Ship Repair and Maintenance Services Market Report Scope & Overview:

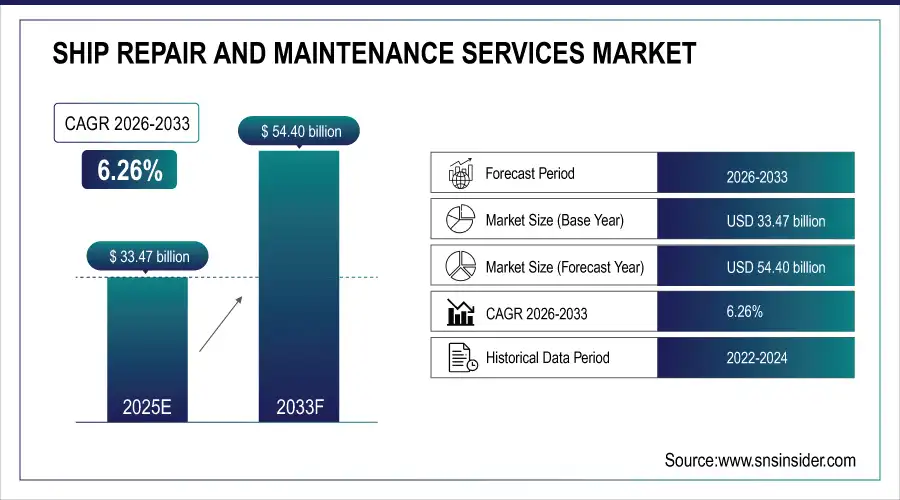

The Ship Repair and Maintenance Services Market size was valued at USD 33.47 billion in 2025E and is expected to reach USD 54.40 billion by 2033, growing at a CAGR of 6.26% during 2026–2033.

The market is expanding with rising global fleet modernization, sustainability regulations, and digital maintenance integration. Increasing investment in ship refurbishment, corrosion control, and propulsion system optimization is strengthening operational reliability and efficiency across commercial, naval, and passenger vessels. The adoption of predictive maintenance systems and eco-friendly dry-docking technologies further supports global market advancement. Growing maritime trade, aging fleets, and regulatory mandates for emission control are pushing ship operators toward scheduled maintenance and upgrades. Integration of automation, digital inspections, and advanced materials ensures improved vessel safety, reduced downtime, and enhanced marine performance globally.

Ship Repair and Maintenance Services Market Size and Forecast

-

Market Size in 2025E: USD 33.47 Billion

-

Market Size by 2033: USD 54.40 Billion

-

CAGR: 6.26% (2026–2033)

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Ship Repair and Maintenance Services Market - Request Free Sample Report

Key Ship Repair and Maintenance Services Market Trends

-

Rising retrofitting of ships with energy-efficient propulsion systems is driving maintenance revenue streams.

-

Increased adoption of AI-driven diagnostics and remote monitoring is optimizing ship repair schedules.

-

Growing focus on green ship repairs and sustainable materials supports regulatory compliance.

-

Expansion of regional shipyards and cross-border collaboration enhances global servicing capabilities.

-

Demand for hybrid and electric vessel maintenance is growing in response to emission control mandates.

-

Integration of digital twins and automation is improving maintenance precision and turnaround times.

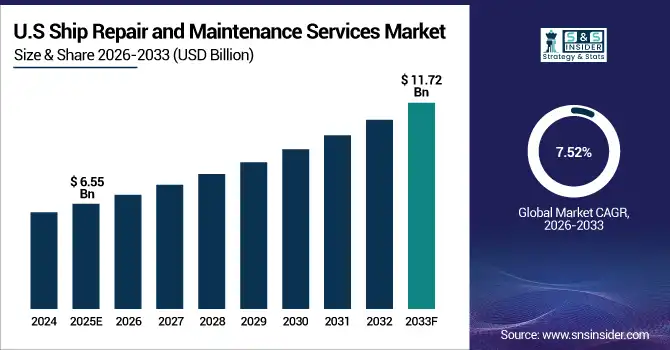

U.S. Ship Repair and Maintenance Services Market Insights

The U.S. Ship Repair and Maintenance Services Market size was USD 6.55 billion in 2025 and is expected to reach USD 11.72 billion by 2033, growing at a CAGR of 7.52% during 2025–2033.

