Skin Antiseptic Products Market Size & Trends:

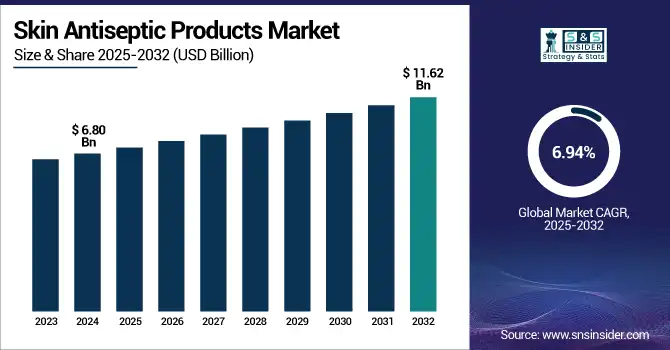

The Skin Antiseptic Products Market size was valued at USD 6.80 billion in 2024 and is expected to reach USD 11.62 billion by 2032, growing at a CAGR of 6.94% over the forecast period of 2025-2032. The skin antiseptic products market is booming with increasing focus on infection control and the need to prevent hospital-acquired infections (HAIs) and healthcare-associated disease. Preoperative skin preparation and medical skin disinfectants are especially needed, given an estimated 15 million procedures carried out in the U.S. (CDC). Increased awareness of antimicrobial resistance and strict regulatory guidance from bodies, such as the FDA and CDC, are pushing healthcare providers to adopt high-efficacy antiseptic solutions. Skin antiseptics, such as chlorhexidine products, iodine-based antiseptics, and alcohol-based antiseptics, have become central to surgical site infection prevention and routine skin disinfection protocols.

To Get more information on Skin Antiseptic Products Market - Request Free Sample Report

Accompanying emerging antimicrobial stewardship regulations and spurring innovation within the global skin antiseptic products market, 3M and BD initiated a shared R&D project early in 2025 for the creation of novel antiseptic solutions and coatings for targeting ICU infections.

Major hospitals are enhancing their budgets for hospital antiseptic products and antimicrobial skin products, driven by quality mandates and performance metrics. Companies are innovating in topical antiseptics and introducing formulations with broad-spectrum action, minimal side effects, and faster application times to capture a larger skin antiseptic products market share.

According to a 2024 study in JAMA, chlorhexidine-alcohol reduces SSIs more significantly than povidone-iodine, thus impacting American hospital protocol changes and building chlorhexidine product demand.

Skin Antiseptic Products Market Dynamics:

Drivers:

-

Rising Demand for Infection Control and Innovation in Antiseptic Formulations Accelerates the Market Growth

Rising global initiatives to reduce healthcare-associated infections (HAIs) and more surgical and outpatient operations drive the skin antiseptic products market growth. While the WHO defines infection prevention as a basic component of universal health coverage, the CDC requires rigorous skin disinfection procedures in all healthcare environments. Manufacturers are reacting to increasing demand with creative antimicrobial skin products, including fast-drying alcohol-based solutions and chlorhexidine products with long antibacterial action. Product introductions are accelerating with regulatory approvals, such as FDA clearance of novel preoperative skin antiseptics under expedited paths.

Growing commercial interest is shown by increased R&D spending, which includes Johnson & Johnson's USD 15.9 billion global commitment in 2023, some of which supports infection control innovation. Furthermore, widening the market base increases consumer demand for hand hygiene products and at-home medicinal skin disinfectants following the epidemic. The growing skin antiseptic products market share of advanced formulations and ongoing product development targeted at greater safety requirements and user compliance mirror these developments.

Restraints:

-

Safety Concerns, Product Recalls, and Regulatory Compliance Costs Hamper the Market Growth

Safety issues, stringent regulatory review, and increased compliance expenses all contribute to limiting the size of the skin antiseptic products market. The FDA issued warnings regarding issues from topical antiseptics, such as rare allergic responses and contamination concerns, such as the 2023 recalls associated with Achromobacter contamination in alcohol-based solutions (ASA Australia). These incidents have led to a tightening of quality control, thus increasing manufacturing and testing costs for companies. In addition, recalls due to carcinogens, such as benzene, have resulted in supply chain issues and undermined customer confidence in certain hospital antiseptic products.

Now requiring full safety and efficacy data for product approvals, regulatory systems in the U.S., EU, and Asia prolong time-to-market and inflate R&D expenditures. This added control limits the scope of smaller businesses to join the market and extends innovation cycles, which, as a consequence, reduces the entire growth of the skin antiseptic products market. Also, the availability of low-quality or counterfeit antiseptic treatment in poorly regulated markets damages legitimate suppliers, which affects their regular supply and income.

