CNC Milling Machine Tools Market Report Scope & Overview:

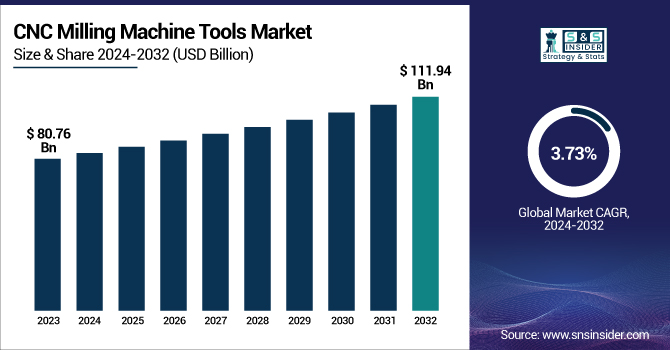

The CNC Milling Machine Tools Market size was estimated at USD 80.76 billion in 2023 and is expected to reach USD 111.94 billion by 2032, with a growing CAGR of 3.73% over the forecast period 2024-2032.

To Get more information on CNC Milling Machine Tools Market - Request Free Sample Report

The CNC Milling Machine Tools market report provides up-to-date statistics, facts, and figures, including key insights such as production volume trends, import-export data, capacity utilization rates, and price trends. It also includes historical and projected supply-demand gaps, adoption rates of different technologies, as well as patents filed by the players in the competitive milling machines landscape. Further, the report provides a detailed understanding of consumer buying behavior, investment flows, trade tariffs, and raw material price variations that shape the market performance. Key performance indicators (KPIs) benchmarking and correlation between the growth of industrial automation and demand for CNC tools are also studied to deliver a comprehensive, holistic market overview.

Technological advances and growing demand from diverse industries, such as automotive, aerospace, and electronics, are fuelling the growth of the CNC Milling Machine Tools Market. These machining tools play a very important role in high-end machining, punching, and ensuring the quality and efficiency of production. Automation, robotics, and software integration are the new norms to make machines more versatile and affordable. Increasing demand for custom and complex parts is driving the use of CNC milling machines among several end-user industries.

The U.S. CNC Milling Machine Tools Market was valued at USD 11.38 billion as of 2023 and is expected to reach USD 14.92 billion by 2032, at a CAGR of approximately 4% from 2024 to 2032. High adoption levels of automation and Industry 4.0 technologies and a strong presence in the automotive, aerospace, and defence sectors set a high bar for the U.S. market. The industry is a cyclical supply industry that depends heavily on innovation, with major manufacturers such as Haas Automation Inc. and Hardinge Inc.

Market Dynamics

Key Drivers:

-

Increasing demand for precision engineering across the automotive and aerospace industries is fueling the growth of the CNC milling machine tools market

The demand for precision engineering in automotive and aerospace materials is one of the fundamental driving forces propelling the CNC milling machine tools market growth. In both industries, parts manufactured with complex geometries, such as engines, aero components, and other intricate designs, are subject to a need for highly accurate and reliable production processes. They come with production capabilities of tolerances and quality that only such automated technology can achieve with high precision and repeatability, and little to no human interaction. The demand for CNC milling machines that can manufacture complex parts will increase as these industries continue to progress and concentrate on improving efficiency and quality. This trend is compounded by the worldwide push for process innovation across the way things are made and the need for increased automation of the manufacturing of critical, high-performance components.

Restraint:

-

High Initial Investment and Maintenance Costs Limit the Adoption of CNC Milling Machine Tools in Small Businesses

One of the significant challenges in the market is the high initial investment and continuous maintenance costs of CNC milling machines despite their advanced capabilities. However, the adoption of this technology is a barrier to many small and medium enterprises (SMEs) as these machines usually need huge capital expenses to purchase, configure, and train. Moreover, continued expenses related to maintenance, spare parts, and skilled technicians to operate the equipment and maintain it properly further increase the operational expenditures. This poses a challenge for smaller businesses, particularly in developing markets, as they often struggle to justify the capital outlay, curbing their access to the benefits of CNC milling tech. Additionally, the high-performance CNC machines must be constantly maintained, and this requires specific knowledge to ensure operational efficacy, which can be further off-putting to potential purchasers.

Opportunity:

-

Improved Automation and Internet of Things (IoT) Integration Open New Potential for CNC Milling Machine Tools Market

The use of Automation and IoT (Internet of Things) with CNC milling machine tools provides a huge opportunity for the growth of the market. Machine-to-machine communication in real-time to other devices and systems is one of the technological enablers that DOI72 is using that helps operators access crucial information on predictive maintenance, process control, and data, which will make better decisions. Automated operation of CNC milling tools yields high production rates, minimal human error, improved operational efficiency, and hence, lower production cost. With IoT integration, CNC machines can be monitored remotely and quickly diagnosed to save time and make them cost-effective. These developments provide immense opportunities for the market growth of CNC milling machine tools as manufacturers look to maximize production efficiency across sectors such as automotive, aerospace, and electronics.

