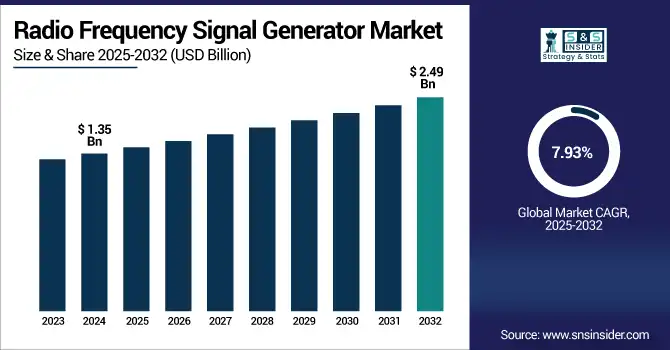

Radio Frequency Signal Generator Market Size Analysis:

The Radio Frequency Signal Generator Market size was valued at USD 1.35 Billion in 2024 and is projected to reach USD 2.49 Billion by 2032, growing at a CAGR of 7.93% during 2025-2032.

To Get more information on Radio Frequency Signal Generator Market - Request Free Sample Report

The Radio Frequency Signal Generator market is experiencing strong growth due to the increasing requirement of high precision and low-noise signal generation for advanced RF systems. Rising use in high-energy physics, communications and aerospace and defense applications is driving demand for ultra-stable reference signals and broad frequency coverage. The growth of this market is driven by the increase in signal purity and power efficiency, and reduction of phase noise, along with the evolution of modular amplifier technology. The latest high-performance signal generators offer accurate synchronization, real-time monitoring, and precise control in RF testing environments. Moreover, the advanced oscilloscope and broadband amplifier integration is also paving ways for the complex systems testing. There is a natural progression in the market to provide space-saving, low-power and high-reliability RF solutions that support the performance requirements found in next-generation architectures.

Rohde & Schwarz is revolutionizing RF measurement for particle accelerators with advanced solutions like the MXO 5 oscilloscope, SMA100B signal generator, and ultra-stable BBA series amplifiers—delivering precision, power, and phase stability for cutting-edge accelerator performance.

The U.S Radio Frequency Signal Generator Market size was valued at USD 0.24 Billion in 2024 and is projected to reach USD 0.47 Billion by 2032, growing at a CAGR of 8.56% during 2025-2032. This growth is fueled by increasing demand for RF testing in defense, aerospace, and wireless communication, alongside rising R&D investments and 5G rollout initiatives.

The U.S. Radio Frequency Signal Generator market trend is the rising adoption of advanced signal generation technologies to support 5G, satellite, and aerospace applications. There's growing emphasis on high-frequency, low-phase-noise performance, modular design, and integration with AI-driven test systems, enabling precise signal generation, real-time analysis, and efficient testing for complex and high-speed RF environments.

Radio Frequency Signal Generator Market Dynamics:

Drivers:

-

Growing Demand for Advanced RF Testing Solutions Amid Heightened Security Requirements

Growing awareness about secure communications, electromagnetic interference, and critical infrastructure protection are propelling the need for ultra-high performance RF signal generation solutions. RF Signal Generators are essential in testing, calibrating, and validating the radio frequency systems supporting defense, aerospace, and surveillance technologies. With military and defense governments, as well as the private sector investing in electromagnetic defense systems, drone detecting solutions, and communication jamming countermeasures; the demand placed on signal generators which feature ultra-low phase noise, high output power, and frequency stability also grows. The rising number of applications where highly robust and compliant RF performance is required has driven the RF Signal Generator market expansion over the forecast period significantly.

Despite FCC bans on the sale and use of RF jammers, companies in the U.S. are brazenly advertising RF jammers online. These unapproved dodads are a danger to general society and have required numerous government examinations

Restraints:

-

Complex Integration Requirements Limit Adoption and Market Growth of RF Signal Generators

Integrating radio frequency signal generators into advanced communication systems presents a significant technical challenge, especially in sectors like aerospace, 5G, and defense where precision and synchronization are critical. Such systems need to work reliably in complicated hardware and software environments that need many models to be customized, calibrated and run in real-time. It requires a workforce skilled in RF engineering, signal integrity, and system-level testing. That said, the bandwidth for integration sits outside the ability of many end-users especially smaller labs and emerging market participants—to handle in-house effectively. Therefore, RF signal generator adoption is infrequent or delayed, resulting in market penetration and scalability bottlenecks for quick-changing innovative applications.

Opportunities:

-

Rising Drone Surveillance Threats Drive Demand for Advanced RF Signal Detection Solutions

The growing frequency of unidentified drone sightings near sensitive locations like airports and military installations has triggered significant demand for effective drone detection systems. As a result, this trend provides significant market opportunities for radio frequency (RF) signal generators, which play a vital role in test and calibration of RF sensors used in these types of networks. RF signal generators play a significant role in simulating real-world signal environments, validating the performance of RF sensor systems, and training AI-based threat classification systems as authorities look for effective passive monitoring solutions that can detect specific fingerprint of signals emitted by drone models. Growing investments in high-end RF technologies due to the emerging need for national security and public safety as well as regulatory pressure to prevent aerial threat is driving the growth potential of RF signal generator in defense, aerospace, and law enforcement sectors.

