Solid State Relay Market Key Insights:

Get More Information on Solid State Relay Market - Request Sample Report

The Solid State Relay Market Size was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.82 Billion by 2032 and grow at a CAGR of 5.51% over the forecast period 2024-2032.

More efficient and productive production is demanded by manufacturers and industries, and in such scenarios, the SSR becomes a reliable and effective switching solution when switching applications are concerned, making it an indispensable component of modern machinery and equipment. Renewable sources of energy are a major growth driver for the SSR market. The shift in the world towards renewable energy solutions is facing an increased demand for SSRs among solar inverters and other renewable systems due to their desirable characteristics of durability, fast-switching performance, and high-voltage handling capability. Energy efficiency and sustainability worldwide also assist in this upward growth in the adoption of SSR technology. By 2028, solar power capacity is anticipated to reach 4,500 GW, effectively doubling current levels. Wind energy capacity is expected to grow to 1,700 GW within the same period. Annual investments in renewable energy are projected to exceed USD 500 billion.

In the health sector, in particular, SSRs widely apply to the variety of medical instruments required to provide precise control and assured operation to ensure patient safety and efficient treatment. Similarly, in the automotive industry, SSRs have become more indispensable for controlling electrical loads and overall performance enhancement in the entire vehicle. With the trend of miniaturization of electronic components, compact SSRs have been established that enable them to be used in tighter spaces without any loss in performance. This has revolutionized the face of SSRs in consumer electronics and smart devices, paving the way for wider market coverage.

MARKET DYNAMICS

KEY DRIVERS:

-

Smart Technology Integration Drives Exponential Growth in Solid-State Relay Demand Across Industries

Due to the growth of the Industrial Internet of Things and the concept of intelligent manufacturing, advanced features like remote monitoring, diagnostics, and control capabilities are being added to SSRs. This helps get real-time data collection and analysis, which enables various industries to optimize their processes, enhance predictive maintenance, and reduce downtime. As industries embrace intelligent solutions to increase the efficiency of operations, SSRs with intelligent technologies are likely to have their demand grow exponentially.

-

Innovative Thermal Management Solutions Enhance the Performance and Reliability of Solid-State Relays in the Industry

The trend in the Solid-State Relay (SSR) involves the development of improved thermal management solutions. As the applications involving SSRs are highly power-consuming and require to be switched on and off, effective heat dissipation becomes important for the desired performance along with a long-lasting operational life. Manufacturers still focus on innovative cooling techniques like advanced heat sinks, thermal interface materials, and smart cooling technologies, which help handle heat efficiently. This trend not only improves the reliability and length of life for SSRs but increases their efficiency in demanding applications. As such, industries seek more robust and efficient components, hence thermal management solutions in SSR design continue to pick momentum.

RESTRAIN:

-

Challenges of High Front-End Costs and Thermal Management Hinder Solid-State Relay Adoption in Industries

Their higher durability and efficiency in the long term may make SSRs an attractive choice, but more so, the front-end investment can be a strong barrier for many small and medium-sized enterprises without sufficient funds. Price sensitivity may limit adoption in industries where cost sensitivities are high. Another issue is thermal concerns with SSRs. While solutions for thermal management are evolving continuously, a relay's operation can still generate copious amounts of heat, which may negatively affect the performance and reliability of the system. Effective dissipation of heat is critical when the application is highly powered. If the heat is not managed properly, then the long-term life span and reliability of the relays might be compromised or even fail due to overheating.

SSRs usually have a primary investment amount, which is 2 to 3 times higher than the electromechanical relays investment amount as it might also demand integration and potential system modification. Most of the companies do not focus on the long-term benefits that SSRs offer such as up to 30% savings in maintenance cost and being shifted towards cheaper traditional options. SSRs generate 30-50% more heat than EMRs, which also complicates cooling solutions, adding overall costs of up to 10-20%. Severe overheating also degrades performance and reliability, adding mitigation costs, so SSR acceptance is an expensive proposition in general.

MARKET SEGMENTATION ANALYSIS

BY MOUNTING TYPE

In 2023, the Panel Mount segment dominated the largest share in the Solid-State Relay (SSR) market, accounting for 42% of the total market share. The main reason behind this trend is the convenience of installment as well as reliability in industrial applications such as motor control and automation. Their fast-switching ability and energy efficiency make them a best-fit option for increasing industrialization towards automation focus and, as such, are thus preferred by manufacturers.

