Shea Butter Market Report Scope & Overview:

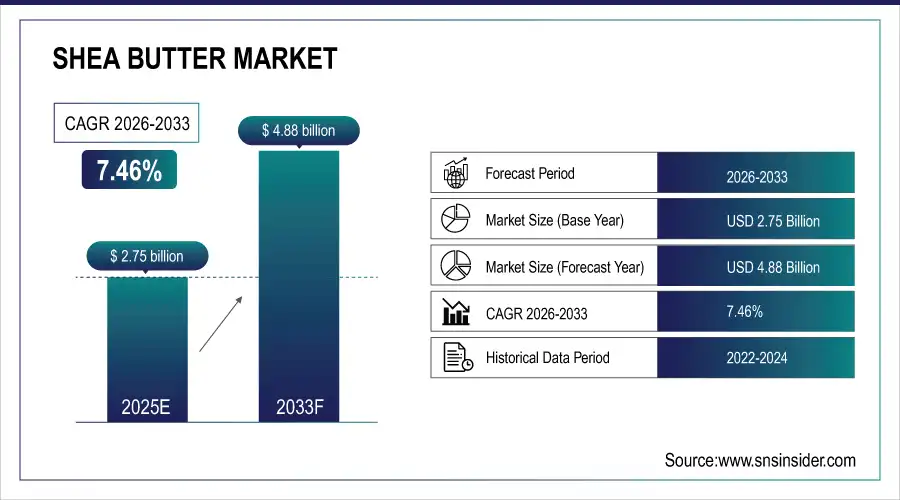

The Shea Butter Market Size was valued at USD 2.75 Billion in 2025E and is expected to reach USD 4.88 Billion by 2033 and grow at a CAGR of 7.46% over the forecast period 2026-2033.

The Shea Butter Market analysis, driven by increasing demand for natural and organic ingredients in cosmetics, skin care, and hair care products. Growing consumer consciousness regarding moisturizing and anti- wrinkle benefits of shea butter escalate its usage. According to study, approximately Over 70% of skincare products launched globally in 2024 contained natural oils like shea butter.

Market Size and Forecast:

-

Market Size in 2025: USD 2.75 Billion

-

Market Size by 2033: USD 4.88 Billion

-

CAGR: 7.46% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Shea Butter Market - Request Free Sample Report

Shea Butter Market Trends

-

Rising global preference for natural and organic personal care ingredients.

-

Growing awareness of shea butter’s moisturizing and anti-aging benefits.

-

Increasing adoption of fair-trade and ethically sourced shea butter products.

-

Expanding applications in food products as cocoa butter substitute.

-

Rising use of shea butter in pharmaceutical ointments and creams.

-

E-commerce growth enhancing accessibility and global distribution of shea-based products.

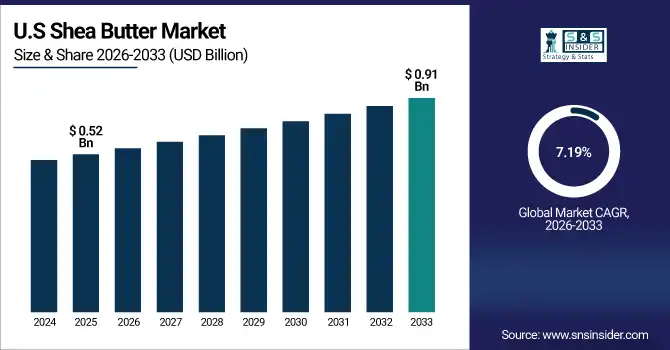

The U.S. Shea Butter Market size was USD 0.52 Billion in 2025E and is expected to reach USD 0.91 Billion by 2033, growing at a CAGR of 7.19% over the forecast period of 2026-2033, due to rising consumer preference for natural and organic skincare and haircare products, increasing awareness of shea butter’s moisturizing and healing properties, and expanding online retail accessibility.

Shea Butter Market Growth Drivers:

-

Rising Global Demand for Natural and Organic Shea Butter Products

The growing consumer inclination towards natural, chemical-free and organic based skin care and haircare products is one of the key factors for Shea Butter Market. Shea butter is prized for its moisturizing, anti-aging and skin-healing properties and it’s used to make a multitude of creams, lotions, soaps and haircare products. Gray said the trend toward organic and ethically sourced ingredients is growing awareness, which also promotes use of inulin, especially in developed markets like Western Europe and North America, where the market continues to grow.