U.S. researchers highlight radio frequency sensors as a promising solution for tracking drones, offering precise identification based on signal patterns. However, widespread deployment faces limitations due to protocol variation, signal interference in urban areas, and high infrastructure costs.

Challenges:

-

Urban Interference and Protocol Diversity Limit RF Signal Generator Effectiveness

The Radio Frequency Signal Generator market faces several critical challenges, primarily stemming from complex real-world deployment environments. nt. Signals that propagate through urban and industrial grounds always face very complicated RF environments and it will be impossible to either simulate this RF environment or validate that the signal behavior is accurate. As a result, RF signal generators are not as effective when doing testing and calibrating for communication systems. Moreover, the lack of standards in communication protocols among devices—particularly with regard to new technologies such as drones and the Internet of Things (IoT)—means generators must be capable of operating across a wider bandwidth and supporting many different modulation schemes, which raises cost and complexity when designing products. Legacy systems have led to a lack of interoperability, which, together with the high development costs and continuously changing global spectrum regulations, adds on to the operational challenges. Such parameters inhibit mass adoption of security, telecom, and aerospace products and stifle scalable solutions enablement by RF signal generator solutions to be built.

Radio Frequency Signal Generator Market Segmentation Outlook:

By Product Type

In 2024, the Analog Signal Generators segment held the largest share of the Radio Frequency Signal Generator market at approximately 60%, due to the extensive use of analog RF Signal Generators in traditional RF testing, education, and low-cost industrial applications. Their simplicity, affordability and ability to generate continuous wave signals that can cover a broad range of frequencies at an exceptionally low cost lead to their large-scale adoption in legacy systems, maintenance, and some basic modulation applications across telecom, broadcasting and defense industry.

The Vector Signal Generators segment is projected to witness the fastest growth in the Radio Frequency Signal Generator market during 2025–2032, with the rising demand for complex signal testing for the likes of 5G, satellite communication, IoT, and advanced radar systems. Since they can generate digitally modulated signals, they play a crucial role in the validation of next-gen wireless protocols, MIMO systems, and high-speed data transmission technologies.

By Application

In 2024, the Telecommunications segment held the largest share of the Radio Frequency Signal Generator market at approximately 38%, driven by the widespread deployment of 5G infrastructure, increased investments in network testing, and the demand for high-frequency signal validation. RF signal generators are critical for designing, testing, and maintaining telecom equipment such as base stations, antennas, and wireless modules, enabling reliable communication across expanding mobile networks.

The Automotive segment is projected to witness the fastest growth in the Radio Frequency Signal Generator market during 2025–2032, with a robust CAGR of 16.83%, driven by the increasing penetration of connected vehicles, ADAS, and V2X communication technology. As with RF signal generators, the need is growing for testing radar, infotainment systems, and wireless connectivity features for next-gen smart vehicles.

By Frequency Range

In 2024, the 1 GHz to 6 GHz segment held the largest share of the Radio Frequency Signal Generator market at approximately 52%, is projected to witness the fastest growth in the during 2025–2032, with a robust CAGR of 13.78% due to the rapid utilization of mid-band frequencies in 5G networks, increasing deployment of Wi-Fi 6 and Wi-Fi 6E technologies, and growing demand for accurate signal testing for advanced radar, satellite communication, and wireless systems. Its broad compatibility across telecom and defense sectors only augments the segment's leading position.

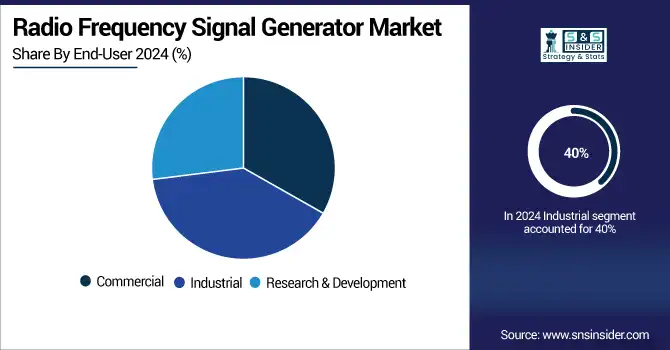

By End-User

In 2024, the Industrial segment held the largest share of the Radio Frequency Signal Generator market at approximately 40%, owing to the increased adoption of Radio Frequency Signal Generators in manufacturing automation, industrial IoT systems, and adoption of predictive maintenance testing. RF signal generators are being used in industries for accurate diagnostics, mechanical calibration, and EMI/EMC compliance. The growth is additionally fueled by increasing deployment of smart factory, rising expenditure on wireless sensor network, and incorporation of high-frequency RF in robotics and control systems in industrial environments.

