Connected Living Room Market Size & Trends Analysis:

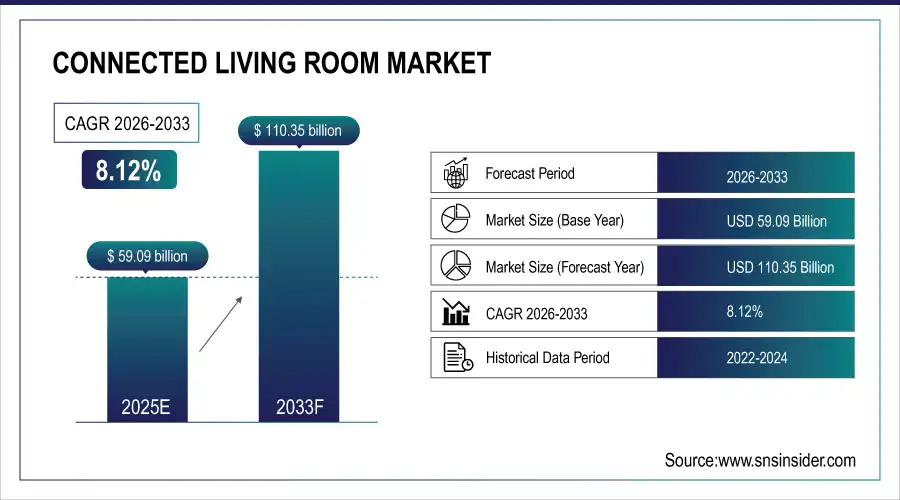

The Connected Living Room Market Size is estimated at USD 59.09 Billion in 2025 and is projected to reach USD 110.35 Billion by 2033, growing at a CAGR of 8.12% during the forecast period 2026–2033.

The Connected Living Room Market analysis report gives a full picture of integrated smart home ecosystems, with a focus on entertainment, networking, and control solutions in homes. During the forecast period, the market is likely to increase because more people want seamless entertainment experiences, high-speed broadband is becoming more common, AI and voice assistants are being used more, and content streaming services are becoming more popular.

The connected living room ecosystem is expected to penetrate over 45% of broadband households in key markets by 2025, driven by device interoperability and rising demand for integrated entertainment.

Market Size and Growth Projection:

-

Market Size in 2025E: USD 59.09 Billion

-

Market Size by 2033: USD 110.35 Billion

-

CAGR: 8.12% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Connected Living Room Market - Request Free Sample Report

Connected Living Room Market Trends:

-

Growing adoption of 4K/8K Smart TVs and integration with streaming platforms is central to ecosystem growth, with over 70% of new TVs shipped being internet-connected.

-

Rise of cloud gaming services is blurring lines between consoles and streaming devices, expanding the gaming application segment.

-

Voice-controlled smart speakers are becoming central hubs, with multi-room audio setups growing by over 25% annually.

-

Increased interoperability between devices (TVs, speakers, phones, tablets) via universal protocols is reducing ecosystem fragmentation.

-

Advancements in Wi-Fi 6/6E and Bluetooth LE Audio are enhancing wireless streaming quality and reliability for low-latency applications.

-

Growing integration of smart home security and monitoring features (via cameras, sensors) directly into living room displays and hubs.

U.S. Connected Living Room Market Size Outlook:

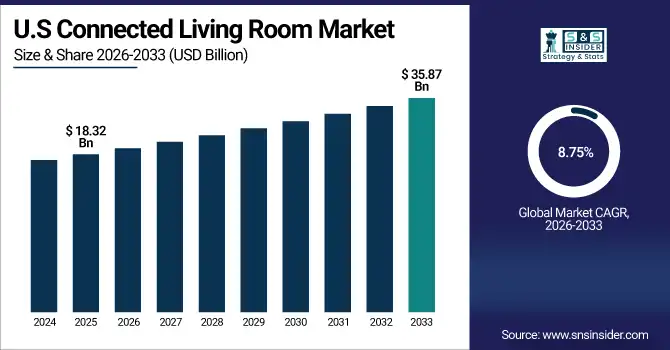

The U.S. Connected Living Room Market is projected to grow from USD 18.32 Billion in 2025E to USD 35.87 Billion by 2033, at a CAGR of 8.75%. High disposable income, early acceptance of new technologies, a lot of streaming service subscribers, a strong broadband infrastructure, and the presence of top technology and content firms all help growth.

