Dental Consumables Market Size & Trends:

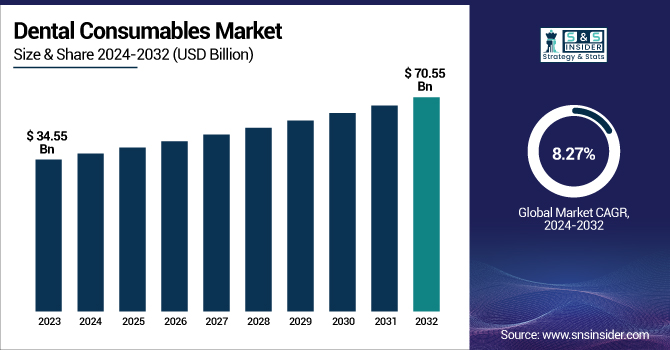

The Dental Consumables Market size was valued at USD 34.55 billion in 2023 and is expected to reach USD 70.55 billion by 2032 and grow at a CAGR of 8.27%.

To Get more information on Dental Consumables Market - Request Free Sample Report

This report highlights dental consumables sales and adoption patterns by region, driven by rising dental actions and enhanced oral health consciousness. The research examines healthcare spending and cost patterns, illustrating the effect of treatment cost inflation and insurance coverage on demand for the market. It also investigates new technologies and innovations, including 3D printing and biocompatible materials, that are improving the effectiveness and quality of dental products. The report includes a focused analysis on endodontic consumables, highlighting their role in root canal treatments and their growing demand as part of advanced dental care solutions. Additionally, it evaluates regulatory and compliance patterns, including changing safety norms, product approvals, and their impact on market growth.

Dental Consumables Market Dynamics

Drivers

• Rising cases of oral diseases and increasing demand for restorative and cosmetic dentistry have led to the growth of the dental consumables market.

As per the World Health Organization (WHO), almost 3.5 billion individuals across the globe are afflicted with oral diseases, with the most prevalent being untreated cavities. Increased focus on dental care, combined with improvements in CAD/CAM technology, biomaterials, and 3D printing, has dramatically enhanced the efficiency of treatments and patient experiences. The preference for slightly invasive treatments such as clear aligners, digital impressions, and laser dentistry is also fueling market growth. In addition, an increasing aging population has driven request for dentures, implants, and prosthetic treatments since elderly people are more to lose their teeth and experience periodontal diseases.

Oral healthcare initiatives from the government and increased insurance coverage in some countries have also increased the availability of dental treatments, boosting market demand. Increased dental tourism in Thailand, India, and Mexico has also helped grow the market as patients look for quality but cheap dental care. The use of environment-friendly and biocompatible materials, including zirconia and calcium phosphate-based materials, is also another area improving the popularity of contemporary dental treatment.

Restraints

• The dental consumables industry is limited in many ways, mostly because dental procedures and consumables are so expensive.

Most middle- and low-income groups consider dental procedures too expensive, especially in areas where dental insurance is not readily available. One dental implant procedure alone, for instance, can reach USD 3,000 to USD 5,000, which is out of reach for most of the population. Moreover, strict regulatory clearances of new dental materials and instruments delay market growth. The U.S. FDA and the European Medicines Agency (EMA) have stringent regulations for the consent of dental implants, biocompatible materials, and orthodontic consumables, which cause product launches to be delayed. The other major restraint is the lack of trained dental practitioners, particularly in developing nations. Inadequate training of dentists and specialists’ results in increased patient waiting times and decreased access to specialized dental treatment.

The industry is also suffering from increased issues related to environmental effects from dental waste, for example, mercury-containing amalgam materials and plastics employed once at clinics. In addition, the COVID-19 pandemic short-term interrupted supply, resulting in ups and downs regarding the availability of important dental consumables, thereby limiting market stability even more.

Opportunities

The COVID-19 pandemic also caused short-term supply disruptions, which made critical dental supplies harder to find at times. This made the market even less stable.

The growing adoption of teledentistry, artificial intelligence-based diagnostics, and robot-assisted dental treatments is set to transform the sector, improving the efficiency and accessibility of dental care. As part of evolving Dental Consumables Market Trends, demand for biocompatible and intelligent dental materials including self-healing composites and antimicrobial coatings is also on the rise, opening up new possibilities for product innovation. In addition, growth in dental insurance coverage in nations such as China, Brazil, and Saudi Arabia is reducing the cost of dental treatments and boosting market penetration. Latin American and African emerging markets are also offering opportunities as urbanization advances rapidly and more dental professionals join the industry.

