Bipolar Junction Transistors Market Size & Growth:

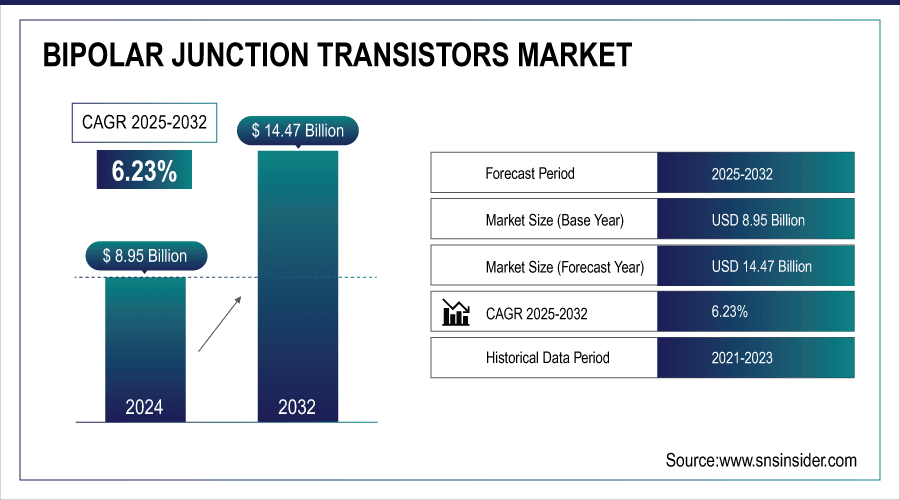

The Bipolar Junction Transistors Market size was valued at USD 8.95 billion in 2024 and is expected to reach USD 14.47 billion by 2032, growing at a CAGR of 6.23% over the forecast period of 2025-2032.

Bipolar Junction Transistors Market growth is driven by increasing demand for energy-efficient electronic products, increasing penetration in EVs and industrial devices, and development in semiconductor manufacturing and miniaturization technologies.

To Get More Information On Bipolar Junction Transistors Market - Request Free Sample Report

The Bipolar junction transistors market is developing, and with addition of better switching capabilities and overall performance, demand for the same is increasing in automotive, industrial, and consumer electronics industries. The growth in the electric vehicle market and in automation in other sectors are contributing. Further accelerated growth is driven by advances in semiconductor materials (particularly germanium and compound semiconductors) and semiconductor manufacturing. New use cases in health and telecom, as well as worldwide digitalization.

-

In 2024, over 210 new hospitals globally integrated RF-powered MRI systems, each requiring multiple high-frequency RF supply units rated at 10–30 kW. Additionally, proton therapy centers expanded by 9% in 2024, necessitating RF-driven particle acceleration chambers.

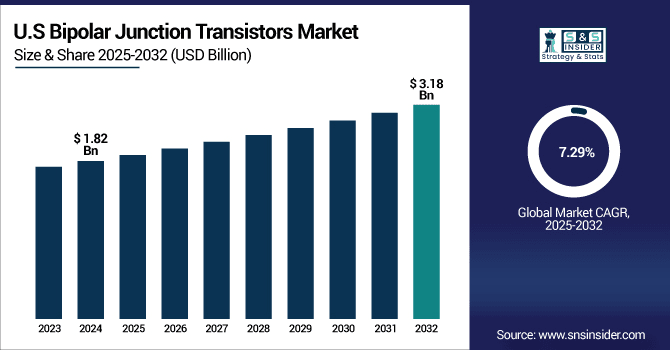

The U.S. Bipolar Junction Transistors Market size is estimated to be valued at USD 1.82 billion in 2024 and is projected to grow at a CAGR of 7.29%, reaching USD 3.18 billion by 2032. The market in the U.S. for Bipolar Junction Transistors is also increasing due to growing demand for high-performance consumer electronics, increasing telecom infrastructure and power management in data centers and smart grid systems.