The DIN Rail Mount segment is the fastest-growing category, with a projected CAGR of 6.13% during the forecast period. This is because modular electrical systems that optimize space within the control panels are gaining more and more acceptance. The concept of Smart Manufacturing and Industry 4.0 has also increased the need for components that can be easily integrated into automated environments, and DIN rail-mounted SSRs may well turn out to be an attractive option for modern applications.

BY OUTPUT VOLTAGE

In 2023, AC solid-state relays dominated the market share of 53%, leading the overall SSR market. This is because AC SSRs have been widely used in industries such as manufacturing, lighting, and HVAC systems. The solid-state relays are also strongly used in industrial applications such as withstanding high voltages, fast switching capabilities, and reliability in harsh environments. With companies looking forward to more energy-efficient solutions, AC SSR delivers reliable performance and supports better energy management.

The DC solid-state relay segment will witness the highest growth with a projected CAGR of 5.99% in the forecast period. This growth is mostly because of the growing demand for renewable energy technologies, like solar and battery storage systems. The need to control the electricity loads in a DC SSR is high. Additionally, the electric vehicle market combined with advancements in batteries again brought the demand for DC solid-state relays forward. All these compact designs, short response times, and DC application reliability make them prime candidates for some of the fastest-evolving industries in terms of areas of electrification and sustainable energy solutions.

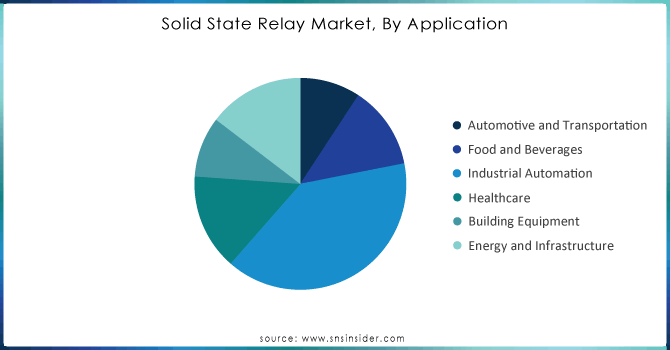

BY Application

In 2023, the Industrial Automation application segment dominated the Solid-State Relay (SSR) market, holding 39% of the total market share. The main reason is that the necessity for automation solutions persists within various industries. Manufacturers require efficiency while minimizing the costs of running their operations and increasing safety through faster and more reliable SSR switching for the control of motors, sensors, and other critical elements that make up automated systems. Besides, current industrial trends in the direction of smart factories and Industry 4.0 projects act as boosters for SSRs in industrial automation applications.

The healthcare application segment is expected to be the fastest-growing area within the SSR market with an estimated CAGR of 6.45%. Growth would primarily be due to the rising demand for advanced medical equipment and devices requiring precise control as well as dependable operation. There are widespread uses of SSRs today in applications such as imaging systems, laboratory equipment, and patient monitoring systems, simply because they provide safety and accuracy. The continually developing healthcare technology will eventually be calling for reliable and efficient components like SSRs. This therefore will lead to an increase in the demand for this sector.

Need Any Customization Research On Solid State Relay Market - Inquiry Now

REGIONAL ANALYSIS

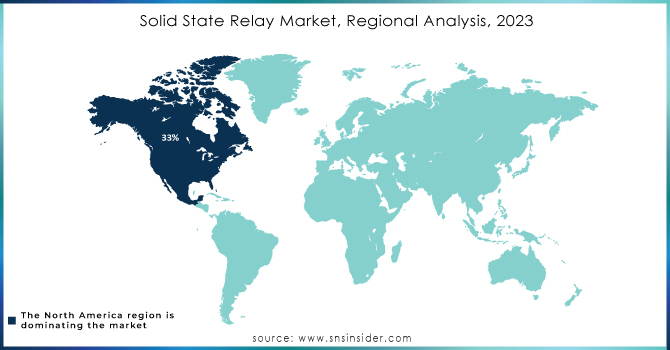

In 2023, North America dominated the SSR market, capturing 33% of the total market share. This can be largely attributed to the strong industrial base in the region and an enhanced emphasis on automation and advanced manufacturing technologies. Companies like Omron Corporation and Rockwell Automation have greatly invested in research and development, giving them the capability of innovating solutions from an early age.