Fair-trade or sustainably sourced shea butter accounts for 35% of global exports, highlighting ethical sourcing importance.

Shea Butter Market Restraints:

-

Seasonal Supply and Geographic Dependency Limit Shea Butter Market Growth

High reliance on raw shea nuts sourced from West African countries is a significant challenge in the market. Shea nut output is seasonal and vulnerable to climatic disturbances, pest infestations, and logistics. This results in the supply risk and price variations that influence both producers and end-users. Further, insufficient processing facilities in producing areas may cause a lag for the refining and export process and limit market expansion.

Shea Butter Market Opportunities:

-

Rapid Expansion of Shea Butter in Food and Pharmaceutical Applications

One of the major opportunities for the Shea Butter Market is its rapid expansion into the food and pharmaceutical sectors. In the food industry, it has found an increasing use as a cocoa butter equivalent in chocolates, fat spreads and bakery products owing to its nutritive and functional attributes. Other uses for shea butter In the pharmaceutical industry, shea butter is used in products such as ointments and creams because of its anti-inflammatory properties and healing qualities. Increasing consumer trends towards healthfulness and regulatory appetite for the use of natural ingredients in food and drugs present substantial opportunities for growth in these categories.

Health-conscious consumers influence over 30% of new shea butter product development in food and pharma.

Shea Butter Market Segmentation Analysis:

-

By Type: In 2025, Raw Shea Butter led the market with a share of 65.20%, while Refined Shea Butter is the fastest-growing segment with a CAGR of 8.50%.

-

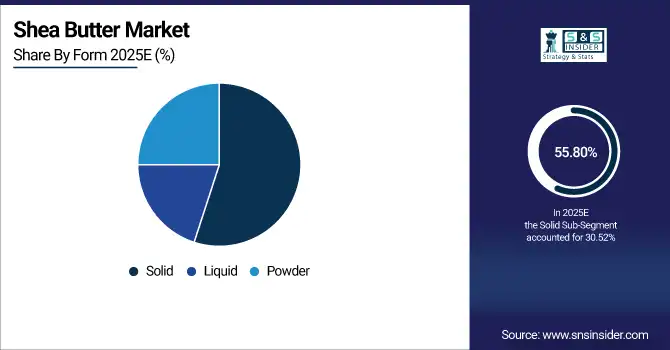

By Form: In 2025, Solid Shea Butter led the market with a share of 55.80%, while Liquid Shea Butter is the fastest-growing segment with a CAGR of 9.08%.

-

By Application: In 2025, Cosmetics & Personal Care led the market with a share of 60.06%, while Food is the fastest-growing segment with a CAGR of 8.80%.

-

By Distribution Channel: In 2025, Supermarkets & Hypermarkets led the market with a share of 40.04%, while Online Retail is the fastest-growing segment with a CAGR of 9.45%.

By Type, Raw Shea Butter Lead Market and Refined Shea Butter Fastest Growth.

The Raw Shea Butter lead the market in 2025, due to its natural contents, availability, and usage in cosmetics, personal care products and food products. This is all made from scratch with organic non chemical ingredients so it is hugely popular. Meanwhile, Refined Shea Butter is the fastest-growing segment, driven by reliable in quality and has longer shelf life when compared with its counterparts also easy for commercial formulation. Producers are now showing greater preference for refined shea butter in lotions, creams, and industrial applications, which in turn is helping the market to grow rapidly over the projected period.

By Form, Solid Shea Butter Lead Market and Liquid Shea Butter Fastest Growth.

The Solid Shea Butter lead the market in 2025, owing to its widely used in cosmetics, personal care and traditional applications due to its stability and handling are highly valued. Lotions, soaps and haircare products are in such solid form due to consumers and manufacturers favor it. Meanwhile, Liquid Shea Butter is growing fastest segment, due to enhanced requirement for formulas that are more blendable and absorbable including lotions, oils and industrial use. Its ease of processing and flexibility is directing fast adoption in the market, driving substantial growth to it over the forecast period.

By Application, Cosmetics & Personal Care Lead Market and Food Fastest Growth.

