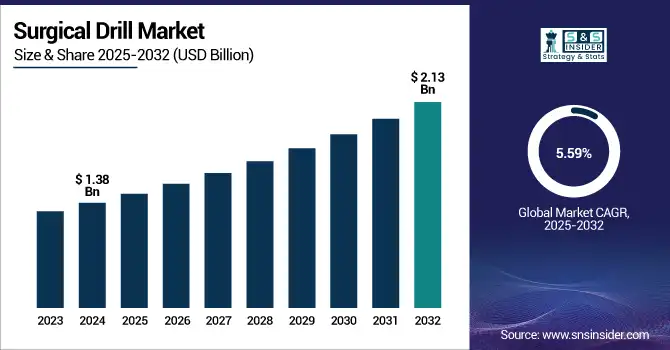

Surgical Drill Market Size Analysis:

The Surgical Drill Market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.13 billion by 2032, growing at a CAGR of 5.59% over the forecast period of 2025-2032.

The global surgical drill market is undergoing a growth momentum owing to its prevalence in several extremity procedures globally, technological advancements, and expanding healthcare budgets. (The number of surgical procedures has increased drastically, particularly in low- and middle-income countries, highlighting the increasing demand.) Hospitals and ambulatory surgical centers are increasingly turning to precision surgical tools such as electric and pneumatic drills due to increased speed, accuracy, and patient outcomes.

To Get more information on Surgical Drill Market - Request Free Sample Report

According to the Centers for Medicare & Medicaid Services (CMS), spending on healthcare has grown steadily, including the cost of advanced surgical instruments. Additionally, the U.S. surgical drill market is complemented by favorable reimbursement policies and strong investments in research and development, which are reflected in the number of NIH and PubMed-based publications.

As reported by The American Journal of Medicine in 2024, the number of U.S. neuroscience centers using battery and MRI-compatible technology for surgical drills has risen by 25%. This is helping to make surgeries safer and more efficient.

Computer-aided systems and robotics in neurosurgical and orthopedic drills are promising improvements that could improve procedural results, as demonstrated in the neurosurgery transformation programs at the Mayo Clinic. Moreover, lifecycle management reports on medical equipment, such as those published by THET and ACCE, highlighted the potential value of preventive maintenance and lifecycle planning, which can lead to longer-lived and more effective surgical drills, better supply chains, and cost savings. An increase in the geriatric population, a high prevalence of orthopedic-related diseases, and trauma cases is boosting the demand for the surgical drill market in developing countries. Additionally, regulatory developments such as the accelerated approval by the FDA of innovative drill systems through the 510(k) process make product entry even easier and encourage innovation. Global health collaborations dedicated to supplying modern cutting devices to underserved areas are also helping to buoy the global surgical drill market.

For instance, according to CMS Highlights Report and CDC statistics, a lot of money is being invested in surgical facilities and modern medical equipment should create a good market future for surgical drill and technologies’ development for companies such as Stryker and Medtronic.

Surgical Drill Market Dynamics:

Drivers:

-

Surge in Complex Surgeries and Strategic Industry Collaborations Accelerate Market Demand

One of the key factors fueling the expansion of the surgical drills market is the rise in patients with complex cranial, spinal, and maxillofacial procedures that necessitate precision drilling. The demand for neurosurgery has grown steadily (by about 18%) in the last five years, from trends in conditions such as brain tumors and spinal deformities, as published in the Journal of Neurosurgery report. This requirement is triggering drills integration with imaging platforms and navigation systems. Strategic alliances between hospitals and major players of the surgical drill market, for instance, Zimmer Biomet’s collaboration with Brainlab, are resulting in the creation of smart, sensor-equipped drills that offer instant feedback.

The U.S. surgical drill market is being supported by federal investment under programs such as the Advanced Research Projects Agency for Health (ARPA-H), which is providing multimillion-dollar grants for the development of new surgical instrumentation. Moreover, recommendations from organizations such as AORN (Association of periOperative Registered Nurses), focusing on safety and cost savings, have necessitated healthcare institutions to discard old-fashioned, hand-operated drills for new electric/battery-driven models. Increasing preference for day-care surgeries and outpatient surgical centers is further driving the demand for lightweight and portable drills. This shift in product is reinforcing the market, potentially driving the next cycle of innovation in the surgical drill market analysis, as modernisation happens in operating rooms in all hospitals.