Another major opportunity resides in the trend of tailored and 3D-printed dentistry, with the potential for quicker and more precise renewals. Growth in dental tourism in Southeast Asia and Eastern Europe is also pushing the availability of affordable, quality dental care even further. Additionally, collaborations among healthcare providers and dental manufacturers are enabling the distribution of new products, which paves the way for increased adoption of clear aligners, orthodontic supplies, CAD/CAM restorations, and bioactive dental products

Challenges

• The dental consumables market faces several challenges, primarily due to supply chain disruptions and fluctuating raw material costs.

Dental Consumables Market Growth is being motivated by several key tasks. The rise in the cost of zirconia, ceramics, and precious metals used in dental crowns and implants has led to cost fluctuations, directly impacting the profit margins of producers. Additionally, dental waste management is emerging as a critical issue, with regulatory agencies imposing stricter guidelines on the disposal of biomedical waste, amalgam fillings, and plastic-based consumables. Market penetration remains limited in emerging economies due to inadequate awareness and the lack of focus on preventive dental healthcare, where oral health often takes a back seat. Furthermore, dentophobia continues to act as a major deterrent, discouraging patients especially in developed markets from seeking timely treatment, thereby affecting overall market expansion.

Moreover, gaps in dental insurance reimbursement pose fiscal difficulties for providers and patients alike, particularly in those nations where cosmetic and elective procedures are not reimbursable. The emergence of direct-to-consumer aligners and do-it-yourself dental products has also presented difficulties for conventional dental clinics, with patients increasingly moving toward at-home remedies. Finally, the fast pace of technological development is a challenge for small dental clinics since high initial investment in CAD/CAM technology, AI tools, and digital scanners restricts their capacity to implement new technologies.

Dental Consumables Market Segmentation Analysis

By Product

The dental implants category led the Dental Consumables market in 2023, with a revenue share of 15.5%. The trend is spurred by the increased incidence of tooth loss, the demand for long-term dental restoration options, and the development of implant technology, such as minimally invasive treatment. Additionally, advancements in dental restorative materials have enhanced the durability and aesthetic outcomes of implants, further supporting market growth. The demand for aesthetic and functional tooth replacements also contributed to the expansion of the market.

The CAD/CAM device segment was the fastest-growing segment. The growth of digital dentistry adoption, enhanced efficiency in the production of customized restorations, and decreased procedure time are factors driving accelerated growth. Chairside CAD/CAM technology innovation has increased the level of acceptance among dentists, also contributing to increased market demand.

By Specialty

The general dentistry category was at the forefront with a 54.4% share of revenues in 2023, dominating as the top specialty. This can be ascribed to the heavy patient flow pursuing regular dental procedures, including restorations, preventive therapies, and cosmetics. The prevalence of general dental care and increasing focus on preventive oral health also significantly helped drive the market toward domination.

The oral surgery segment saw the highest growth rate among specialties. Increasing demand for complex dental procedures such as extractions, implant placements, and bone grafting has fueled demand for oral surgery procedures. The growing use of innovative surgical techniques and anesthesia methods has also improved patient comfort, boosting segment growth further.

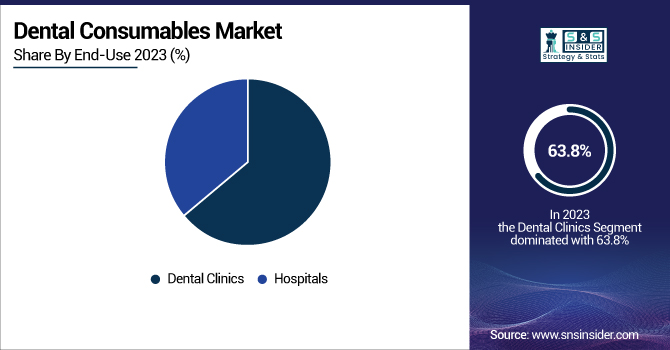

By End-Use

The dental clinics segment accounted for the most revenue, with a 63.8% market share in 2023. The success of dental clinics lies in their accessibility, customized treatment, and affordability over hospital-based dental practice. The popularity of specialist dental services and the availability of high-end dental equipment in private clinics have also further entrenched them in their market base.

The hospitals segment showed the strongest growth of end-use segments. Hospital-based dental departments' expansion, increased investments in sophisticated dental technologies, and the incorporation of multidisciplinary treatment strategies have driven its expansion. Increased patients undergoing complex dental and maxillofacial treatments in hospitals have also enhanced demand in this segment.