Skin Antiseptic Products Market Segmentation Analysis:

By Formulation

In 2024, the alcohol antiseptics held the highest share of the skin antiseptic products market, driven by their fast bactericidal activity, affordability, and extensive availability. Ethanol and isopropanol are widely used in hospitals and elsewhere as they quickly evaporate and kill most germs, including some bacteria, fungi, and viruses with a protective coating. In injections, surgical area preparation, and general hand hygiene, hospitals and clinics utilize alcohol-based antiseptic therapy to the fullest. Strong support from the CDC and WHO regulatory approvals has enhanced their significance in infection prevention and thus ratified their market presence.

Octenidine-based antiseptics are projected to be the most rapidly growing product in the skin antiseptic products market with their unique advantages in safety, efficacy, and tolerance. Octenidine is not flammable, less mucosa-irritating, and less skin-irritating, and efficient toward multidrug-resistant organisms (MDROs), in contrast to alcohols or iodine-based solutions. For mucous membrane therapy, catheter insertion, and wound care, it is gaining popularity in Europe and some regions of Asia. Octenidine is best suited for surgical preparation and catheter care procedures since clinical studies have established it to have long-lasting residual activity. As hospitals use octenidine in antiseptic stewardship programs, regulatory pressure has been on the rise.

By Product Type

With 54% of the market, the solutions segment was the product type with the greatest revenue-generating potential within the skin antiseptic products market in 2024. Their ability to adapt to and be applied in numerous environments of therapy, such as the healing of small wounds to prepping large sites for surgery, allows them to reign supreme. Preoperative disinfection relies on the adequate amount and size covered, something that these solutions, formulated by alcohol, iodine, or chlorhexidine, best serve. To ensure complete site sterilization, ambulatory surgery centers and hospitals select solutions for their flexible use with applicators, swabs, or gauze. Additionally, ideal for institutional applications are their cost-effectiveness in bulk purchase and compatibility with sterile methods.

The wipes segment is likely to witness rapid growth in the skin antiseptic products market owing to the increasing demand for convenient, mobile, and hygienic disposable single-use antiseptics. Application of antiseptic wipes for daily disinfection has increased dramatically as a result of a move toward outpatient treatment, home treatment, and ambulatory health care services. Particularly cherished for injections, IV insertions, and dressing of wounds in non-hospital settings are these pre-soaked, ready-to-use supplies. Currently, highlighting the use of contactless and one-time disinfecting, infection control interventions aid in supporting the transition to using wipes over reusable devices.

By Application

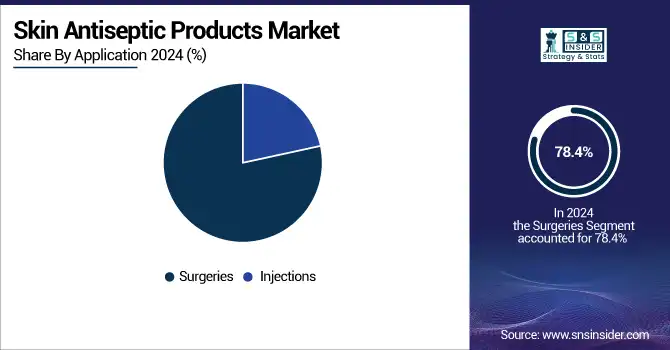

Commanding a large market share of 78.4%, the injections application segment dominated the skin antiseptic products market analysis in 2024. The extremely high rate of injections administered at all healthcare levels, such as immunizations, IV therapy, and routine delivery of medicine, permits this dominant position. The need for rapid-acting and easy-to-apply skin antiseptics is always high, as every injection requires sterile skin preparation to prevent local and systemic infections. Due to their quick drying times and wide-spectrum activity, alcohol-based wipes and solutions are particularly prevalent in this segment. Reinforced by the CDC's standard precautions, heightened awareness of injection safety, and stringent compliance with disinfection protocols contribute further to the dominance of the segment.

Surgical applications of skin antiseptics are anticipated to register the strongest growth during the forecast period. Spurred by increasing volumes of surgery, growing older populations, and increased attention to preventing surgical site infections, effective preoperative skin disinfection becomes increasingly significant as the global healthcare systems ramp up elective and emergency procedures after a pandemic. Owing to their rapid onset and ongoing uncontaminated activity, newer chlorhexidine formulations and alcohol-containing antiseptic solutions are quite ubiquitous in operating rooms. For instance, according to the WHO and the CDC, a rigorous preoperative preparation protocol recommends dual-agent antiseptics for high-risk surgical procedures, thus promoting product use.

