Single-Use Bioreactors Market Report Scope & Overview:

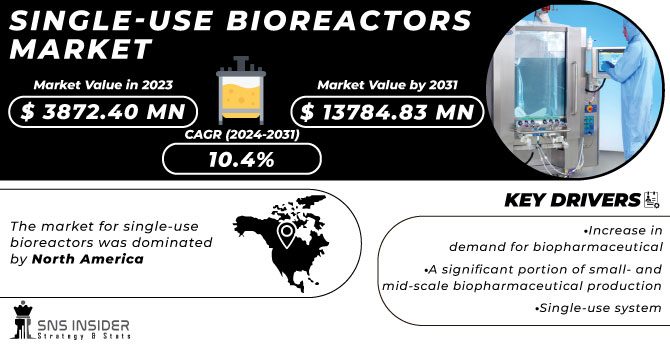

The Single-Use Bioreactors Market Size was valued at USD 3872.40 million in 2023 and is expected to reach USD 13784.83 million by 2031 and grow at a CAGR of 17.2% over the forecast period 2024-2031.

Due to their great efficiency, single-use bioreactors are ideal for the manufacturing of biopharmaceutical products. They have advanced significantly in recent years as a result of firms' tireless attempts to disseminate goods. They may be seen working on sensor systems, designs, stirring mechanisms, and single-use bioreactor film technology.

Get more information on Single-Use Bioreactors Market - Request Sample Report

The growing acceptance of single-use bioreactors among small businesses and start-ups, reduced automation complexity, ease of agriculture of marine organisms, reduced energy and water consumption, the growing biologics market, technological advancements in single-use bioreactors, and the growth of biopharmaceutical research and development are all factors driving the market forward. However, obstacles such as single-use bioreactor administration challenges and worries about leachables and extractables are projected to stymie market expansion in the foreseeable term.

Furthermore, license expiration and emerging markets are projected to generate favorable new chances for the single-use bioreactors market to flourish. Despite this, one of the main difficulties for the growth of single-use bioreactors during the projection period is projected to be the desire for improved single-use sensors and the standardization of single-use layouts.

MARKET DYNAMICS

DRIVERS

-

Increase in demand for biopharmaceutical

-

A significant portion of small- and mid-scale biopharmaceutical production

-

Single-use system

OPPORTUNITIES

-

Emerging countries market

-

Availability of less severe regulatory rules

-

Low-cost trained workforce

CHALLENGES

-

Availability of sensors that are dependable, accurate, and affordable.

-

The quality of available sensors does not meet GMP requirements.

IMPACT OF COVID-19

Coronavirus is a recently distinguished novel Corona that causes an irresistible affliction. Coronavirus, which was generally obscure until the episode in Wuhan, China, in December 2019, has gone from a local issue to a worldwide pandemic in only half a month. In light of the novel COVID pandemic, numerous biopharmaceutical organizations are quickly creating antibodies. Because of the novel COVID pandemic, numerous biopharmaceutical organizations are quickly creating antibodies. Moderna Therapeutics, for example, has a messenger RNA vaccine in Phase I studies, Inovio Pharmaceuticals has a DNA vaccine in human trials, and Novavax is working on a vaccine based on its recombination protein nanoparticle platform. If these programs have passed their trials, single-use equipment and systems will be used to support clinical and commercial manufacturing platforms.

In the quest to produce a coronavirus vaccine, many prominent single-use bioreactor manufacturers are presently collaborating with businesses that have a vaccine in development or are already in clinical trials. Sartorius, for instance, has supported CanSino Biologics Inc. what's more, Maj. Gen. Chen Wei's group at China's Academy of Military Medical Sciences' Institute of Bioengineering in the formation of the primary antibody up-and-comer against the new COVID SARS-CoV-2 to enter clinical preliminaries. Here and there, this affects the SUB market. In the bioprocessing solutions market, the impact of the coronavirus crisis on supply chains, manufacturing, and shipments to consumers has been manageable until now. Predictability in the short and medium-term is severely limited and has little impact.