According to research, increasing U.S. naval and commercial fleet maintenance expenditures, accounting for nearly 38% of total marine O&M budgets, have driven the need for upgraded shipyard infrastructure and smart inspection technologies. This cause, high operational intensity and extended vessel lifespans, effects rising demand for regular hull cleaning, engine overhauls, and retrofitting to improve vessel performance. Expansion of predictive maintenance technologies and modular repair solutions optimizes turnaround efficiency and reduces unplanned downtime.

Ship Repair and Maintenance Services Market Drivers:

-

Growing Demand for Eco-Friendly Shipbuilding and Retrofits Accelerates Market Expansion

The push toward decarbonization and lower emissions across the global maritime sector is driving investments in sustainable repair and retrofit solutions. This cause, International Maritime Organization compliance and carbon regulations, effects greater adoption of fuel-efficient propellers, low-friction hull coatings, and emission control systems. Ship repair facilities are modernizing operations with waste minimization technologies, green dry-docks, and alternative fuel retrofits. Port authorities and shipowners increasingly prefer maintenance partners capable of delivering environmentally efficient services. This transition is reshaping technical standards and increasing recurring retrofit service contracts in major repair yards worldwide.

In May 2025, Singapore-based Keppel O&M introduced a hybrid dry-dock system reducing freshwater use by 40% during hull cleaning operations, demonstrating how sustainability initiatives directly enhance market competitiveness.

Ship Repair and Maintenance Services Market Restraints:

-

Skilled Workforce Shortages and Aging Infrastructure Limit Market Efficiency

The ship repair sector faces skilled labor shortages and outdated facility infrastructure, particularly in developing regions. This cause, declining vocational training investments and slow modernization, effects longer lead times and inflated costs for vessel servicing. Shipyards operating with limited automation or digital capability encounter scheduling delays and lower throughput. Additionally, insufficient maintenance tracking systems lead to inefficiencies in spare parts management and quality assurance. Global capacity imbalance between small-scale and advanced shipyards continues to challenge operational consistency and repair quality, especially during peak maritime demand cycles.

In 2024, European repair yards reported an average 16% backlog in vessels awaiting servicing due to qualified technician shortages and limited dry-dock availability.

Ship Repair and Maintenance Services Market Opportunities:

-

AI and Predictive Maintenance Solutions Create New Profit Avenues for Ship Repair Companies

Integration of AI and data analytics platforms into ship repair workflows offers significant opportunity for operational transformation. This cause, increasing digitalization and IoT sensor deployment on vessels, effects enhanced accuracy in monitoring machinery, engines, and structural health. Predictive maintenance systems can forecast component failures, optimize spare part usage, and minimize unplanned dry-docking. Global shipyards adopting AI-driven defect detection, drone-based inspections, and automated reporting achieve higher efficiency and reduced human error. This development is paving the way for data-driven maintenance ecosystems, aligning with next-generation smart ship operations.

In June 2025, a Norwegian shipyard introduced an AI-powered inspection drone capable of detecting hull corrosion within 0.5 mm accuracy, reducing inspection time by 45%.

Ship Repair and Maintenance Services Market Segmentation Analysis:

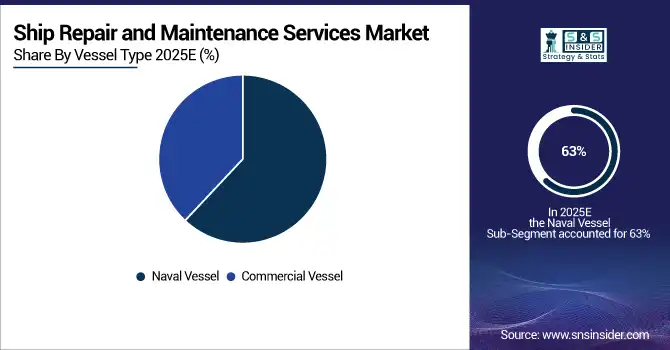

By Vessel Type, Naval Vessels Lead Market While Commercial Vessels Register Fastest Growth

