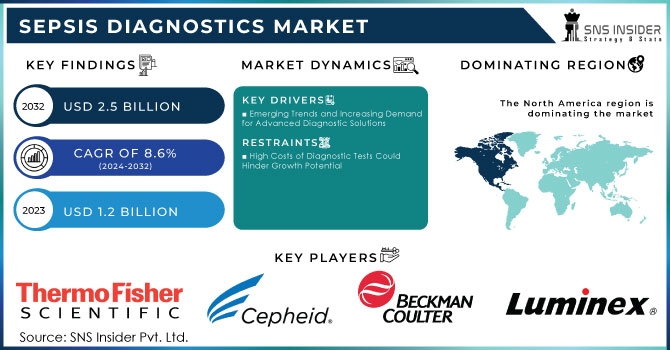

Sepsis Diagnostics Market Size Analysis:

The Sepsis Diagnostics Market size was valued at USD 1.2 billion in 2023 and is expected to reach USD 2.5 billion by 2032 and grow at a CAGR of 8.6% over the forecast period 2024-2032.

Get More Information on Sepsis Diagnostics Market - Request Sample Report

The sepsis diagnostics market is witnessing tremendous growth and is attributed to several factors. Among the prominent factors driving the growth are the arrival of advanced diagnostic and treatment solutions, the severe prevalence of sepsis, and increased awareness of the condition. The Centers for Disease Control and Prevention notes that in developed countries like the U.S., sepsis is the leading cause of death, killing 270,000 patients annually. But it also represents a significant condition in low- and middle-income countries wherein the illness is undiagnosed and often remains untreated because access to health care is lacking. According to the Global Sepsis Alliance, in 2020, sepsis accounted for nearly 11 million deaths yearly worldwide and surpasses fatalities from breast cancer prostate cancer, and HIV/AIDS. This presents a dire call for strengthening awareness, prevention, and treatment, most importantly in deprived areas.

Pneumonia is said to be the cause of sepsis and septic shock, which influences everybody of all ages. Both community-acquired and hospital-acquired pneumonia can lead to severe pneumonia and heighten the risk of sepsis. According to recent research, over 50% of sepsis patients have a history of pneumonia. Both the conditions showed an upward trend mainly because of the COVID-19 pandemic. Another report published in The Lancet Respiratory Medicine in August 2021 claims that the number of sepsis-related cases and sepsis-related mortality also increased drastically, which leads to an immediate need for diagnosis and treatment.

Technological developments are the sepsis diagnostics market's most significant growth drivers. Molecular diagnostic technologies, multiplex assays, and biomarkers are some of the products that drive the business. Such high-quality companies leading in this market are T2 Biosystems, Becton, Dickinson and Company, and F. Hoffmann-La Roche. Such speedy and accurate diagnostics will lead to better results and reduce the global disease burden for patients in the long term. Despite these innovations, several areas remain open for further investment in the market: costly diagnostic tests, education concerning sepsis, and restricted use of diagnostic equipment in underdeveloped countries. Moreover, new alternative methods for diagnosing sepsis will eventually question the conventional mode at some step in time. With the advancement of technology, healthcare providers will have to weigh the pros and cons before making necessary changes in the marketing flow of sepsis diagnostics.

Sepsis Diagnostics Market Dynamics

Drivers

-

Emerging Trends and Increasing Demand for Advanced Diagnostic Solutions

The alarming rise in global sepsis prevalence is the main driver for the sepsis diagnostics market. Estimates indicate that there are around 49 million cases of sepsis every year, resulting in nearly 11 million deaths worldwide, accounting for almost 20% of total global mortality. Approximately 19 million infections and about 2.9 million fatalities occur in under five years of age. An estimated 85% of cases and mortality rates in sepsis occur in low- and middle-income countries, giving governments and health organizations a real cue to implement initiatives on the prevention of sepsis and integration of cutting-edge technologies into diagnostics.

Furthermore, a growing incidence of HAIs contributes a great deal to the growth of the market. The Centers for Disease Control and Prevention estimate that HAIs cause almost 1.7 million infections and nearly 100,000 deaths per year in the United States. According to the World Health Organization, HAIs affect hundreds of millions of people around the world, hence expanding the need for proper sepsis diagnostics.

Sepsis diagnostics market growth will be placed under urgent demand spurred by the steadily rising infection rates, especially in the most vulnerable populations-newborns in developing countries, for example. The interplay of these factors, therefore, places this market for sepsis diagnostics at the cusp of substantial growth in the years ahead.

