Structural Health Monitoring Market Report Scope & Overview:

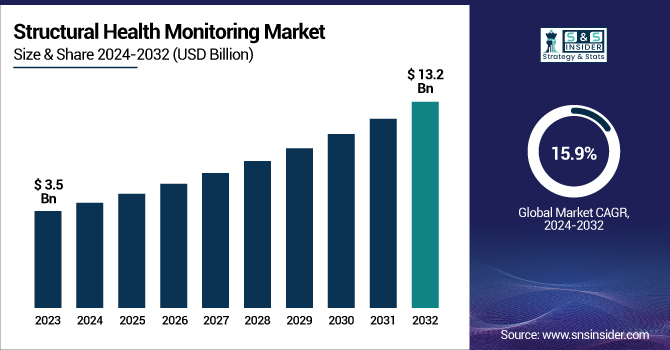

The Structural Health Monitoring Market Size was valued at USD 3.5 Billion in 2023 and is expected to reach USD 13.2 Billion by 2032, growing at a CAGR of 15.9% over the forecast period 2024-2032.

To Get more information on Structural Health Monitoring Market - Request Free Sample Report

The high growth of the structural health monitoring (SHM) market is due to governments focusing greater attention on infrastructure safety, sustainability, and the need for investment over the next decade. In 2023, the U.S. Federal Highway Administration reported that more than 43% of bridges in the United States were either structurally deficient or functionally obsolete, calling for advanced monitoring systems for structural health and framework maintenance. Faced with aging or failing infrastructure, governments across the globe are installing tough regulations to better protect infrastructure. Take the example of the Green Deal by the European Commission where in its secondary section states that creatively improving the background of infrastructure needs without compromising the sustainable & safe infrastructure of developing countries will surely introduce its effects on demand of SHM technologies throughout Europe.

Rising investments in urbanization along with a growing focus on disaster-resilient infrastructure are also fueling the market. With the development of smart cities and modernization of transportation networks, particularly in developing economies, governments are investing huge amounts of money in these infrastructures in Asia-Pacific and Latin America and this is driving the adoption of smart health monitoring (SHM) systems. In 2023, the U.S. Department of Transportation allocated more than $50 billion for infrastructure improvements, including the use of SHM to monitor bridges, dams, and other critical infrastructure. The increased demand for lowering maintenance costs and safety of infrastructure projects is also increasing the demand for SHM solutions, especially in regions with large transportation and civil construction of infrastructure projects. Providing this in various governments that are focused on improving public infrastructure while mitigating environmental impacts generated by construction will increasingly look for vigilant SHM solutions.

Structural Health Monitoring Market Dynamics

Drivers

-

The increasing need for automated maintenance and repair systems, especially in critical infrastructures such as bridges, dams, and buildings, is driving the SHM market's growth.

-

The growing frequency of natural disasters such as earthquakes, floods, and hurricanes has heightened the demand for advanced monitoring systems to ensure infrastructure safety.

-

The development of sophisticated wireless sensors and Internet of Things (IoT) technology is enhancing the efficiency and accuracy of SHM systems, driving their adoption across various industries.

The increasing demand for automated maintenance of critical infrastructure is one of the primary factors driving the Structural Health Monitoring (SHM) market. Aging infrastructure, coupled with the higher frequency of extreme weather events, has made the need for monitoring of structures like bridges, dams, and even skyscrapers critical for their safety and longevity. Automated SHM systems employ sophisticated sensors and technologies to gather real-time data on the condition of the structures, allowing for early warning of potential problems without the need for physical inspections. As a result, maintenance is carried out faster and cheaper because necessary major repairs can be avoided. To illustrate, the wireless sensors in bridges enable real-time monitoring of strain and displacement which is a proactive maintenance strategy .

The growing importance of automated monitoring is also driven by the need to meet strict safety regulations. As an example, in the USA, the law of the Federal Highway Administration (FHWA) has been changed and more careful bridge monitoring is being implemented, which is one of the major drivers of the adoption of SHM technologies. In addition, interest in SHM systems has become widespread after natural disasters such as earthquakes and hurricanes to evaluate and monitor the health of structures and infrastructure after being impacted. This embedded motion is primarily reflected in the shift towards automated systems (both the selves and others) to ensure structures are more durable, have a better lifespan, and guarantee safety, but have also aided in the construction of smarter and more sustainable cities and other infrastructures around the world.

Restraints:

-

The significant upfront cost associated with installing SHM systems and maintaining them remains a major challenge, limiting adoption, particularly in smaller projects.

-

The complexity involved in interpreting the vast amounts of data collected by SHM systems can be a barrier, as it requires specialized expertise and advanced software

The high installation and monitoring costs of Structural Health Monitoring (SHM) systems act as one of the prime restraints for the market. The solution that is, the deployment of SHM technology, particularly in large-scale infrastructure projects comes at significant cost, including hardware, smart sensors, software, and human capital. Ongoing maintenance and data analysis can also add major costs. This can prevent smaller organizations or those with low budgets from implementing SHM systems. Again, the cost is an issue, and even more so as the installation process is complex and the monitoring equipment is often very specialized, and so very expensive making it difficult but keep in mind very costly for some sectors to justify such a purchase. Even if there is a clear long-term return on investment with earlier damage detection, projects associated with government and infrastructure may struggle to set aside the funds to implement these technologies precisely because of a longer return on investment. The financial drawback is one of the main barriers preventing effective adoption of SHM systems, particularly in budget-limited areas.

