Strapping Machine Market Report Scope & Overview:

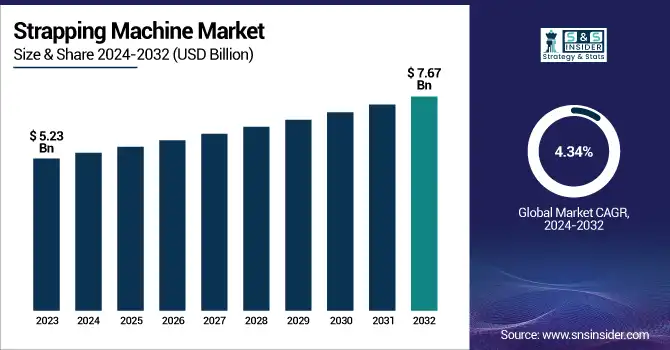

The Strapping Machine Market was valued at USD 5.23 billion in 2023 and is expected to reach USD 7.67 billion by 2032, with a growing CAGR of 4.34% over the forecast period 2024-2032. This report offers a comprehensive analysis of the Strapping Machine Market, focusing on manufacturing output, capacity utilization, and technological adoption trends across various regions. It highlights key metrics such as maintenance frequency and downtime, providing insights into operational efficiency and equipment longevity. The report also includes the latest export/import statistics, shedding light on global trade dynamics. Additionally, it tracks the rising adoption of automation and smart strapping technologies, showcasing a shift towards more efficient, tech-driven solutions in the market.

To Get more information on Strapping Machine Market - Request Free Sample Report

The U.S. strapping machine market is projected to grow steadily, with a Compound Annual Growth Rate (CAGR) of 3.93% from 2023 to 2032. The market size is expected to increase from USD 1.47 billion in 2023 to USD 2.08 billion by 2032. This growth reflects a consistent demand for strapping machines across various industries in the U.S., driven by advancements in automation and packaging efficiency.

Strapping Machine Market Dynamics

Drivers

-

The surge in e-commerce, especially in emerging markets like India, Brazil, and China, is driving demand for efficient packaging solutions to ensure product safety during transit.

E-commerce expansion, especially in emerging markets like India, Brazil, and China, is a key driver in the packaging industry. With the increasing trend towards online shopping, there has been a growing need for effective and high-quality packaging solutions that guarantee product safety all through the transportation process. With more consumers moving to e-commerce, retailers lean on safe, economical packaging to protect product integrity. This is driving the growth in strapping machine market as these machines gives strength for the packages and durability to packages so that no damages occur during long-distance shipping. So, there is also demand for customizable packaging solutions, e-commerce is not a one-size-fits-all affair, given the wide variety of products out there, from delicate to massive or off-shape products. Within both the packaging and logistics spaces, companies are embracing advanced technologies to foster more effective packaging, decrease waste and promote sustainability which represents a unique growth opportunity.

Restraint

-

High initial investment and ongoing maintenance costs of advanced strapping machines can strain SMEs with limited budgets, hindering their adoption of such technologies.

The high initial investment and maintenance costs associated with advanced strapping machines can be a significant barrier for small and medium-sized enterprises (SMEs). In addition, such machines would typically involve an automated process and a related technology, requiring a sufficiently large upfront investment to procure and install the machine. The ongoing maintenance and repair of these devices can also be quite expensive, especially if specialized knowledge or components are required. This can be daunting for SMEs that don't deal with a lot of capital, restricting their investment in such technologies. Also, these costs can reduce profitability, as businesses may be required to allocate more to the upkeep of machines than to elsewhere in the process, like product development or marketing. Consequently, a lot of SMEs might be reluctant to switch to more advanced strapping solutions, and instead selecting some entry-level or manual strapping devices that don't provide the proper efficiency and the key advantages.

Opportunities

-

IoT integration in strapping machines enables real-time monitoring, proactive maintenance, and optimized performance, reducing downtime and improving efficiency.

The integration of Internet of Things (IoT) technology in strapping machines offers significant advantages in terms of operational efficiency and maintenance. This enables manufacturers to monitor machine behaviour, identify outliers, and be notified of possible equipment failure all before a costly breakdown occurs. Performance can also be optimized thanks to IoT-based systems that can collect data on aspects such as strapping tension, cycle time, and material use. Predictive maintenance Because of IoT, companies can plan devices for repair or substitution based on the condition of the equipment rather than based on a certain, fixed timeline. It helps in minimizing unplanned downtimes and increases the life of the machines. Overall, the integration of IoT into strapping machines leads to increased productivity, lower maintenance costs, and better efficiency and effectiveness in manufacturing processes, which aligns with the trend toward smarter, more efficient manufacturing technologies.

