BOPP Films Market Size:

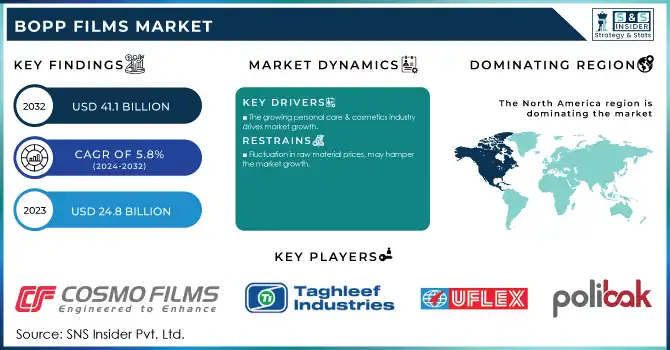

The BOPP Films Market size was USD 24.8 billion in 2023 and is expected to reach USD 41.1 billion by 2032 and grow at a CAGR of 5.8% over the forecast period of 2024-2032.

Get More Information on BOPP Films Market - Request Sample Report

The adoption of digital printing technologies has significantly driven the BOPP films market. BOPP film's compatibility with digital printing & the push for sustainable production techniques has helped this market progress in parallel as the technology gap has closed, with the adoption of digital printing technologies resulting in the proliferation of the BOPP films market. Digital printing helps with no need to compromise with exact patterns or accurate color assortments thus ensuring you get graphics with your entire life that require a few steps further to the final stage of branding and marketing purposes as well. Another reason why the manufacturers prefer BOPP films for printing is that they offer a smooth and uniform surface for excellent adhesion and clear print. This ability proves useful in creating customized and low-volume stamping pieces for niche markets and marketing efforts. Digital printing also cuts down on setup and waste, making it cheaper for businesses large and small. With consumers improving their demand for uniqueness and personalization in packaging, the potential of digital printing and BOPP films further expands innovation and market applications.

In March 2024, TOPPAN Inc. and its subsidiary, TOPPAN Speciality Films Private Limited (TSF), developed GL-SP, a barrier film utilizing BOPP as the substrate to increase its production capacity.

The BOPP (Biaxially-Oriented Polypropylene) films market has been witnessing significant growth due to the increasing demand for packaged foods. As urbanization is taking place at a huge speed and with convenience and fast-paced living prevailing, people are increasingly choosing ready-to-eat and easy-to-store, convenience food. BOPP films are lightweight, durable, and possess moisture barrier characteristics suitable for retaining freshness and increasing the shelf life of packaged foods. In addition, the rising awareness regarding food safety & hygiene is further increasing demand for reliable and tamper-evident packaging, in which BOPP films are ideal. This demand has been further driven by the growth of the e-commerce industry as BOPP films provide safe transportation of food items. This trend is especially notable in emerging economies, attributable to rising disposable incomes and changing dietary patterns that are driving growth in packaged food consumption, thereby stimulating the global BOPP films market growth.

In 2024, Innovia Films introduced new sustainable products, such as Bicor 25 and 30 MBH568. These films are motive at the flexible packaging and labeling industries, meeting the new European mechanical recycling guidelines.

BOPP Films Market Dynamics

Drivers

-

The growing personal care & cosmetics industry drives market growth.

The increasing personal care and cosmetics sector is one of the major factors bode with the growth of BOPP films market. With grooming, wellness, and beauty now top of the consumer agenda, the personal care segment, including skincare, haircare, and cosmetics, were the notches around which growth was driven. The high protection, freshness, and attractive look with quality printing BOPP films are widely used in this industry. These films provide better clarity and make sure to showcase branding and product details appealingly. Moreover, they are resistant to moisture, and durable enough that they are perfect for wrapping and sealing cosmetics, which usually need airtight and tamper-proof packages. With booming especially in the developing regions, disposable income of individuals increasing the consumption of personal care and cosmetics, BOPP films for personal care and cosmetics packaging are projected to witness considerable demand throughout the forecast period.

According to the Indian government’s Ministry of Commerce and Industry, the Indian cosmetic and personal care industry is expected to grow at a robust pace, with the total market size surpassing USD 20 billion by 2025. This growth is driven by rising disposable incomes, urbanization, and changing consumer preferences. The demand for packaging materials, including BOPP films, in this sector will likely grow in parallel to this expanding market.

Restraint

-

Fluctuation in raw material prices, may hamper the market growth.