Naval vessels hold a dominant 63% revenue share in 2025E due to consistent demand for maintenance under defense contracts and fleet readiness programs. This cause, increasing national security allocations, effects higher funding for scheduled dry-docking, electronic system upgrades, and weapon integration support. Major naval agencies deploy structured maintenance cycles every 3–5 years, ensuring long-term service continuity, boosting repair yard utilization, and elevating technical standards across the Ship Repair and Maintenance Services Market.

Commercial vessels are registering the fastest growth at a projected CAGR of 8.58% during the forecast period. Growing commercial fleet size, global trade expansion, and the need for cost-efficient operations drive regular inspections and component replacement activities. The expansion of third-party repair partnerships and digitalized maintenance tracking are enhancing reliability and efficiency, strengthening the segment’s integration with global maritime supply chains.

By Commercial Vessel, Container Ships Lead Market While Fishing Vessels Register Fastest Growth

Container ships command a 43% market share in 2025E due to global containerization trends and port infrastructure upgrades. This cause, increased intercontinental trade volume, effects higher frequency of dry-docking, hull optimization, and engine retrofitting for large cargo carriers. The integration of advanced propulsion management and modular refit solutions supports sustained growth within global shipping maintenance networks.

Fishing vessels are expected to record the fastest CAGR of 9.61% over the forecast period. This cause, rising seafood demand and stricter maritime safety regulations, effects frequent hull inspections, deck equipment repairs, and small-engine maintenance services. Modernization of coastal fleets and introduction of hybrid propulsion systems are further enhancing repair value streams for this segment globally.

By Service, General Services Lead Market While Engine Parts Register Fastest Growth

General services dominate with 39% revenue share in 2025E, supported by recurring demand for hull maintenance, propulsion checks, and navigation system inspections. This cause, regular regulatory compliance, effects stable service volumes across dockyards. These recurring service contracts enhance customer retention and fleet reliability across commercial and government-owned ships.

The engine parts segment is the fastest-growing service area due to the critical need for mechanical integrity and fuel efficiency. This cause, extended vessel lifespan and rising fuel optimization needs, effects demand for turbocharger refurbishments, crankshaft balancing, and emission control upgrades, aligned with maritime sustainability goals.

By Dock Type, Graving Docks Lead Market While Floating Docks Register Fastest Growth

Graving docks dominate with 52% revenue in 2025E because of their ability to accommodate larger vessels for complex overhauls. This cause, demand for precision alignment and full-facility maintenance, effects higher utilization in heavy ships and naval fleets. These permanent structures ensure efficient scheduling and long-term asset stability in major ports.

Floating docks, in contrast, are projected to grow fastest due to mobility advantages and cost-effective installation. This cause, demand for flexible regional repair capacity, effects expansion of smaller repair hubs that cater to coastal and mid-size vessels, boosting global repair accessibility.

By End-User, Government & Defense Lead Market While Commercial Segment Registers Fastest Growth

Government and defense sectors represent 63% revenue in 2025E, driven by robust naval fleet modernization programs. This cause, strategic emphasis on maritime security, effects recurring repair contracts, advanced retrofits, and lifecycle extensions for combat-ready vessels. Defense contracts provide steady revenue to major shipyards globally.

The commercial segment is expanding at the fastest rate due to increased merchant fleet growth and cost-driven outsourcing to specialized shipyards. This cause, operational efficiency goals, effects rapid adoption of digital repair systems and outsourcing models, enhancing service profitability and throughput.

