Stethoscope Market Overview:

The Stethoscope Market size was valued at USD 636.15 million in 2023 and is projected to reach USD 1060.49 million by 2032, growing at a CAGR of 5.86% from 2024-2032.

To Get more information on Stethoscope Market - Request Free Sample Report

The stethoscope market report provides data and insights on the state of the industry. It contains an in-depth analysis of the incidence and prevalence of cardiovascular and respiratory diseases fueling stethoscope demand, as well as regional prescribing and usage trends. It also assesses the trends in healthcare expenditure influencing diagnostics and gauges the increasing utilization of digital stethoscopes in different healthcare settings. Moreover, it also highlights integration abilities with electronic health records as well as regulatory standard compliance across regions, thereby presenting a holistic overview of conventional and smart stethoscope dynamics in the worldwide healthcare ecosystem.

The global stethoscope market is experiencing robust growth, driven by advancements in healthcare technology and the increasing prevalence of cardiovascular and respiratory diseases. The 2023 global age-standardized mortality rate was 108.8 deaths per 100,000 for ischemic heart diseases, as per the reports of the American College of Cardiology Foundation indicating the increasing burden of cardiovascular diseases. The market is also driven by government initiatives promoting advanced medical devices. The stethoscope market in the U.S. has demonstrated consistent growth from USD 163.75 million in 2023 to USD 268.01 million in 2032. This sustained growth corresponds to a compound annual growth rate (CAGR) of 5.65%, fueled by factors such as growing healthcare awareness, the use of digital diagnostic tools, and more investment in primary care infrastructure. The upward trend highlights strong market demand and robust opportunities for innovation and expansion in both analog and digital stethoscope segments.

Stethoscope Market Dynamics

Drivers

-

The increasing prevalence of cardiovascular and respiratory diseases has heightened the demand for advanced diagnostic tools, including stethoscopes.

The global rise in cardiovascular diseases (CVDS) has led to significant growth in the demand for diagnostic instruments such as stethoscopes. Cardiovascular diseases (CVDs) include heart attacks and strokes and are the leading cause of death globally, accounting for more than 18 million deaths each year. One of the biggest contributors to these conditions is high blood pressure, which affects an estimated 1.3 billion people worldwide almost half of whom are unaware they have the problem. This widespread underdiagnosis emphasizes an urgent need for good diagnostic tools. Moreover, the high intake of sweetened beverages contributes to over 2.2 million new diabetes cases and 1.1 million new heart disease cases annually, predisposing these individuals to CVDs. With the increasing prevalence of non-communicable diseases, especially in low and middle-income countries where health systems may lack a focus on chronic disease management, stethoscopes can help hospitals and clinics catch issues for early intervention. As a result, healthcare practitioners are relying more and more on stethoscopes for early intervention to decrease the morbidity and mortality of CVD.

Restraint

-

The high initial cost of smart stethoscopes compared to traditional models may limit their adoption, particularly in low-income healthcare settings.

In healthcare institutions, these high costs are a major factor limiting the adoption of smart stethoscopes as compared to conventional models. Traditional stethoscopes usually range from $20 to $200 in price and are therefore widely available for most health care professionals. Smart stethoscopes with features such as AI-based diagnostics, noise reduction, or Bluetooth connectivity are available from $100 to $800. . For instance, the Eko DUO ECG + Digital Stethoscope is priced between $349 and $400, while the Thinklabs One Digital Stethoscope can cost up to $600. Such a significant cost discrepancy poses a financial burden, particularly for providers and institutions operating in lower-income or resource-limited settings. Smart stethoscopes are expensive, draining scarce budgets that can simply not afford these sophisticated diagnostic devices. This poses a significant obstacle to their widespread adoption, especially in developing countries where healthcare facilities are in short supply, as costly gadgetry can discourage use despite their potential to increase diagnostic accuracy and fill the gaps left in access with telemedicine.

Opportunity

-

Technological advancements, such as the integration of artificial intelligence and digital capabilities, are enhancing stethoscope functionalities, offering improved diagnostic accuracy and supporting telemedicine applications.

One of the biggest opportunities in the stethoscope market is the growth and penetration of AI and digital technologies in auscultation devices. Digital sensors and AI analytics are transforming standard diagnostic approaches toward smart stethoscopes that provide visualization and noise cancellation as well as automatic sound interpretation. Such innovations allow higher diagnostic accuracy whilst enabling the monitoring of patients from a distance and telemedicine, which are fast becoming cornerstones of contemporary healthcare systems. Geneticist and physician Eric Topol notes that according to a 2024 study found in the Journal of Medical Systems, AI-assisted auscultation for the identification of abnormal heart sounds demonstrated a diagnostic accuracy of 87.5% compared to traditional stethoscopes alone, which only 70% of the time were able to identify an abnormal heart sound. Moreover, a recent survey carried out by the American Telemedicine Association (ATA) at the beginning of 2025 revealed that more than 62 percent of healthcare practitioners currently utilize smart diagnostic tools, such as digital stethoscopes, when engaging in remote patient engagements. Additionally, cloud-connected smart stethoscopes can also enable physicians to store, access, and share patient data seamlessly with one another, ensuring continuity of care and collaborative diagnostics spanning geographies. For example, businesses like Eko Health and 3M now provide digital stethoscopes that are integrated with ECG and Bluetooth technology to allow clinical-grade recordings of biomarkers outside of the clinic. These trends fit with the momentum toward value-based care and personalized medicine in which early and accurate diagnosis holds substantial importance. As healthcare systems increasingly prioritize digital transformation, the demand for intelligent auscultation tools is expected to surge.