The growth of BOPP films market is hindered by the high fluctuation of raw material prices especially the price of polypropylene. BOPP films are manufactured from a primary raw material called polypropylene (a derivative of petroleum), which is majorly affected by the global market, such as changes in crude oil prices, supply chain disrupt, and geopolitical disputes. Such variations trigger unpredictable rising of production costs which may result in price instability of BOPP films. This may make it difficult for manufacturers to hold pricing, with smaller producers likely to have trouble absorbing these changes in cost without taking a hit to the bottom line. Moreover, elevated costs of raw materials could compel businesses to pass on the higher costs to consumers, which may lead to a decline in market demand for BOPP films, more so in price-sensitive markets. The volatility in raw material expenses also makes investors shy about putting money in the market and limits the BOPP films market from growing fully.

BOPP Films Market Segmentation

By Type

In 2023, bags & pouches accounted for the largest revenue share of the market at 56%. The bags & pouches segment is leading the market share as they are widely used for food processing and consumer goods packaging. This is critical for keeping products fresh and prolonging their shelf life, which is why they provide great HDPE Barrier properties, durability, and printability. This segment is expected to witness growth due to emerging demand for flexible packaging solutions, thereby offering consumers convenient and reliable packaging options. Additionally, bags and pouches are lightweight and space-efficient, which helps in reducing transportation costs. With the rising demand for convenience and single-serving packaging, particularly in the food and beverage sector, bags and pouches provide an ideal solution for easy storage, portability, and shelf display. Furthermore, their ability to preserve product freshness, extend shelf life, and offer tamper-evident features has made them increasingly popular in the packaging of perishable goods

By Thickness

The market for 15-30 microns dominated as the largest revenue share of 38% in 2023. This segment is a large part of the market, with a compromise between flexibility and strength. These films are increasingly used in a number of applications, ranging from packaging for foods and beverages to personal care products due to their excellent barrier properties and durability.

The 30–45-micron group lends itself to the higher-end applications where increased protection and mechanical properties are needed, like in industrial packaging and heavy-duty wraps.

By Production Process

The tenter process held the largest market share around 60% in 2023. The process of the so-called tenter frame stretch film in machine direction (MD) and transverse direction (TD) provides BOPP films with a unique enhancement of their mechanical properties, including improvement in strength, clarity and dimensional stability. It is followed by orienting these layers further, enhancing their optical properties thus attaining high gloss of films, very good printability and suitability for multiple packaging solutions. These films are known for their superior moisture, chemical, and temperature resistance and are widely used in the packaging of food, cosmetics, and other consumer goods that require attractive and effective packaging after being produced by the tenter process. Moreover, the tender process is versatile and scalable, enabling the manufacture of films with different thicknesses and properties, making it easier to meet the requirements of different markets. Higher quality of film coupled with high producing efficiency has made tenter to emerge as the prevailing technology in BOPP films market; largest revenue share of the market.

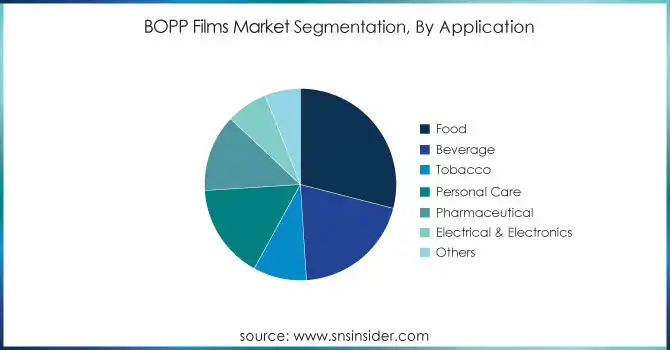

By Application

The food segment held the largest market share around 29% in 2023. The use of BOPP films is very common in food packaging as it provides exceptional barrier properties that keep the contents safe from moisture, air, and other contamination and thus increase the shelf life of perishable products. These films provide not only better clarity and printability but also the capability for bright, striking packaging that stands your brand out on the shelf and attracts your customers. Furthermore, BOPP films are convenient and inexpensive, thus enabling the packaging of a huge range of food products, such as snacks, baked goods, frozen foods, and ready-to-eat meals. With the increasing trend of packaged and processed foods due to urbanization, busy lifestyles of consumers, and changes in taste and preference towards convenient food, the requirement of rigid and superlative food packaging material such as BOPP films has increased. Robustness, as well as barrier protection and aesthetics, has made this segment the biggest for BOPP films, irrespective of the application food remains the largest segment in the BOPP films market.