Structural Health Monitoring Market Segment Analysis

By Solution

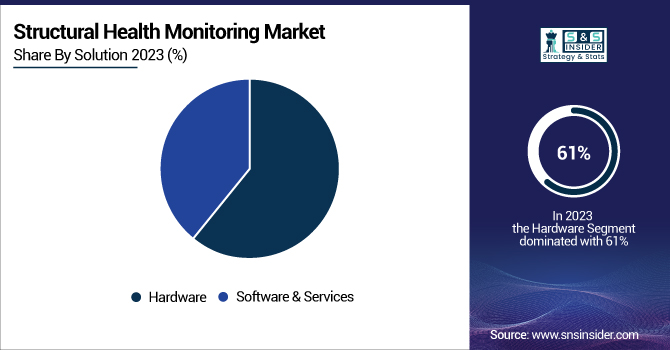

The hardware segment led the market in 2023 with the largest revenue share of over 61%. This dominance is mainly fueled by diverse hardware elements, including sensors, data acquisition systems, and structural components, that play a key role in state-of-the-art monitoring of conditions of different structures. These hardware devices are fundamental to the collection and real-time processing of data to identify faults and so confirm the safety of infrastructures including bridges, dams, and buildings. Translating SHM architectures into equipment, this demand for hardware solutions has increased over the last decade due to the great uptake of SHM solutions in critical infrastructures such as transportation networks and buildings.

This trend is being fueled in large part by governments around the world. Investments by various bodies such as the U.S. Federal Highway Administration in smart technologies such as fiber optic sensors and wireless monitoring systems for bridges and highways have also been bolstering hardware segment growth. Over €100 million of funding was offered through the European Union’s Horizon 2020 program specifically for research and development of SHM hardware technologies that can be used to create safer and more sustainable bridges and highways in 2023. The growing requirement for timely and precise information for evaluating infrastructure status has also spurred greater dependence on state-of-the-art hardware solutions. In addition, hardware solutions play an integral part in predictive analytics that lessen the lifecycle expenses of infrastructure, a prime aspect of concern for governments and organizations around the world. The availability of several proposed advanced materials and devices such as piezoelectric sensors and wireless sensor networks further propel the hardware segment growth.

By Technology

In 2023, the wired SHM segment held the highest revenue share at 58%. The reason for this consistent appearance of wired SHM systems is their reliability, clear long-term data, and cost efficiency in long-term monitoring projects. Such systems provide the reliable performance and real-time monitoring capabilities needed for critical infrastructure. Wired SHM technologies, such as strain gauges, accelerometers, and displacement sensors, are particularly popular for monitoring large and stationary infrastructure like bridges and dams, which require a stable and uninterrupted power source.

Government investments and initiatives have been key drivers in the adoption of wired SHM solutions. This growth was mainly due to the installation of wired SHM systems in critical bridges in the US on account of the ongoing U.S. Department of Transportation's Bridge Maintenance and Safety Program which has earmarked funds for this type of bridge. Moreover, a range of European Union-based SHM projects, including the SmartBridge Initiative, have been based on wired SHM technologies for the real-time monitoring of several bridges, addressing the need to mitigate bridge failure as well as improve public and structural safety. Such systems are highly modular and provide accurate data for long-term assessment, and thus governments are also using wired solutions within their infrastructure safety programs. As a result, wired SHM systems continue to be the preferred choice for large-scale monitoring applications, despite the growing interest in wireless alternatives.

By Application

The bridges and dams segment held the largest revenue share of more than 33% of overall structural health monitoring in 2023. The significant share of this segment is due to the critical role that bridges and dams play in transportation and water management infrastructure, respectively. These structures, however, are susceptible to aging, environmental stress, and natural disasters, and governments around the world invest significant amounts into ensuring their safety, stability, and durability.

For instance, the U.S. Federal Highway Administration allocated $2 billion in 2023 for the monitoring and rehabilitation of bridges, a large portion of which was directed toward SHM technologies. Demand for SHM technologies is also being boosted due to the incorporation of SHM technologies in dam safety programs by the U.S. Army Corps of Engineers, also conducting similar work by USACE, which has also been incorporating SHM technologies in its dam safety programs. Likewise, some European countries are also funding SHM projects targeted at large dams and bridges through a national infrastructure program with an emphasis on safety quantification and risk mitigation. These facilities also need to be monitored as extreme weather events including floods and earthquakes have become more frequent. In bridges and dams, SHM allows real-time understanding of physical conditions, which helps to repair and avoid disastrous failures. Governments around the world are increasingly focusing on ensuring the safety of these structures, thus the bridges and dams application is expected to register the highest growth in the coming years for SHM solutions.