Connected Living Room Market Growth Drivers:

-

Surging Consumer Demand for Integrated, High-Quality Home Entertainment and Convenience is Accelerating Adoption of Connected Living Room Ecosystems

The Connected Living Room Market is growing as more and more people want to watch and listen to content in one place. The rise of streaming video and audio services needs powerful hardware, which is why Smart TVs, streaming gadgets, and soundbars are selling so well. People want to be able to operate all of their devices easily and make them work together. This is driving the use of central hubs, such as smart speakers and smartphones. The need for convenience through voice control, automated procedures, and experiences in more than one place drives constant innovation and integration. The growing "home-centric" trend since the pandemic has also made the living room a main place for work, play, and talking, which has led to continued investment in linked devices.

Connected living room device shipments are projected to exceed 1.8 billion units annually by 2025, driven by replacement cycles and integration of new AI features.

Connected Living Room Market Restraints:

-

Consumer Concerns Over Data Privacy, Security Vulnerabilities, and High Costs of Premium Devices are Restraining Broader Market Penetration

Consumer concerns over data privacy and security pose significant restraints for the Connected Living Room Market. The always-on, internet-connected nature of devices, such as smart speakers and TVs raises fears about data collection, eavesdropping, and potential breaches. Fragmentation across different ecosystems (Google, Apple, and Amazon) can cause compatibility issues, leading to consumer frustration. Additionally, the relatively high cost of premium connected devices and the requirement for robust, high-speed internet connections can limit adoption in cost-sensitive or under-connected regions. These factors slow overall market growth despite clear technological benefits.

Connected Living Room Market Opportunities:

-

Rapid Evolution Towards AI-Powered, Context-Aware Environments, and Expansion of Smart Home Ecosystem Present Significant Opportunities for Market Expansion

The quick shift toward smart houses that use AI to make predictions is a big chance. Machine learning has come a long way, and now gadgets can guess what users want, automate tasks, and provide them personalized content. As the smart home ecosystem grows, electronics in the living room can work together with lighting, climate, and security systems to make a single platform for managing the home. This trend gives businesses a chance to provide interfaces that are easier to use, better interoperability solutions, and subscription-based service models that bring in recurring revenue and help the industry grow over time.

AI and predictive features are expected to be key purchase drivers for over 35% of connected living room products by 2025.

Connected Living Room Market Segmentation Analysis:

-

By Type, Smart TVs held the largest market share of 38.72% in 2025, while Smart Speakers are expected to grow at the fastest CAGR of 10.15% during 2026–2033.

-

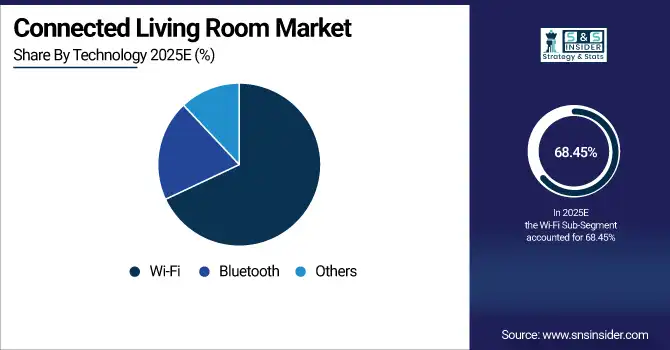

By Technology, Wi-Fi accounted for the highest market share of 68.45% in 2025, while Bluetooth is projected to expand at the fastest CAGR of 9.20% during the forecast period.

-

By Application, Video Streaming dominated with a 52.33% share in 2025, while Gaming is expected to grow at the fastest CAGR of 9.85% through 2026–2033.

By Type, Smart TVs Dominate While Smart Speakers Expand Rapidly:

Smart TVs segment dominated the market as they serve as the central visual display and primary content gateway for the connected living room. Over 220 million Smart TVs were shipped globally in 2025, with integrated streaming apps, voice assistants, and smart home dashboards becoming standard features. Their central role in entertainment and increasing affordability solidify their leading share.

Smart Speakers are the fastest-growing segment, driven by their role as affordable voice-controlled hubs for music, information, and smart home control. In 2025, shipments exceeded 180 million units, reflecting their rapid adoption as secondary interfaces that complement and control other connected devices, driving ecosystem cohesion.