Challenge

-

Data privacy and security concerns associated with the use of smart stethoscopes can hinder their widespread adoption, as both patients and healthcare providers may be cautious about the potential risks of sensitive health information being compromised.

The adoption of smart stethoscopes in healthcare poses complex data privacy and security issues. More than 305 million patient records have been compromised in 2024 a 26% increase from 2023 data reflecting the growing risk to sensitive health information. Organizations specifically faced attacks on cloud systems, with 61% of healthcare organizations reporting to have encountered such attacks, while 86% of those attacks resulting in loss of funds or damage to operations. The growing use of IoT devices, such as smart stethoscopes, in healthcare has increased the attack surface, making unauthorized access a serious risk. More specifically, unauthorized access was cited by 53% of healthcare organizations as the largest cloud security threat. Limitations in updating legacy devices increase the risks of cyber-attacks. These breaches not only violate patient confidentiality, but also undermine trust in digital health innovations. Addressing these issues necessitates robust encryption, stringent access controls, regular security audits, and comprehensive staff training to safeguard patient data effectively.

Stethoscope Market Segment Analysis

By Technology Type

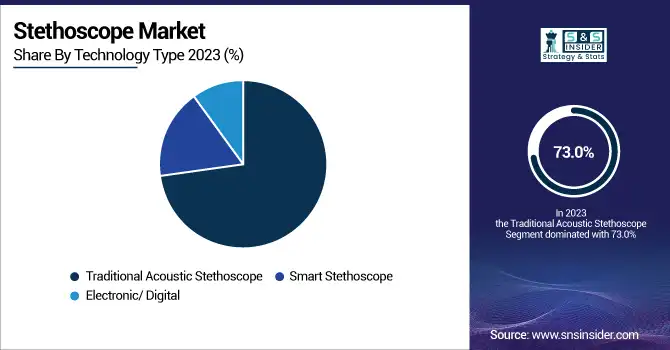

The traditional acoustic stethoscope accounted for the largest revenue share of 73.0% in 2023. It is due to its low cost, uncomplicatedness, and dependability that has led to its universal acceptance. Acoustic stethoscopes are lightweight, simple to use, and do not require an external power supply, thus becoming essential for everyday clinical examinations. They are especially popular among doctors and medical students because of their effectiveness when auscultating heart and lung sounds. Moreover, their wide availability with modest prices enables them to become a powerful solution for healthcare providers in low-resource settings, especially when compared to digital stethoscopes. Government statistics emphasize how affordable diagnostic tools can solve this major healthcare challenge. For instance, the CDC stated that cardiovascular diseases continue to be the top cause of death in the U.S., and this is where dependable diagnostic equipment such as acoustic stethoscopes play an important role. Many have advanced features like noise cancellation, AI-powered diagnostics, and the ability to store and share recordings, but their higher cost and reliance on battery power limits their frequent use compared to traditional stethoscopes. The acoustic stethoscope also remains important for medical education. It is an essential tool for teaching medical students auscultation techniques. The dominance in this segment is also strengthened due to ease of maintenance and endurance which implies it is widely used by healthcare facilities across the globe.

By Sales Channel

In 2023, distributors contributed towards a 53% share of the overall revenue in the stethoscope market owing to wide coverage and ability to serve across different geographies. Distributors help make products available in every possible location with various products, acting as a channel between manufacturers and end-users. This is vital in emerging markets where there is less access to manufacturers.

Governments worldwide have teamed with distributors to increase access to medical devices. For instance, India’s National Health Mission has engaged with distributors to supply critical diagnostic equipment such as stethoscopes to primary healthcare facilities. Such partnerships ensure access to critical equipment for rural healthcare providers. Distributors also educate healthcare professionals on product features and use. That they frequently run workshops as well as training sessions showing users how to get used to advanced stethoscope models. Distributors also guide manufacturers through the compliance landscape and streamline distribution logistics, which can accelerate market entry.

By End-Use

In 2023, hospitals accounted for the largest revenue share of 41% due to high patient footfalls and demand for diagnosis tools in multiple specialties. Stethoscopes are heavily used in many departments of hospitals including cardiology, pulmonology, and general medicine for accurate diagnosis and developing treatment plans. A rise in chronic illnesses has escalated the need at the hospital level for reliable diagnostic tools. For instance, the American Hospital Association found an increase in admissions from cardiovascular conditions that require careful auscultation with stethoscopes. Hospitals also prefer to use durable, sturdy, and of good quality stethoscopes as they have to go through a lot of wear and tear. Hospital seduction of stethoscopes has also been fueled by the government. The introduction of more advanced medical devices has also been accelerated, especially in countries such as India where already the focus of government programs has been on stronger secondary and tertiary care facilities. The bulk purchasing power of hospitals for diagnostic tools leads them to be a significant driving force in market growth.