Restraints:

-

Regulatory Complexities and Training Gaps Pose Operational and Adoption Challenges, Hindering Market Growth

The FDA, EMA, and other regulatory agencies mandated that for Class II and Class III surgical devices, technical files, usability studies, and post-market clinical follow-up be provided, which increased the timelines for development of the devices. For instance, due to delays in EU MDR certification in 2023, more than 14,000 devices were stuck in the queue for conformity assessment, including surgical power tools. The lack of harmonization between regional standards further complicates matters for multinational surgical drill companies attempting to globally PIF a single device. From the operational view, one of the most important challenges is the lack of knowledge of the new generation surgical tool.

Fewer than half of junior surgeons who were defined as having less than five years of experience felt very confident operating a powered surgical tool, according to one study published in The Journal of the American College of Surgeons, pointing to a skills gap that can affect procedural safety. Rural hospitals and undersourced areas can sometimes find it difficult to place certified technicians and trainers, so advanced training exercises are often less effective and not used enough. Moreover, fear of thermal injury, drill-bit breakage, and device overheating reticence surgeons unfamiliar with high-speed drills to adopt the technology. These interconnecting regulatory and learning curves are still a primary deterrent to the surgical drill market growth.

Surgical Drill Market Segmentation Analysis:

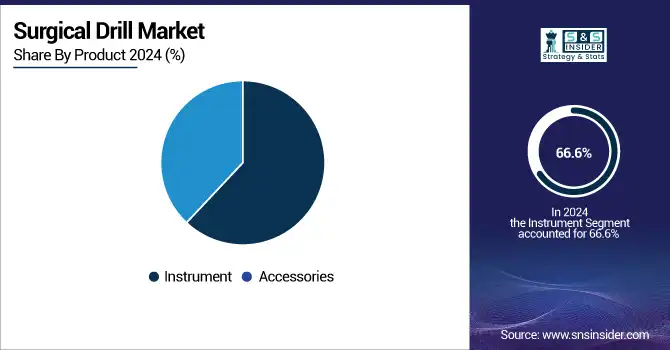

By Product

The product segment that dominated the surgical drill market is instruments, and it collected 66.6% of the total revenues in 2024. The market power wielded by powered surgical drills is also a result of the high adoption in intricate surgical interventions such as neurosurgical, orthopedic, and maxillofacial surgeries. Electrical and battery-driven drills are also being used with increasing frequency in hospitals and specialized surgical centers due to their accuracy, time savings, and improved security. Surgeons prefer reusable instruments that provide better ergonomics, torque, and accept different surgical attachments. Advances in integrated navigation systems and robotics in surgery have further increased the demand for surgical drill instruments of advanced technology. When you consider the long-term usability and efficiency of such devices, their initial prices are less of a concern.

During 2025-2032, the accessories segment, across the global surgical drill market, is anticipated to be registering the highest CAGR. Supplementary parts such as drill tool, burr, battery, charger, and sterilization tray are the parts for supporting operation and customization in surgical drill. These parts, unlike tools, typically need to be replaced often due to sterilization-induced damage, wear, or modified procedures. A growing trend toward less invasive/specialty-specific surgeries has resulted in the need for more customized accessory packs.

By Application

In 2024, the orthopedic surgeries held a dominant position in the surgical drill market share of 46.2%. This leadership comes from the global boom in trauma, sports injury, and joint replacement surgery, all of which involve precision drilling into bone. This demand is largely due to the growing geriatric population exposed to osteoarthritis and fractures. Moreover, increasing the orthopedic implant technology, such has been patient-specific implants, and robotic-assisted surgery is fueling demand for high-performance drills. These drills allow surgeons to gain maximum control, accuracy speed, especially necessary in cases such as spinal fixation and total knee or hip arthroplasty.

Dental surgeries are estimated to be the largest market of the surgical drill market during the forecast period of 2025 to 2032. Growth in this segment is primarily attributed to the growing demand for dental implants, root canal treatments, and cosmetic dentistry, and the rapid adoption of advanced technologies in the dental 3D printing market. Small, high-speed, precision-controlled drills are necessary for dental applications involving small anatomical spaces and high rotational speed. Increasing incidence of dental diseases, along with increasing demand for aesthetics, is driving the procedural volumes globally. Cosmetic and restorative dentistry is increasing, especially among aging and urban people, according to the American Dental Association.

