PIGMENT DISPERSIONS MARKET REPORT SCOPE & OVERVIEW:

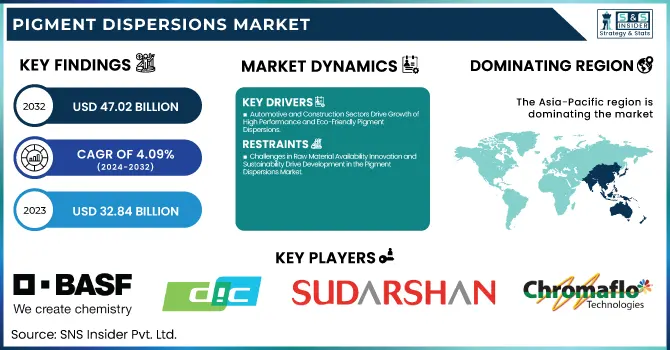

The Pigment Dispersions Market was valued at USD 32.84 billion in 2023 and is expected to reach USD 47.02 billion by 2032, growing at a CAGR of 4.09% over the forecast period 2024-2032.

Get More Information on Pigment Dispersions Market - Request Sample Report

The pigment dispersions market is booming with the rising demand for quality, bright pigments in different industries including paints and coatings, textiles, plastics, and automotive. With growing consumer demand for green and sustainable products, manufacturers are more concentrated on providing more competitive performance and environmentally safe pigments. The market is also benefiting from the increased usage of environmentally friendly products such as solvent-free and water-based pigment dispersions. In addition to this, a growing number of construction and automotive applications are placing an increased emphasis on high-performance coatings that contain improved durability and color stability, stimulating the demand for pigment dispersions. Approximately 10 million tons of pigment dispersions are consumed each year by the coatings industry, while the textile sector consumes 350,000 tons a year, making up 22% of the global pigment market. The plastics sector will need 500,000 tons, mostly for packaging and consumer products.

The increasing demands for advancements in pigmentation in packaging, printing, and personal care. With the research and emergence of e-commerce and global shopping, the need to stand apart has grown, thus demanding a design that instills visual appeal, which means innovative pigment dispersions with high wham will be needed. In addition, the increasing trend of customization of products such as providing specific colors for different applications and encouraging the manufacturers to innovate pigment dispersion technologies. In addition, the continuous growth of industrialization in developing countries will further boost the growth of the Global content disarm and reconstruction market in the coming years. More than 80% of new packaging designs in 2024 are making use of advanced pigment dispersions with deep, long-lasting colors. At least 50% of new printers in the printing sector are selecting pigment-based inks for enhanced quality and demand for UV-cured inks is growing at a rate of 11%. In personal care, 25% of new cosmetics and skincare introduce pigment dispersions to control stability, and 40% of innovation contains natural, ecological pigments.

Pigment Dispersions Market Dynamics

KEY DRIVERS:

-

Automotive and Construction Sectors Drive Growth of High Performance and Eco-Friendly Pigment Dispersions

Increasing demand for high-performance coatings in the automotive and construction sectors is one of the main factors driving growth in the Pigment dispersion market. In particular, the automotive industry has witnessed substantial technological developments in coatings as manufacturers strive for better durability, corrosion resistance, and appearance properties of vehicle finishes. With increasing consumer demand for vehicle appearance and performance, automotive manufacturers are progressively adopting advanced pigment dispersion technologies. Furthermore, increasing demand from the construction industry for sustainable, lightweight, and durable coatings is another factor fueling market growth. As a result, these industries are increasingly utilizing water-based and low-VOC dispersions especially since the stricter environmental regulations are imposing the limitation on paints and coating resources, making the pigments used therein to meet the functional requirements. By 2024, 60% of automotive coatings will be high-performance, including 10 million vehicles incorporating metallic or pearlescent finishes enabled by advanced pigment dispersions. Pigment dispersions will be used in more than 15 million square meters of coatings within the construction sector, with demand for green, low-volatile organic compound (VOC) alternatives to grow by 15%. Furthermore, due to increasing sustainability concerns the Automotive and Construction industry is expected to grow 20% of the water-based coatings.