Stethoscope Market Regional Insights

The global stethoscope market is dominated by North America, which held a revenue share of 33% in 2023. The advanced healthcare infrastructure along with high healthcare expenditure and high per capita income additionally boosts the market growth and leads the region as the largest market, while chronic diseases such as cardiovascular disorders and respiratory disorders are also rampant. North America’s dominance is largely owing to the United States. As a result, demand for new stethoscope technologies is trending upward, especially digital and smart functions. 3M Littmann and Welch Allyn dominate leading manufacturers, and their new products designed for the healthcare professional’s needs, increase the market. The stethoscope market in Europe accounts for a substantial portion of the global stethoscope market. Germany, France, and the United Kingdom are such countries that are prominent in the medical diagnostics market in Europe, backed by established healthcare systems and rising digitization in medical diagnostics. Germany’s market is especially interesting since they have adopted digital stethoscopes with advanced functions, such as telecommunication.

The stethoscope market in Asia Pacific is expected to grow at a lucrative rate due to rapid urbanization, emerging health frameworks, and growing medical expenditure. Governments in countries like India and China are also a big sector of this growth as they focus on strengthening primary healthcare facilities and improving access to diagnostic tools in rural areas. For example, the use of stethoscopes among primary care providers has expanded in India due to the country’s villagers’ efforts to strengthen rural health care. Also, the growing awareness about preventive care and chronic disease management has created a demand for advanced diagnostic tools, like smart stethoscopes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Stethoscope Market

-

3M Company (Littmann Classic III, Littmann Cardiology IV)

-

Welch Allyn (Harvey DLX Stethoscope, FlexiPort Reusable Stethoscope)

-

American Diagnostic Corporation (Adscope 600 Platinum, Adscope 615 Platinum)

-

Heine Optotechnik GmbH & Co. KG (Gamma 3.2 Acoustic Stethoscope, GAMMA C3 Cardiology Stethoscope)

-

GF Health Products, Inc. (Lumiscope Professional Stethoscope, GF 110 Stethoscope)

-

Cardionics (E-Scope II, SimScope)

-

MDF Instruments (MDF MD One, MDF ProCardial C3)

-

Rudolf Riester GmbH (Riester Duplex 2.0, Riester Cardiophon 2.0)

-

Eko Health Inc. (Eko CORE Digital Stethoscope, Eko DUO ECG + Stethoscope)

-

Thinklabs Medical LLC (Thinklabs One Digital Stethoscope, Thinklabs ds32a)

-

Prestige Medical (Clinical Lite, Clinical I)

-

Medline Industries, LP (Medline Single Head Stethoscope, Medline Dual Head Stethoscope)

-

SunTech Medical, Inc. (Orbit-K Stethoscope, Tango+ with Stethoscope Option)

-

Amico Corporation (Amico Cardiology Stethoscope, Amico Sprague Stethoscope)

-

Spirit Medical Co., Ltd. (CK-S601PF Cardiology Stethoscope, CK-A603PF Acoustic Stethoscope)

-

Rossmax International Ltd. (Rossmax EB500 Cardiology Stethoscope, Rossmax EB200 Dual Head)

-

TaiDoc Technology Corporation (TD-7101 Electronic Stethoscope, TD-7100 Professional Stethoscope)

-

Narang Medical Limited (NM-205 Sprague Rappaport Type, NM-201 Deluxe Stethoscope)

-

Boen Healthcare Co., Ltd. (Boen Acoustic Stethoscope BA1001, Cardiology BA2002)

-

Honsun (Nantong) Co., Ltd. (HS-30C Cardiology Stethoscope, HS-20B Dual Head)

Recent Developments in the Stethoscope Industry

-

In January 2024, 3M Littmann launched an upgraded Bluetooth connectivity for remote diagnostics to its flagship model, the CORE Digital Stethoscope.

-

In November 2024, the company partnered with rural healthcare providers in India to distribute low-cost acoustic stethoscopes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 636.15 Million |

| Market Size by 2032 | USD 1060.49 Million |

| CAGR | CAGR of 5.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology Type (Smart Stethoscope, Electronic/ Digital, Traditional Acoustic Stethoscope) • By Sales Channel (E-commerce, Distributors, Direct Purchase) • By End-use (Home Healthcare, Hospitals, EMT/ First Responders, Clinics, Nurse Practitioners, Veterinary) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Welch Allyn, American Diagnostic Corporation, Heine Optotechnik GmbH & Co. KG, GF Health Products, Inc., Cardionics, MDF Instruments, Rudolf Riester GmbH, Eko Health Inc., Thinklabs Medical LLC, Prestige Medical, Medline Industries, LP, SunTech Medical, Inc., Amico Corporation, Spirit Medical Co., Ltd., Rossmax International Ltd., TaiDoc Technology Corporation, Narang Medical Limited, Boen Healthcare Co., Ltd., Honsun (Nantong) Co., Ltd. |