Inline Viscosity Sensor Market Size & Trends:

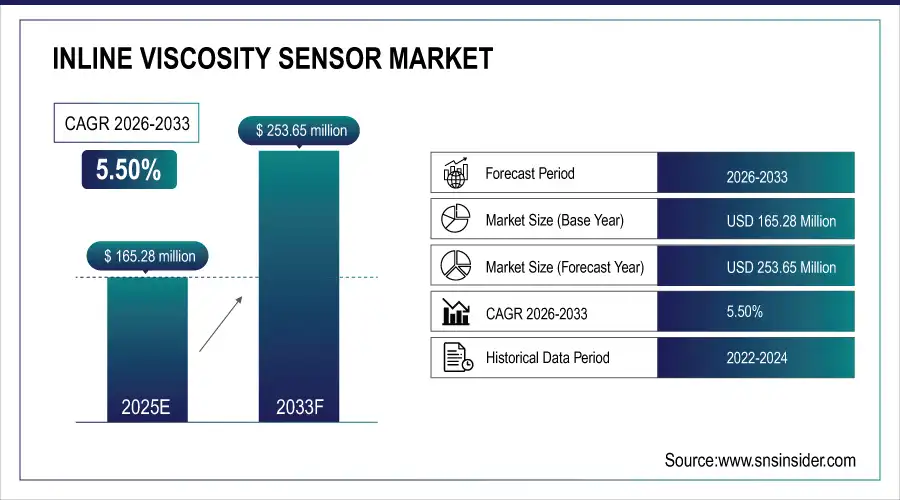

The Inline Viscosity Sensor Market Size was valued at USD 165.28 million in 2025E and is expected to reach USD 253.65 million by 2033 and grow at a CAGR of 5.50% over the forecast period 2026-2033.

The global market for inline viscosity sensors is witnessing rapid growth driven by the acceleration of industrial automation and the demand for real time process optimization. With design industries focusing on high-fidelity monitoring equipment to improve their efficiency, end use adoption of these sensors is witnessing a rise in the oil & gas, food & beverage and chemical industries. They also come with the benefit of allowing nonstop viscosity measurement for better quality control, less time loss from production downtime, and less scrap. This is further compounded by a growing requirement among end-users for a low cost, energy efficient solution that delivers continuous product performance in challenging manufacturing environments.

According to research, globally, 72% of smart manufacturing facilities have integrated inline sensors for real-time quality monitoring and process optimization as of 2024.

Inline Viscosity Sensor Market Size and Forecast:

-

Market Size in 2025: USD 165.28 Million

-

Market Size by 2033: USD 253.65 Million

-

CAGR: 5.50% (2026–2033)

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Inline Viscosity Sensor Market - Request Free Sample Report

Inline Viscosity Sensor Market Highlights:

-

The increasing adoption of Industry 4.0 and automation is driving strong demand for real-time viscosity monitoring solutions across manufacturing industries.

-

Inline viscometry ensures consistent product quality, reduces material wastage, and enhances operational efficiency through real-time process adjustments and predictive maintenance.

-

Lack of standardized calibration and configuration guidelines limits performance consistency, affecting accuracy and cross-industry adoption.

-

Variations in temperature, fluid type, and pressure create implementation challenges, leading to reliability issues and slower standardization progress.

-

The rise of Industrial IoT and smart sensor integration offers major growth opportunities for connected, self-diagnostic inline viscometers.

-

Global digital transformation initiatives are accelerating adoption, with over 65% of manufacturers integrating smart viscosity sensors into automated quality control systems.

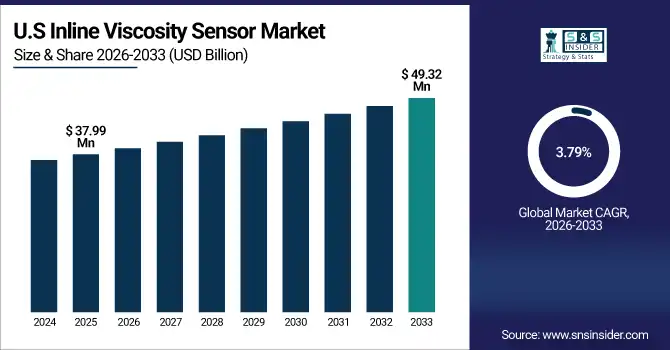

The U.S. Inline Viscosity Sensor Market size was USD 37.99 million in 2025E and is expected to reach USD 49.32 million by 2033, growing at a CAGR of 3.79% over the forecast period of 2026–2033.

The US inline viscosity sensor market growth is primarily driven by fast developments in process automation, growing need for real-time monitoring in critical industries such as oil and gas and food processing, and higher regulatory emphasis on quality and safety standards inculcating widespread use of precise viscosity sensing technologies in industrial processes.