Challenges

-

Technological advancements in the strapping machine market require continuous investment in R&D, which can be resource-intensive for manufacturers to stay competitive and meet customer demands.

Technological advancements are crucial for the growth and evolution of the strapping machine market. With industries becoming even more automated and efficient, innovative, high-performance strapping machines are in demand. In order to ensure that they remain competitive against other firms in their field and continue to please the needs of its diversified customer base constantly evolving, this fast pace of change has forced companies to make ongoing investment in R&D. Disruptive technologies like automation, IoT integration, and sustainable materials are transforming the industry. But the rollout of such technologies is resource-intensive and requires considerable financial and human capital. This development may prove challenging for the small and medium-sized manufacturers whose innovation capacity often requires substantial resource allocation to R&D. Thus, the companies that have successfully invested in new technologies and provide personalized, efficient, and sustainable strapping solutions would most likely prosper and companies failing to innovate may find it difficult to remain competitive in the market.

Strapping Machine Market Segmentation Outlook

By Product

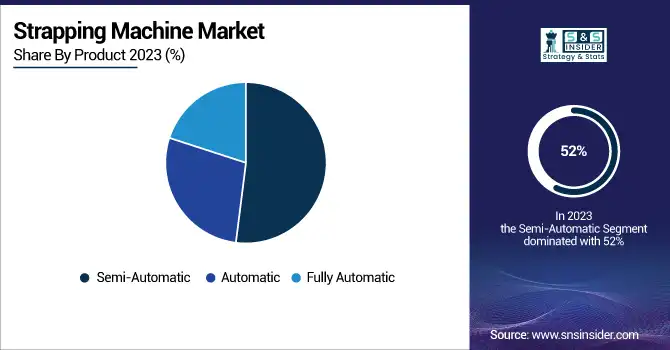

The semi-automatic segment dominated with a market share of over 52% in 2023, due to its cost-effectiveness, user-friendly operation, and broad applicability across small- to medium-sized enterprises. Such machines are especially popular in developing countries, where bodegas tend to run on smaller budgets and workers lean toward practical, low-maintenance solutions. They require little information and have a simple configuration which facilitates their introduction into the manufacturing process without the need for a costly investment in capital goods. Some common sectors relying on semi-automatic strapping machines for bundling and securing their products include food & beverage, logistics, and retail. With the pace of many regions moving towards industrialization, and the demand for packaging solutions being reliable in many sectors, semi-automatic models are still the most common hybrid available, falling somewhere between the level of manual and fully automated approaches.

By Material

The polypropylene (PP) segment dominated with a market share of over 48% in 2023, due to its affordability, lightweight nature, and versatility across various applications. Suitable for light to medium-duty packaging, corrugated cardboard is especially favored by food and beverage, consumer goods and logistics industries. The PP is completing what these sectors need as it provides high strength flexibility strapping solution to secure in a safe manner which doesn't ask for high tensile strength. Additionally, its ease of handling, recyclability, and compatibility with both automatic and semi-automatic strapping machines, play a partial role in the increasing traction of polypropylene in the aforementioned applications. Furthermore, PP strapping reduces product damage in packaging or transport, making it widely used. In addition, the rise in demand for cost-effective and efficient packaging materials is pushing polypropylene to be the leading packaging strapping material.

By Application

The Food & Beverage segment dominated with a market share of over 32% in 2023, primarily driven by the growing need for secure and efficient packaging solutions. Strapping machines are an essential component in ensuring product integrity by reducing handling and transport damage, as well as extending lifespan. Due to the high quality and efficient packaging, industry players are increasingly incorporating automated strapping systems to improve the speed, consistency, and hygiene of packaged food and drink products, driven by the exponential growth in demand for secondary packaged products matched with the rapid rise in demand for packaged food products and drinks in emerging economies. Moreover, the rising trend of convenience foods, online grocery shopping, and ready-to-eat meals globally drive the need for sustainable and more reliable packaging technologies. Thereby making Food & Beverage a major pillar for the advancement and stability of strapping machine market.

