Speech Analytics Market Size & Overview:

Get More Information on Speech Analytics Market - Request Sample Report

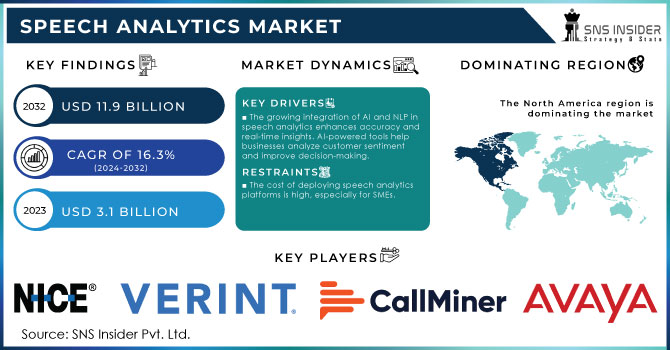

Speech Analytics Market size was valued at USD 3.1 billion in 2023 and is expected to grow to USD 11.9 billion by 2032 and grow at a CAGR of 16.3% over the forecast period of 2024-2032.

The speech analytics market is growing due to the rise of government initiatives, the adoption of technology, and the demand for better customer service management in varied industries have led to its expansion. According to the recent statistics presented by the U.S. Department of Commerce, global AI-supported analytics, including speech, adoption has increased by 21% up to 2023. Both public and private sectors focus on improving their operational efficiency and interaction with customers. The European Commission Digital Economy and Society Index mentioned that the increase of AI and speech market technologies among European enterprises has increased by 28% up to 2023. It has been prevalent in telecommunications, retail, and some other areas where real-time customer information appears to be critical. Various governments have contributed to the expansion by the allocation of funds to develop the AI market. For example, the UK government has provided £100 million to create AI and speech analytics to boost businesses’ productivity and customer service. Along with that, the existing privacy laws in Europe, particularly GDPR, have included multiple measures for companies that have to comply with applicable data protection standards and enjoy the use of advanced analytics for their data. This factor contributes to the growing demand for speech analytics in the compliance sector.

Businesses utilize speech analytics solutions powered by AI, ML, and NLP to enhance customer support by recognizing low levels of customer satisfaction and timely improving the situation. These technologies allow organizations to save time and money on recognizing, understanding, and addressing customer concerns and requests. In addition, AI can help organizations analyze the root cause and assess sentiment, predicting potential issues with agents’ behavior, sales points, or customer churns. For example, in May 2023, Canary Speech integrated AI into its voice analysis technology to address mental health issues, reduce healthcare costs, and improve remote patient monitoring. AI/ML allows agents to be assisted in selected tasks and recognized self-service automation opportunities in real time.

Speech analytics is a system that uses artificial intelligence and natural language processing to interpret and analyze consumer conversations from real-time or recorded audio data. Managers of contact centers generally utilize speech analytics to determine the words that are frequently used during customer interactions to identify and comprehend their top contact drivers. AI-driven speech recognition technologies can be used to analyze customer calls to identify areas where customer service can be improved. For example, businesses can use AI-driven speech recognition technologies to identify common customer complaints or to track the average wait time for customer service calls. With discussions that resemble real-person interactions, the integration of voice technology with mobile banking is anticipated to improve consumer happiness.

| Category | Details |

|

Cloud-Based Solutions |

Increasing shift towards cloud-based speech analytics for flexibility and scalability. |

|

AI Integration |

Enhanced integration of AI for more accurate predictive insights and automation capabilities. |

|

Real-Time Analytics |

Growing demand for real-time speech analytics to improve customer experience and response times. |

|

Multilingual Support |

Rising need for multilingual speech analytics tools to cater to global customer bases. |

|

Voice Biometrics |

Increasing use of voice biometrics for enhanced security and fraud detection in various industries. |

|

Call Center Optimization |

Widespread use in contact centers to enhance agent performance and reduce customer churn. |

|

Regulatory Compliance |

Greater focus on compliance-driven analytics to meet industry-specific regulatory standards. |

|

Sentiment Analysis |

Expanding role of sentiment analysis in understanding customer emotions and refining interactions. |

Speech Analytics Market dynamics

Drivers

-

The growing integration of AI and NLP in speech analytics enhances accuracy and real-time insights. AI-powered tools help businesses analyze customer sentiment and improve decision-making.

