Sterilization Equipment Market Overview:

The Sterilization Equipment Market Size was valued at USD 7.0 Billion in 2023 and is expected to reach USD 18.44 Billion by 2032, growing at a CAGR of 11.38% over the forecast period 2024-2032.

To Get more information on Sterilization Equipment Market - Request Free Sample Report

The report covers comprehensive information on the Sterilization Equipment Market including statistical analysis and upcoming trends that contribute to growth in Sterilization Equipment Market. It includes global market size and growth rate, healthcare-associated infections (HAIs) incidence and prevalence, and adoption trends for hospitals, ambulatory surgical centers, and pharmaceutical companies. The report further studies regulatory compliance across different regions, the prevalence of hospital spending on sterilization equipment by facility type, and innovations in automated and environment-friendly sterilization technologies. Regional trends, market adoption rates, cost dynamics, and the effect of stringent sterilization standards are also all mentioned in the report. Access to this information not only helps other stakeholders in the industry make informed decisions but also provides a data-driven overview of the sterilization equipment ecosystem.

Sterilization Equipment Market is expected to grow in the forecast period owing to increasing demand for infection control measures and stringent regulatory standards. A key market driver is the increasing incidence of healthcare-associated infections (HAIs), which impact one in 31 patients every day in the U.S., according to the Centers for Disease Control and Prevention (CDC). Mitigating these risks depends on the use of advanced sterilization technologies. The sterilization equipment market in the United States has exhibited consistent growth, increasing from USD 1.86 billion in 2023 to USD 4.86 billion in 2032, Growing With a noteworthy CAGR of 11.25% during the forecast period. the market growth is attributed to the rising numbers of healthcare-associated infection (HAI) cases, strict sterilization regulations, and growing infrastructure investments by hospitals. Demand is further spurred by advanced sterilization technologies such as low-temperature sterilizers and IoT-enabled tracking systems across hospitals, pharmaceutical companies, and research laboratories.

Sterilization Equipment Market Dynamics

Drivers

-

The increasing number of surgical procedures worldwide has heightened the demand for effective sterilization equipment to ensure patient safety and prevent infections.

The rising incidence of surgical procedures across the globe has, in turn, increased the demand for surgical sterilization equipment to promote safety and prevent infections. In 2023, the International Society of Aesthetic Plastic Surgery (ISAPS) reported a total of 34.9 million aesthetic procedures, marking a 3.4% increase from the previous year. Notably, surgical procedures experienced a 5.5% rise, totaling over 15.8 million operations. The increase is especially noticeable in minimally invasive surgeries. As an example, in the third quarter of 2024, Intuitive Surgical saw an 18% YoY growth in the global number of procedures performed using their da Vinci robotic systems. This increase also highlights an increasing dependence on sophisticated surgical technologies.

Beyond aesthetic and robotic-assisted operations, there is still a significant demand for surgical procedures. According to a study published by the National Center for Biotechnology Information (NCBI), 321.5 million inpatient surgical procedures were needed in 2010 to treat the global burden of disease. Although this data is from 2010, it sets the premise for the enormity of the surgical requirements, which have most probably increased in the years thereafter. The continued increase across multiple medical fields makes for an imperative for strict sterilization protocols. This onboarding of sterilization equipment is the main hurdle to be cleared in ensuring the prevention of postoperative infections, to lay, only to improve the experience of surgery for the patients. With surgical volumes continuing to rise, healthcare facilities must invest in state-of-the-art sterilization technologies to ensure safe levels of infection control and patient care.

Restraint

-

The high cost of sterilization equipment poses a significant challenge, particularly for small and medium-sized healthcare facilities, limiting their ability to invest in advanced sterilization technologies.