Strapping Machine Market Key Regional Analysis

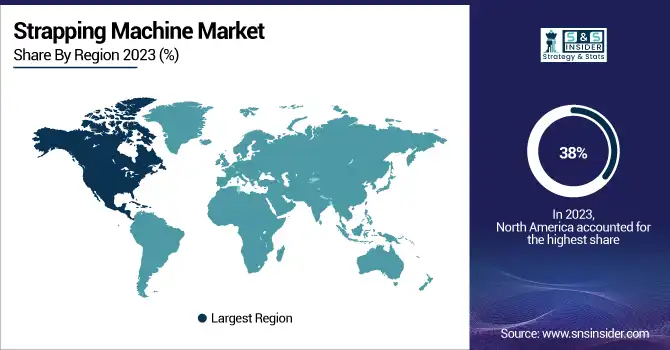

The North America region dominated with a market share of over 38% in 2023, due to its mature industrial and commercial infrastructure. High developed packaging, logistic and e-commerce industries in the region are continuously looking for efficient and automated strapping solutions to optimally perform their operations and increase productivity. Moreover, the region's market position has been bolstered by the presence of major market players and early adoption of advanced manufacturing technologies. North America being one of the major markets for strapping is focused on automation, sustainability, and product safety in various industries including food and beverage, pharmaceuticals and consumer goods. Government regulations that promote safe transportation and packaging practices further favor the market's positive growth in this region.

Asia-Pacific is projected to be the fastest-growing region in the strapping machine market, driven by a surge in industrialization and rapid expansion of the manufacturing sector. Many nations, including China, India, Japan, and Southeast Asian countries, are experiencing a surge in demand for packaging solutions that are automated and productive. Furthermore, the rising e-commerce industry along with the increasing exports has created a high demand for reliable packaging systems, which in turn is promoting the utilization of these strapping machines. Furthermore, supporting elements such as infrastructure improvement, foreign direct investments (FDIs), and supportive government policies regarding manufacturing and automation will also help accelerate this market. Global companies are attracted by cost-effective production when innovating in strapping technologies and, together with the supportive manufacturing infrastructures in Asia-Pacific, the region is set to become a key area for future growth in strapping technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Strapping Machine Market key players are:

-

Dynaric Inc. (D-2400 High-Speed Bottom-Sealing Strapping Machine)

-

Fromm Holdings AG (Automatic and Semi-Automatic Strapping Machines)

-

Messersì Packaging S.r.l. (Packaging Machinery and Strapping Machines)

-

MJ Maillis S.A. (Strapping Machines, Stretch Films, Protective Packaging Solutions)

-

Mosca GmbH (SoniXs® Ultrasonic Sealing Strapping Machines)

-

Polychem Corporation (Strapping Machines and Tools)

-

Samuel Strapping Systems (Strapping and Packaging Systems, Tools, and Accessories)

-

StraPack Inc. (Strapping Machines, Tools, and Packaging Materials)

-

Strapex Group (Strapping Machines and Tools)

-

Transpak Equipment Corp. (Strapping Machines and Packaging Equipment)

-

Signode Packaging Systems Corporation (Strapping, Wrapping, and Protective Packaging Systems)

-

Wulftec International Inc. (Stretch Wrapping Machines, Strapping Systems, Conveyor Systems)

-

Packway Machines (Coil Strapping Machines)

-

Sri Sai Pack (Box Strapping Machines)

-

Packmach Systems (Strapping Machines, Carton Sealing Machines, Shrink Machines)

-

Alligator Automations (Strapping Machines and Packaging Equipment)

-

Millennium Group (Strapping Machines and Packaging Solutions)

-

Quality Strapping (Strapping Machines and Tools)

-

Reisopack SL (Strapping Machines and Packaging Equipment)

-

InnovaGroup (Strapping Machines and Packaging Solutions)

Suppliers for (broad range of packaging solutions, including strapping machines, tools, and consumables) on the Strapping Machine Market

-

Signode Industrial Group

-

Mosca GmbH

-

Strapex Group

-

FROMM Group

-

Dynaric, Inc.

-

ITW Signode

-

Beckhoff Automation

-

Samuel Strapping Systems

-

PAC Strapping Products

-

Transpak Equipment Corp

Recent Development

In February 2025: Mosca and Reisopack merged to create MoRe Packaging Group S.L., with the goal of expanding their footprint in the Spanish market. This collaboration brings together their expertise to offer improved packaging solutions and services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.23 Billion |

| Market Size by 2032 | USD 7.67 Billion |

| CAGR | CAGR of 4.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Semi-Automatic, Automatic, Fully Automatic) • By Materials (Steel, Polypropylene, Polyester) • By Application (Food & Beverage, Consumer Electronics, Household Appliances, Newspaper & Graphics, Metal, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dynaric Inc., Fromm Holdings AG, Messersì Packaging S.r.l., MJ Maillis S.A., Mosca GmbH, Polychem Corporation, Samuel Strapping Systems, StraPack Inc., Strapex Group, Transpak Equipment Corp., Signode Packaging Systems Corporation, Wulftec International Inc., Packway Machines, Sri Sai Pack, Packmach Systems, Alligator Automations, Millennium Group, Quality Strapping, Reisopack SL, InnovaGroup |