Spend Analytics Market Report Scope & Overview:

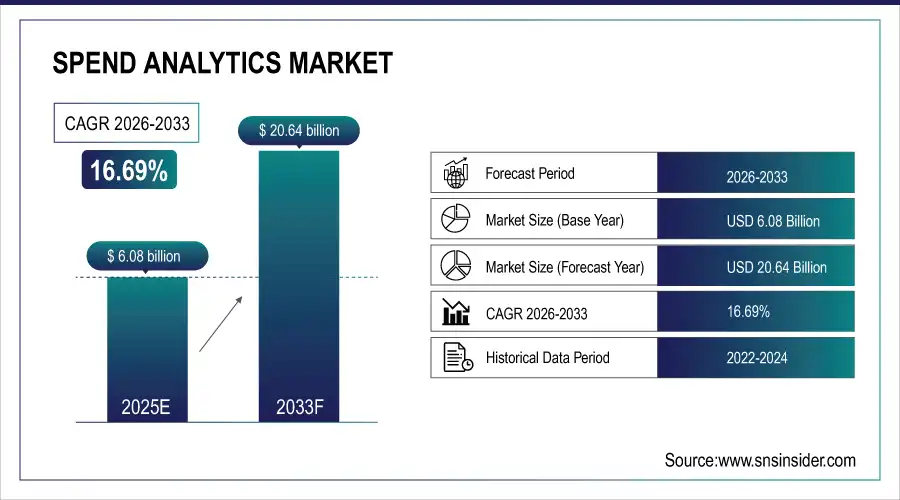

Spend Analytics Market was valued at USD 6.08 billion in 2025E and is expected to reach USD 20.64 billion by 2033, growing at a CAGR of 16.69% from 2026-2033.

The Spend Analytics Market is growing due to increasing demand for cost optimization, improved procurement efficiency, and strategic sourcing across industries. Rising adoption of advanced analytics, AI, and cloud-based solutions enables real-time spend visibility and actionable insights. Organizations aim to reduce maverick spending, enhance supplier management, and support data-driven decision-making. Additionally, digital transformation initiatives and regulatory compliance requirements are driving widespread implementation, contributing to rapid market growth globally.

Spend Analytics Market Size and Forecast

-

Spend Analytics Market Size in 2025: USD 6.08 Billion

-

Spend Analytics Market Size by 2033: USD 20.64 Billion

-

CAGR: 16.69% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Spend Analytics Market - Request Free Sample Report

Spend Analytics Market Trends

-

Rising need for cost optimization and strategic procurement is driving the spend analytics market.

-

Growing adoption of AI, machine learning, and big data analytics is enhancing visibility into organizational spending.

-

Expansion across BFSI, retail, manufacturing, and healthcare sectors is boosting market growth.

-

Integration with ERP, procurement, and finance systems is improving decision-making and operational efficiency.

-

Increasing focus on compliance, risk management, and supplier performance monitoring is shaping adoption trends.

-

Advancements in cloud-based and real-time analytics solutions are supporting scalability and accessibility.

-

Collaborations between software vendors, enterprises, and consulting firms are accelerating innovation and global deployment.

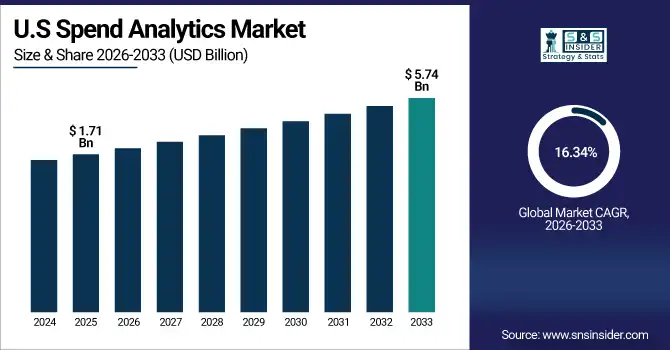

U.S. Spend Analytics Market was valued at USD 1.71 billion in 2025E and is expected to reach USD 5.74 billion by 2033, growing at a CAGR of 16.34% from 2026-2033.

The U.S. Spend Analytics Market is growing due to high adoption of advanced analytics, focus on cost optimization, improved procurement efficiency, real-time spend visibility, and increasing demand for strategic sourcing and supplier management across enterprises.