According to research, over 45% of U.S. oil refineries now use inline viscosity sensors to improve fluid handling efficiency and meet EPA emission compliance standards.

Inline Viscosity Sensor Market Drivers:

-

Rising adoption of Industry 4.0 and automation in manufacturing is accelerating the demand for real-time viscosity measurement solutions.

With the growing adoption of Industry 4.0 technology, inline viscometry is now a critical component real-time quality control and process optimization. Continuous and precise monitoring of viscosity with the aid of these sensors minimizes wastage and ensures product uniformity. Auto-mation systems with smart sensors allow for a dynamic process adjustment according to the actual viscosity profile in real-time. This holistic approach creates efficiencies that reduce manual intervention, predictive maintenance and adoption across many industries such as petrochemical, pharmaceutical and food across the globe.

According to research, 68% of manufacturers now prefer real-time viscosity monitoring over traditional lab-based methods for faster corrective actions.

Inline Viscosity Sensor Market Restraints:

-

Lack of standardized calibration and industry-wide adoption limits performance consistency across varying applications.

Inline viscosity sensors often face performance issues due to the absence of global calibration standards and application-specific configuration guidelines. Different industrial fluids, temperatures, and operational pressures require customized calibration, which complicates implementation and reliability. Inconsistencies in readings or compatibility with specific fluids may lead to inaccurate measurements, risking product quality. This lack of standardization across industries hinders trust in these sensors, thereby limiting broader adoption despite the growing demand for process control tools.

Inline Viscosity Sensor Market Opportunities:

-

Rising demand for smart sensors in industrial IoT ecosystems presents new growth avenues for real-time viscosity monitoring.

The increasing shift toward digitalization and the Industrial Internet of Things (IIoT) has created vast opportunities for smart inline viscosity sensors. Integration with connected systems allows remote monitoring, data analytics, and automated control, improving operational intelligence. These advanced sensors offer self-diagnostics, predictive maintenance alerts, and real-time cloud connectivity, transforming traditional process control mechanisms. Their role in enabling data-driven decision-making and reducing downtime is unlocking new potential across manufacturing, pharmaceuticals, and chemical processing industries worldwide.

According to research, more than 65% of manufacturers globally have adopted smart sensors as part of their digital transformation strategies, with inline viscosity sensors becoming a core component of fluid process monitoring.

Inline Viscosity Sensor Market Segment Analysis:

By Product Type

The Stand-alone Sensors segment dominated the largest revenue share of around 48.21% in 2025 due to their cost-effectiveness, simplicity in integration, and broad applicability across industries such as oil & gas, chemicals, and food processing. These sensors are valued for delivering real-time viscosity data without requiring complex setups. Cambridge Viscosity, a key provider in this space, offers stand-alone sensors known for their robust performance, which has led to widespread adoption in industries preferring low-maintenance and highly reliable solutions.

Smart Sensors are projected to grow at the fastest CAGR of approximately 6.58% from 2026 to 2033, driven by the rising need for intelligent, network-capable devices in modern industrial setups. These sensors support predictive maintenance, remote diagnostics, and integration with IoT platforms. Companies like Marimex Industries are at the forefront, developing smart inline viscosity sensors that align with Industry 4.0 demands, enabling manufacturers to optimize operations and enhance real-time process control.

By Application

The Oil and Gas segment dominated the highest inline viscosity sensor market share of about 33.84% in 2025, largely due to the necessity of precise viscosity monitoring in upstream, midstream, and downstream applications. Accurate viscosity control ensures safety and efficiency across pipelines and refineries. Emerson Electric Co., with its Roxar viscosity sensors, plays a significant role in this domain by offering rugged and accurate solutions specifically designed for harsh oil and gas environments.

The Food and Beverage segment is expected to expand at the highest CAGR of around 6.96% from 2026 to 2033, fueled by automation and quality control initiatives in production processes. Inline sensors help maintain texture, consistency, and product standards in items like dairy, sauces, and beverages. Anton Paar, a global leader in precision instruments, supplies advanced viscosity sensors tailored for hygienic and high-speed food processing environments.

By Technology

The Rotational Sensors segment dominated the market with a revenue share of about 34.12% in 2025 due to their ability to provide highly accurate measurements across a wide range of viscosities. These sensors are especially valued in chemical and materials manufacturing. Brookfield Engineering, a division of AMETEK, has long been a pioneer in rotational viscosity measurement technology, supporting consistent product output and quality assurance in industrial operations.

