Smart Contracts Market Size & Overview:

Get more Information on Smart Contracts Market - Request Sample Report

Smart Contracts Market Size was valued at USD 1.6 Billion in 2023 and is expected to reach USD 11.7 Billion by 2032, growing at a CAGR of 24.7% over the forecast period 2024-2032.

The smart contracts market has been growing swiftly due to an increasing acceptance of blockchain technology and its potential among the players of different industries. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code, reducing costs, eliminating the need for intermediaries, and making transactions quick. Governments across the world are championing the adoption of smart contracts due to their potential to transform sectors such as finance, supply chain, and energy.

In the U.S., the Department of Energy has allocated significant funds toward blockchain and smart contract projects, signaling strong governmental backing for this technology in energy trading and management. Similarly, China has intensified its efforts to incorporate blockchain into trade finance, with the Ministry of Industry and Information Technology pushing for more blockchain-driven financial systems. Increased government-induced initiatives will further reaffirm their commitment to improve transparency, security, and efficiency in all digital systems which will have an indirect but a positive impact on the smart contracts market. In financial services, the use of smart contracts for blockchain-based solutions is also seeing strong momentum, with these technologies also being applied in areas such as loan management, securities trading, and claims processing. The ongoing adoption of blockchain in diverse industries, coupled with rising demand for automation and improved contract security, will continue to propel market growth. Regulatory frameworks, such as those being established by governments in North America, Europe, and Asia, will further enhance the credibility and reach of smart contracts, ensuring their application across more sectors in the coming years.

Market Dynamics

Drivers

-

The increasing adoption of blockchain technology in sectors like finance, supply chain, and real estate drives smart contracts' growth due to their ability to automate and secure transactions.

-

Smart contracts reduce fraud risks by automating transactions and providing immutable, transparent records on decentralized ledgers.

-

By eliminating intermediaries, smart contracts help reduce transaction costs and processing time, benefiting enterprises aiming to streamline operations.

Increasing adoption of blockchain technology across different industries such as finance, supply chain, healthcare, and real estate is one of the major factors driving the growth of the smart contracts market. The rise in popularity is driven by the understanding that blockchain has the potential to automate transactions, eliminate the need for third parties, and increase transparency and security. As an illustration, within the finance business, blockchain-based mostly good contracts at the moment are automating and enhancing processes equivalent to world funds and insurance coverage declare settlements. In 2023, The Adoption of Smart Contracts (FTI) stated that 70% of financial institutions will be exploring or implementing blockchain, with smart contracts forming a central part of their strategy. These institutions are adopting blockchain to enable faster processing and lower transaction fees, giving them an edge over competitors.

In supply chain management Walmart and IBM, are applying smart contracts for goods to be traced in real time, effectively preventing fraud and aiding compliance with regulatory standards. For instance, the blockchain-based food traceability system of Walmart speeds the tracing of food from six days to seconds. This is not limited to real estate, where smart contracts streamline the process of transferring ownership of properties, reducing the amount of paperwork needed to complete property transfers and, consequently, the amount of time it typically takes to do so. Increasing adoption across various industries is one of the key factors driving the growth of the Smart Contracts market.

Restraints

-

Designing, coding, and deploying smart contracts require advanced technical skills, which can pose a barrier for non-technical enterprises, Errors in code can lead to vulnerabilities, potentially resulting in financial losses or data breaches.

-

The lack of standardization and varying global regulations around blockchain and smart contracts create uncertainties for widespread adoption.

The technical complexity associated with developing and deploying smart contracts is one of the major restraining factors for the growth of the smart contracts market. Blockchain technology provides automation and efficiency, but it also demands specialized knowledge in coding and blockchain development to write smart contracts. This complexity can be daunting for organizations without in-house technical expertise, leading to increased reliance on third-party developers or blockchain experts. Additionally, just a minor coding mistake in the smart contracts can lead to huge loopholes which are very easily exploitable resulting in monetary losses. This is another technical barrier that is also applicable to the implementation process itself because organizations must ensure proper integration of smart contracts with existing systems. Consequently, this complexity dissuades many potential adopters from seeking this technology, predominantly in smaller businesses that do not have the time to mitigate these challenges .

Segment analysis

By Platform

In 2023, Ethereum dominated the smart contracts market, accounting for more than 48% of the market share. Ethereum benefits from wide adoption, a rich developer ecosystem, and a vibrant ecosystem of dApps and smart contracts that run on the platform. The blockchain takes a distinct appeal for being able to host a wide variety of contract types, in particular contracts that power decentralized finance (DeFi) apps. Its ecosystem facilitates the creation and execution of self-executing contracts for industries ranging from finance to real estate, making it the preferred platform for businesses and developers.