The high cost of sterilization equipment significantly impacts healthcare facilities, especially small and medium-sized enterprises (SMEs). Although effective, advanced sterilization technologies require significant upfront financial investments that can put a strain on the financial resources of these institutions. Beyond the purchase price, ongoing maintenance and repair expenses add to the financial burden, making it challenging for SMEs to adopt and sustain such equipment. In light of these financial pressures, some healthcare facilities are seeking alternatives, such as single-use medical devices (SUDs). The reprocessing of SUDs has become a low-cost alternative, with the cost to the FDA-regulated reprocessor of reprocessed devices being only 25%-40% of the original cost of the device. However, the shift towards reprocessing SUDs introduces additional considerations. Facilities must invest in proper reprocessing equipment and training to ensure patient safety and compliance with regulatory standards. While this strategy can alleviate some financial pressures, it requires careful implementation and oversight. Still, high costs for sterilization equipment and maintaining it remain a significant barrier, especially for SMEs, which may limit their ability to deliver the highest levels of infection control. Tackling these cost challenges will leave all healthcare facilities able to invest in an effective sterilization solution that protects patient health.

Opportunity

-

Emerging economies, such as India and China, present substantial growth opportunities due to expanding healthcare infrastructures and increasing awareness of infection control measures.

Emerging economies such as India and China are projected to offer significant growth opportunities for the sterilization equipment market, thanks to the growing focus on infection control and improvement in healthcare infrastructure. The healthcare sector in India is seeing huge growth. Apollo Hospitals Enterprise Ltd, one of the largest private healthcare chains in India, posted a 51.8% rise in third-quarter profit at ₹3.72 billion. This increase is because of higher patient occupancy rates, which hit 68% compared to 66% the previous year, and a surge in surgical procedures. There is also an exciting opportunity in China’s healthcare landscape. By 2035, China’s aging population is expected to be more than 400 million people aged 60 and older, driving demand for medical services and related equipment. Such a demographic transition has created a growing "silver economy," where healthcare services precisely developed catering to the aged population are attracting huge investments. While competition and operational costs hinder profitability, the government's favourable policies, such as subsidies, are facilitating home care services and propelling the healthcare sector. International investors are paying more attention to these markets. For example, Nordic firm EQT has deployed some $6 billion in India in a year-and-a-half, exceeding its original target. The firm is actively targeting sectors such as healthcare, real estate, and infrastructure, reflecting global confidence in India's healthcare expansion.

Challenge

-

Ensuring compliance with stringent regulatory standards requires significant investment in research, development, and testing, posing a challenge for manufacturers in the sterilization equipment market.

Ensuring compliance with stringent regulatory standards is one of the most challenging aspects of the sterilization equipment market. For a sterilization technique to be considered effective, the manufacturers are mandated by regulatory authorities like the U.S. Food and Drug Administration (FDA) to carry out the necessary validation studies that prove how relevant the procedure is with regard to sterility assurance. This involves extensive paperwork of everything and verifying the equipment is capable of destroying all forms of microbial life. For example, the FDA requires extensive pre-market submissions for sterilizers, which can be time- and labor-intensive and expensive for manufacturers.

The complexity of compliance is further heightened by the need to adapt to evolving sterilization technologies. This includes updates to their safety and effectiveness for newer sterilization processes, including hydrogen peroxide gas plasma and ethylene oxide gas. Tapping into these new methods requires additional validation and testing, which also adds pressure on manufacturers’ resources. Globally, manufacturers need to comply with different regulations while still following standards from institutions such as the International Organization for Standardization (ISO). ISO 13485 describes quality management system requirements for the medical device industry, which encompasses sterilization. Achieving compliance with such standards demands significant investment in quality control and regulatory affairs, impacting both time to market and operational costs.