By Technology, Wi-Fi Dominates While Bluetooth Expands Rapidly:

Wi-Fi segment dominated the market due to its essential role in providing high-bandwidth internet connectivity for streaming video, audio, and cloud-based services. Over 95% of connected living room core devices relied primarily on Wi-Fi for connectivity in 2025, supported by the rollout of Wi-Fi 6/6E for improved performance in dense device environments.

Bluetooth is the fastest-growing segment, driven by the proliferation of wireless headphones, earbuds, soundbars, and controllers that require low-energy, short-range connectivity. The adoption of Bluetooth LE Audio for higher quality wireless audio is accelerating its use case in 2025, especially for personal audio and peripheral device connections.

By Application, Video Streaming Dominates While Gaming Expands Rapidly:

Video Streaming application segment dominated the market, accounting for over half of all connected living room data traffic and device utility. The subscription-based model of services like Netflix, Disney+, and Amazon Prime Video, coupled with the production of exclusive 4K/HDR content, continuously drives demand for capable Smart TVs and streaming devices.

Gaming is the fastest-growing application segment, fueled by next-generation console cycles, the expansion of PC gaming into the living room, and the emergence of cloud gaming services (Xbox Cloud Gaming, NVIDIA GeForce Now). This growth is driving sales of high-performance consoles, gaming-specific TVs with high refresh rates, and low-latency accessories in 2025.

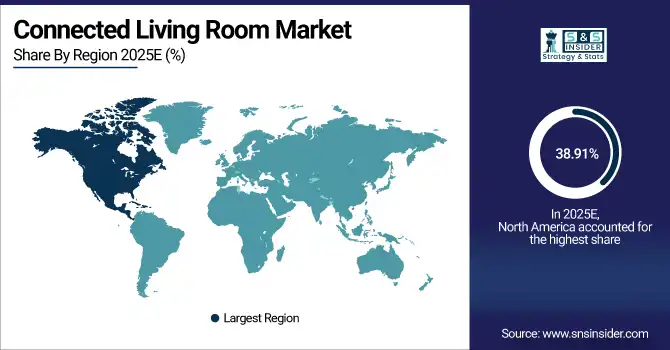

Connected Living Room Market Regional Analysis:

North America Connected Living Room Market Insights:

Due to high rates of technology use, strong consumer purchasing power, and the presence of significant international tech and content companies, North America held a 38.91% share in the connected living room market in 2025. Because of its highly developed 5G and broadband infrastructure, large number of streaming service subscribers, and rapid adoption of smart home ecosystems, North America generates the highest revenue of any area.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Connected Living Room Market Insights: The U.S. is the core market, accounting for nearly 86% of North American demand. Growth is driven by the world's highest spending on consumer electronics, intense competition among Amazon, Google, and Apple in the smart home space, and a culture that prioritizes home entertainment and technological convenience.

Asia Pacific Connected Living Room Market Insights:

The fastest-growing region is Asia Pacific, which is expected to increase at a CAGR of 9.05%. Large populations, rising disposable incomes in nations, such as China and India, quick urbanization, and growing internet penetration all contribute to growth. Important development drivers include the rapid expansion of regional streaming services and the local production of reasonably priced devices.

-

China Connected Living Room Market Insights: China dominates the Asia-Pacific region, contributing approximately 52% of regional revenue. A vast domestic market, strong local players (Xiaomi, Huawei, TCL), and government support for a robust digital ecosystem drive growth. Integration of advanced features, such as 8K displays and AIoT (AI + Internet of Things) is particularly pronounced.

Europe Connected Living Room Market Insights:

Europe is the second-largest regional market, characterized by high standards of living and strong consumer awareness of technology. Growth is driven by demand for premium audio-visual equipment, concerns over data privacy leading to demand for local/European solutions, and the integration of living room tech with home energy management systems. Germany, the U.K., and France are the leading adopters.

-

Germany Connected Living Room Market Insights: Germany leads Europe with nearly 25% regional demand, supported by high engineering standards, a strong consumer electronics retail sector, and high broadband penetration. Demand is particularly strong for high-quality Smart TVs, multi-room audio systems, and devices that offer robust data protection features.

Latin America Connected Living Room Market Insights

Latin America is witnessing steady growth in the Connected Living Room Market, driven by rising internet penetration, expanding middle-class populations, and increasing adoption of smart TVs and streaming platforms. Improving broadband infrastructure and affordable connected devices are supporting market expansion across urban households. Growing demand for cost-effective home entertainment solutions and increasing penetration of regional and global OTT platforms are strengthening connected living room adoption in the region.