Ethereum’s growth has been further supported by continuous technological advancements, including the transition to Ethereum 2.0 in 2023, which switched the platform from energy-intensive proof-of-work (PoW) to proof-of-stake (PoS), significantly improving scalability and reducing transaction costs. Government backing in regions like Europe further reinforces Ethereum’s dominance. The European Blockchain Observatory, for example, acknowledges Ethereum as a foundational blockchain platform for public-private partnerships, leveraging its transparency and security for sectors such as governance and finance. Moreover, Ethereum also supports new technologies in crypto such as non-fungible tokens (NFTs) and dApps, thus bringing it to the forefront of blockchain development. Both the wide developer community, along with the major institutions on Ethereum guarantee a healthy level of adaptability in the platform, permitting it to change and adjust alongside the newly arrived regulatory and technological paradigms. With the continued adoption of blockchain technology, Ethereum is well-positioned to capture a significant portion of the market share, particularly if the platform demonstrates scalability and regulatory support over the long term.

By Contract Type

DAOs are another major segment of the smart contracts market, accounting for 36% of the type of contract in 2023. The DAO enables organizations to be governed by code, without the need for intermediaries and other typical governance infrastructure. Such a smart contract is gaining momentum in industries that put high value on decentralization in control and transparency like fintech, supply chain, and social governance. Most governments have realized the benefits of DAOs, especially because of how they help promote transparency and eliminate bureaucratic inefficiencies. For example, in Wyoming, USA, DAOs are now legally recognized as business entities, one of the most progressive moves regarding blockchain to date. This legal recognition has paved the way for the establishment of DAO-led enterprises that rely on blockchain-based smart contracts for governance, decision-making, and operations. DAOs are desirable because they self-execute as they are not piloted based upon human parties, but rather by a set of code so they are shielded from human error or corruption and can hold people more accountable.

Another factor adding to the rise of DAOs is the technical infrastructure provided by platforms such as Ethereum that can create and support DAOs. As they become a stronger tool for governance, finance, and the formation of new decentralized communities. Government involvement and the legal frameworks being built around DAOs will play a critical role in shaping their growth trajectory.

By Enterprises size

In 2023, the smart contracts market was dominated by the large enterprise segment, which accounted for 68% of the market share. Big organizations, especially in finance, trade, and supply chain, have been adopting blockchain, since it reduces costs, fastens operations, and improves visibility of the entire process. The adoption of smart contracts by these enterprises increases the automation of complex workflows while reducing the susceptibility to errors or fraud, an important feature for high-value transactions and cross-border trade. All over the globe, governments have invented industries on the back of large enterprises to smart contracts and blockchain. As an example, the SEC has promoted innovation on the blockchain in major financial markets in the USA, which has prompted many large firms to investigate solutions on the blockchain. Moreover, according to the U.S. Census Bureau, 76% of the Fortune 500 firms have undertaken blockchain projects which indicates the important contribution of large-scale companies to the growth of the market.

In addition, global enterprises in sectors such as automotive, logistics, and healthcare are utilizing smart contracts to promote supply chain efficiency and regulatory compliance. For the enterprise of the future as operations scale, smart contracts provide better audit trails and secure transaction mechanisms that will become essential for the enterprise doing big data and transaction volume. Nevertheless, as regulations become more favorable and the number of tailored smart contract solutions becomes more available, the prevalence of larger enterprises in the smart contracts market will likely continue for several years.

By End-user

The Banking, Financial Services, and Insurance (BFSI) sector continued to dominate the smart contracts market in 2023, contributing more than 37% to the global market share. There has been a growing need among the BFSI sector propelled by the use of blockchain technology to perform their works, like trade finance, insurance claims, and loan agreements, utilizing smart contract methods to ensure secure, transparent, and relatively cheap solutions to their daily problems via blockchain technology. Smart contracts automate these processes, ensuring reliability, minimizing human error, and fraud, and faster settlements.

The support of the government has been a significant factor in the integration of smart contracts in the BFSI sector. The Monetary Authority of Singapore (MAS) has, for example, been very active in encouraging the adoption of blockchain technology in financial services, with a focus on applications targeted to cross-border payments and smart contract-driven lending. Likewise, the European Central Bank (ECB) is considering the possibility of using blockchain to secure financial transactions, necessarily accelerating the broader use of smart contracts throughout European financial markets. As regulation becomes clearer and blockchain infrastructure matures, the market of smart contracts in BFSI will be larger. Smart contracts in BFSI help streamline operations, reduce settlement times, and ensure compliance with regulatory standards, which is especially critical in the wake of the 2008 financial crisis. As governments continue to support blockchain adoption through favorable regulatory frameworks, the BFSI sector’s reliance on smart contracts will likely continue to grow.

Need any customization research on Smart Contracts Market - Enquiry Now

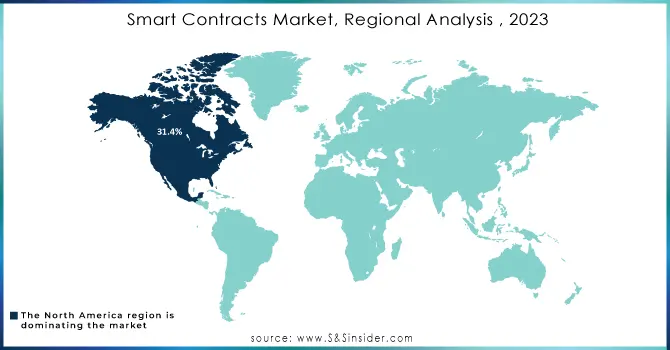

Regional Analysis

North America maintained its position as the dominant region for smart contracts, which accounted for a 32% share of the region. Factors like the technologically advanced infrastructure of the region together with a high adoption rate of blockchain technologies and powerful government initiatives have contributed to this dominance. The U.S. has seen substantial investments in blockchain startups, while Canada has made significant strides in integrating blockchain into government services.

