Video Sync Separator Market Report Scope & Overview:

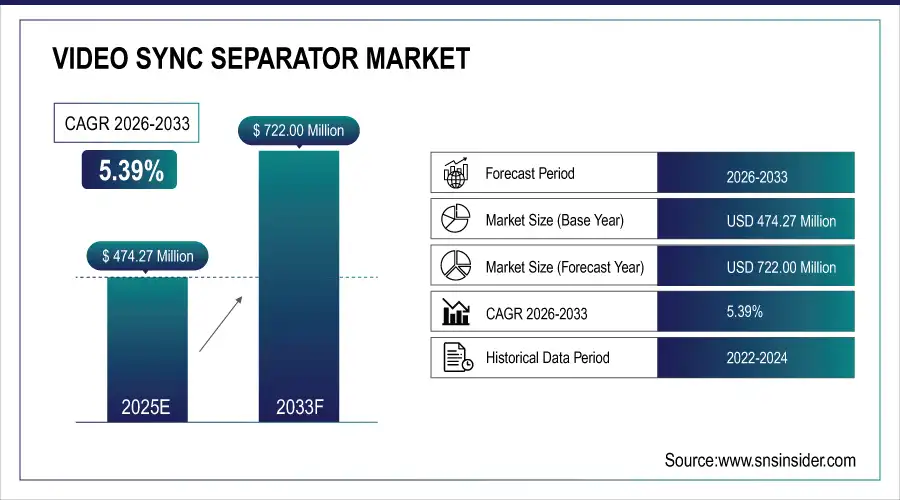

The Video Sync Separator Market Size was valued at USD 474.27 Million in 2025E and is expected to reach USD 722.00 Million by 2033, growing at a CAGR of 5.39% over the forecast period of 2026-2033.

The Video Sync Separator Market is witnessing steady growth, driven by rising demand for high-quality video signal processing across consumer electronics, automotive, and broadcasting sectors. These devices enable precise synchronization of video signals for enhanced image stability and clarity. Growing adoption in HDTV, 4K/8K systems, and advanced imaging technologies is boosting market expansion.

Market Size and Forecast:

-

Video Sync Separator Market Size in 2025E: USD 474.27 Million

-

Video Sync Separator Market Size by 2033: USD 4.22 Million

-

CAGR: 5.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Video Sync Separator Market - Request Free Sample Report

Key Video Sync Separator Market Trends

-

Growing integration of sync separators in HDTV, 4K, and 8K systems is enhancing video precision and image stability.

-

Increasing use of video synchronization in automotive infotainment and ADAS displays is driving product innovation.

-

Rising demand for high-performance imaging systems in industrial and defense sectors is boosting adoption.

-

Advancements in semiconductor technology are improving signal accuracy, noise reduction, and power efficiency.

-

Miniaturization and multi-standard compatibility are becoming key trends to support compact and versatile electronic designs.

-

Expansion of broadcast and video production applications is fueling market growth for professional-grade sync solutions.

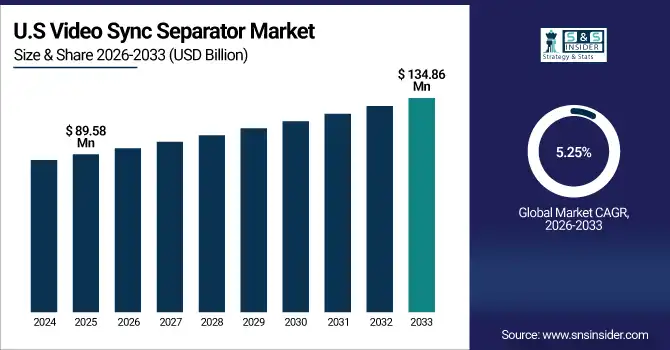

U.S. Video Sync Separator Market Insights

The U.S. Video Sync Separator Market size was USD 89.58 million in 2025 and is expected to reach USD 134.86 billion by 2033 growing at a CAGR of 5.25% over the forecast period of 2026-2033. The growth is driven by rising integration of advanced video synchronization technologies in 4K/8K displays, imaging systems, and automotive infotainment. Increasing adoption of signal processing devices for enhanced picture stability and accuracy across consumer electronics and broadcasting applications is further accelerating market expansion.

Video Sync Separator Market Growth Driver

-

Growing Integration of High-Resolution Display Technologies Drives Video Sync Separator Market Growth

The increasing demand for high-resolution video formats such as 4K, 8K, and Ultra-HD displays is significantly driving the Video Sync Separator Market. The growing adoption of digital broadcasting, advanced imaging systems, and automotive display solutions has increased the need for precise video synchronization. As video quality expectations rise, manufacturers are integrating sync separators to ensure seamless frame alignment and signal accuracy. This trend has also been fueled by developments in semiconductor technology, enabling miniaturized, high-performance components suitable for next-generation video devices. Consequently, the expanding consumer electronics and infotainment sectors are propelling overall market growth.