-

Companies are leveraging speech analytics to gain insights into customer preferences and behavior, this helps enhance customer satisfaction and loyalty, driving market growth.

-

Speech analytics helps organizations comply with regulatory standards by monitoring customer interactions.

Artificial intelligence and natural language processing integration with speech analytics are changing the way organizations analyze and understand customer conversations. With the help of AI and NLP capabilities, these technologies allow converting, transcribing, and interpreting spoken data on a large scale instantly. The wide adoption of AI is related to the need for appropriately accurate analysis, real-time reaction, and improved customer experience. Operational efficiency is enhanced by 20-30% with the use of businesses utilizing AI-driven analytics. These technologies help organizations understand not only what customers say but also their motivation to make improvements. Thus, the NLP algorithms allow understanding that a customer is upset with the product during a call and help a support team to solve the problem quickly.

Moreover, AI-based sentiment analysis is becoming increasingly popular, and banking, healthcare, and retail are the early adopters of these technologies interested in improved customer experience. In particular, as reported by HBM, Humana made use of IBM’s Watson speech analytics-powered platform NLP. With the help of this application, the provider managed to improve the performance of its call centers, enhance the telephone communication experience of customers, and refine the call handling process. As the tools developed with the use of AI and NLP continue to improve, their use for speech analytics will become increasingly widespread and will serve the need for more precise, scalable, and instant applications in various industries.

Restraints

-

The cost of deploying speech analytics platforms is high, especially for SMEs.

-

Handling sensitive customer data through speech analytics tools raises privacy concerns.

-

Strict regulatory frameworks around data protection may limit market growth in certain regions.

One of the vital restraints for the Speech analytics Market is the Data Privacy and Security Concerns. As speech analytics tools deal with voice data, huge volumes containing personal and sensitive details of the customers are processed in this technology. customer identity, financial details, or other personally identifiable information. Businesses make use of these speech analytics tools to keep the customer’s data securely and protect it from unauthorized access or breaches. Businesses have to implement strong security to the voice data to comply with the data protecting policies that are strictly followed in some major regions GDPR in Europe and CCPA in California. Not only due to compliance, but businesses are also facing many other consequences in case of unauthorized access to voice data. As it comes as one of sensitive data, the severity of the breach will attract a huge number of cyber threats and may affect the customer base and business. As a result, some businesses remain hesitant to adopt speech analytics solutions due to these security and compliance risks.

Speech Analytics Market Segment analysis

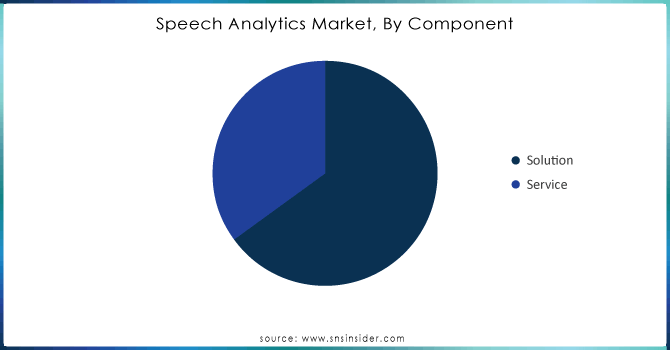

By Components

The speech analytics market was led by the solutions component segment in 2023, which occupied 63% of the share of the revenue. The factor that mainly affected the substantial share of that component in the market is the rising requirement for comprehensive speech analytics platforms. Various solutions are widely recognized due to their integration with customer relationship management and the latest technologies, such as AI and NLP. The importance of the mentioned solutions is critical for companies that seek promotion of their customer experience and optimization of their operations. According to the U.S. Small Business Administration, in 2023, more than 45% of the SMEs in the U.S. adopted solutions for speech analytics to optimize their customer service and sales process. The same tendency is observed in other industries and government institutions. Thus, the spending of the UK’s government on AI and analytics technologies by various departments increased. Additionally, one of the other significant factors contributing to the demand for that segment is the rising level of requirements for the compliance of the adopted solutions for the regulatory standards, including GDPR.