Segmentation Analysis

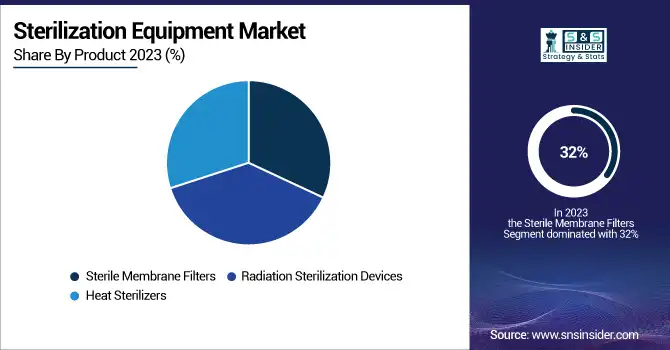

Sterilization Equipment Market By Product

Sterile membrane filters emerged as the leading product segment in the sterilization equipment market, accounting for 32% of revenue in 2023. These filters play an integral role in maintaining contamination-free conditions, especially in pharmaceutical production, biotechnology, and healthcare facilities. They can filter out microorganisms, particulates, and other contaminants so effectively, that they are essential for things like vaccine production, intravenous drug preparation, and laboratory research. The rising requirement for sterile surroundings in biopharmaceutical manufacturing is a prominent factor fueling the advancement of membrane filters. Globally, governments are prioritizing stringent regulatory standards for the manufacture of drugs. For example, in the U.S., FDA follows stringent sterility testing procedures for pharmaceutical products, thus increasing the need for effective filtration solutions. Moreover, technology improvements such as high-performance polymer membranes in filter technology leading to improved durability and filtration efficiency are expected to boost the market growth. The rising cases of chronic illnesses, including diabetes and cancer, has also driven up the need for sterile injectable drugs, which need high-quality filtration during manufacture.

Heat sterilizers are projected to grow with the fastest CAGR over the forecast period in the sterilization equipment market, driven by their effectiveness in eliminating microorganisms without requiring chemical agents. They use high temperatures to destroy pathogens on medical instruments and laboratory equipment, making them a great choice for healthcare facilities seeking eco-friendly sterilization techniques. Because of their adaptability, affordability, and ability to sterilize a wide range of materials, including surgical tools, glassware, and textiles, autoclaves are a common type of heat sterilizer. Similarly, the growing utilization of reusable medical instruments has also driven their demand for autoclaves. According to recent government data from the U.S., hospitals have been transitioning toward sustainable practices by reducing reliance on disposable items while ensuring effective sterilization through heat-based systems.

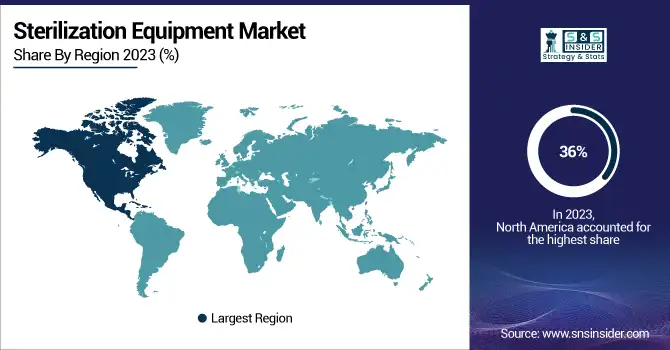

Sterilization Equipment Market Regional Insights

In 2023, North America held a 36% share of the global sterilization equipment market. Such leadership is largely due to its developed healthcare facilities and strict regulations maintaining the highest standards of infection control. Demand for sterilization technologies has been significantly driven by the region's strong adoption of disposable medical devices like syringes, catheters, and surgical instruments. As the largest contributor in North America, the U.S. has actively worked to implement wide-ranging government measures to boost patient safety. For instance, the FDA has rolled out programs that promote innovative sterilization approaches as a way to minimize detrimental emissions associated with processes such as ethylene oxide sterilization. Moreover, government investment in upgrading hospital infrastructure has also facilitated the adoption of advanced equipment across healthcare facilities. The rising rate of healthcare-associated infections (HAIs) is another major key factor contributing to regional growth. Nosocomial infections (NIs), or healthcare-associated infections (HAIs), accounted for 128,000 deaths annually in the U.S. in the year up to October 2023, according to CDC estimates that show around 5% of hospitalized patients worldwide are affected. Hospitals have invested heavily in effective sterilization solutions to combat these risks.