Spend Analytics Market Growth Drivers:

-

Increasing adoption of advanced analytics solutions by enterprises to enhance procurement efficiency and control organizational spending patterns globally

Enterprises are increasingly adopting spend analytics solutions to gain complete visibility into their procurement and operational expenditures. These tools help organizations identify savings opportunities, optimize supplier performance, and reduce maverick spending. By analyzing historical and real-time spending data, companies can make data-driven decisions, negotiate better contracts, and forecast future procurement needs. Additionally, regulatory compliance requirements and the need to improve financial efficiency are pushing organizations to implement sophisticated analytics solutions. The growing focus on cost reduction and strategic sourcing is accelerating the adoption of spend analytics across multiple industries worldwide.

Spend Analytics Market Restraints:

-

Concerns regarding data security and privacy issues impact organizations’ willingness to fully implement spend analytics systems

Handling sensitive financial and procurement data poses significant security and compliance challenges. Organizations are concerned about data breaches, cyberattacks, and unauthorized access, which can expose confidential supplier information and internal spending patterns. Compliance with regulations such as GDPR or industry-specific standards adds additional complexity. Ensuring secure data storage, encryption, and controlled access requires continuous investment and monitoring. These concerns may lead organizations to limit analytics usage, avoid cloud deployment, or delay full-scale adoption. As a result, data security and privacy issues act as major restraints, slowing the overall growth of the spend analytics market globally.

Spend Analytics Market Opportunities:

-

Integration of artificial intelligence and machine learning opens avenues for predictive and prescriptive spend analytics capabilities

The incorporation of AI and ML into spend analytics platforms is creating significant growth opportunities. These technologies enable predictive modeling, anomaly detection, and prescriptive recommendations to optimize procurement decisions. AI-driven insights allow businesses to forecast demand, improve supplier selection, and negotiate better contracts with reduced risk. Automation of routine analysis saves time and resources, improving efficiency. Additionally, AI helps identify hidden cost-saving opportunities and strategic sourcing options. The increasing adoption of intelligent analytics solutions by enterprises across industries provides a lucrative opportunity for vendors to innovate and expand their offerings in the spend analytics market.

Spend Analytics Market Segment Highlights

-

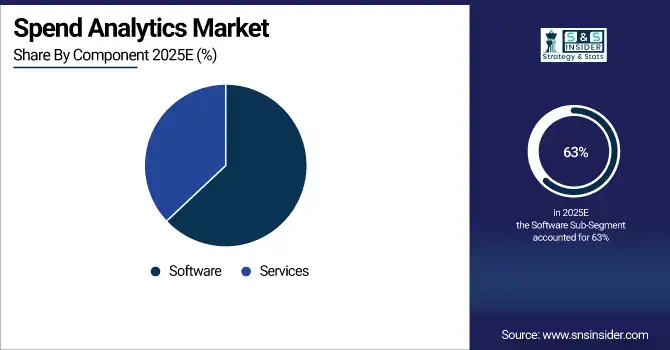

By Component, Software dominated with ~63% share in 2025; Services fastest growing (CAGR).

-

By Business Function, Procurement dominated with ~38% share in 2025; Finance fastest growing (CAGR).

-

By Type, Predictive Analytics dominated with ~42% share in 2025; Prescriptive Analytics fastest growing (CAGR).

-

By Industry Vertical, Manufacturing dominated with ~22% share in 2025; Retail & E-commerce fastest growing (CAGR).

-

By Deployment, Cloud dominated with ~62% share in 2025; Cloud fastest growing (CAGR).

Spend Analytics Market Segment Analysis

By Component, Software dominated the Spend Analytics Market, while Services is expected to grow at the fastest CAGR

Software segment dominated the Spend Analytics Market as enterprises widely adopted software solutions to enhance procurement efficiency, reduce costs, and gain comprehensive insights. Advanced analytics features, seamless integration with ERP systems, and the ability to generate actionable intelligence across departments made software the preferred choice, capturing the largest revenue share.

Services segment is expected to grow at the fastest CAGR from 2026-2033 because organizations increasingly rely on external expertise for implementation, customization, training, and maintenance of spend analytics solutions. Outsourcing services ensures smooth integration, optimized system performance, and access to skilled professionals, driving rapid adoption across industries globally.

By Business Function, Procurement led the market, with Finance projected to grow at the fastest CAGR

Procurement segment dominated the Spend Analytics Market because enterprises focused on optimizing supplier management, reducing maverick spending, and improving sourcing strategies. Spend analytics provided enhanced visibility, contract compliance, and actionable insights into procurement processes, resulting in higher revenue generation compared to other business functions in 2025.

