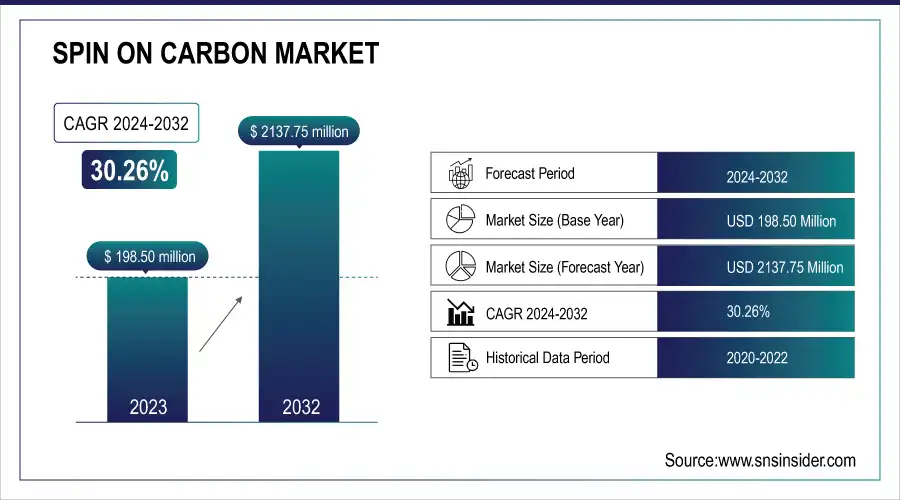

Spin on Carbon Market Size & Growth:

The Spin on Carbon Market was valued at USD 198.50 million in 2023 and is expected to reach USD 2137.75 million by 2032, growing at a CAGR of 30.26% over the forecast period 2024-2032.

chip design, particularly for advanced nodes where high-resolution patterning and dielectric isolation are essential, spin-on carbon occupies a significant position. It is used for optimized fab capacity utilization, simplified processing, and reduced defect density. Spin-on carbon is used in semiconductor innovation, from next-generation lithography and 3D integration for higher performance and miniaturization. The improved gap filling, uniformity, and layer consistency optimize the manufacturing processes, which is beneficial in augmenting the manufacturing yield and accommodating sophisticated device architectures for various semiconductor applications. To support the growing need for sub-7nm and 3D chip architectures, U.S.-based fabs including those from Intel and GlobalFoundries heavily adopted spin-on carbon materials in 2024. Increased utilization of spin-on carbon for advanced lithography and dielectric steps to improve device performance and throughput were reported by facilities in states such as Arizona and New York.

To Get more information on Spin on Carbon Market - Request Free Sample Report

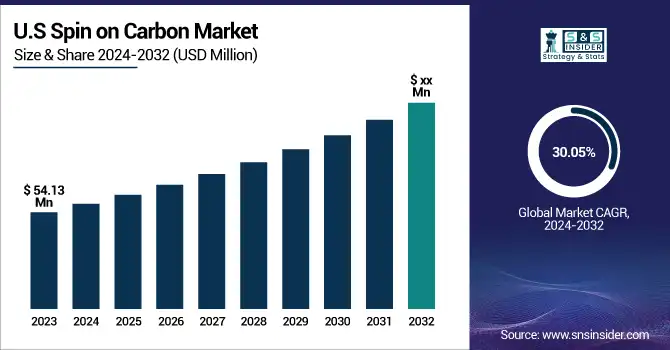

The U.S. Spin on Carbon Market is estimated to be USD 54.13 Million in 2023 and is projected to grow at a CAGR of 30.05%. Chip production for AI, automotive, and aerospace has boosted demand for spin-on carbon materials, U.S. semiconductor manufacturers have reported. Top fabs in Oregon and Texas inserted spin-on carbon in some sub-5nm process flows to boost etch resistance, uniformity and design flexibility.

Spin on Carbon Market Dynamics

Key Drivers:

-

Spin on Carbon Fuels Next Gen Semiconductor Growth with Advanced Nodes FinFETs and 3D Integration

The spin-on carbon market is mainly impacting the driving of the fast development of semiconductor technologies, especially sub-10nm and 3D integration nodes. The increasing need for high-resolution patterning for advanced chip designs has been driving demand for high-performance dielectric and sacrificial materials such as spin-on carbon to enable better etch performance and results. This trend-accelerating market is driven by the ramping of FinFETs, 3D NAND, and logic devices at both foundries and IDMs. In addition, both the electric vehicle (EV) and consumer electronics markets continue to demand high chip density and efficiency, which further benefits spin-on carbon in advanced technology nodes. Its increasing use is also driven by the need for stringent industry requirements such as materials that feature high thermal stability, low dielectric constants, and superior gap-filling properties.