Bipolar Junction Transistors Market Dynamics:

Key Drivers:

-

Rising Demand for Energy Efficient Bipolar Junction Transistors Fuels Growth Across Multiple High-Tech Sectors

An increase in the need for energy-efficient electronic devices in sectors such as automotive, industrial automation, and consumer electronics is mainly propelling the worldwide Bipolar Junction Transistors Market trends. Market expansion is also accelerating due to increasing implementation of BJTs in electric vehicles (EVs) for power control and battery management. Additionally, semiconductor manufacturing processes are also advancing due to material innovations (inclusion of compound semiconductors) so that circuits can be designed to utilize higher speed and lower power switching and/or amplifying transistors. Market dynamics are also driven by increasing use of BJTs in telecommunications and renewable energy systems.

-

According to IEEE Transactions on Power Electronics (2023), BJTs in EV battery management systems handle voltages ranging from 300V to 800V and currents exceeding 200A, ensuring efficient power regulation and thermal stability under harsh conditions.

Restraints:

-

Growing Competition from Advanced Semiconductor Technologies Challenges Bipolar Junction Transistors Market Expansion

The main challenge in the BJT market is the growing competition from alternative semiconductor devices, such as MOSFETs and IGBTs, which provide benefits in terms of power efficiency and ease of integration for specific applications. These new technologies offer greater efficiency and generally require less complex drive circuitry than BJTs, which also experience higher switching losses. The physical limitations (difficulties) of BJTs, such as smaller switching speeds compared to developing transistor types, such as GaN (Gallium Nitride) and SiC (Silicon Carbide) devices, also limit their use in ultra-high-frequency or high-power applications.

Opportunities:

-

Emerging Markets Drive Bipolar Junction Transistor Growth Through Industrialization Smart Grids and IoT Expansion

Emerging markets present an attractive growth opportunity, supported by industrialization and infrastructure investment, increasing demand for electronics. The distinguishing features of BJTs allow their applications in previously unconnected areas, such as medical devices and portable electronics. Further enhancing this opportunity is the global expansion of smart grids and IoT technologies that are accelerating the demand for high performance, low-cost switching solutions, providing an additional opportunity for BJT fabricators to develop scalable solutions.

-

According to a 2023 review in Sensors and Actuators A, IoT devices globally surpassed 14 billion units in 2023, with BJTs enabling low-cost, high-performance switching circuits essential for sensor nodes and communication modules.

Challenges:

-

Challenges in Bipolar Junction Transistor Miniaturization Manufacturing and Supply Chain Impact Market Growth

The continuous trend toward miniaturization and better electronic devices force manufacturers to always improve their BJT design and materials. BJTs tend to be complicated to scale lower without creating reliability and thermal problems, especially since devices are often shrunk to fit applications that are space-constrained. In addition, the implementation of BJTs in cutting-edge semiconductor process technology with digital components provide challenges here that negatively affect both yield and manufacturing. Finally, however, changes in raw materials will upset production and delivery schedules as well, exacerbated by global disruption of supply chains.

Bipolar Junction Transistors Market Segmentation Analysis:

By Type

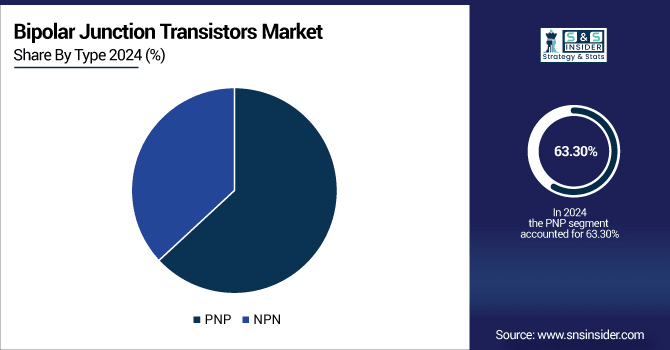

PNP Bipolar Junction Transistors (BJTs) accounted for 63.3% of the market share in 2024. This predominance comes from their extensive use in analog circuits, the complementary push-pull amplifier topologies, and industrial applications where, for specific polarities of voltages and current flows, PNP transistors perform better than NPN. They have remained strong in the market despite the emergence of wide bandgap technologies including SiC and Gallium-Nitride due to their competent switching characteristics and design compatibility to particular circuit designs that are prevalent in applications especially consumer electronics and power management systems.