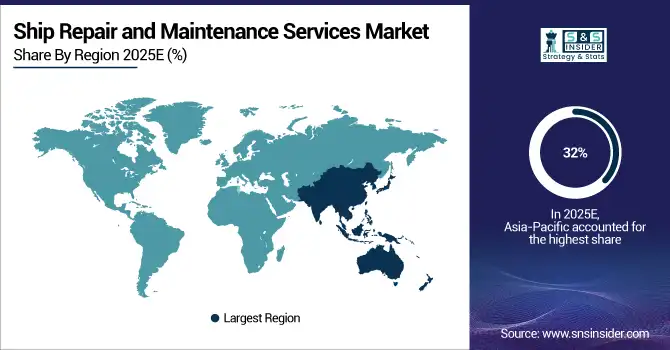

Ship Repair and Maintenance Services Market Regional Insights:

Asia-Pacific Dominates Ship Repair and Maintenance Services Market in 2025E

Asia-Pacific is projected to hold around 32% of the ship repair and maintenance services market in 2025E due to the expansion of commercial fleets and a robust shipyard network. The region’s rapid adoption of modern dry-docking technologies and digital maintenance systems further drives market growth. Strong state support, investments in port infrastructure, and increasing retrofit demand contribute to the region’s continued dominance. The presence of large-scale shipyards and technologically advanced repair solutions enhances service efficiency and competitiveness, maintaining Asia-Pacific’s leading position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Leads Asia-Pacific’s Ship Repair and Maintenance Services Market

China dominates the regional market due to its massive shipbuilding capacity, high retrofit demand, and significant investments in port infrastructure. Key shipbuilding hubs like Shanghai and Dalian have implemented AI-enabled inspection systems and autonomous repair equipment, accelerating service output and operational efficiency. Strong government backing, strategic modernization initiatives, and a focus on advanced repair technologies position China as the top market in Asia-Pacific’s ship repair and maintenance services sector.

North America is the Fastest-Growing Region in Ship Repair and Maintenance Services Market in 2025E

North America is expected to grow at an estimated CAGR of 8.12% from 2025E, driven by modernization of naval maintenance programs and expansion of offshore energy vessels. The region’s well-established shipyards, advanced repair infrastructure, and technical upgrade initiatives contribute to rising revenue. Increasing adoption of emission reduction retrofits and inspection robotics further supports rapid market growth, making North America the fastest-growing region globally.

-

United States Leads North America’s Ship Repair and Maintenance Services Market

The U.S. dominates due to its strong naval maintenance programs, partnerships between military and private repair contractors, and established shipyard infrastructure. A growing emphasis on emission-reducing retrofits, coupled with the integration of advanced inspection and repair robotics, strengthens market leadership. Continuous investment in technology and infrastructure ensures the U.S. remains the top contributor to North America’s ship repair and maintenance services market.

Europe Ship Repair and Maintenance Services Market Insights, 2025

Europe accounted for approximately 27% of the global market in 2024, supported by compliance with EU maritime efficiency regulations. Retrofit and maintenance activity across major ports, combined with a focus on sustainable maritime operations, drive steady market growth.

-

Germany Leads Europe’s Ship Repair and Maintenance Services Market

Germany dominates due to its advanced engineering capabilities and well-established shipyards in Hamburg and Kiel. The country’s early adoption of green coating technologies, commitment to sustainable maritime practices, and strong technical expertise position it as the key driver of Europe’s market growth.

Middle East & Africa and Latin America Ship Repair and Maintenance Services Market Insights, 2025

In 2025, the ship repair and maintenance services market in the Middle East & Africa and Latin America experienced moderate growth. This expansion was primarily driven by the development and modernization of port infrastructure, which enhanced repair and maintenance capabilities. Additionally, increasing activities in offshore fleet operations, including maintenance of commercial and energy vessels, contributed to higher service demand. Strategic investments and regional focus on maritime efficiency further supported steady market growth in these regions.

-

Brazil and UAE Lead Their Respective Regional Markets

Brazil leads Latin America through increasing offshore petroleum operations and coastal fleet upgrades. In the Middle East & Africa, the UAE drives growth via strategic investments in port repair hubs and advanced dry-docking systems at Dubai Maritime City. Both countries serve as regional repair and maintenance centers, reinforcing their pivotal roles in market expansion.