By End-use

With 53.3% of total revenue, hospitals dominated the skin antiseptic products market in 2024. The great volume of patient contacts, operations, invasive procedures, and infection risk present in hospital environments helps to explain this leadership. Constant pressure from the CDC, FDA, and Joint Commission on regulatory benchmarks for infection control and patient safety drives hospitals toward compliance. They thus keep ongoing procurement cycles for hospital antiseptic supplies, including swabs, wipes, and solutions. Purchasing institutional doses of alcohol-based skin antiseptics, povidone iodine, and chlorhexidine guarantees continuous use in general wards, ICUs, ERs, and operating rooms.

Outpatient facilities are emerging as the fastest-developing end-use category in the skin antiseptic products market trends since the healthcare industry is gradually shifting toward decentralized and least intrusive treatment. Small, efficient, and standardized antiseptic products for skin used in facilitating speedy patient turnover and minimizing infection rates are required in urgent care centers, day-surgery units, and clinics. Demand for products, such as preoperative skin preparation wipes and ready-to-use antiseptic solutions, has skyrocketed as the number of treatments, including IV insertions, minor excisions, and vaccines, increases.

Regional Insights:

North America led the skin antiseptic products market due to its advanced healthcare infrastructure, stringent regulatory norms, and extensive surgical volume. With the rising rate of healthcare-associated infections (HAIs) as the driving factor, there was a big presence of significant skin antiseptic product vendors and continued investment in R&D on hospital antiseptic products. The U.S. skin antiseptic products market size was valued at USD 2.36 billion in 2024 and is expected to reach USD 4.22 billion by 2032, growing at a CAGR of 7.58% over the forecast period of 2025-2032. Alcoholic antiseptics and chlorhexidine are widely employed in most American hospitals to enhance skin cleansing protocols and prepare skin for surgery. In addition, mature hospital-acquired infection control regulations sustain a robust demand for hand care products and antimicrobial skin products. Canada is next in line with greater healthcare spending and improved acceptance of skin antiseptics in outpatient settings.

Europe remains a huge region for the market of skin antiseptic products due to its robust health care system, government-backed infection control initiatives, and rising surgical procedures. Germany's high hospital rate and devotion to strict surgical site infection control regulations assisted in making it top the European market in 2024. Antiseptics, particularly iodine antiseptics and chlorhexidine products, are more in demand in this region. Medical skin disinfectants are also increasingly being utilized in surgical and injection-based environments in the U.K. and France. As alcohol-based antiseptics continue to gain popularity in preoperative treatments, Europe's focus on skin disinfection processes and increasing hospital antiseptic solution acceptance has contributed to sustained market growth.

Asia-Pacific is to be the fastest-growing region in the skin antiseptic products market on account of increasing awareness of infection control, rapid growth of healthcare infrastructure, and growing volumes of surgery. China led the regional market in 2024 due to government initiatives promoting hospital cleanliness and a high number of hospitals. Increased need for antiseptic products in public as well as private healthcare is propelling quick market growth in India. Preoperative skin antiseptic treatment procedures and alcoholic antiseptics are becoming quite common here. The region is forecast to maintain a strong skin antiseptic product market growth, as there is increasing demand for the prevention of surgical site infection and an increase in outpatient and home care services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Skin Antiseptic Products Market Key Players

Leading skin antiseptic products companies operating in the market comprise 3M, EcoLab, BD, Sage Products LLC, B. Braun Melsungen AG, Schulke & Mayr GmbH, Cardinal Health, Smith & Nephew, Avrio Health, and Microgen.

Recent Developments in the Skin Antiseptic Products Market

-

In January 2024, a study published by MedicalXpress revealed that the choice of skin disinfectant plays a critical role in surgical outcomes, with certain antiseptic solutions proving significantly more effective in reducing post-surgical infection rates.

-

In April 2023, 3M Health Care launched the 3M SoluPrep S Sterile Antiseptic Solution, a new presurgical skin prep designed to optimize efficacy and support sterile application in clinical settings, enhancing safety during surgical procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.80 Billion |

| Market Size by 2032 | USD 11.62 Billion |

| CAGR | CAGR of 6.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Formulation (Alcohols, Chlorhexidine, Povidone Iodine, Octenidine, and Others) • By Product Type (Solutions, Swab Sticks, and Wipes) • By Application (Surgeries, Injections) • By End-use (Hospitals, Outpatient Facilities, Home Care, and Research & Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3M, EcoLab, BD, Sage Products LLC, B. Braun Melsungen AG, Schulke & Mayr GmbH, Cardinal Health, Smith & Nephew, Avrio Health, and Microgen. |