For instance, in April 2025, Texas Instruments Incorporated launched an advanced sync separator IC optimized for 8K television systems. The product ensures accurate horizontal and vertical synchronization even under noisy signal conditions, improving display stability. Such innovations are creating new revenue opportunities for display manufacturers and chipmakers seeking to enhance signal precision and video quality.

Video Sync Separator Market Restraint

-

High Cost of Advanced Semiconductor Components Restrains Market Expansion

The increasing cost of semiconductor materials and production processes is emerging as a major restraint in the Video Sync Separator Market. The integration of complex ICs and precision signal-processing units requires high-quality components, which elevate manufacturing expenses. This cost escalation limits the affordability of sync separators for small and mid-sized device manufacturers. Additionally, global supply chain disruptions and fluctuating raw material prices have intensified cost pressures. As a result, manufacturers often face challenges in maintaining competitive pricing while meeting performance standards, particularly in developing markets.

For example, in January 2025, several Asian component suppliers reported a 12% rise in IC fabrication costs due to increased silicon wafer prices and limited foundry capacity. This spike directly affected the pricing structure of video sync components, compelling OEMs to delay production schedules or seek alternative sourcing options.

Video Sync Separator Market Opportunity

-

Expansion of AI-Powered Video Processing Creates New Market Opportunities

The integration of Artificial Intelligence (AI) and machine learning into video processing systems is creating lucrative opportunities for the Video Sync Separator Market. AI-enhanced sync systems improve signal timing, error correction, and adaptive frame synchronization in real time. This is particularly beneficial for autonomous vehicles, smart surveillance systems, and advanced broadcasting equipment where accuracy and latency reduction are critical. With the rise of intelligent edge devices, sync separators are evolving to support AI-based decision-making, contributing to efficient power management and improved visual output quality. Consequently, AI-driven advancements are reshaping market dynamics toward smarter synchronization technologies.

In September 2025, Analog Devices Inc. announced the launch of an AI-assisted sync management chipset designed for autonomous driving applications. The system leverages deep learning algorithms to adaptively optimize video signal alignment, ensuring stable visual feeds under dynamic conditions. This innovation highlights how AI integration is unlocking new potential in synchronization technologies across industries.

Video Sync Separator Market Segment Highlights:

-

By Product Type: Composite Sync Separator – 45% (largest), Horizontal Sync Separator – 25%, Vertical Sync Separator – 18%, Multi-Standard Sync Separator – 12%

-

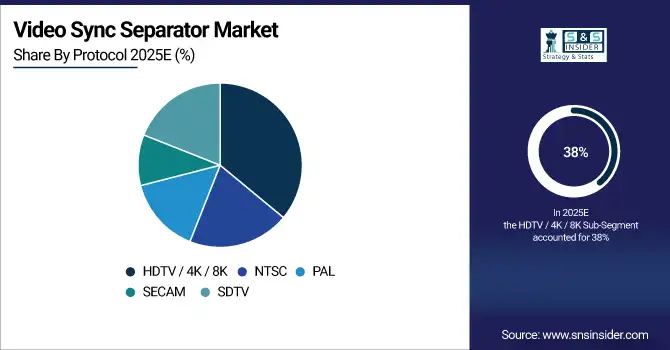

By Protocol: HDTV / 4K / 8K – 38% (largest), NTSC – 25%, PAL – 20%, SDTV – 10%, SECAM – 7%

-

By Application: Consumer Electronics – 40% (largest), Imaging Systems – 25%, Automotive Infotainment & Display Systems – 18%, Broadcast & Video Production Equipment – 10%, Industrial and Defense Equipment – 7%

-

By End-User Industry: Consumer Electronics Manufacturers – 35% (largest), Original Equipment Manufacturers (OEMs) – 25%, Broadcast Equipment Providers – 20%, Automotive & Transportation Industry – 12%, Medical & Industrial Device Manufacturers – 8%

Video Sync Separator Market Segment Analysis

By Product Type

The Composite Sync Separator segment leads the Video Sync Separator Market with a 45% share, driven by its extensive use in consumer electronics, imaging systems, and broadcasting equipment. Its ability to separate both horizontal and vertical sync signals from composite video inputs enhances signal accuracy and display performance. The Horizontal Sync Separator segment, accounting for 25%, is gaining traction in high-definition televisions and automotive display systems that require precise horizontal timing control. Vertical Sync Separators, with 18%, are widely used in industrial imaging and video production systems to ensure stable frame synchronization. Meanwhile, the Multi-Standard Sync Separator segment, holding 12%, is increasingly preferred for devices supporting multiple video protocols such as PAL, NTSC, and HDTV, offering versatility and cross-standard compatibility.