The Cosmetics & Personal Care leads the market in 2025, due to extensive requirements for natural and organic skincare, haircare and body care accessories. Its moisturizing, anti-aging and skin-healing properties are a favorite ingredient in lotions, creams, soaps and hair products sold on store shelves around the world. Meanwhile, the Food segment is seeing the fastest growth as its use as a cocoa butter equivalent in chocolates and spreads plus bakery products across browns, breads and cakes expands. Increasing trends in health-conscious consumption and product innovation are driving adoption, leading to sharp growth.

By Distribution Channel, Supermarkets & Hypermarkets Lead Market and Online Retail Fastest Growth.

The Supermarkets & Hypermarkets leads the market in 2025, as they offer a wide selection of products, the ability to purchase in bulk, and have gained consumer confidence. In cosmetics, personal care and food products ultra refined Shea butters are still favoured by consumers from these offline retail channels. Meanwhile, Online Retail is the fastest-expanding segment, driven by growing e-commerce penetration and greater convenience in-home shopping and wider range of products. Increasing popularity of e-commerce and digital channels is promoting market penetration and driving growth at a record pace in this channel.

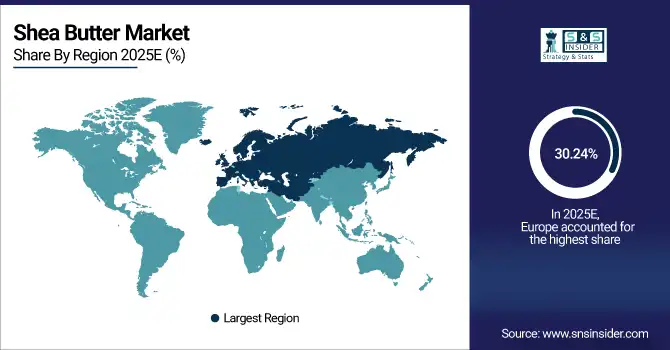

Shea Butter Market Regional Analysis:

Europe Shea Butter Market Insights:

The Europe dominated the Shea Butter Market in 2025E, with over 30.24% revenue share, driven primarily by cosmetics, personal care and haircare products. As customers continue to favor natural, organic, and ethically sourced products so adoption of raw shea butter is growing rapidly alongside refined shea butter. The area has good retail infrastructure, high e-commerce penetration and increasing awareness of sustainable and fair-trade products. Furthermore, manufacturers concentrate on premium products containing shea butter and increasing eco-friendly and health-conscious consumption are supporting the market growth over Europe.

Get Customized Report as per Your Business Requirement - Enquiry Now

Germany and U.K. Shea Butter Market Insights

Germany and the U.K. lead the Shea Butter Market due to strong consumer preference for natural, organic, and ethically sourced personal care products. High awareness of skincare benefits, coupled with advanced retail and e-commerce infrastructure, drives significant demand for raw and refined shea butter in these regions.

Asia Pacific Shea Butter Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 9.25%, due to raising awareness for natural and organic personal care products. Growing disposable income and evolving consumer lifestyles continue to drive sales of skincare, hair care, and cosmetic products with shea butter. The market in the region is rapidly growing as refined shea butter is easy to be used in industrial and commercial sectors. Moreover, expansion of online sales and web shops for shea-based products has contributed to product availability.

China and India Shea Butter Market Insights

China and India are the fastest-growing markets for shea butter due to rising disposable incomes, increasing awareness of natural and organic personal care products, rapid e-commerce adoption, and expanding applications in cosmetics, food, and pharmaceuticals, driving strong demand and high market growth in these countries.

North America Shea Butter Market Insights

North America has a substantial share in the market on account of rising consumer inclination towards natural, organic and chemical-free skin and hair care products. Growing knowledge about moisturizing, anti-aging and skin-repair properties of shea butter has resulted in increased usage of it in cosmetics, personal care and health & wellness products. Besides, the growth of e-commerce and online retail has improved access to shea-based products. Increased focus on sustainable and socially responsible sourcing of ingredients, in addition to improvements made to refined shea butter offerings are part of the ongoing growth dynamics laid out over North America.