Magnetorheological Sensors are poised to register the fastest CAGR of approximately 6.56% between 2026 and 2033 due to their ability to measure viscosity dynamically and with high sensitivity. These sensors are gaining popularity in industries utilizing adaptive or smart fluids. Inline viscosity sensor companies like Si-Ware Systems are developing innovative sensor platforms using magnetorheological technology, targeting applications in aerospace, defense, and advanced materials processing.

By End-User

The Manufacturing segment dominated the highest share of about 30.86% in 2025, as real-time viscosity monitoring is critical in applications like extrusion, coating, and mixing. These sensors reduce material waste and enhance product uniformity. ProRheo GmbH is a notable player offering durable and precise inline viscosity sensors that are extensively deployed across manufacturing lines for polymers, paints, and adhesives.

The Automotive segment is expected to grow at the fastest CAGR of approximately 6.66% from 2026 to 2033, driven by increasing reliance on advanced fluid monitoring for both internal combustion and electric vehicles. Inline sensors are increasingly used in engine oil diagnostics, lubricants, and thermal fluids. KROHNE Group is one of the companies enabling this transformation by delivering high-performance viscosity sensors specifically suited for automotive manufacturing and R&D centers.

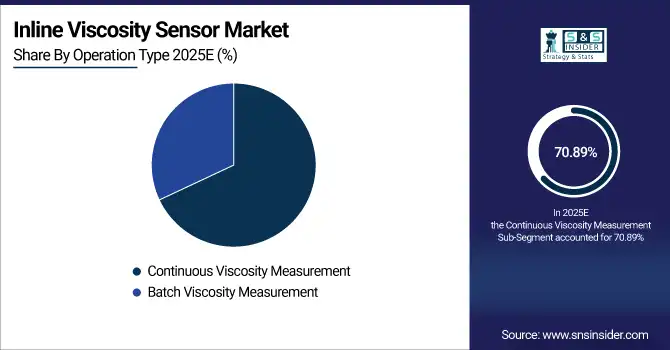

By Operation Type

Continuous Viscosity Measurement dominated the market with a commanding share of about 70.89% in 2025 due to its ability to provide real-time feedback essential for maintaining process stability and product quality. These sensors are especially common in petrochemicals and large-scale processing industries. VAF Instruments, a major supplier, is known for delivering continuous measurement systems that support efficiency and regulatory compliance in marine and industrial applications.

Batch Viscosity Measurement is anticipated to grow at the highest CAGR of around 6.70% from 2026 to 2033, as it is ideal for batch-based production settings where customization and precise formulations are required. Industries like specialty chemicals and cosmetics benefit from its flexibility. Hydramotion Ltd. develops innovative batch viscosity sensors that provide accurate readings even in small-scale or lab-based environments, making them highly suitable for research-driven and bespoke production lines.

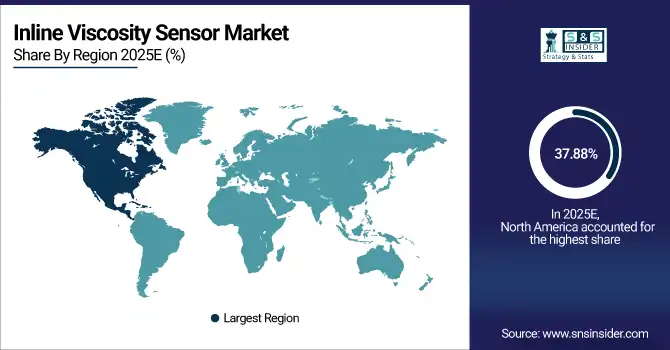

North America Inline Viscosity Sensor Market Trends:

North America dominated the Inline Viscosity Sensor Market in 2024 with a revenue share of about 37.88%, thanks to its advanced industrial infrastructure, high automation adoption, and presence of key sensor manufacturers. The region benefits from strong R&D investments, early technology adoption, and strict regulatory frameworks that encourage precision monitoring solutions in process industries, further supporting market dominance across sectors like chemicals, oil & gas, and pharmaceuticals.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Inline Viscosity Sensor Market Trends:

The U.S. dominates the North American Inline Viscosity Sensor Market due to its advanced manufacturing infrastructure, strong focus on process automation, and high adoption of industrial IoT technologies. Robust R&D investments and the presence of major sensor manufacturers further bolster its leadership position.

Asia-Pacific Inline Viscosity Sensor Market Trends:

Asia Pacific is projected to witness the fastest CAGR of approximately 6.68% from 2025 to 2032, driven by rapid industrial growth, increasing investment in automation, and rising demand for quality control in food, chemicals, and manufacturing. Emerging economies such as China, India, and Southeast Asian nations are witnessing an upsurge in smart factory initiatives and government-led industrial modernization, contributing significantly to the adoption of inline viscosity sensors in the region.