By Protocol

The HDTV / 4K / 8K segment dominates the market with a 38% share, fueled by growing adoption of ultra-high-definition displays and next-generation broadcast systems that require superior video synchronization. The NTSC segment holds 25%, maintaining strong demand in legacy broadcast equipment and standard-definition devices. The PAL segment accounts for 20%, supported by its extensive use in European and Asian broadcasting applications. SDTV, representing 10%, continues to serve cost-effective and industrial display setups. Meanwhile, the SECAM segment, with 7%, remains relevant in specific regional markets where analog transmission standards are still operational.

By Application

The Consumer Electronics segment holds the largest share at 40%, driven by widespread integration of sync separators in televisions, monitors, and set-top boxes to ensure stable picture output. The Imaging Systems segment, contributing 25%, benefits from increased use in medical imaging, industrial inspection, and security surveillance devices. The Automotive Infotainment & Display Systems segment, at 18%, is expanding rapidly due to growing adoption of advanced driver-assistance systems (ADAS) and high-resolution vehicle dashboards. The Broadcast & Video Production Equipment segment, with 10%, relies on precise signal timing for professional video output and live broadcasting. Lastly, Industrial and Defense Equipment, holding 7%, use sync separators for machine vision, radar, and simulation applications where timing accuracy is critical.

By End-User Industry

The Consumer Electronics Manufacturers segment leads with a 35% share, driven by mass production of high-definition devices and increasing consumer demand for superior video quality. Original Equipment Manufacturers (OEMs) hold 25%, leveraging sync separators in product integration across display and signal control applications. Broadcast Equipment Providers, with 20%, utilize sync separation technologies for studio automation, signal correction, and content distribution. The Automotive & Transportation Industry, at 12%, is witnessing fast growth due to integration in infotainment and in-vehicle display systems. Meanwhile, Medical & Industrial Device Manufacturers, representing 8%, apply these technologies in imaging diagnostics, factory automation, and mission-critical video processing applications, enhancing system accuracy and performance.

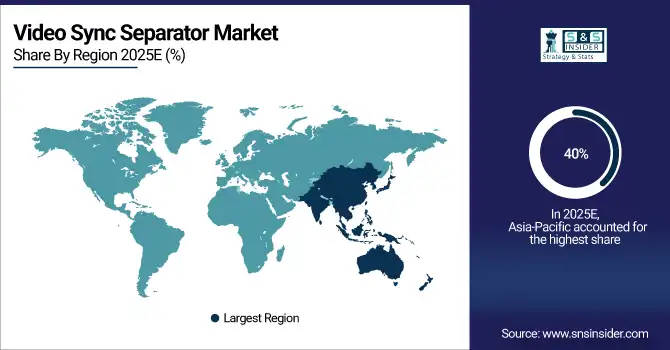

Video Sync Separator Market Regional Analysis

Asia-Pacific Video Sync Separator Market Insights

Asia-Pacific dominates the Video Sync Separator Market with a 40% share in 2025, making it the largest and fastest-growing region worldwide. The surge in consumer electronics production, automotive display systems, and industrial automation across China, Japan, South Korea, and India drives substantial demand for sync separators. Rising adoption of HDTV, 4K/8K, and IoT-enabled imaging systems is fueling technological upgrades. Moreover, government-backed initiatives promoting semiconductor innovation and digital infrastructure are reinforcing regional growth. Collaboration between domestic firms and global chip manufacturers further strengthens design capabilities, supply chain resilience, and market competitiveness, solidifying Asia-Pacific’s leadership in advanced video synchronization technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Video Sync Separator Market Insights

North America accounts for 25% of the Video Sync Separator Market in 2025, supported by robust technological innovation and the presence of leading semiconductor companies in the U.S. and Canada. The region benefits from extensive R&D activities, particularly in AI-driven video processing, broadcasting, and automotive infotainment systems. Strong consumer demand for high-definition video devices and professional broadcast equipment continues to propel market growth. The U.S. leads regional adoption through early integration of advanced sync solutions in defense and industrial imaging. Strategic partnerships between OEMs and universities are further driving innovation, ensuring North America remains a global hub for synchronization and signal processing advancements.

Europe Video Sync Separator Market Insights

Europe holds a 20% share of the Video Sync Separator Market in 2025, driven by advancements in high-precision engineering and sustainable electronics manufacturing. Major contributors such as Germany, France, and the U.K. emphasize the development of reliable video synchronization systems for medical imaging, automotive electronics, and industrial automation. The region benefits from strong regulatory frameworks promoting eco-friendly designs and energy-efficient components. The European Union’s digital transformation initiatives and investments in R&D under the Horizon Europe program are accelerating the adoption of next-generation signal-processing ICs. Europe’s commitment to quality standards and technical innovation continues to support steady market growth.