Finance segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing demand for real-time financial insights, cost control, and budget optimization. Spend analytics allows finance teams to forecast expenditures, detect inefficiencies, and support strategic decision-making, encouraging rapid adoption across enterprises worldwide.

By Type, Predictive Analytics dominated the market, while Prescriptive Analytics is expected to register the fastest growth

Predictive Analytics segment dominated the Spend Analytics Market as enterprises prioritized forecasting future spending, detecting anomalies, and making informed procurement decisions. Its ability to anticipate trends, identify cost-saving opportunities, and provide actionable insights led to higher revenue compared to other analytics types in 2025.

Prescriptive Analytics segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for actionable recommendations. Businesses aim to optimize sourcing strategies, improve supplier performance, and implement proactive cost management, leveraging prescriptive insights to enhance operational efficiency and strategic decision-making.

By Industry Vertical, Manufacturing led the market, with Retail & E-commerce anticipated to grow at the fastest CAGR

Manufacturing segment dominated the Spend Analytics Market because large-scale production involves complex procurement, high-volume spending, and multiple suppliers. Spend analytics enables manufacturers to identify cost-saving opportunities, optimize sourcing, streamline operations, and ensure compliance, contributing the highest revenue compared to other industry verticals in 2025.

Retail & E-commerce segment is expected to grow at the fastest CAGR from 2026-2033 as increasing online sales and complex supply chains demand enhanced spend visibility. Analytics solutions help retailers optimize procurement, manage suppliers, control costs, and improve operational efficiency, driving rapid adoption in this growing sector.

By Deployment, Cloud dominated the market and is projected to grow at the fastest CAGR

Cloud segment dominated the Spend Analytics Market as organizations preferred scalable, flexible, and easily deployable solutions that provide real-time access to spending data across multiple locations. Cloud platforms reduce IT infrastructure costs, simplify maintenance, and enable seamless updates. The segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing adoption of digital transformation initiatives, demand for remote access, enhanced collaboration, and subscription-based pricing models, making cloud solutions highly attractive for enterprises of all sizes.

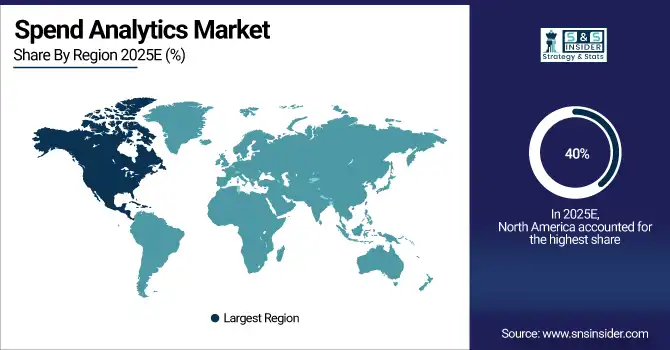

Spend Analytics Market Regional Analysis

North America Spend Analytics Market Insights

North America dominated the Spend Analytics Market with the highest revenue share of about 40% in 2025 due to the presence of major market players, advanced technological infrastructure, and high adoption of digital procurement and analytics solutions. Strong focus on cost optimization, strategic sourcing, and regulatory compliance drives widespread implementation of spend analytics across enterprises in the region, contributing to significant market revenue and leadership globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Spend Analytics Market Insights

Asia Pacific segment is expected to grow at the fastest CAGR of about 18.36% from 2026-2033 due to increasing digitization, rapid industrialization, and growing adoption of cloud-based spend analytics solutions. Rising awareness of cost optimization, strategic procurement, and improved supplier management across emerging economies such as China and India is accelerating market growth. Expansion of SMEs and growing investments in technology-driven procurement processes are also contributing to the fastest growth in the region.

Europe Spend Analytics Market Insights

Europe holds a significant share in the Spend Analytics Market due to increasing adoption of digital procurement solutions, regulatory compliance requirements, and focus on cost optimization across industries. Advanced technological infrastructure, presence of key market players, and growing demand for strategic sourcing and supplier management solutions drive market growth. Enterprises in the region are leveraging spend analytics to enhance visibility, improve decision-making, and achieve operational efficiency, strengthening Europe’s position in the global market

Middle East & Africa and Latin America Spend Analytics Market Insights

Middle East & Africa and Latin America are emerging markets in the Spend Analytics sector, driven by increasing digital transformation, growing awareness of cost optimization, and adoption of cloud-based procurement solutions. Organizations in these regions are focusing on improving supplier management, operational efficiency, and strategic sourcing. Investments in advanced analytics technologies, expansion of SMEs, and rising demand for real-time spend visibility are accelerating market growth, making these regions important for future market expansion.