Competitive Landscape for the Ship Repair and Maintenance Services Market:

Damen Shipyards Group

Damen Shipyards Group, headquartered in the Netherlands, is a global leader in shipbuilding, repair, and conversion services. Offering comprehensive dry-docking, hull upgrades, and system retrofits, Damen operates over 30 shipyards worldwide. The company’s modular service model enhances efficiency and minimizes turnaround time, catering to both commercial and naval clients.

-

In August 2025, Damen expanded its Curaçao shipyard with a new floating dock facility, capable of servicing vessels up to 200 meters in length, improving regional repair capacity.

Hyundai Mipo Dockyard Co. Ltd.

Hyundai Mipo Dockyard, based in South Korea, specializes in shipbuilding and comprehensive repair solutions for oil tankers, container ships, and naval vessels. Integrating digital inspection and energy efficiency retrofits, it plays a crucial role in Asia’s maritime maintenance ecosystem.

-

In March 2025, Hyundai Mipo launched an automated paint and coating line reducing turnaround time by 25%, enhancing capacity utilization in its Ulsan facility.

Sembcorp Marine Ltd.

Sembcorp Marine, headquartered in Singapore, delivers integrated ship repair, rig maintenance, and conversion services. The company leverages advanced automation, robotic cleaning, and sustainability technologies to improve productivity and energy efficiency across its yards.

-

In February 2025, Sembcorp Marine introduced a zero-waste hull cleaning system that reduced water consumption by 30%, aligning with its green operations initiative.

China Shipbuilding Industry Corporation (CSIC)

CSIC, one of China’s largest state-owned enterprises, manages extensive ship repair and maintenance facilities servicing naval, container, and cargo fleets. Its innovation-driven initiatives in digital diagnostics and energy-efficient retrofits strengthen China’s global competitiveness in the sector.

-

In April 2025, CSIC unveiled an AI-driven predictive maintenance software suite integrated across its northern shipyards, streamlining inspection and overhaul scheduling processes.

Ship Repair and Maintenance Services Market Key Players:

-

Damen Shipyards Group

-

Hyundai Mipo Dockyard Co. Ltd.

-

Sembcorp Marine Ltd.

-

China Shipbuilding Industry Corporation (CSIC)

-

Fincantieri S.p.A.

-

Hanjin Heavy Industries

-

Swissco Holdings Limited

-

Egyptian Ship Repair & Building Company

-

Desan Shipyard

-

United Shipbuilding Corporation

-

Keppel Offshore & Marine

-

Huntington Ingalls Industries, Inc.

-

Babcock International Group PLC

-

Garden Reach Shipbuilders and Engineers Limited

-

Varren Marines Shipping Pvt Ltd

-

Navantia S.A.

-

Rolls-Royce plc

-

Tsuneishi Shipbuilding

-

Arab Shipbuilding and Repair Yard

-

Hindustan Shipyard Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 33.47 Billion |

| Market Size by 2033 | US$ 54.40 Billion |

| CAGR | CAGR of 6.26 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vessel Type (Commercial Vessel, Naval Vessel) • By Commercial Vessel Type (Fishing Vessel, Container Ships, Passenger Ships & Ferry, Others) • By Service Type (General Service, Engine Parts, Dockage, Electric Works, Others) • By Dock Type (Graving Dock, Floating Dock, Others) • By End User (Government & Defense, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Damen Shipyards Group, Hyundai Mipo Dockyard Co. Ltd., Sembcorp Marine Ltd., China Shipbuilding Industry Corporation (CSIC), Fincantieri S.p.A., Hanjin Heavy Industries, Swissco Holdings Limited, Egyptian Ship Repair & Building Company, Desan Shipyard, United Shipbuilding Corporation, Keppel Offshore & Marine, Huntington Ingalls Industries, Inc., Babcock International Group PLC, Garden Reach Shipbuilders and Engineers Limited, Varren Marines Shipping Pvt Ltd, Navantia S.A., Rolls-Royce plc, Tsuneishi Shipbuilding, Arab Shipbuilding and Repair Yard, and Hindustan Shipyard Limited. |