Middle East & Africa (MEA) Video Sync Separator Market Insights

The Middle East & Africa region holds an 8% share of the global Video Sync Separator Market in 2025, showing gradual but steady growth. Expanding infrastructure, rising investments in smart cities, and modernization of broadcasting networks in the UAE, Saudi Arabia, and South Africa are key contributors. Increased deployment of display and video monitoring systems in commercial, industrial, and defense applications is fueling demand. Moreover, collaborations between regional integrators and global semiconductor suppliers are helping develop local technological capabilities. The push for economic diversification and adoption of smart communication solutions positions MEA for continued moderate growth.

Latin America Video Sync Separator Market Insights

Latin America captures a 7% share of the Video Sync Separator Market in 2025, supported by the expanding consumer electronics and automotive manufacturing sectors in Brazil, Mexico, and Argentina. Rapid urbanization, digital transformation, and investment in smart infrastructure are key market accelerators. The increasing use of video synchronization in infotainment systems, broadcasting, and security solutions is enhancing product demand. Regional governments are promoting semiconductor ecosystem development through training and R&D incentives. Despite occasional economic challenges, ongoing partnerships with global manufacturers and a rising focus on local assembly are fostering stable market growth across Latin America.

Competitive Landscape for Video Sync Separator Market:

Renesas Electronics Corporation

Renesas Electronics Corporation is a leading semiconductor manufacturer specializing in microcontrollers, analog devices, and integrated circuits for video synchronization, automotive, and industrial applications.

-

In March 2025, Renesas launched its RSX8000 Video Sync Separator Chipset, featuring ultra-low latency signal processing and AI-assisted synchronization for 8K and automotive-grade video systems, improving timing precision and visual performance.

Texas Instruments Incorporated

Texas Instruments is a global leader in analog and embedded processing solutions, offering advanced signal conditioning and synchronization ICs for imaging and broadcasting applications.

-

In February 2025, TI introduced its TVS950 Sync Signal Processor Series, incorporating intelligent timing correction and wide-format compatibility, optimized for next-generation display panels and video transmission systems.

Analog Devices Inc.

Analog Devices Inc. (ADI) specializes in high-performance analog, mixed-signal, and DSP technologies for industrial automation, defense, and communication sectors.

-

In May 2025, ADI launched its AD-SYNC 4000 Series, designed to support precision synchronization in industrial vision systems and AI-powered camera modules, offering adaptive frame correction and ultra-fast signal stability.

STMicroelectronics N.V.

STMicroelectronics is a global semiconductor company providing advanced analog, digital, and mixed-signal ICs for imaging, consumer electronics, and automotive applications.

-

In April 2025, STMicroelectronics unveiled its STS900 Sync Separator IC, tailored for high-definition broadcasting and infotainment systems, delivering superior synchronization accuracy and energy-efficient signal management.

Video Sync Separator Market Key Players

Some of the VIDEO SYNC SEPARATOR Companies

-

Renesas Electronics Corporation

-

Texas Instruments Incorporated

-

ROHM Semiconductor

-

Maxim Integrated

-

Intersil Corporation

-

National Semiconductor Corporation

-

NTE Electronics

-

Gennum Corporation

-

Analog Devices Inc.

-

ON Semiconductor Corporation

-

STMicroelectronics N.V.

-

Microchip Technology Inc.

-

Cypress Semiconductor Corporation

-

Semtech Corporation

-

NXP Semiconductors N.V.

-

Infineon Technologies AG

-

Dialog Semiconductor Plc

-

Broadcom Inc.

-

Digital Blocks Inc.

-

Elantec

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD474.27 Million |

| Market Size by 2033 | USD 722 Million |

| CAGR | CAGR of5.39% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Composite Sync Separator, Horizontal Sync Separator, Vertical Sync Separator, Multi-Standard Sync Separator) • By Protocol (NTSC, PAL, SECAM, SDTV, HDTV / 4K / 8K) • By Application (Imaging Systems, Consumer Electronics, Automotive Infotainment & Display Systems, Broadcast & Video Production Equipment, Industrial and Defense Equipment) • By End-User Industry (Original Equipment Manufacturers (OEMs), Consumer Electronics Manufacturers, Broadcast Equipment Providers, Automotive & Transportation Industry, Medical & Industrial Device Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Renesas Electronics Corporation, Texas Instruments Incorporated, ROHM Semiconductor, Maxim Integrated, Intersil Corporation, National Semiconductor Corporation, NTE Electronics, Gennum Corporation, Analog Devices Inc., ON Semiconductor Corporation, STMicroelectronics N.V., Microchip Technology Inc., Cypress Semiconductor Corporation, Semtech Corporation, NXP Semiconductors N.V., Infineon Technologies AG, Dialog Semiconductor Plc, Broadcom Inc., Digital Blocks Inc., Elantec (now part of other entities). |