Challenge:

-

Inadequate Skilled Workforce and Technical Know-how Challenge Efficient Deployment of CNC Milling Machine Tools Across Sectors

The comprehensive CNC milling machine tools market report emphasizes the lack of skilled manpower and technological knowledge required for operating and maintaining the reproduction of these machines as a major issue aggravating growth for the market. Due to their complexity, CNC milling machines require highly skilled operators who are familiar with the details of the machine's hardware as well as the software that drives it. However, the demand for such skilled professionals is not matching the rate at which they are being produced, particularly in developing countries, where technical education and vocational training are often inadequate. A lack of training groups the first three points together: younger workers are going through training only to get stuck after working hours, the production process is being deployed incorrectly, and spending more time being idle, which leads to greater costs. These machines can also prove more complex because, as technology continues to advance, the knowledge required to troubleshoot and maintain these machines becomes increasingly specialized, making it more difficult to find and keep competent technicians, no matter the industry.

Segments Analysis

By Product Type

In 2023, vertical CNC milling machines accounted for the largest revenue share of 54.61% in the CNC milling machine tools market, owing to their extensive utilization in industries including aerospace, automotive, and precision engineering. These machines are the popular choice because of their versatility, ease of use, and capability to conduct a number of milling operations with great precision. Other device makers, such as Haas Automation and DMG Mori, have taken the opportunity to introduce new-generation vertical CNC machines that feature higher accuracy, bolted machining speeds, and better automation capabilities. With industries focusing on enhanced efficiency with complex part designs, vertical CNC milling machines remain indispensable, dominating the market and emerging as a prominent segment in the CNC milling industry.

The horizontal CNC milling machines sub-segment of the CNC milling machines segment is anticipated to achieve the highest growth rate over the forecast period, with a CAGR of 4.92% as they can process complex, large parts that can handle greater weight, size, and machining applications compared to other types of machines, which allow for a greater efficiency in multi-axis machining. Manufacturers with horizontal CNC machines see improved chip removal, lower downtime, and more automation. Minor enhancements in product development (companies like Mazak and Siemens releasing new-generation, highly enhanced models) have primarily concentrated on improving capacity, precision, and versatility, targeting industries such as automobile and heavy machinery.

By Axis Type

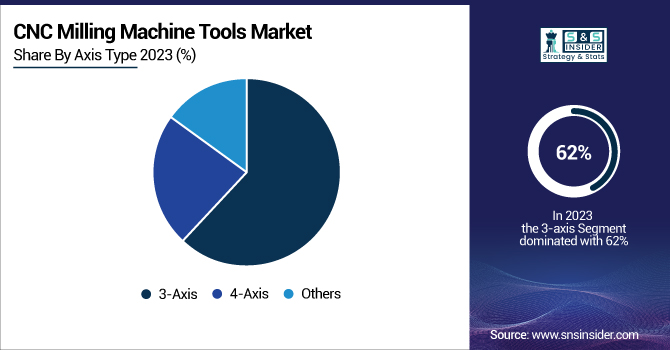

A 3-axis segment of the CNC milling machine tools market was estimated to have the largest revenue share of 62% in 2023. This segment remains popular due to its simplicity, versatility, and low cost, which makes it well-suited for the automotive, aerospace, and electronics industries. Haas Automation, Inc., DMG Mori, and other leading corporations manufactured modernized 3-axis CNC equipment with increased machining speeds and better accuracy. As an example, DMG Mori launched its CMX 1100 V, an agile 3-axis milling machine that steps up productivity in the machining of complicated components. The 3-axis segment leads the CNC milling tools market owing to the increasing demand for accurate machining available among milling machine operators.

In the forecast period, the 4-axis segment of the CNC milling machine tools market is witnessing the highest compound annual growth rate (CAGR) of 5.03%. This growth is driven by the growing need for advanced, high-efficiency machines offering superior accuracy, ideal for complex part generation with a single setup. Innovators like Okuma Corporation and Mazak Corporation have discussed new 4-axis CNC machines, such as Okuma's MULTUS B400, in the context of these changing demands. This equipment provides greater versatility and shorter manufacturing time, which makes it highly sought after in facilities that need intricate designs. The lucrative growth of the 4-axis segment showcases the steady movement of the market towards more specialized, high-performing milling solutions.

By End-User

The automotive segment held the largest revenue share of the CNC milling machine tools market in 2023, accounting for 38.59%, due to the rising demand for high-precision components in electric and autonomous vehicles. To produce EV components, DMG MORI unveiled sophisticated 5-axis milling solutions, while Mazak featured the INTEGREX i-H Series designed for the machining of complex engine and transmission components. In addition, Haas Automation added to its vertical milling product line for Tier 1 automotive suppliers. Equipped with such a robust development, we've seen the automotive sector playing a part when it comes to insistent quality, reliability, and above all, cost-effectiveness to retain an ever-growing market share in the CNC milling machine tools market segment.