By End Use

The leading end user of the surgical drill market is hospitals and clinics, which held a share of 53.3% of the market in 2024. They'll also grow faster than the others through 2032. These facilities are high-volume performers for surgery in all specialties (orthopedics, neurosurgery, and dental reconstructions). Early adoption of innovative surgical technologies such as robotic systems and artificial intelligence-powered drills is possible, given access to high-end infrastructure, expert staff, and procurement budgets. Increasing incidence of non-communicable diseases necessitating surgical treatment, including degenerative bone diseases and dental diseases, has also increased the footfall of patients visiting the hospital.

Regional Insights:

North America led the global surgical drill market in 2024 on account of a developed healthcare system, massive investment in surgical technologies, and a large number of orthopedic and neurosurgical procedures in the region. The U.S. surgical drill market size was valued at USD 0.41 billion in 2024 and is expected to reach USD 0.55 billion by 2032, growing at a CAGR of 3.97% over the forecast period of 2025-2032, driven by a strong R&D ecosystem, fast uptake of innovative surgical products, and the presence of key players such as Stryker and Medtronic. The U.S. represented more than 38% of total global surgical procedures in 2023, which reflects robust demand for precision instruments, including surgical drills. Canada also plays a leading role due to its universal healthcare system and increasing number of elderly citizens. There has been an increasing number of public-private hospital partnerships in Mexico and greater access to surgical care. The area is expected to continue to dominate, as technology is adopted and new devices are given regulatory approval.

European surgical drill is growing due to various factors such as an upsurge in the number of orthopedic and neurosurgery being carried out, a rise in the expenditure on health, and supportive government policies for healthcare upgradation. Countries such as Germany are ahead in the region in terms of several surgeries. Germany itself conducts over 2 million orthopedic surgeries every year, and such high numbers of surgeries are responsible for a high demand for surgical drills. The market is facilitated by strict regulations as the CE Mark, which guarantees a high-quality and safe product, and so paves the way for acceptance and use of new surgical devices. Moreover, countries such as the UK and France are heavily investing in advanced health care infrastructure, and minimally invasive surgical technologies are also fueling the market upsurge. Ageing populations and growing rates of lifestyle-related illnesses in Italy and Spain are also driving demand for surgery. The European market is anticipated to continue to grow at a steady pace on account of continuous R&D investments, joint healthcare initiatives, and supportive reimbursement policies that uphold the use of sophisticated surgical devices.

The APAC surgical drills market is projected to grow at the highest CAGR across all global regions due to growing healthcare infrastructure, huge population base, and rising number of surgical procedures in the region. Asia Pacific is led by China, attributable to significant government spending on healthcare modernization in the form of “Healthy China 2030,” which has augmented production and usage of surgical technologies in the region. More than 1.5 million orthopedic procedures were conducted in China in 2023, demonstrating the huge market for precision surgical drills. Another important growth factor is India, with its growing trauma workload, a middle class demanding better healthcare facilities, and a proliferation of specialty hospitals with their high-end instruments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Surgical Drill Market Key Players:

Leading surgical drill companies operating in the market are Arthrex, Inc., B. Braun SE, Medtronic, Johnson & Johnson Services, Inc., Stryker, Apothecaries Sundries Manufacturing Co., ConMed Corporation, 3M, MicroAire, and Zimmer Biomet.

Recent Developments in the Surgical Drill Market:

-

In January 2025, the South East Regional Health Authority (SERHA) defended its JUSD 31 million purchase of a neurosurgical drill, highlighting its importance in expanding neurosurgical treatment capacity in Jamaica.

-

In March 2024, Genome BC invested USD 1.13 million in a pioneering initiative to enhance surgical care for skeletal traction, advancing orthopedic surgical precision and patient recovery outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.38 Billion |

| Market Size by 2032 | USD 2.13 Billion |

| CAGR | CAGR of 5.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instrument (Pneumatic Drill, Electric Drill, Battery-Powered Drill), Accessories) • By Application (Orthopedic Surgeries, Dental Surgeries, ENT Surgeries, Others) • By End Use (Hospitals & Clinics, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Arthrex, Inc., B. Braun SE, Medtronic, Johnson & Johnson Services, Inc., Stryker, Apothecaries Sundries Manufacturing Co., ConMed Corporation, 3M, MicroAire, and Zimmer Biomet. |