U.S and Canada Shea Butter Market Insights

The U.S. and Canada are witnessing steady growth in the Shea Butter Market due to increasing consumer preference for natural and organic skincare, rising awareness of shea butter’s moisturizing and healing properties, and expanding online retail channels that enhance accessibility and product adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Shea Butter Market Insights

The LATAM and MEA are Promising Regions in the Shea Butter Market. LATAM is witnessing growing consumer was consumer awareness regarding products made with natural and organic personal care, along with higher disposable incomes which are contributing towards the demand for shea butter in cosmetics, skincare and hair care applications. MEA market expansion is being supported by plenty of raw material availability and the increasing investments in refining and processing facilities. Furthermore, these two regions are witnessing the on-going use of shea butter in food and pharmaceutical applications along with a growing e-commerce penetration and sustainability trends that will continue to drive market growth forces.

Shea Butter Market Competitive Landscape:

Shea Yeleen contributes to the Shea Butter Market by providing premium, ethically sourced shea butter products while empowering local communities. Their innovative co-manufacturing facilities and fair-trade practices enhance supply chain transparency and sustainability. The company focuses on high-quality skincare and haircare applications, meeting rising consumer demand for natural, organic ingredients. By combining product innovation with social impact, Shea Yeleen supports market expansion and strengthens consumer trust in ethical and environmentally responsible shea butter products.

-

In September 2025, Shea Yeleen opened a 3,000-square-foot co-manufacturing space in Washington, D.C., aimed at providing economic opportunities in underserved communities and fostering diversity in the beauty industry.

Alaffia leverages its purpose-driven business model to strengthen the Shea Butter Market, combining high-quality shea butter with community empowerment. Through sustainable sourcing and ethical production practices, the company ensures fair trade benefits for West African shea producers. Strategic partnerships, including collaborations with companies like AYÉYA, enhance product reach in natural and organic skincare. Alaffia’s emphasis on social impact, coupled with increasing consumer demand for ethical and natural products, drives steady market growth.

-

In June 2025, Alaffia leadership of its original co-founder, Olowo-n'djo Tchala, and entered a strategic partnership with AYÉYA, a purpose-driven beauty company. This collaboration aims to strengthen their mission of empowering communities in West Africa and driving sustainable, ethical sourcing of shea butter.

AAK AB plays a significant role in the Shea Butter Market by focusing on sustainable, high-quality shea butter production. The company emphasizes climate-compensated and optimized formulations like Lipex Shea, suitable for diverse skincare applications. Their initiatives in traceability, ethical sourcing, and sustainability have strengthened market trust, while innovations in product quality and stability support growing adoption across cosmetics, personal care, and industrial applications worldwide, reinforcing AAK’s position as a market leader.

-

In April 2025, AAK introduced Lipex Shea, a climate-compensated, optimized pure shea butter with a superior crystallization profile and high oxidative stability. It is suitable for use in a wide range of skincare applications.

Shea Butter Market Key Players:

Some of the Shea Butter Market Companies are:

-

BASF SE

-

Cargill, Inc.

-

AAK AB

-

Bunge Limited

-

Olvea Group

-

Croda International Plc

-

Clariant AG

-

Suru Chemicals

-

Ghana Nuts Company Ltd.

-

Agrobotanicals, LLC

-

The Savannah Fruits Company (SFC)

-

Ojoba Collective

-

Shea Yeleen

-

Baraka Shea Butter

-

Alaffia

-

Eos Products (EOS)

-

Babo Botanicals

-

Shea Butter Like Whoa

-

Deluxe Shea Butter

-

AOS Products Private Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.75 Billion |

| Market Size by 2033 | USD 4.88 Billion |

| CAGR | CAGR of 7.46% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Raw, Refined) • By Form (Solid, Liquid, Powder) • By Application (Cosmetics & Personal Care, Food, Others) • By Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Direct Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BASF SE, Cargill, Inc., AAK AB, Bunge Limited, Olvea Group, Croda International Plc, Clariant AG, Suru Chemicals, Ghana Nuts Company Ltd., Agrobotanicals, LLC, The Savannah Fruits Company (SFC), Ojoba Collective, Shea Yeleen, Baraka Shea Butter, Alaffia, Eos Products (EOS), Babo Botanicals, Shea Butter Like Whoa, Deluxe Shea Butter, AOS Products Private Limited, and Others. |