence. Production capabilities are also supported by an abundant supply of skilled labor and strong manufacturing centers.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Sensor Market Insights

China is a big player in sensor sales and use, especially in products for automotive, industrial, and consumer electronics. The nation is the world's dominant manufacturer of MEMS and CMOS sensors. Rising smart city initiatives, automation and IoT penetration are major drivers.

North America Sensor Market Insights

North America is expected to witness the fastest growth in the Sensor Market over 2026-2033, with a projected CAGR of 10.81% due to technological development for aerospace, automotive, and healthcare industries that are turning as potential customers for sensor market in the region. MEMS (Micro Electro-Mechanical Systems), CMOS and NEMS sensors are commonly used for industrial automation as well as smart devices. Prominent presence of major manufacturers and research institutions fuels innovation.

U.S. Sensor Market Insights

The U.S. is a key market for sensor market due to Automotive, healthcare, and consumer electronics are the key drivers of the market. Many leading-edge technologies such as MEMS, CMOS and NEMS sensors are used. Increasing adoption of IoT, smart vehicles and wearables drive the market growth.

Europe Sensor Market Insights

In 2025, Europe is a developed sensor market with Germany, France, and the U.K contributing to key share. Growth is driven by industrial automation, automotive sensors and healthcare applications. Growing penetration of AI and IoT-based systems to propel demand for advanced sensors. Rigorous regulatory criteria for quality and performance. Growth is backed by robust R&D network and key government initiatives towards smart manufacturing.

Germany Sensor Market Insights

Germany dominates the European sensor market in automotive and industrial automation. Increasing implementation of smart manufacturing and Industry 4.0 continue to boost growth. Local manufacturers specialize in MEMS, CMOS and biosensors.

Latin America (LATAM) and Middle East & Africa (MEA) Sensor Market Insights

The Sensor Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing use in automotive, healthcare & industrial. Strong growth due to urbanization and industrial automation is seen in several Latin American countries, with Brazil and Mexico performing particularly well. South Africa, Egypt, UAE are the other MEA regions which holds market share and play an active role in sensors deployment in intelligent infrastructure or energy use cases.

Sensor Market Competitive Landscape:

TSMC is the world’s largest semiconductor foundry and provides manufacturing services for CMOS sensors as well as MEMS and NEMS sensors. Its innovative manufacturing techniques deliver high quality, performance-enhanced and energy-saving sensors for automotive, consumer electronics and industrial applications. With R&D strengths and worldwide partners, TSMC is a major player in the sensor market Expansion.

-

In October 2025, Taiwan's chief tariff negotiator confirmed that Taiwan would not accept the U.S. proposal for a 50-50 split in semiconductor production. This decision underscores Taiwan's commitment to maintaining its semiconductor manufacturing base domestically. TSMC continues to play a pivotal role in global chip production, ensuring the supply of advanced sensors for various applications.

Bosch Sensortec’s expertise lies in the development of MEMS-based sensors for automotive applications, smartphones, tablets, wearables and other IoT products. The company develops motion, environmental and pressure sensors necessary for smart devices and connected systems.

-

In June 2025, Bosch Sensortec showcased its BMV080 particulate matter sensor, the world's smallest of its kind. The company highlighted new tools and platforms to support the integration of this sensor, emphasizing its potential in air quality monitoring and smart workplace solutions.

Sony Semiconductor Solutions develops cutting-edge image sensors, LSI and other semiconductors as well as system solutions. Its CMOS sensor technology is used in smartphones, cameras and self-driving car systems. High R&D, product innovation and well-established distribution network stands to edge Sony further in the competitive sensor business.

-

In October 2025, Sony announced the upcoming release of the IMX775 CMOS RGB-IR image sensor, featuring the industry's smallest 2.1 µm pixel size. This sensor delivers both RGB and IR imaging on a single chip, designed for in-cabin monitoring cameras in vehicles. It aims to enhance driver and passenger state recognition, contributing to advancements in automotive safety and monitoring systems.

Mitsubishi Electric creates high-quality sensors for industrial automation, automotive and other demanding applications. Its product offerings comprise image, motion, optical and environmental sensors. By its precise, reliable and flexible offerings suitable for automation system use, Mitsubishi Electric supports the smart manufacturing and IoT (Internet of Things) technologies by intensively entering into market globally as a leading sensor products manufacture.

-

In September 2025, Mitsubishi Electric developed a new contactless body sensor capable of high-precision monitoring of vital body data using radio waves. This sensor enables continuous and accurate daily measurement of indicators such as heart rate and respiration, particularly in situations where contact-type sensors may be difficult to use.

Key Sensor Companies are:

-

Taiwan Semiconductor Manufacturing Company Limited

-

Sony Semiconductor Solutions Corporation

-

Mitsubishi Electric Corporation

-

Honeywell International Inc

-

Qualcomm Technologies, Inc.

-

Endress+Hauser Group Services AG

-

TE Connectivity

-

WIKA Instruments India Pvt. Ltd.

-

Renesas Electronics Corporation

-

Teledyne Technologies Incorporated

-

Rockwell Automation

-

Infineon Technologies AG

-

ams-OSRAM AG

-

TDK Corporation

-

Sensirion AG

-

Figaro Engineering Inc.

-

Omega Engineering Inc

-

First Sensor AG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 238.91 Billion |

| Market Size by 2033 | USD 516.55 Billion |

| CAGR | CAGR of 10.14% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (CMOS, MEMS, NEMS) • By Application (Aerospace and Defense, Automotive, Biomedical and Healthcare, Consumer Electronics, Industrial, Others) • By Type (Biosensors, Image Sensors, Motion Sensors, Optical Sensors, Radar Sensors, Others) • By Distribution Channel (Direct Sales, Distributors, Retailers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Taiwan Semiconductor Manufacturing Company Limited, Bosch Sensortec GmbH, Sony Semiconductor Solutions Corporation, Mitsubishi Electric Corporation, Honeywell International Inc, Qualcomm Technologies, Inc., Endress+Hauser Group Services AG, NXP Semiconductors, TE Connectivity, WIKA Instruments India Pvt. Ltd., Renesas Electronics Corporation, Teledyne Technologies Incorporated, Rockwell Automation, Infineon Technologies AG, ams-OSRAM AG, TDK Corporation, Sensirion AG, Figaro Engineering Inc., Omega Engineering Inc., First Sensor AG |