Restrain:

-

Complex Integration Challenges Hinder Spin on Carbon Adoption in Advanced Semiconductor Manufacturing Processes

Integration of spin-on carbon into semiconductor fabrication is quite complex which is one of the major restraints in the growth of the spin-on carbon market. With advances in lithography, etching, and deposition, as chip architectures grow more complex, guaranteeing compatibility with existing technologies is becoming ever more problematic. This is problematic for some applications because inconsistencies in the way materials behave under these extreme processing conditions, like ultra-high vacuum or exposure to plasma, can impact yield and reliability. Also, the qualification and test of technology before its use in mass production, unlike consumer electronics, needs to go through a longer period, especially with conservative players in the industry.

Opportunity:

-

Normal Temperature Spin on Carbon Unlocks Opportunities in 3D ICs HPC and Emerging Semiconductor Applications

Integration of spin-on carbon materials is likely to motivate groundbreaking opportunities in advanced packaging technologies such as 2.5D/3D ICs, chipsets, and heterogeneous integration. These high-temperature requirements create a need for low-temperature and flexible material solutions to meet the growing interest in system-in-package (SiP) and high-performance computing (HPC)—which is where normal-temperature spin-on carbon comes into play. Moreover, while photonics, MEMS, and power devices are still in their infancy, new studies suggest that these activities in the automotive and IoT sectors could be broadening the application spectrum. Over the next decade, collaborations between raw material suppliers and semiconductor manufacturers that specialize in manufacturing advanced chips will provide an additional opportunity for growth.

Challenges:

-

Knowledge Gaps and Regulatory Hurdles Challenge Wider Adoption of Spin on Carbon in Semiconductor Industry

The most exigent thing is that many mid-tier fabs and packaging houses are not that aware or technical about the spin-on carbon materials themselves. The knowledge gap leads to reluctance to adopt newer material solutions. Additionally, the need for uniform film thickness as well as the avoidance of defects (e.g., voids, cracks) during its application is somewhat challenging as well, particularly for high-aspect-ratio structures. The changing legal environment related to chemicals and materials in semiconductor processing is another challenge. To meet international safety and environmental requirements throws extensive paperwork and reformulations into the mix for manufacturers. Finally, other materials and deposition techniques, such as chemical vapor deposition (CVD) or atomic layer deposition (ALD), are also used as alternatives to spin-on carbon, which keeps spin-on carbon under constant competitive pressure.

Spin on Carbon Market Segmentation Overview

By Material Type

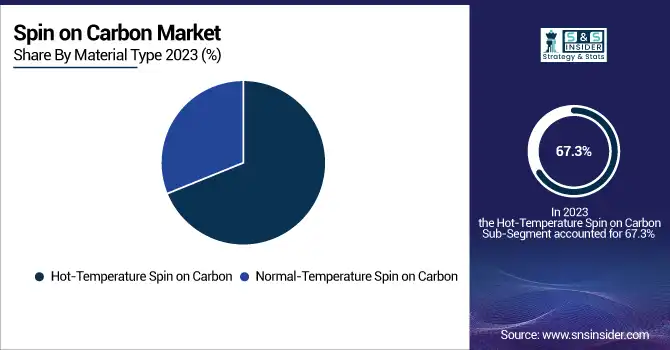

The segment of hot-temperature spin-on carbon had been dominating the market with 67.3% of market share in 2023. This supremacy owes to its remarkable thermal stability and high-performance attributes, which have made the material well-suited for advanced semiconductor applications, especially for logic and memory devices at smaller nodes. Hot-temperature spin-on carbon is essential in high-temperature processes and harsh etching techniques, owing to its combination of superb dielectric properties and gap-filling ability that make it a requirement for advanced semiconductor manufacturing.

From 2024 to 2032, normal-temperature spin-on carbon is anticipated to dominate the projected CAGR growth. The upside of the resin is its lower processing requirements at a lower temperature range leads to lower energy consumption and production costs. With the semiconductor industry making a transition to more sustainable and cost-effective manufacturing practices, normal-temperature spin-on carbon is emerging to catch terrific interest, especially in advanced packaging, MEMS, and photonics applications. This trend is a result of the ongoing demand for origami-like, bendable, lower-cost solutions for next-gen electronics.

By Application

The spin-on carbon market share of Power devices in 2023 is dominated by the 36.3% market share. The leadership is attributed to the increasing penetration of power semiconductors, particularly in EVs, industrial automation, and regenerative energy systems. The combination of high dielectric performance under thermal stress from spin-on carbon materials and accurate pattern transfer is highly important during the fabrication process of high-voltage as well as efficient power devices. This makes them prime candidates for next-generation SiC and GaN power components with utility during extreme processing conditions.

Advanced packaging is set to experience the highest CAGR growth between 2024 and 2032. With more devices moving towards chipset-based architectures, 2.5D/3D integration, and heterogeneous packaging, there is a growing volume of demand for higher-performance materials like spin-on carbon materials, offering the ideal combination of gap-filling, planarization, and low-temperature processability. As the semiconductor industry evolves to higher density and performance, spin-on carbon (SOC) becomes more relevant since it can provide small, fast, and thermally efficient packaging solutions.