The aerospace and Defence segment is anticipated to register the highest CAGR of about 6% over the forecast period, on account of increasing demand for lightweight high-strength materials and precision parts. Okuma Corp. developed its GENOS M560V-e vertical mill for aerospace-grade alloys for its 2024 lineup. Makino also introduced the DA300 5-axis milling system for improved part accuracy in Defence applications. This growth is being driven by rising investment in military aircraft and satellite systems around the world. The introduction of such innovations aligns with the requirement for machining complex geometries, which is followed by a positive impact on the vertical both technologically and economically , which in turn is positively impacting the growth of the CNC milling solutions market.

Regional Analysis

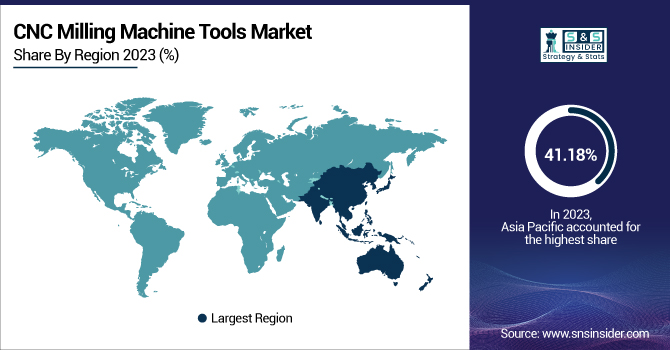

In the CNC milling machine tools market, the Asia Pacific region accounted for the largest revenue share of 41.18% in 2023 as a result of strong manufacturing activities in several countries, including China, Japan, and India. Rapid industrialization, a booming automotive sector, and high demand from electronics and aerospace industries fuel the region’s growth. In August 2023, Yamazaki Mazak introduced the next-generation VARIAXIS i-800 NEO CNC machine, designed specifically for Japan, which increases the ability of 5-axis machining. DMG Mori, likewise, grew its production plant in China to meet domestic needs. These developments highlight the region's technological advancement and bolster Asia Pacific's leadership in the CNC milling tools market.

The European CNC milling machine tools market is projected to have the highest CAGR of 4.56% during the forecast period, with an increasing focus on automation and Industry 4.0 initiatives. Leading machine tool manufacturers also have a significant presence in Europe, where Germany, Italy, and France are the main contributors in this regard. When the G550T launched in July 2023, GROB-WERKE (Germany) showcased the new CNC machine combining turning and milling in a high-precision environment. To add, Italy's FIDIA introduced its GTF series for aerospace applications. Such product innovations cater to Europe's rising demand for energy-efficient, multi-functional CNC machines that, in turn, drive regional market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

F-Zimmermann – (FZ42 Compact, FZU Series)

-

The CHIRON Group – (FZ 16 S five-axis, DZ 25 P five-axis)

-

GROB-WERKE – (G350, G550T)

-

JTEKT – (FH5000S-i, FA1050S)

-

Gleason Corporation – (Phoenix 280C, GP300)

-

DMG MORI SEIKI – (CMX 600 V, DMU 50)

-

GF Machining Solutions Management – (MILL S 500, MILL P 800 U ST)

-

Five – (Xceeder 900, HSM Line)

-

Ace Micromatic Group – (VMC 850e, SmartMill SPM)

-

Haas Automation – (VF-2, UMC-500)

-

Doosan – (DNM 5700, DVF 5000)

-

HYUNDAI WIA – (XF6300, KH50G)

-

Makino – (D200Z, a51nx)

Recent Developments

-

February 2024 – GF Machining Solutions introduced a next-generation digital suite called “rConnect Dashboard,” designed to optimize machine availability and productivity in real-time. It integrates predictive analytics and remote service support across its CNC milling platforms.

-

June 2024 – Doosan unveiled its updated DVF 5000 series featuring an AI-integrated spindle health monitoring system for improved uptime and predictive maintenance. This innovation enhances 5-axis CNC milling precision while reducing downtime.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 80.76 Billion |

| Market Size by 2032 | US$ 111.94 Billion |

| CAGR | CAGR of 3.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type – (Vertical CNC Milling Machines, Horizontal CNC Milling Machines, Universal CNC Milling Machines) • By Axis Type – (3-Axis, 4-Axis, Others) • By End-User – (Automotive, Electrical and Electronics, Aerospace and Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GF Machining Solutions Management, Doosan, HYUNDAI WIA, Five, Gleason Corporation, The CHIRON Group, Makino, GROB-WERKE, Ace Micromatic Group, JTEKT, DMG MORI SEIKI, Haas Automation, F-Zimmermann |