Spend Analytics Market Competitive Landscape:

Coupa Software Inc.

Coupa Software is a leading global provider of cloud-based spend management and procurement solutions. Its AI-driven platform enables enterprises to gain visibility into total spend, optimize procurement processes, manage supplier risk, and generate actionable insights for cost savings. Coupa integrates analytics, predictive modeling, and collaborative sourcing to help businesses make informed financial decisions, improve compliance, and maximize operational efficiency across procurement, finance, and supply chain functions.

-

2025 – Coupa announced a collaboration with MIT Data Science Lab to create a predictive Business Spend Index (BSI) report using AI and community spend data, expanding analytical insights for spend forecasting.

-

2025 – Coupa reported strong adoption of its AI-driven total spend management platform, managing over $425B spend and generating nearly $15B in savings via analytics-infused insights.

-

2024 – Coupa’s AI total spend management platform saw widespread global adoption and major customer growth, demonstrating advanced spend visibility, classification, and analytics across enterprise procurement.

SAP SE

SAP SE is a multinational enterprise software corporation specializing in business process solutions, including ERP, procurement, finance, and analytics. Its spend management suite provides AI-powered insights, dashboards, and control tools across SAP Ariba, SAP S/4HANA, and the SAP Business Network. SAP enables organizations to centralize procurement, optimize supplier performance, improve compliance, and make data-driven financial decisions. The platform integrates analytics, automation, and visibility to enhance efficiency and strategic spend management at enterprise scale.

-

2025 – SAP launched SAP Spend Control Tower within its Spend Analytics suite, offering unified AI-powered spend visibility and spend dashboards across SAP Ariba, SAP S/4HANA, and the Business Network.

-

2023 – At SAP Spend Connect Live, SAP revealed future spend analytics innovations including SAP Spend Control Tower, unifying spend data and analytics across SAP solutions for deeper insights.

Basware Corporation

Basware Corporation is a global provider of networked procure-to-pay and financial automation solutions, focusing on spend visibility, accounts payable, and analytics. Its platforms leverage AI and GenAI technologies to automate procurement, optimize supplier engagement, improve compliance, and generate actionable insights for CFOs and finance teams. Basware’s solutions provide full spend transparency, category analysis, and predictive recommendations, helping organizations reduce costs, streamline operations, and enhance financial decision-making across global enterprise environments.

-

2024 – Basware expanded analytics with a new Analytics Dashboard that provides 100 % automated spend visibility, enabling breakdowns by categories, contracts, compliance, and action recommendations.

-

2024 – Basware introduced its GenAI ‘CFO Cockpit’ to transform insights and automate spend, AP processes, and reporting for finance leaders within its analytics platform.

Spend Analytics Market Key Players

-

SAP SE

-

Oracle Corporation

-

IBM Corporation

-

SAS Institute Inc.

-

JAGGAER

-

Zycus Inc.

-

GEP Worldwide

-

Ivalua Inc.

-

Proactis Holdings Plc

-

Basware Corporation

-

Rosslyn Data Technologies

-

Xeeva Inc.

-

Determine (Corcentric)

-

SynerTrade

-

Scanmarket

-

Sievo Oy

-

Simfoni

-

Empronc Solutions Pvt. Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.08 Billion |

| Market Size by 2033 | USD 20.64 Billion |

| CAGR | CAGR of 16.69% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Predictive Analytics, Prescriptive Analytics, Descriptive Analytics) • By Component (Services, Software) • By Business Function (Finance, Information Technology (IT), Marketing, Procurement) • By Deployment (Cloud, On-Premises) • By Industry Vertical (Energy and Utilities, Government and Defense, Healthcare and Life Sciences, Manufacturing, Retail and E-commerce, Telecommunications and IT, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SAP SE, Coupa Software Inc., Oracle Corporation, IBM Corporation, SAS Institute Inc., JAGGAER, Zycus Inc., GEP Worldwide, Ivalua Inc., SpendHQ, Proactis Holdings Plc, Basware Corporation, Rosslyn Data Technologies, Xeeva Inc., Determine (Corcentric), SynerTrade, Scanmarket, Sievo Oy, Simfoni, Empronc Solutions Pvt. Ltd. |