-

Brazil Connected Living Room Market Insights: Brazil is the largest market in Latin America, accounting for approximately 43% of regional demand. Growth is driven by high smart TV penetration, strong uptake of streaming services, and rising adoption of smart speakers and connected audio systems. Expanding broadband access and competitive device pricing continue to support market growth.

Middle East & Africa Connected Living Room Market Insights

The Middle East & Africa Connected Living Room Market is expanding gradually, supported by rising disposable incomes, improving broadband connectivity, and increasing adoption of smart home technologies. Growth is strongest in GCC countries, where smart TVs, streaming devices, and voice-controlled systems are gaining popularity. Government-led digital transformation initiatives and growing interest in premium home entertainment experiences are driving connected living room adoption across the region.

-

United Arab Emirates Connected Living Room Market Insights: The UAE leads the MEA region with nearly 31% market share, driven by high household incomes, advanced broadband infrastructure, and strong adoption of smart home ecosystems. Demand for premium smart TVs, voice assistants, and integrated home entertainment systems is high, supported by widespread streaming service penetration and tech-savvy consumers.

Connected Living Room Market Competitive Landscape:

Samsung Electronics Co., Ltd.

Samsung, a world leader in consumer electronics, was founded in 1938 and has its headquarters in Suwon, South Korea. With its QLED and Neo QLED technologies, the business leads the Smart TV market. It also provides a whole ecosystem that includes soundbars, smartphones, tablets, and smart home appliances that are integrated through its SmartThings platform.

-

In 2024, Samsung strengthened its connected ecosystem by deepening the integration of its Tizen OS-based Smart TVs with SmartThings, allowing for more seamless control of third-party smart home devices.

Sony Group Corporation

Sony, a major force in electronics and entertainment, was founded in 1946 and is headquartered in Tokyo, Japan. Offering a vertically integrated entertainment experience, the company is a major player in the production of content, gaming consoles (PlayStation), soundbars, home theater systems, and high-end Smart TVs (BRAVIA).

-

In 2023, Sony enhanced its PlayStation 5 ecosystem with deeper integration with BRAVIA TVs for auto HDR tone mapping and exclusive audio features, bridging gaming and premium viewing.

Amazon.com, Inc.

With its Alexa speech assistant, Fire TV streaming devices, and Echo smart speaker line, Amazon, which was founded in 1994 and has its headquarters in Seattle, USA, is a powerful force. Content distribution (Prime Video), e-commerce integration, and offering the software layer for a wide range of third-party smart home devices are its strong points.

-

In 2024, Amazon launched next-generation Echo Show devices with improved contextual awareness and deeper integration with smart home security services like Ring.

Connected Living Room Companies are:

-

Sony Group Corporation

-

Amazon.com, Inc.

-

LG Electronics Inc.

-

Apple Inc.

-

Google LLC (Alphabet Inc.)

-

Roku, Inc.

-

Microsoft Corporation (Xbox)

-

Panasonic Holdings Corporation

-

TCL Electronics Holdings Ltd.

-

Hisense Group

-

Sonos, Inc.

-

Bose Corporation

-

NVIDIA Corporation (Shield TV)

-

Comcast Corporation (Sky, Xfinity)

-

Huawei Technologies Co., Ltd.

-

Sharp Corporation

-

Vizio Holdings Corp.

-

Logitech International S.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 59.09 Billion |

| Market Size by 2033 | USD 110.35 Billion |

| CAGR | CAGR of 8.12% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Smart TVs, Gaming Consoles, Computer and Laptop, Smart Speakers, Smartphones and Tablets, Others) • By Technology (Wi-Fi, Bluetooth, Others) • By Application(Video Streaming, Audio Streaming, Gaming, Security, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Samsung Electronics Co., Ltd., Sony Group Corporation, Amazon.com, Inc., LG Electronics Inc., Apple Inc., Google LLC (Alphabet Inc.), Xiaomi Corporation, Roku, Inc., Microsoft Corporation (Xbox), Panasonic Holdings Corporation, TCL Electronics Holdings Ltd., Hisense Group, Sonos, Inc., Bose Corporation, NVIDIA Corporation (Shield TV), Comcast Corporation (Sky, Xfinity), Huawei Technologies Co., Ltd., Sharp Corporation, Vizio Holdings Corp., Logitech International S.A. are key players in the connected living room market. |