Restraints

-

High Costs of Diagnostic Tests Could Hinder Growth Potential

Sepsis Diagnostics Market Segmentation Analysis

By Product

The blood culture media segment accounted for the largest market share in 2023, procuring more than 38.9% of revenue. Blood culture is one of the most economical and accessible methods of testing. Product innovation in this segment includes BD BACTEC platelet quality control media, launched by BD in April 2019. This medium is being used to detect and curb the incidences of contamination in patients who receive platelet transfusions, to the benefit of blood banks, microbiology laboratories, and transfusion services. Thus, the anticipated growth shall be maintained in the category of blood culture media due to the entry of these products.

The assay kits & reagents segment is expected to have the highest compound annual growth rate during the forecast period. Assay kits, when used in combination with analyzers, yield high-throughput analytical results for disease detection. For instance, the VIDAS B.R.A.H.M.S. PCT by bioMérieux SA enables the rapid detection of microorganisms responsible for sepsis by measuring PCT in human serum or plasma and provides results within about 20 minutes. Major manufacturers aggressively explore large markets by developing new products. Example In May 2021, Ortho Clinical Diagnostics launched the VITROS Immunodiagnostic Products IL-6 Reagent Pack on its VITROS Critical Care menu.

By Technology

In 2023, the market was led by the microbiology technology segment, which accounted for more than 48.9% of total revenue. Typically, microbial culture is considered the primary and gold standard means of detecting infectious organisms in most laboratory settings. Besides this, strategic initiatives by the industry players help to supplement growth for this segment. As an example, in April 2019, BD launched BD BACTEC platelet quality control media to identify and reduce contamination in patients undergoing a transfusion of platelets.

The molecular diagnostics segment would also be forecasted to grow at the highest compound annual growth rate in the coming years. This technique is more of a great utility tool for detection as it cuts down the time required in identifying pathogens quite to an extent, thereby allowing early detection and treatment which is speedier than its traditional counterparts. The most common culprits behind skin infections are methicillin-resistant Staphylococcus Aureus (MRSA), which can be detected by using PCR as well as Nucleic Acid Sequence-based Amplification (NASBA), and molecular diagnostics is considered a standard method of identifying a pathogen after a blood culture.

By Pathogen

In 2023, the bacterial segment held the highest market share, with a total revenue share of 86.0%, and is expected to continue as the market leader throughout the forecast period. This can be attributed to the higher incidence of bacterial sepsis, a greater incidence of hospital-acquired infections, and increasing numbers of surgical procedures. Researchers at SAGE Journals published a study in January 2019 that shows bacterial infections are the most prevalent, where gram-negative bacteria infected 62.2% of the patients, followed by 46.8% by gram-positive bacteria. Of this, the gram-negative bacteria sub-segment is expected to dominate the market during the forecast period.

The fungal segment is anticipated to gain high growth during the forecast period due to advanced diagnostic devices for the detection of pathogens. One of the most important tests for the diagnosis of mycotic infection is the ELISA from Laboratory Corporation of America Holdings, which detects IgG, IgA, and IgM antibodies to Candida albicans, that has been reported to be one of the key pathogens responsible for bloodstream infections and septic shock. Other crucial products for the detection of fungal sepsis include BacT/ALERT Culture Media provided by bioMérieux SA and BD BACTEC Media offered by BD, widely used for the isolation and identification of fungal pathogens.

By Method

Conventional diagnostics segment generated revenue of 57.6% in the global market in 2023. The traditional diagnostic approach relies on the judgment and expertise of healthcare professionals to analyze a patient's clinical symptoms and interpret the results of laboratory and imaging tests. Early detection and timely treatment represent the crux of improving the patient outcome with this approach.

The automated diagnostics segment is likely to grow at the fastest rate during the forecast period. Automated techniques include Clinical Decision Support Systems (CDSS), machine learning algorithms, biomarkers, and continuous monitoring systems. Continuous monitoring systems, including wearable devices and implantable sensors, track vital signs and clinical data in real-time. These technologies can detect changes in a patient's condition, which may portend the development of disease, and thus can immediately alert the appropriate healthcare professional for timely intervention.