Do You Need any Customization Research on Speech Analytics Market - Enquire Now

By Enterprise Size

Large enterprises dominated the speech analytics market with a revenue share of 58% in 2023. This is mainly because large companies have huge numbers of client bases as well as complex operational activities where businesses have to implement smart analytics for efficiently tracking clients’ appeal. For instance, most of the U.S. large companies with over 500 workers have adopted speech analytics tools for client servicing optimization and their retaining strategies. Moreover, large enterprises have more financial resources to invest in AI-based speech analytics solutions in order to have more complicated and separate solutions with smart technologies like real-time analytics, multi-language as well as integration with the existing software. Additionally, in the healthcare and finance sectors, the state laid down very strict legislation on client call processing that made big organizations use advanced analytics solutions, which increased the share of large companies in the market.

By Vertical

The Banking, Financial Services, and Insurance-BFSI held a significant share of the Speech Analytics Market in 2023. This is primarily due to the growing need for enhanced management of customer interactions along with compliance with regulations. According to U.S. Federal Reserve government statistics, nearly 70% of financial institutions in North America have implemented speech analysis mechanisms based on voice interfaces. These solutions are used to monitor customer calls, identify fraud, and ensure compliance with government regulations. For example, tools to listen to customers have been used to comply with the Dodd-Frank Act and Anti-Money Laundering-AML. According to the EBA, in major European financial institutions, the use of speech analysis tools increased by 35% chiefly to enhance customer experience as well as aid in compliance with the GDPR. Thus, the BFSI sector retains its dominance since it is constantly coming under active regulatory pressure. This in turn generates continued interest in speech analysis solutions, ensuring it retains a substantial market share.

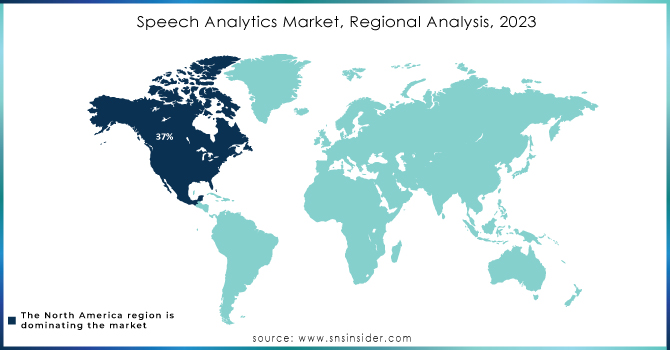

Regional analysis

In 2023, North America was the largest region in the speech analytics market with a significant market share of 37%. The main reason for this dominance is the rapid rate of AI and analytic technologies adoption, along with unprecedented government assistance in the realm of digitalization. Specifically, the report by the U.S. Department of Commerce indicates that in 2023, at least 30% of all investments in AI and speech analytics were made by the U.S. alone. With federal initiatives like the AI in Government Act, particularly emphasizing the importance of using AI and analytics in a variety of federally run organizations, including healthcare and education, the trend is likely to be reinforced in the long term. Therefore, speech analytics in North America will remain the dominant trend.