For example, a significant number of SSRs are being incorporated into industrial automation processes—robotics and conveyor systems—is giving rise to huge demand. The energy management sector also utilizes SSRs mainly due to reliability in power system control. The consumer electronic sector also features SSRs where substantial switching capability with high precision is in demand. In this context, the aforementioned factors denote North America as a leading market for SSRsThe.

Asia Pacific region is expected to grow substantially with a CAGR of 6.03% during the forecast period. Rapid industrialization and significant infrastructure investments are key growth drivers. For instance, India’s National Infrastructure Pipeline aims to invest $1.4 trillion by 2025, enhancing demand for SSRs in smart grids and automation. Major economies like China and India are also investing heavily in smart manufacturing, contributing to increased demand for reliable components. In the renewable energy sector, China leads globally, accounting for nearly 50% of solar panel production, while India targets 450 GW of renewable energy capacity by 2030. This push for automation across sectors, including manufacturing and energy management, underscores the Asia Pacific region's critical role in driving SSR adoption as industries seek efficient and reliable solutions to meet their growing needs.

KEY PLAYERS

Some of the major players in the Solid State Relay Market are:

-

Omron Corporation (G3NA, G3MB)

-

Crydom (Sensata Technologies) (D1D, D2D)

-

Panasonic Corporation (AQH3213, AQH3214)

-

Siemens AG (SIRIUS 3RF, 3UG4511)

-

Schneider Electric (ZB5AA3, ZB5AA1)

-

TE Connectivity (DIP, EFF)

-

Fujitsu Limited (FTR-B3, FTR-B4)

-

IXYS Corporation (MOC3063, MOC3041)

-

STMicroelectronics (MOC3063, MOC3041)

-

Broadcom Inc. (H11L1, H11L2)

-

Vishay Intertechnology (VO216L, VO222L)

-

Mitsubishi Electric (G3F, G3S)

-

NEC Corporation (PS2501-1, PS2502-1)

-

Bourns, Inc. (BTS5400-1, BTS5400-2)

-

NTE Electronics (NTE1505, NTE1508)

-

Littelfuse, Inc. (V23080A, V23084A)

-

Solid State Devices, Inc. (SDD-70, SDD-100)

-

Omni Pro Electronics (RSL, RS)

-

Honeywell International Inc. (DC410, DC411)

-

Apcos GmbH (S82, S83)

RECENT TRENDS

-

In August 2024, Littelfuse introduced the SRP1 family of solid-state relays (SSRs) to address the growing demand for more reliable switching performance in industrial and commercial applications

-

In March 2024, Carlo Gavazzi announced an expansion of its RM1D series of solid-state relays (SSRs) with the introduction of a new 3 Amp DC-rated version. This addition aims to enhance the versatility and application range of the RM1D series.

-

In December 2023, Japanese electronics manufacturer Toshiba launched the TLX9910, a new PV output photocoupler designed specifically for solid-state relays.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.13 Billion |

| Market Size by 2032 | USD 1.82 Billion |

| CAGR | CAGR of 5.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mounting type (Panel mount, DIN rail mount, PCB mount), • By Output voltage (AC solid-state relay, DC solid-state relay, AC/DC solid-state relays), • By Application (Automotive and Transportation, Food and Beverages, Industrial Automation, Healthcare, Building Equipment, Energy and Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Omron Corporation, Crydom (Sensata Technologies), Panasonic Corporation, Siemens AG, Schneider Electric, TE Connectivity, Fujitsu Limited, IXYS Corporation, STMicroelectronics, Broadcom Inc., Vishay Intertechnology, Mitsubishi Electric, NEC Corporation, Bourns, Inc., NTE Electronics, Littelfuse, Inc., Solid State Devices, Inc., Omni Pro Electronics, Honeywell International Inc., Apcos GmbH. |

| Key Drivers | • Smart Technology Integration Drives Exponential Growth in Solid-State Relay Demand Across Industries • Innovative Thermal Management Solutions Enhance Performance and Reliability of Solid-State Relays in Industry |

| RESTRAINTS | • Challenges of High Front-End Costs and Thermal Management Hinder Solid-State Relay Adoption in Industries |