-

Rising Demand for Sustainable Packaging Drives Growth in Pigment Dispersions Market for Food and Beverage

The growth of packaging industries, especially in the food and beverage sector, is another notable factor because pigment dispersions are the key to producing eye-appealing, functional packaging to draw consumers' attention. As E-commerce and international trade are on the rise, the need for attractive and durable packaging has increased. Packaging should be a way to communicate with the brand, protect the product, and meet the food safety rules. With the rise of eco-friendly consumer ethos, there is a high demand for sustainable packaging solutions using eco-friendly pigments. Key factors that stimulate the growth of the Pigment Dispersions Market include the development of novel, sustainable packaging materials along with the use of non-toxic and biodegradable pigments. Especially, the demand for the non-toxic nature of pigments that meet the criteria of food safety is also imported, and hence the innovations in the production of high-quality, safe, and sustainable pigment dispersions have increased accordingly. This is anticipated to broaden the market scope, thereby facilitating the growth of the sector. Sparxell is using up to 50% of plant-derived natural pigments, and about 30% of new food packaging in 2024 is prioritizing non-toxic, biodegradable pigments. In order to meet the colorful demands of e-commerce embellishments, 40% of e-commerce packaging will incorporate pigment dispersions with improved durability and branding.

RESTRAIN:

-

Challenges in Raw Material Availability Innovation and Sustainability Drive Development in the Pigment Dispersions Market

Lack of availability of raw materials, particularly among competitive and high-end pigment technology (e.g. certain organic and inorganic pigments) is one of the major challenges faced in the Pigment Dispersions Market. Challenges of extraction, processing, and supply chains create delays in production and limit how much of the material can be used by the manufacturers to meet increasing demands in the market. Also, certain chemicals in the pigment formulations are regulated by environmental authorities, limiting the available range of pigments that can be used, causing difficulties for companies that pursue balanced performance and compliance. The need for continuous innovation and development is another major challenge in dispersion technologies. The call for highly technological and functional products from the industries is pushing pigment manufacturers to achieve high quality, high stability, and high dispersion efficiency. Challenge of Developing New Dispersion Methods Relative to the Sustainability of Pigments For many players, developing new dispersion methods that enable clean and sustainable emulsions from eco-friendly and renewable pigments can prove to be a challenge due to the high technical expertise required for this process.

Pigment Dispersions Market Segments

BY DISPERSION TYPE

Solvent-based dispersions hold the largest market share of 54% in 2023 owing to their high performance in applications with high demand such as automotive and industrial coatings and some ink markets. Solvent-based dispersions offer exceptional adhesion and durability, as well as resistance to exposure to moisture and extreme temperatures, which is why industries that require top performance have turned to them. These dispersions are also highly compatible with several substrates, providing reproducible and reliable performance. Due to proven performance, solvent-based alternatives remain the top choice in industries dependent on high-performance finishes, despite rising pressure from regulators.

Water-based dispersions are anticipated to witness the fastest CAGR during 2024-2032 as a result of the increasing need for green and sustainable solutions. Because of their low volatile organic compounds (VOC) content, water-based dispersions comply with strict environmental regulations and are popular among companies that are looking to minimize their ecological footprint. The performance of water-based dispersions has been greatly enhanced with technological advances, closing the gap with that of solvent-based systems. As a result, these have found their way into applications such as decorative paints, packaging, and textiles, where environmental compliance and safety are key. The increasing consumer and industrial inclination towards environment-friendly products also encourages the move to such products, making water-based dispersions one of the major growth drivers for the next few years.

BY APPLICATION

In 2023, decorative paints and coatings accounted for the leading market share of 32% on account of their extensive application in residential, commercial, and infrastructural applications. The demand for decorative paints is directly proportional to the growth of construction activities as decorative paints beautify and embellish buildings but also offer protective features to buildings and other structures. Furthermore, the demand for decorative coatings is significantly increasing due to consumer preferences for colorful and customized interiors with growing urbanization and rising disposable income. This product also takes advantage of advances in pigment technology that features improved durability, better color retention, and properties that are supportive of sustainability trends such as low-VOC and water-based coatings.