The Research & Development segment is projected to witness the fastest growth in the Radio Frequency Signal Generator market during 2025–2032, with a robust CAGR of 10.64%, due to rising innovation in wireless communication, satellite systems, and radar technologies. Pragmatic demand for next-gen RF components, 5G/6G prototypes, and mmWave applications (both commercial outside and defence R&D markets) addressing extensive R&D growth on a platform/system basis are expected to drive the need for advanced signal generators. An even tighter focus on product validation and fast prototyping accelerates time to market in this area.

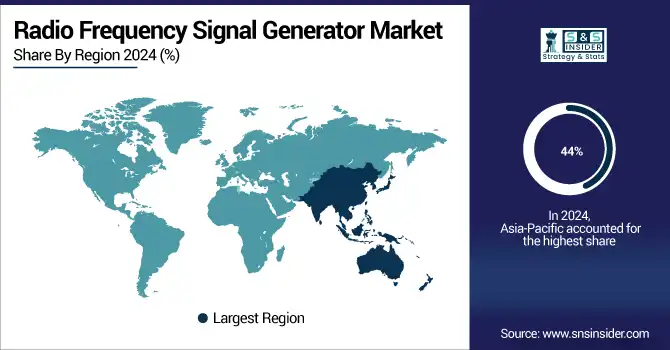

Radio Frequency Signal Generator Market Regional Analysis:

In 2024 Asia-Pacific dominated the Radio Frequency Signal Generator market and accounted for 44% of revenue share. driven by robust demand from electronics manufacturing, telecommunications, and automotive sectors in countries like China, Japan, South Korea, and India. The region benefits from expanding 5G deployment, rapid industrial automation, and strong investments in R&D and defense technologies.

North America is expected to witness the fastest growth in the Radio Frequency Signal Generator market over 2025-2032, with a projected CAGR of 9.62% This growth is fueled by Increased investments in R&D and advanced wireless communication testing and rising demand from defense and aerospace are some of the major factors fueling the regional market growth. A healthy presence of governing authorities, an early adoption of the technologies like 6G and IOT, and growing applications in autonomous vehicle development will further help in the gradual expansion of the market of North America, across the U.S. and Canada.

In 2024, Europe emerged as a promising region in the Radio Frequency Signal Generator market, owing to the growing investments in 5G infrastructure, defense modernization, and increasing demand for wireless communication testing. Of note, Germany, the UK, and France, are responsible for some of the most innovative RF technology and advanced automotive electronics development around. We expect the momentum in Europe to hold with increasing funding for aerospace and research initiatives, coupled with continued strong adoption of industrial automation

LATAM and MEA are experiencing steady growth in the Radio Frequency Signal Generator market, due to increasing urbanization, expanding telecom infrastructure, and increase adoption of wireless technologies. Brazil, Mexico, the UAE, and South Africa are developing 4G/5G networks and industrial automation .The increasing need for RF testing in automotive, defense, and IoT applications is likely to boost market growth in these emerging regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Radio Frequency Signal Generator Companies are:

The Radio Frequency Signal Generator Market are Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Tektronix Inc., National Instruments, B&K Precision, Berkeley Nucleonics, Keithley Instruments, Vaunix Technology, Good Will Instrument, Yokogawa Electric, Fluke Corporation, Siglent Technologies, Marconi Instruments, Cobham Plc, Giga-tronics, Thurlby Thandar Instruments, LitePoint, Aeroflex Inc., Boonton Electronics. and Others.

Recent Developments:

-

In May 2025, Rohde & Schwarz hosted the RF Testing Innovations Forum 2025 on May 20–21, offering design engineers deep insights into cutting-edge RF testing trends such as mmWave accuracy, wideband load pull, sub-THz component analysis, AI-driven antenna simulations, and advanced network analyzer evolution.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.35 Billion |

| Market Size by 2032 | USD 2.49 Billion |

| CAGR | CAGR of 7.93% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Analog Signal Generators and Vector Signal Generators) • By Application(Telecommunications, Aerospace & Defense, Automotive, Electronics Manufacturing and Others) • By Frequency Range(Up to 1 GHz, 1 GHz to 6 GHz and Above 6 GHz) • By End-User(Commercial, Industrial and Research & Development) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Radio Frequency Signal Generator market Companies are Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Tektronix Inc., National Instruments, B&K Precision, Berkeley Nucleonics, Keithley Instruments, Vaunix Technology, Good Will Instrument, Yokogawa Electric, Fluke Corporation, Siglent Technologies, Marconi Instruments, Cobham Plc, Giga-tronics, Thurlby Thandar Instruments, LitePoint, Aeroflex Inc., Boonton Electronics. and Others. |