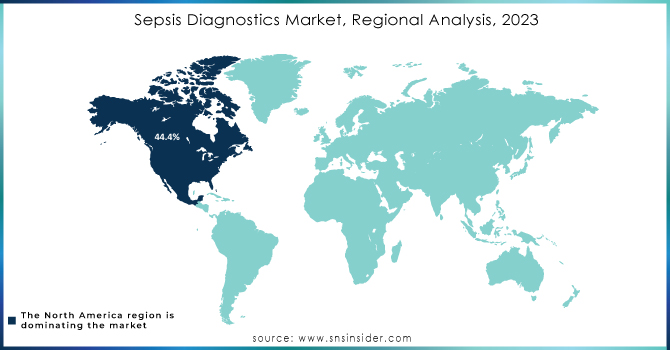

Regional Insights

North America led the market in 2023, capturing more than 44.4% of the total revenue share, largely due to a high rate of sepsis and infectious diseases. This has surged the demand for new diagnostic technologies. Extensive developments in the region have also provided tremendous momentum for the growth of the market. For example, in January 2023, Cytovale received FDA approval for its IntelliSep Sepsis Test. The test is expected to identify sepsis at the earliest possible stage.

The highest growth in the period between 2024 and 2032 is expected for the Asia Pacific region, particularly driven by the increasing demand for diagnostic solutions for infectious diseases the region witnesses today, such as China and India. Moreover, it is further boosted by advancements in molecular diagnostics like Point-of-Care testing devices, next-generation sequencing technology, and the implementation of machine learning and artificial intelligence. To commercialize its Sepset(ER) Sepsis Diagnostic Test in China, Asep Medical Holdings, Inc. entered into a joint venture with Sansure Biotech Inc. of that country in January 2023.

Need any customization research on Sepsis Diagnostics Market - Enquiry Now

Sepsis Diagnostics Market Key Players

-

GenMark Diagnostics (ePlex Respiratory Pathogen Panel)

-

Cepheid (Xpert MRSA/SA Blood Culture, Xpert Carba-R)

-

Beckman Coulter, Inc. (Dxl 800, Blood Culture Systems)

-

Luminex Corp. (xMAP Technology, Luminex Aries System)

-

BD, Becton, Dickinson & Company (BD BACTEC Blood Culture System, BD Veritor System)

-

Seegene Inc. (Allplex Sepsis Assay)

-

Immunexpress, Inc. (SeptiCyte Rapid)

-

bioMérieux SA (BIOFIRE FilmArray Blood Culture Identification (BCID) Panel)

-

Thermo Fisher Scientific, Inc. (Oxiod Signal)

-

Danaher Corporation (Beckman Coulter, Inc.) (Verity System)

-

F. Hoffmann-La Roche AG (Elecsys Procalcitonin (PCT))

-

Koninklijke Philips N.V. (Philips IntelliSpace Portal)

-

Bruker (MALDI Biotyper) and others.

Recent Developments in the Sepsis Diagnostics Market

-

In February 2023, Immunexpress launched its SeptiCyte Rapid test in the U.S., enabling quick diagnosis of sepsis in patients within an hour. This point-of-care test assists clinicians in identifying patients at an earlier stage, facilitating timely interventions and improving outcomes.

-

In January 2023, Cytovale introduced its IntelliSep sepsis diagnostics test, specifically designed for patients in emergency departments experiencing sepsis.

-

In January 2023, PERSOWN Inc. rolled out SMASH-H, a real-time sepsis monitoring system aimed at addressing the growing burden of sepsis.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.2 Billion |

| Market Size by 2032 | USD 2.5 Billion |

| CAGR | CAGR of 8.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Blood Culture Media, Assay Kits and Reagents, Software) • By Technology (Microbiology, Molecular Diagnostics, Immunoassays, Flow Cytometry, Others) • By Pathogen (Bacterial Sepsis, Fungal Sepsis, Viral Sepsis, Others)• By Testing Type (Laboratory Testing, PoC Testing) • By Method (Automated Diagnostics, Conventional Diagnostics) • By End-user (Hospitals & Clinics, Pathology & Reference Laboratories, Research Institutes and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GenMark Diagnostics, Cepheid, Beckman Coulter, Inc., Luminex Corp., BD, Becton, Dickinson & Company, Seegene Inc., Immunexpress, Inc., bioMérieux SA, Thermo Fisher Scientific, Inc., Danaher Corporation, Hoffmann-La Roche AG, Koninklijke Philips N.V., Bruker and Others |

| Key Drivers | • Emerging Trends and Increasing Demand for Advanced Diagnostic Solutions |