Plastics are projected to be the fastest-growing material type from 2024 to 2032, due to their rising application across automotive, packaging, electronics, and consumer goods industries. Pigments form an important part of plastics used for color and property enhancement such as UV stability, thermal stability, and opacity. Rising demand for lighter-weight, stronger, and more aesthetically desirable products, especially in automotive and packaging, is driving the growth of plastic pigments. In addition, the growth of bio-based & recyclable plastics is providing a basis for novel sustainable-compliant resin opportunities for pigment dispersions.

BY PRODUCT

In 2023, inorganic pigments accounted for the highest market share of 53%, as they have excellent durability, and stability under extreme environmental conditions, and are cost-effective. These pigments have found extensive use in construction materials, industrial coatings, and automotive paints where durability is the key factor. High-performance applications are best suited for their resistance to heat, light, and chemicals. Tio2 is also widely used as an opacifying agent in paints, coatings, and plastics, and by its nature, it is an inorganic pigment. Their versatility in the variety of earth tones and metallic finishes they are available in only enhances their use in more both practical and decorative ways.

The organic pigments segment is projected to expand at the fastest CAGR over the forecast period from 2024 to 2032 due to their colorfulness, availability of numerous colors, and eco-friendly nature, along with high demand for packaging, textiles, and decorative coatings applications. Since these pigments come from carbon-based compounds, they are non-toxic and more environmentally friendly than some inorganic alternatives. With the ever-changing industrial world now prioritizing eco-friendly and sustainable solutions, organic pigments have gained increasing traction. Advances in technology have made organic pigments better, and easier to stabilize and mix with different materials. On the other hand, the rising use of bright and tailor-made colors in various end-use industries like fashion, consumer products, and automotive interiors is surging the consumption of organic pigments. Organic pigments are anticipated to witness growth owing to the combination of stringent environmental regulations and demand for high-performance pigments in emerging markets.

BY END USE

In 2023, building and construction led the market with a share of 34%, attributed to the wide applications of pigment dispersions in decorative paint, coating, and other construction materials. The pace of global urbanization, particularly within developing economies, has now caused a substantial increase in demand for domestic, commercial, and infrastructure growth. Pigments help bring a visual aspect to construction materials, making them more durable, UV-resistant, and weatherproof. Furthermore, government spending on housing projects and infrastructure on the national and regional fronts coupled with increasing demand for aesthetically pleasing and durable finishes place pigment dispersions at an advantage appealing to this industry.

The automotive industry is projected to be the fastest-growing end-use sector in terms of CAGR between 2024 to 2032. Automotive manufacturers are increasing their efforts for advanced pigment technologies, which help deliver unique and long-lasting finishes that reflect consumer demand for trend-setting automobiles providing high-end performance. The trend of electric vehicle (EV) manufacturing, where lower-weight materials and coatings are designed for improved energy efficiency and the attractiveness of the vehicle, is also fueling this growth. Moreover, the utilization of novel technology in pigments, which includes heat-reflective coating and self-healing coating, is paving the way for advancements in the automotive industry. The increasing vehicle production, especially in Asia-Pacific and other emerging countries, along with the increase in demand from consumers for premium finishes will create expansion opportunities for pigment dispersions in the automotive market at a rapid pace.

Pigment Dispersions Market Regional Analysis

Asia-Pacific accounted for the largest market share of 37% in 2023 and is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period as a result of rising industrialization and urbanization in developing countries of the Asia-Pacific region, coupled with the expansion of key end-use industries. This growth is primarily propelled by large-scale infrastructure projects in countries such as China, India, Japan, and several nations in Southeast Asia, growing automotive market expansion, and the increasing consumer demand for high-quality products. For example, the huge capital investments of China in urban development through projects including the Belt and Road Initiative, have driven demand for construction materials and decorative paints. Likewise, India has plenty of demand for decorative and industrial coatings for the inclusion of its "Smart Cities Mission”. Asia-Pacific is home to many of the world's largest automobile manufacturers, including Toyota, Hyundai, and Honda, as well as emerging electric vehicle manufacturers such as BYD in China that have established industry-leading production and supply chain facilities in the region. This creates demands for advanced pigment dispersions in high-performance automotive paints and coatings from these companies. Moreover, the rapid growth of e-commerce in countries such as Japan and South Korea, coupled with the rising need for attractive eco-friendly packaging is promoting the growth in the packaging market. Another big contributor is the textile industries, especially in India and Bangladesh, where chic organic pigments are used to dye premium quality fabrics. The examples from the real world further showcase the latent potential in this area for many of the applications in the field of pigment dispersion throughout the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Pigment Dispersions Market are:

-

BASF SE [Dispersions & Resins, Performance and Formulation Additives]

-

DIC Corporation [General Purpose Pigments, Functional Pigments]

-

Sudarshan Chemical Industries [Pigment Dispersions, High-Performance Pigments]

-

Chromaflo Technologies [Colorant Dispersions, Tinting Systems]

-

Cabot Corporation [Black Pigment Dispersions, Aqueous Dispersions]

-

Heubach GmbH [Organic Pigments, Inorganic Pigments]

-

Penn Color [Color Concentrates, Pigment Dispersions]

-

Pidilite Industries [Pigment Emulsions, Textile Pigments]

-

Lanxess AG [Iron Oxide Pigments, Chrome Oxide Pigments]

-

DyStar Corporation [Textile Pigments, Industrial Pigments]

-

Clariant Ltd. [Pigment Preparations, High-Performance Pigments]

-

Ferro Corporation [Ceramic Pigments, Porcelain Enamel Pigments]

-

Huntsman Corporation [Titanium Dioxide Pigments, Specialty Pigments]

-

Sun Chemical Corporation [Printing Inks, Coatings Pigments]

-

American Elements [Nanoparticle Pigments, Rare Earth Pigments]

-

Aralon Color GmbH [Fluorescent Pigments, Phosphorescent Pigments]

-

Aakash Chemicals [Specialty Pigments, Color Dispersions]

-

Burgess Pigment Company [Kaolin Clay Pigments, Extender Pigments]

-

Americhem, Inc. [Color Masterbatches, Additive Masterbatches]

-

Vi-Chem Corporation [Thermoplastic Compounds, Polymeric Alloys]

Some of the Raw Material Suppliers for Pigment Dispersions Companies:

-

Chemours

-

Venator Materials

-

Tronox Holdings

-

Kronos Worldwide

-

Cristal Global

-

Ishihara Sangyo Kaisha

-

Lomon Billions Group

-

Iluka Resources

-

Rio Tinto Group

-

Base Resources

RECENT TRENDS

-

In November 2024, BASF opened a new production line for water-based dispersions in Heerenveen, the Netherlands, powered by green electricity from the Hollandse Kust Zuid wind farm.

-

In October 2024, Sudarshan Chemical entered into a definitive agreement to acquire the Heubach Group, creating a global leader in the pigment industry. The acquisition aims to enhance product portfolios and expand market reach across Europe, the Americas, and APAC regions.

-

In May 2024, Cabot Corporation launched MAJESTIC 710, a specialty carbon black for water-based formulations, enhancing color performance and reducing formulation complexity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 32.84 Billion |

| Market Size by 2032 | US$ 47.02 Billion |

| CAGR | CAGR of 4.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Dispersion Type (Water-based dispersions, Solvent-based dispersions) • By Application (Automotive paints & coatings, Decorative paints & coatings, Industrial paints & coatings, Inks, Plastics, Others) • By Product (Organic pigments, Inorganic pigments) • By End Use (Building & construction, Automotive, Packaging, Paper & printing, Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, DIC Corporation, Sudarshan Chemical Industries, Chromaflo Technologies, Cabot Corporation, Heubach GmbH, Penn Color, Pidilite Industries, Lanxess AG, DyStar Corporation, Clariant Ltd., Ferro Corporation, Huntsman Corporation, Sun Chemical Corporation, American Elements, Aralon Color GmbH, Aakash Chemicals, Burgess Pigment Company, Americhem, Inc., Vi-Chem Corporation, and Others |

| Key Drivers | • Automotive and Construction Sectors Drive Growth of High Performance and Eco-Friendly Pigment Dispersions • Rising Demand for Sustainable Packaging Drives Growth in Pigment Dispersions Market for Food and Beverage |

| Restraints | • Challenges in Raw Material Availability Innovation and Sustainability Drive Development in the Pigment Dispersions Market |