On the other hand, the smart contracts market in Asia-Pacific is projected to be the fastest-growing region because of its highest CAGR. China, Japan, and South Korea countries launched massive blockchain initiatives, and substantial growth in such projects led by the government is only expected in the future. For instance, China’s Ministry of Industry and Information Technology has made substantial investments in blockchain research and application, with a focus on improving trade and finance mechanisms. Additionally, the vibrant tech startup ecosystem in India and other ASEAN countries further accelerates the adoption of smart contracts in industries like supply chain, fintech, and healthcare. The Asia-Pacific region’s rapid adoption is attributed to its lower transaction costs, faster scalability, and increasing government support for the development of the blockchain. The region captured a significant share of the worldwide smart contracts market share in 2023, and their share is expected to grow as nations in the region continue to adopt digital transformation.

Key Players

Service Providers / Manufacturers

-

IBM (IBM Blockchain, IBM Food Trust)

-

Microsoft (Azure Blockchain Service, Ethereum on Azure)

-

Amazon Web Services (AWS Blockchain Templates, Amazon Managed Blockchain)

-

Oracle (Oracle Blockchain Platform, Oracle Intelligent Track and Trace)

-

Accenture (Accenture Blockchain for Supply Chain, Accenture Blockchain for Finance)

-

SAP (SAP Leonardo, SAP Blockchain Technology)

-

R3 (Corda, Corda Enterprise)

-

Ethereum Foundation (Ethereum, Ethereum 2.0)

-

Blockchain Foundry (Smart Contracts on Bitcoin, Blockpress)

-

Hyperledger (Hyperledger Fabric, Hyperledger Indy)

Key Users

-

Deutsche Bank

-

JPMorgan Chase

-

HSBC

-

Wells Fargo

-

Nestlé

-

Walmart

-

L’Oreal

-

Maersk

-

Microsoft

-

UPS

Recent Developments:

-

June 2023: In order to make the EON Smart Contract Platform more accessible and robust, Horizen, a provider of public blockchain technology as well as Ankr, Web3's Infrastructure Provider are working together. A package of developer tools has been made available by this collaboration to enable the deployment of smart contract applications.

-

In March 2023, Chainlink Functions created the first serverless platform for integrating their smart contracts and decentralized applications (dApps) directly into the Web 2.0 API ecosystem. This service enables Web 2.0 API customization via the Chainlink network.

-

January 2023: Bunzz, a web3 development platform for decentralized applications, has raised USD 4.5 million in seed funding. Over 8,000 developers of DApps have made use of this platform, and the funding has helped strengthen Bunzzus's smart contract network.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.6 Billion |

| Market Size by 2032 | USD 11.7 Billion |

| CAGR | CAGR of 24.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

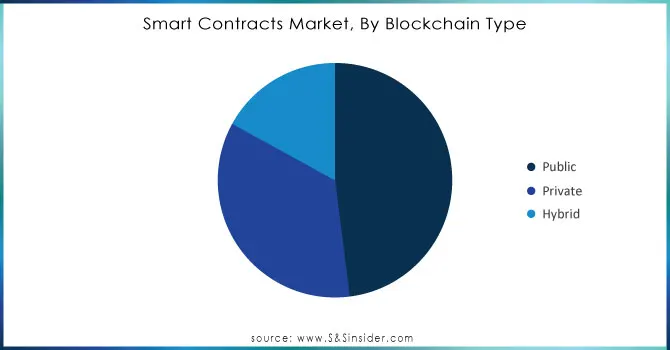

| Key Segments | • By Platform (Ethereum, Cardano, BNB Chain, Polkadot, Others) • By Blockchain Type (Public, Private, Hybrid) • By Contract Type (Smart Legal Contracts, Decentralized Autonomous Organizations (DAO), Application Logic Contracts) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By End-Use (BFSI, Retail, Healthcare, Real Estate, Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

IBM, Microsoft, Amazon Web Services, Oracle, Accenture, SAP, R3, Ethereum Foundation, Blockchain Foundry, Hyperledger. |

| Key Drivers | •The increasing adoption of blockchain technology in sectors like finance, supply chain, and real estate drives smart contracts' growth due to their ability to automate and secure transactions •Smart contracts reduce fraud risks by automating transactions and providing immutable, transparent records on decentralized ledgers. •By eliminating intermediaries, smart contracts help reduce transaction costs and processing time, benefiting enterprises aiming to streamline operations |

| Market Retraints | •Designing, coding, and deploying smart contracts require advanced technical skills, which can pose a barrier for non-technical enterprises, Errors in code can lead to vulnerabilities, potentially resulting in financial losses or data breaches •The lack of standardization and varying global regulations around blockchain and smart contracts create uncertainties for widespread adoption. |