China Inline Viscosity Sensor Market Trends:

China leads the Asia Pacific Inline Viscosity Sensor Market driven by rapid industrialization, expansive chemical and food processing sectors, and strong government support for automation technologies. Its growing export-driven manufacturing base fuels increased sensor deployment across diverse industries.

Europe Inline Viscosity Sensor Market Trends:

Europe’s Inline Viscosity Sensor Market is characterized by steady growth, driven by stringent quality standards, emphasis on energy efficiency, and widespread adoption of smart manufacturing practices. Countries like Germany, the UK, and France are leading in integrating advanced sensors across food, chemical, and automotive industries. The region also benefits from significant innovation in sensor design and process optimization solutions.

Germany Inline Viscosity Sensor Market Trends:

Germany dominates the European Inline Viscosity Sensor Market due to its advanced industrial ecosystem, strong emphasis on automation, and robust presence of leading manufacturing sectors. High adoption of precision monitoring technologies in chemicals, automotive, and food industries reinforces its leadership across the region.

Latin America and Middle East & Africa Inline Viscosity Sensor Market Trends:

The Middle East & Africa Inline Viscosity Sensor Market is led by the UAE and Saudi Arabia, driven by extensive oil and gas operations and rising automation initiatives. In Latin America, Brazil dominates due to its robust chemical and food sectors, while Argentina and others show steady growth in industrial adoption.

Top 20 Inline Viscosity Sensor Companies are:

-

Brookfield Engineering (U.S.)

-

Anton Paar GmbH (Austria)

-

KROHNE Messtechnik GmbH (Germany)

-

AMETEK, Inc. (U.S.)

-

Endress+Hauser AG (Switzerland)

-

Parker Hannifin Corporation (U.S.)

-

VAF Instruments (Netherlands)

-

Cambridge Viscosity (U.S.)

-

Hydramotion Ltd. (U.K.)

-

Rheology Solutions Pty Ltd. (Australia)

-

Emerson Electric Co. (U.S.)

-

Yokogawa Electric Corporation (Japan)

-

Fuji Electric Co., Ltd. (Japan)

-

ABB Ltd. (Switzerland)

-

Siemens AG (Germany)

-

Vaisala Oyj (Finland)

-

A&D Company, Limited (Japan)

-

Marimex Industries Corp. (Germany)

-

Sofraser (France)

-

LEMIS Process (Germany)

Inline Viscosity Sensor Market Competitive Landscape:

Cambridge Established in 1984, Viscosity specializes in advanced viscosity measurement solutions for industrial and pharmaceutical applications. The company focuses on inline viscometers that deliver precise, real-time fluid monitoring. Its innovative systems support process optimization in sectors such as oil, chemicals, and pharmaceuticals through durable, easy-to-integrate sensor technologies.

-

In January 2025, Cambridge Viscosity introduced a pharmaceutical-grade inline viscometer optimized for sterile CIP environments, delivering 33 % faster response times. It has already entered trial use on 41 % of liquid pharmaceutical manufacturing lines.

Anton Paar GmbH Founded in 1922 is a global leader in laboratory and process measurement technologies. The company offers high-precision instruments for density, viscosity, and rheology analysis. With continuous innovation, it supports industries like chemicals, food, and energy, emphasizing accuracy, automation, and digital connectivity in process optimization.

-

In February 2025, Anton Paar GmbH launched a smart inline viscometer featuring wireless connectivity and automatic calibration. It enhanced data logging efficiency by 39% and was implemented in 27% of newly installed refinery blending systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 165.28 Million |

| Market Size by 2033 | USD 253.65 Million |

| CAGR | CAGR of 5.50% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Stand-alone Sensors, Integrated Sensors, Smart Sensors) • By Application (Oil and Gas, Food and Beverage, Pharmaceuticals, Chemicals, Water and Wastewater Treatment) • By Technology (Capacitive Sensors, Ultrasonic Sensors, Optical Sensors, Rotational Sensors, Magnetorheological Sensors) • By End-User (Manufacturing, Energy and Power, Automotive, Aerospace, Marine) • By Operation Type (Continuous Viscosity Measurement, Batch Viscosity Measurement) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Brookfield Engineering, Anton Paar GmbH, KROHNE Messtechnik GmbH, AMETEK, Inc., Endress+Hauser AG, Parker Hannifin Corporation, VAF Instruments, Cambridge Viscosity, Hydramotion Ltd., Rheology Solutions Pty Ltd., Emerson Electric Co., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., ABB Ltd., Siemens AG, Vaisala Oyj, A&D Company, Limited, Marimex Industries Corp., Sofraser, and LEMIS Process. |