By End User

In 2023, the spin-on carbon market was predominantly driven by foundries with a notable 48.4% share. The scale of production, the long-term strategy of adopting advanced node technologies, and R&D investments are the key parameters for this dominance. Spin-on carbon materials are crucial for advanced lithography processes, particularly in the highly specialized foundries that manufacture state-of-the-art logic and memory chips.

The Outsourced Semiconductor Assembly and Test (OSAT) segment is projected to achieve the fastest compound annual growth rate (CAGR) during 2024-2032. This segment is growing rapidly, being driven by the increased need for advanced packaging technologies such as 2.5D/3D integration and chipset architectures. With their entry into the OSAT space, OSAT players are expected to increase their market share as more spin-on carbon is introduced at the back end to enhance performance, density, and thermal management.

Spin on Carbon Market Regional Analysis

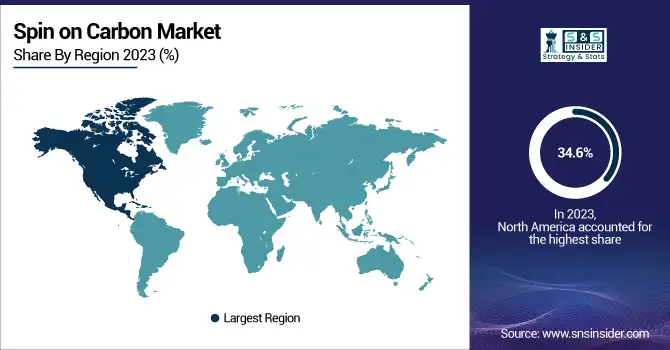

In 2023, North America accounted for 34.6% of the spin-on carbon market, leading the way. Such dominance is primarily driven by the presence of leading semiconductor manufacturers and foundries Intel and TSMC (and its U.S. operations), and research institutions. Its well-established semiconductor manufacturing ecosystem and a heavy emphasis on innovation in artificial intelligence, high-performance computing, and electric vehicles (EVs) are among the primary reasons for its market dominance. The growing appetite for advanced materials such as spin-on carbon is also bolstered by companies such as Applied Materials and Lam Research, further entrenching North America within the global supply chain.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is forecast to rise with the fastest CAGR between 2024 and 2032. The rapid increase is mainly due to the surging semiconductor fabs in nations like China, South Korea, and Taiwan. As the dominant two semiconductor firms in the world, Samsung and TSMC also keep fuelling technology development at the limits, targeting Advanced packaging and 3D integration. Meanwhile, the increased demand for spin-on carbon in electric cars, consumer electronics, and IoT applications around the region is also contributing to the need for these materials. APAC will garner significant growth throughout the forecast period owing to the focus in the region to scale its manufacturing capabilities with a lesser carbon footprint.

Key Players Listed in the Spin on Carbon Market are:

-

Shin-Etsu Chemical Co., Ltd. (Photoresists)

-

OCSiAl (TUBALL single-wall carbon nanotubes)

-

Aksa (Carbon Fiber)

-

Teijin (Carbon Fibers)

-

SGL Carbon (Carbon Fibers)

-

Tokai Carbon (Graphite Electrodes)

-

Toray Industries (Carbon Fiber)

-

Rieter AG (Ring Spinning Machines)

-

Saurer Schlafhorst GmbH & CO. KG (Rotor Spinning Machines)

-

Trützschler (Spinning Preparation Equipment)

-

Murata Machinery, Ltd. (Air-Jet Spinning Machines)

-

Savio Macchine Tessili S.p.A. (Rotor Spinning Machines)

-

Lakshmi Machine Works Limited (Ring Spinning Machines)

-

Living Ink (Algae-Based Pigments)

Spin on Carbon Market Trends

-

In February 2025, Shin-Etsu Chemical is set to reduce greenhouse gas emissions by deploying a biomass cogeneration system at its Thailand facilities, utilizing renewable energy from locally sourced wood chips.

-

In February 2025, SGL Carbon decided to restructure its Carbon Fibers business unit, focusing on streamlining operations and exploring profitable segments. The company also presented preliminary figures for the fiscal year 2024, reporting a decline in adjusted EBITDA due to weakened demand in key sectors.

| Report Attributes | Details |

| Market Size in 2024 | USD 3.44 Billion |

| Market Size by 2032 | USD 13.22 Billion |

| CAGR | CAGR of 16.16% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Type (Educational robots, Industrial robots, Service robots, Research robots, Others) • By End Use (Manufacturing, Healthcare, Entertainment and media, Military and defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Shin-Etsu Chemical Co., Ltd., OCSiAl, Aksa, Teijin, SGL Carbon, Tokai Carbon, Toray Industries, Rieter AG, Saurer Schlafhorst GmbH & Co. KG, Trützschler, Murata Machinery, Ltd., Savio Macchine Tessili S.p.A., Lakshmi Machine Works Limited, Living Ink, and Others. |