Structural Health Monitoring Market Regional Overview

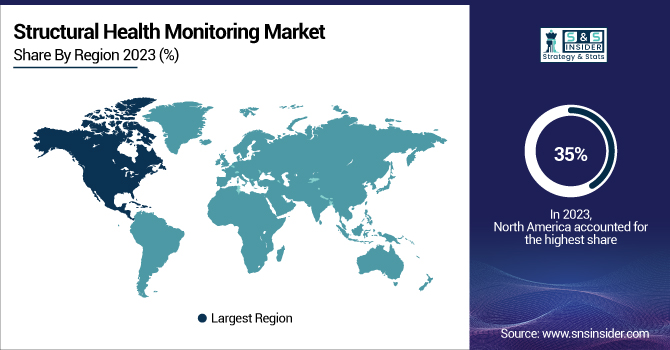

The North American structural health monitoring (SHM) market accounted for the largest revenue share of more than 35% in 2023. This is due to large-scale investments and initiatives taken by government and private sector companies to upgrade and maintain aging infrastructure, thus forming the larger share of the dominant region. In particular, the growth is driven by the U.S. with a massive need to keep a close look at infrastructure that is getting old and a constant need to help make it safe and reduce maintenance costs. As per the U.S. Federal Highway Administration (FHWA) on their 2023 census report, close to 43% of the bridges are classified as structurally deficient or functionally obsolete which validates the potential benefits of employing advanced SHM systems for monitoring this critical infrastructure.

Government projects have played a significant role in promoting SHM technologies. As an example, the U.S. federal government funded over 1.2 trillion dollars with the Infrastructure Investment and Jobs Act (IIJA) which provides billions to support infrastructure upgrades and the installation of SHM systems. The funding is part of the U.S. Department of Transportation for modernizing infrastructure by placing SHM technologies onto critical transportation infrastructures such as bridges, tunnels, and highways.

The structural health monitoring market is anticipated to have the highest region-wise compound annual growth rate (CAGR) in Asia-Pacific, which held a significant market share in structural health monitoring in 2023. Such growth is mainly provided by fast urbanization and infrastructure boom in nations such as China, India, and Japan. Countries are spending a lot to modernize the infrastructure and improve public safety, which is accelerating the demand for SHM solutions to monitor bridges, tunnels, and other critical infrastructures in the region. Spendings of a few billion bucks were made in China as one realizes smart cities where SHM technologies are used for infrastructure monitoring in real-time.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Structural Health Monitoring Market

Service Providers / Manufacturers

-

Geosense (GeoTDR, GeoRadar)

-

National Instruments (NI CompactRIO, NI LabVIEW)

-

Vibrant Technology, Inc. (VibraMAT, VibraMEASURE)

-

GeoSIG (GeoLite, GeoDAS)

-

Kinemetrics, Inc. (Strong Motion Seismic Sensors, K2 Seismic Accelerometer)

-

HBK (Hottinger Brüel & Kjær) (VibroFlex, HBM QuantumX)

-

RST Instruments Ltd. (Vibrating Wire Strain Gauges, Multi-Channel Data Logger)

-

Sisgeo Srl (Vibrating Wire Piezometer, Data Acquisition System)

-

MSI-GeoSolutions (GeoSENSE, GeoLOG)

-

FOSSA Systems (Smart Sensors, SHM System)

Users of Services/Products

-

California Department of Transportation (Caltrans)

-

United States Army Corps of Engineers (USACE)

-

Canadian Ministry of Transportation

-

London Underground

-

New York City Department of Transportation

-

Chicago Transit Authority (CTA)

-

New York Metropolitan Transportation Authority (MTA)

-

Hong Kong MTR Corporation

-

Port of Rotterdam

-

Beijing Infrastructure Investment Group

Recent Developments

-

In April 2024, Acellent Technologies, Inc. announced that it has entered a contract with Korea Aerospace Industries (KAI) to supply the SHM system for KF-21. KF-21, a 4,5-generation fighter jet, is expected to upgrade the South Korean military by substituting its old-generation fighter planes.

-

COWI A/S acquired Mannvit in May 2023 to expand its footprint in Iceland within the infrastructure, industry, environment, and renewable energy sectors. Mannvit, a recognized company within engineering, renewable energy, scientific services, and project management, will strengthen COWI's strategic competence.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.37 Billion |

| Market Size by 2032 | US$ 6.98 Billion |

| CAGR | CAGR of 14.4% From 2023 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Hardware, Software & Services) • By Application Type (Bridges & Dams, Building & Stadiums, Vessels & Platforms, Airframes & Wind Turbines, Large Machines & Equipment) • By Technology Type (Wired, Wireless) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nova Metrix, Sixense, Acellent, Campbell Scientific, Geo kon, Cowi, Geo comp, Pure Technologies, Digitexx, Structural Monitoring Systems. |

| DRIVERS | • The relevance of automated vital infrastructure repair and maintenance has grown. • Structure failures have cascading implications, like loss of life and money. • Major infrastructure investments are being made. |

| Restraints | • Costs of installation and monitoring are high. • Due to reading problems, the results are inaccurate. • In poorer nations, structural health monitoring systems are being adopted slowly. |