During the forecast period, the Asia-Pacific is projected to grow at the highest CAGR, owing to an expanding healthcare infrastructure and a growing awareness regarding infection control measures. Countries such as China and India are pouring resources into modernizing hospitals and clinics and embracing new sterilization technologies. This region is witnessing considerable growth owing to medical tourism. Countries like Thailand and Malaysia are steering towards lower-priced, top-standard health care, which requires strict infection prevention measures. Government initiatives geared towards expansion in healthcare only increase demand further; India’s National Health Mission pays attention to improving hospital hygienic standards at public institutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Sterilization Equipment Market

Key Service Providers/Manufacturers

-

Getinge Group (Steam Sterilizers, Dry Heat Sterilizers)

-

STERIS Corporation (V-PRO Low Temperature Sterilizers, AMSCO Steam Sterilizers)

-

3M Healthcare (Attest Biological Indicators, Steri-Vac Ethylene Oxide Sterilizers)

-

Medtronic plc (Gas Plasma Sterilizers, Steam Sterilizers)

-

Asahi Kasei Corporation (ETO Sterilizers, Plasma Sterilizers)

-

Ansell Ltd (Sterilization Wraps, Barrier Surgical Gloves)

-

Cantel Medical Corporation (AEROFLEX Automatic Endoscope Reprocessor, DSD Edge Sterile Processor)

-

Belimed AG (WD 290 Washer-Disinfector, MST V 446 Steam Sterilizer)

-

Crosstex International, Inc. (Sure-Check Sterilization Pouches, Biological Monitoring Systems)

-

Amsco, Inc. (Century Steam Sterilizers, Eagle Series Sterilizers)

-

MATACHANA Group (S1000 Series Steam Sterilizers, Low Temperature Sterilizers)

-

MMM Group (Selectomat PL Steam Sterilizers, Vacuklav Autoclaves)

-

Steelco S.p.A. (VS L Series Steam Sterilizers, LAB 640 Washer-Disinfectors)

-

Tuttnauer (Elara 11 Class B Autoclave, T-Edge 10 Autoclave)

-

Midmark Corporation (M11 Steam Sterilizer, M3 UltraFast Automatic Sterilizer)

-

Bausch + Ströbel (Syringe Filling Machines, Vial Filling and Closing Machines)

-

Wilco AG (Leak Testing Machines, Visual Inspection Systems)

-

Hindustan Syringes & Medical Devices (Dispovan Single-Use Syringes, IV Cannulas)

-

Medisafe International (Sonic Irrigation Systems, Instrument Cleaning Chemistries)

-

DE LAMA S.p.A. (DLOV Steam Sterilizers, DLST Superheated Water Sterilizers)

Recent Developments

-

In February 2024, Opened a sterile medication facility in Singapore with advanced aseptic fill-finish lines to support biopharmaceutical production.

-

In June 2024, Getinge launched the Poladus 150, a Vaporized Hydrogen Peroxide (VH₂O₂) low-temperature sterilizer for heat-sensitive surgical instrument inspection. Poladus 150 uses advanced cross-contamination barrier technology to reduce healthcare-acquired infections (HCAIs).

-

In July 2024, Midmark released its new generation of M9 and M11 Steam Sterilizers. These sterilizers feature increased durability, an easy-to-use 5-inch touchscreen interface, simplified compliance recordkeeping and optional autofill and auto-drain functions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.0 Billion |

| Market Size by 2032 | USD 18.44 Billion |

| CAGR | CAGR of 11.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Heat Sterilizers {Depyrogenation Oven, Steam Autoclaves}, Sterile Membrane Filters, Radiation Sterilization Devices {Electron Beams, Gamma Rays, Others}, Low-Temperature Sterilizers {Ethylene Oxide Sterilizers, Hydrogen Peroxide Sterilizers, Others}) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Getinge Group, STERIS Corporation, 3M Healthcare, Medtronic plc, Asahi Kasei Corporation, Ansell Ltd, Cantel Medical Corporation, Belimed AG, Crosstex International, Inc., Amsco, Inc., MATACHANA Group, MMM Group, Steelco S.p.A., Tuttnauer, Midmark Corporation, Bausch + Ströbel, Wilco AG, Hindustan Syringes & Medical Devices, Medisafe International, DE LAMA S.p.A. |