During 2025-2032, the highest growth rate is expected to be for NPN BJTs. It is rising due to the higher electron mobility that offers higher effectiveness and faster switching speed and increasingly preferred in high frequency and high-speed application based mostly on telecommunication, automotive electronics, and more recent era digital gadgets. The increasing adoption of NPN transistors in new applications and markets, such as electric vehicles and renewable energy systems, will also contribute to their growth in this time period.

By Application

The consumer electronics sector constituted the highest BJT market share of 28.6% in 2024. This dominance contributes to the popularity of BJTs in devices including audio amplifiers, televisions, smartphones, and other portable electronic devices requiring high-power switching and high-gain amplification. The demand for compact, low-power, high-performance consumer gadgets continues to grow, solidifying the relevance of BJTs in this segment, and driving steady market expansion.

The electric vehicle (EV) segment is projected to observe the highest CAGR over 2025-2032. This growing trend of EV adoption globally is creating a strong demand for BJTs for power control, battery management and motor drive systems. BJTs are essential for handling voltage and currents in a reliable manner as automotive manufacturers develop better efficiency, performance, and safety features.

By Material

Silicon accounted for 85.1% of the Bipolar Junction Transistors Market Share in 2024. Silicon remains the best balance of cost, availability, and repeatable electrical properties making it the material of choice for the majority of standard BJT applications throughout consumer, automotive, and industrial applications. Mature manufacturing processes and established supply chains prevent BJTs from technology replacements thus leading to market ubiquity.

During 2025-2032, BJTs based on germanium are anticipated to witness the highest CAGR. Germanium has better mobility of electrons than silicon, which allows for faster switching capabilities and a potential for high-frequency and low-voltage characteristics. Owing to new advances in material science and hybrid semiconductor processes for producing germanium, germanium is starting to find a niche presence in areas, such as telecommunications and new specialized medical devices.

By End-Use

The automotive sector held the largest share of 34.4% in the Bipolar Junction Transistors market in 2024. This prominence is supported by the growing use of BJTs in electric automobiles, advanced driver assistance systems, and powertrain control modules. Guiding auto makers toward more efficient and reliable vehicles, BJTs are essential in power conversion, battery management, and motor control management. In automotive application, this factor in in conjunction with the prevalent migration towards vehicle electrification and growing emission regulations sustains the demand for BJTs.

The healthcare sector is expected to witness the highest CAGR during 2025-2032. Growing adoption of portable medical devices, along with advanced diagnostics, and imaging equipment is fueling this growth. The localized functionality of the devices requires BJTs as its key units with high gain, low noise and higher switching reliability for precise signal amplification and processing. Rising investments in healthcare and technological advancements will continue fueling the adoption of BJTs in medical applications, opening new growth avenues within this sector.

Bipolar Junction Transistors Market Regional Overview:

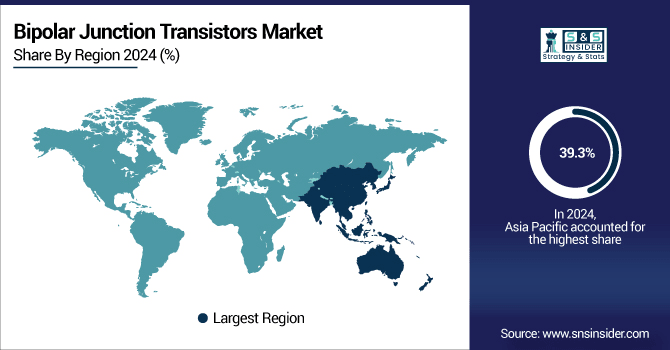

In 2024, Asia Pacific accounted for the largest share of Bipolar Junction Transistors (BJT) market at 39.3% This leadership is powered by the quick industrialization in the region, growing electronics manufacturing base and high demand for consumer electronics. There are a lot of semiconductor fabs and agglomerated supply chains enabling volume manufacturing and innovation in these technologies for transistors. The growth factors comprise the growing adoption of electric vehicles, increasing automation in industries, and the expanding telecommunications infrastructure that needs high-performance switching components. Besides, investments in renewable energy systems and smart grid technologies also drive demand. With the trend of technology and economical production processes, the Asian region remains a significant base for the growth and development of the BJT market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The Asia Pacific Bipolar Junction Transistors market is led by China, which benefits from huge electronics manufacturing ecosystem, increasing industrial automation, developing electric vehicle industry, and large investments in semiconductor research and infrastructure.

North American Bipolar Junction Transistors market will witness a fastest CAGR of 6.94% during 2025-2032. The growth is supported by the increasing implementation of advanced semiconductor technologies and high NFC component requirement for automotive, aerospace, and defense. Additionally, increasing investments in electric vehicle manufacturing and industrial automation continues to fuel the market growth in this region. Coupled with continuous growth in telecom infrastructure and renewables projects fueling the demand for effective power management solutions in the region, North America, is estimated to emerge in the stream of growth markets.

The U.S. is the largest contributor in the North American Bipolar Junction Transistors market due to the Oligopoly nature of the Semiconductor industry with high Research and Development investments, increased adoption of Electric Vehicles, and presence of aerospace and defense electronics.

The bipolar junction transistors (BJT) market in Europe is driven by its well-developed automotive and industrial sectors. The region is characterized by robust technological innovations combined with strict environmental legislation that promotes the penetration of energy-efficient electronics. BJTs are also supported by rising investments in renewable energy, smart grid technologies, and telecommunications infrastructure. Moreover, the steady market growth of manufacturing automation and healthcare advancement in this region also makes it a prominent region for development and applications of BJT.

Owing to robust automotive industry, advanced manufacturing technologies, focus on renewable energy integration and high investments in industrial automation and electronics innovation, Germany is the leading country in European Bipolar Junction Transistors market.

Bipolar Junction Transistor (BJT) markets in Latin America and the Middle East & Africa are also becoming a region of interest, with increasing industrialization, development of telecom infrastructure, and demand for renewable energy adoption. Steady market growth in these regions is attributed to increasing demand for consumer electronics and automotive applications along with government initiatives supporting development of technology.

Key Players:

Some of the major Bipolar Junction Transistors Companies are Texas Instruments, ON Semiconductor, STMicroelectronics, NXP Semiconductors, Infineon Technologies, Toshiba, Analog Devices, Renesas Electronics, Fairchild Semiconductor, and Rohm Semiconductor.

Recent Developments:

-

In June 2024, Toshiba expanded its lineup of bipolar transistors with the introduction of TTC022 and TPCP8515 models. These transistors feature a low collector-emitter saturation voltage, contributing to reduced power consumption in gate drive circuits and current switches for consumer and industrial equipment.

-

In January 2025, ON Semiconductor completed the acquisition of Qorvo’s Silicon Carbide Junction Field-Effect Transistor (SiC JFET) technology portfolio, enhancing its EliteSiC power portfolio for applications in AI data centers and electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.95 Billion |

| Market Size by 2032 | USD 14.47 Billion |

| CAGR | CAGR of 6.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PNP, and NPN) • By Application (Energy & Power, Consumer Electronics, Inverter & UPS, Electric Vehicle, Industrial System, Medical, and Telecommunications) • By Material (Silicon, and Germanium) • By End Use (Automotive, Aerospace & Defense, Healthcare, and Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Texas Instruments, ON Semiconductor, STMicroelectronics, NXP Semiconductors, Infineon Technologies, Toshiba, Analog Devices, Renesas Electronics, Fairchild Semiconductor, and Rohm Semiconductor. |