Dental Consumables Market Regional Insights:

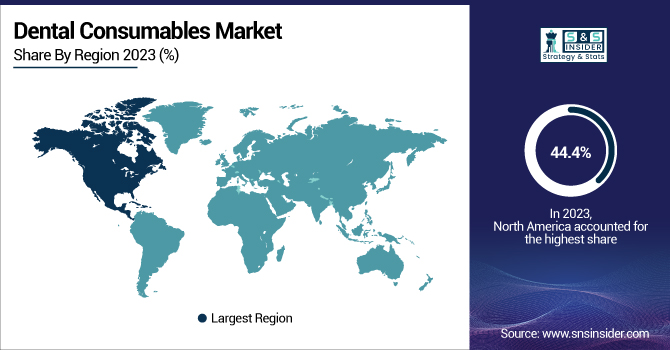

Dental Consumables Market Share was led by North America in 2023, accounting for a dominant revenue share of 44.4%. This regional dominance is driven by high awareness of dental care, an advanced healthcare infrastructure, and the presence of frequent prominent market players. The rising incidence of oral diseases, along with widespread adoption of advanced dental technologies such as CAD/CAM systems, digital impressions, and 3D printing, has significantly propelled market growth. Furthermore, favorable reimbursement policies and a well-established dental insurance framework in countries like the United States and Canada have enhanced patient access to dental care. The growing demand for aesthetic dentistry including teeth whitening, veneers, and clear aligners further reinforces North America's stronghold in the global market.

The Asia-Pacific region is expected to be the highest-growing market for dental consumables. A fast-growing aging population, a growing number of dental practitioners, and the development of dental tourism centers in nations including India, China, and Thailand are driving market growth. Growing mindfulness of oral health, combined with rising disposable income and government efforts to improve access to dental care, has spurred strong market growth in the region. The need for affordable yet advanced dental care is certainly to drive Asia-Pacific's market expansion soon.

Get Customized Report as per Your Business Requirement - Enquiry Now

Dental Consumables Market Companies

Key Players and Their Dental Consumable Products

-

Dentsply Sirona – Ceram.x, CEREC Tessera, WaveOne Gold, Ankylos, Byte Clear Aligners

-

Straumann Holding – BLX Implant System, Roxolid, ClearCorrect Aligners, Straumann Biomaterials

-

3M – Filtek Restoratives, RelyX Cements, Clarity Aligners, Impregum Impression Materials

-

Henry Schein, Inc. – Acclean Prophy Paste, Bioactive Restoratives, Orthodontic Adhesives

-

Patterson Companies, Inc. – TPH Spectra Restoratives, CorePaste, Patterson Impression Materials

-

Envista (Danaher Corporation) – Nobel Biocare Implants, Ormco Damon Braces, KaVo Restorative Solutions

-

Zimmer Biomet – Tapered Screw-Vent Implants, Trabecular Metal Dental Implants, Puros Bone Grafts

-

Ivoclar – IPS e.max Restoratives, Tetric N-Ceram, Variolink Esthetic Cement

-

Coltene Group – HyFlex EDM Files, ParaCore Cement, Brilliant EverGlow Composite

-

Benco Dental – Pro-Sys Fluoride Varnish, Benco Branded Restoratives & Adhesives

Recent Developments in the Dental Consumables Market:

In Feb 2025, Premier Dental Products Company entered a strategic partnership with Radial Equity Partners to drive growth and innovation in dental consumables. The agreement marks a significant development in the industry, though financial terms were not disclosed.

In Feb 2025, Pidilite Industries Limited secured CDSCO licenses for its Wizdent and Kuraray chairside clinical dental materials, strengthening its presence in the dental consumables market. This approval enables the company to expand its portfolio and offer regulated, high-quality dental solutions in India.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 34.55 billion |

| Market Size by 2032 | USD 70.55 billion |

| CAGR | CAGR of 8.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Dental Implants, Crowns & Bridges, Dental Biomaterials, Orthodontic Materials, Endodontic Materials, Periodontic Materials, Dentures, CAD/CAM Devices, Retail Dental Hygiene Essentials, Others] • By Specialty [General, Pediatric, Endodontics, Oral Surgery] • By End-Use [Hospitals, Dental Clinics] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dentsply Sirona, Straumann Holding, 3M, Henry Schein, Inc., Patterson Companies, Inc., Envista (Danaher Corporation), Zimmer Biomet, Ivoclar, Coltene Group, Benco Dental. |