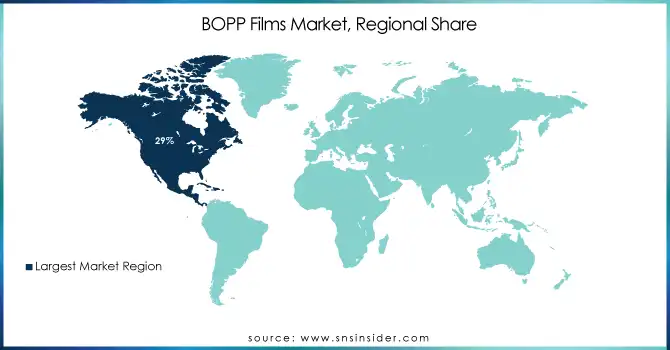

BOPP Films Market Regional Analysis

North America held the largest market share around 29% in 2023. It owing to the well-established packaging industry, advanced technological infrastructure (rising technologies for manufacturing BOPP films) and high demand for sustainable and high-quality packaging solutions in various end-use industries. High applicability of BOPP films in packaging dependent on strong food & beverage, personal care, and consumer goods sectors reinforces the growth of the market in this region. Further, packaged products emphasizing convenience, freshness and sustainability are highly preferred by North American consumers, further boosting demand for BOPP films. In addition, the region is boosted with large investments of innovation and research which results in advanced BOPP films with the improved barrier properties & recyclability as performance attributes of the BOPP films. In addition, the growing focus on sustainability by government regulations and along with industry standards across North America led to the development of packaging manufacturers to provide sustainable solutions such as BOPP films. These factors allow North America to keep its position as the largest market for BOPP films, advancing rapidly due to technological advancement, and changing consumer behavior.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Cosmo Films Ltd. (Cosmo Sensa, Cosmo Polyester Films)

-

TAGHLEEF INDUSTRIES GROUP (TALATEX, THERMOLAM)

-

POLİBAK PLASTİK (Polibak BOPP Films, Polibak Lidding Films)

-

UFlex Limited Inc. (FlexPET, UFlex BOPP Films)

-

SRF Limited (SRF BOPP Films, SRF Specialty Films)

-

NAN YA PLASTICS CORPORATION (NyFilm, NyBond BOPP Films)

-

Vacmet India Ltd (Vacmet BOPP Films, Vacmet Lamination Films)

-

Tatrafan, s.r.o (Tatrafan BOPP Films, Tatrafan Metallized Films)

-

ObenGroup (Oben BOPP Films, Oben Clear Films)

-

FlexFilms (FlexPET, FlexBOPP Films)

-

SIBUR (BOPP SIBUR, SIBUR PET Films)

-

Toray Plastics (Torayfan, Toray BOPP Films)

-

Political SA (POLYBOPP, POLYFILM)

-

Jindal Poly Films Limited (Jindal BOPP Films, Jindal CPP Films)

-

Inteplast Group (Inteplast BOPP, Inteplast Metalized Films)

-

Kraton Polymers (Kraton BOPP Films, Kraton Coated Films)

-

Mitsubishi Polyester Film (Mitsubishi BOPP, Lumirror)

-

AEP Industries Inc. (AEP BOPP, AEP Specialty Films)

-

MOPET (MOPET BOPP Films, MOPET Laminating Films)

-

Coveris (Coveris BOPP, Coveris Stretch Films)

Recent Development:

-

In 2024, Cosmo Films launched a new range of high barrier BOPP films aimed at enhancing shelf life and freshness for the food packaging industry. This move aligns with the growing demand for sustainable and efficient packaging solutions in the food sector.

-

In 2024, UFlex unveiled an advanced high-barrier BOPP film for fresh food packaging, designed to offer better resistance to moisture, oxygen, and light, improving the overall shelf life of packaged food products.

-

In 2023, SRF launched a new range of high-performance BOPP films with enhanced properties, including higher resistance to UV rays and better sealing capabilities. These films are expected to benefit the packaging of perishable goods.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 24.8 Billion |

| Market Size by 2032 | US$ 41.1 Billion |

| CAGR | CAGR of 5.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

•By Type (Wraps, Bags and Pouches, Tapes, Labels, Others) •By Thickness (Below 14 microns, 14-30 microns, 30-45 microns, More than 45 microns) •By Production process (Tenter, Tubular) •By Application (Food, Beverage, Tobacco, Personal Care, Pharmaceutical, Electrical & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cosmo Films Ltd., TAGHLEEF INDUSTRIES GROUP, POLİBAK PLASTİK, UFlex Limited Inc., SRF Limited, NAN YA PLASTICS CORPORATION, Vacmet India Ltd, Tatrafan, s.r.o, ObenGroup, FlexFilms, SIBUR, Toray Plastics, Political SA, Jindal Poly Films Limited, Inteplast Group, and other players. |

| Drivers | •The growing personal care & cosmetics industry drives market growth. |

| Restraints | •Fluctuation in raw material prices, may hamper the market growth. |