MARKET ESTIMATION

By Product:

The single-use bioreactors market is disengaged into three classes: single-use bioreactors structure, single-use media pack, and single-use filtration get-togethers.

By Type:

Stirred tank single-use bioreactors, bubble column single-use bioreactors, and wave-induced single-use bioreactors are the three types of single-use bioreactors available.

By Molecule Type:

The single-use bioreactors market is divided into monoclonal antibodies (MAbs), vaccines, stem cells, gene-modified cells, and other molecules.

By Cell Type:

The single-use bioreactors market is divided into mammalian cells, bacterium cells, yeast cells, and other cells based on cell type.

By Application

The single-use bioreactors market is divided into three categories,

research and development, process development, and bioproduction.

KEY MARKET SEGMENTS:

By Product

-

Single-use Bioreactor Systems

-

Single-use Filtration Assemblies

-

Single-use Media Bags

-

Other

By Type

-

Stirred-tank SUBs

-

Bubble-column SUBs

-

Wave-induced SUBs

-

Other

By type of cell

-

Mammalian Cells

-

Yeast Cells

-

Bacterial Cells

-

Other Cells (Insect and plant cells)

By Molecule Type

-

Monoclonal Antibodies

-

Gene-modified cells

-

Stem Cells

-

Other

By Application

-

Research and Development (R&D)

-

Bioproduction

-

Process Development

By End User

-

Pharmaceutical & Biopharmaceutical Companies

-

Academic & Research Institutes

-

CROs & CMOs

REGIONAL ANALYSIS

The market for single-use bioreactors was dominated by North America, followed by Europe. A significant portion of the North American topographical fragment can be ascribed to the presence of a deep-rooted biopharmaceutical industry as well as significant members in the single-use bioreactors market.

Need any customization research on Single-Use Bioreactors Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

KEY PLAYERS:

The Major Players Thermo Fisher Scientific, Danaher, Sartorius Stedim Biotech, Merck KgaA, Getinge AB, Celltainer Biotech BV, Eppendorf AG, PBS Biotech Inc., Solida Biotech GmbH, Cellexus, Distek Inc., Able Corporation & Biott Corporation, ABEC, G&G Technologies Inc., Satake Chemical Equipment Mfg Ltd., bbi-biotech GmbH, Stobbe Pharma GmbH and Other Players.

Danaher-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3872.40 million |

| Market Size by 2031 | US$ 13784.83 million |

| CAGR | CAGR of 17.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Single-use Bioreactor Systems, Single-use Filtration Assemblies, Single-use Media Bags, Other) • By Type (Stirred-tank SUBs, Bubble-column SUBs, Wave-induced SUBs, Other SUBs ) • By Type of Cell (Mammalian Cells, Yeast Cells, Bacterial Cells, Other Cells) • By Molecule Type (Monoclonal Antibodies, Gene-modified cells, Vaccines, Stem Cells, Other Molecules) • By Application (R&D, Bioproduction, Process Development) • By End User (Pharmaceutical & Biopharmaceutical Companies, Academic & Research Institutes, CROs & CMOs) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Danaher, Sartorius Stedim Biotech, Merck KgaA, Getinge AB, Celltainer Biotech BV, Eppendorf AG, PBS Biotech Inc., Solida Biotech GmbH, Cellexus, Distek Inc., Able Corporation & Biott Corporation, ABEC, G&G Technologies Inc., Satake Chemical Equipment Mfg Ltd., bbi-biotech GmbH, Stobbe Pharma GmbH. |

| DRIVERS | • Increase in demand for biopharmaceutical • A significant portion of small- and mid-scale biopharmaceutical production • Single-use system |

| OPPORTUNITIES | • Emerging countries market • Availability of less severe regulatory rules • Low-cost trained workforce. |