Asia Pacific's speech analytics market is expected to grow at a significant compound annual growth rate. According to the Ministry of Industry and Information Technology (MIIT) in China, speech analytics adoption grew by 45% in 2023, the trend being especially evident in e-commerce, telecommunications, and banking. In addition, the AI Innovation Action Plan introduced by the Ministry is likely to provide a powerful incentive for its growth. The Asia Pacific region has been experiencing significant growth in the speech analytics market. Key players in the Asia Pacific speech analytics market include NICE Systems, Verint Systems, Avaya, Genesys, and Aspect Software, among others. The growth of the market in Asia Pacific is attributed to the increasing adoption of speech analytics solutions by contact centers in the region. The growing demand for CEM solutions and the growing adoption of cloud-based speech analytics solutions are also driving the growth of the market in the Asia Pacific.

Key Players

-

NICE Ltd. (NICE Nexidia, NICE Enlighten)

-

Verint Systems (Verint Speech Analytics, Verint Real-Time Speech Analytics)

-

CallMiner (Eureka Analyze, Eureka Coach)

-

Avaya (Avaya IX Workforce Engagement, Avaya OneCloud)

-

Genesys (Genesys Cloud CX, PureConnect)

-

Zoom Video Communications (Zoom IQ, Zoom Meetings)

-

Aspect Software (Aspect Via, Aspect Unified IP)

-

Calabrio (Calabrio ONE, Calabrio Advanced Reporting)

-

Five9 (Five9 Inference Studio, Five9 IVA)

-

Talkdesk (Talkdesk AI Voice, Talkdesk CX Cloud)

-

Speechmatics (Speechmatics Core Speech-to-Text, Speechmatics Enterprise)

-

Xdroid (Xdroid Real-Time Speech Analytics, Xdroid Emotion Detection)

-

Clarabridge (Clarabridge CX Social, Clarabridge CX Analytics)

-

Cisco Systems (Cisco Webex Contact Center, Cisco Unified Communications Manager)

-

Qualtrics (Qualtrics XM, Qualtrics Vocalize)

-

OpenText (OpenText Explore, OpenText Magellan)

-

8x8 (8x8 Contact Center, 8x8 Voice for Microsoft Teams)

-

Uniphore (Uniphore U-Analyze, Uniphore Q for Sales)

-

Alvaria (Alvaria CX Suite, Alvaria Workforce)

-

Cogito (Cogito AI, Cogito Detect) and others.

Recent Developments

-

In January 2024, The U.S. General Services Administration launched a new customer service platform that is driven by AI and integrated with advanced speech analytics technology. The aim is to improve government-citizen interactions, and this is a crucial onward step in the government’s adoption of speech analytics. The latter is hoped to streamline the provision of public services and improve the efficiency of handling citizens inquiries.

-

In March 2024, Linus Health acquired Aural Analytics to enrich its cognitive assessment platform with speech analysis technology. This is how the company aims to enhance the efficiency of the earlier detection of cognitive decline and contribution to the life sciences market.

-

In February 2023, Genesys announced the general availability of their Genesys Cloud Speech Analytics solution. It was specifically designed to provide the customer with a cloud-based platform for the easy analysis of the voice data. It is expected to help in identifying the trends, measuring satisfaction, and improving the performance of the agents.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.1 billion |

| Market Size by 2032 | USD 11.9 billion |

| CAGR | CAGR of 16.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment (On-Premise, Cloud) • By Organization Size (Large Enterprise, Small and Medium Enterprise) • By Vertical (BFSI, Telecommunications, Healthcare, Retail, Government, Travel and Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

NICE Ltd., Verint Systems, CallMiner, Avaya, Genesys, Zoom Video Communications, Aspect Software, Calabrio, Five9, Talkdesk, Speechmatics, Xdroid, Clarabridge, Cisco Systems, Qualtrics, Uniphore, Alvaria, Cogito |

| Key Drivers |

•The growing integration of AI and NLP in speech analytics enhances accuracy and real-time insights. |

| Market Restraints | •The cost of deploying speech analytics platforms is high, especially for SMEs. •Handling sensitive customer data through speech analytics tools raises privacy concerns. •Strict regulatory frameworks around data protection may limit market growth in certain regions |