Immunohistochemistry Market Overview:

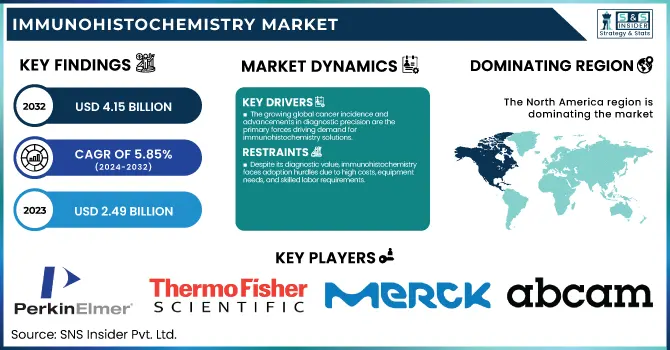

The Immunohistochemistry Market size was valued at USD 2.49 billion in 2023 and is expected to reach USD 4.15 billion by 2032, growing at a CAGR of 5.85% over the forecast period of 2024-2032.

To Get More Information on Immunohistochemistry Market - Request Sample Report

This report underscores increasing cancer incidence and prevalence by category, which continues to drive the need for IHC-based diagnostics. The report analyzes reagent and antibody use trends, including the growing usage of monoclonal and secondary antibodies as a result of their specificity and diagnostic precision. It also investigates pathology lab penetration and automation trends, where developed markets are quickly adopting digital pathology solutions. The healthcare and diagnostic expenditure trend by region is also examined in the report, taking into account government grants, private investments, and out-of-pocket spending in determining market access. Clinical trial activity with IHC biomarkers is increasing, especially in oncology studies, further underscoring the use of IHC within precision medicine strategies.

United States Immunohistochemistry Market Size

The U.S. Immunohistochemistry Market was valued at USD 0.78 billion in 2023 and is expected to reach USD 1.14 billion by 2032, growing at a CAGR of 4.35% over the forecast period of 2024-2032. In the United States, the IHC market is growing consistently with high cancer screening rates, good diagnostic infrastructure, and strong backing for clinical trials and precision medicine through federal support as well as from the private sector.

Immunohistochemistry Market Dynamics

Drivers

-

The growing global cancer incidence and advancements in diagnostic precision are the primary forces driving demand for immunohistochemistry solutions.

The rise in cancer cases globally has become a major driving force for the immunohistochemistry market, considering the method's pivotal position in proper tumor classification and biomarker identification. There were an estimated 20 million new instances of cancer in 2023, as reported by the World Health Organization (WHO), a figure expected to increase dramatically over the next decade. IHC has a crucial role in diagnosing and subtyping cancer types like breast, prostate, and lung, where the treatment is directed by biomarkers such as HER2, ER/PR, and PD-L1. In addition, advances in IHC technology, e.g., automated staining instruments and multiplex IHC, are enhancing test reproducibility, throughput, and diagnostic accuracy. The combination of digital pathology and AI-based image analysis software is complementing efficiency in the clinical laboratory. With increasing personalized medicine and targeted treatments, the demand for companion diagnostics using IHC is quickly rising. Drug manufacturers are also applying IHC to drug development and clinical trials for patient stratification and evaluation of drug response. All these together fortify the market's growth momentum, making IHC a crucial support pillar in contemporary diagnostic and therapeutic practice.

Restraints

-

Despite its diagnostic value, immunohistochemistry faces adoption hurdles due to high costs, equipment needs, and skilled labor requirements.

The high operational expense of immunohistochemistry continues to be a major stumbling block, especially in low- and middle-income nations with scarce diagnostic infrastructure. Although advanced IHC systems bring the advantage of automation and precision, they do come at high capital expense and are beyond the reach of smaller laboratories and rural health facilities. Aside from expensive instruments, reagents and particularly good monoclonal antibodies are expensive and demand very stringent storage. Additionally, IHC methods are time-consuming and require skilled staff for optimal sample processing, staining, and interpretation. Irregularities in manual processes may also result in inter-observer variability, which compromises diagnostic quality. Small labs might not have the standardized procedures and skilled hands to provide reproducible results reliably, leading to the underutilization of IHC. Cost-to-benefit considerations become particularly relevant in non-urgent diagnostics, where quicker or less expensive alternatives might be preferable. Such cost and complexity considerations act in concert to limit the widespread use of IHC, particularly in facilities with poor financial or technical resources, even though its clinical value is established.

Opportunities

-

The rising demand for personalized therapies is creating strong growth potential for IHC as a tool for biomarker validation and treatment selection.

The trend toward personalized medicine opens up considerable growth prospects for the immunohistochemistry market. With targeted therapies becoming the norm, especially in oncology, there is a growing demand for companion diagnostics capable of identifying the right patients likely to benefit from certain treatments. IHC is at the center of this process by identifying protein biomarkers like HER2 in breast cancer or PD-L1 in non-small cell lung cancer that determine therapy decisions and outcomes. For instance, PD-L1 testing by IHC is a requirement for the administration of checkpoint inhibitors such as pembrolizumab. The FDA has cleared a few IHC-based companion diagnostics, with additional ones in the offing as pharma companies embark on biomarker-driven drug development. Moreover, advances in multiplex IHC and image analysis software are allowing scientists to assess several biomarkers simultaneously in a single tissue section, increasing efficiency and understanding. These technologies are especially promising for immuno-oncology and neurodegenerative disease studies. The increased interest in translational research, clinical trials, and precision diagnostics, complemented by robust R&D investment, provides a positive backdrop for IHC application expansion from cancer into infectious diseases, cardiovascular diseases, and beyond.

Challenges

-

Ensuring consistent, reproducible IHC results across different labs remains a persistent challenge affecting test reliability and clinical trust.

Despite technological progress, standardization in IHC is still a significant challenge, particularly when comparing results between laboratories and regions. Variability in staining protocols, quality of antibodies, tissue preparation, and interpretation can greatly affect diagnostic results. For example, variability in HER2 scoring can result in inappropriate treatment decisions in breast cancer patients. The absence of universal quality control standards and the use of manual techniques in most labs lead to variable results. Despite automation, variation in pre-analytical variables, e.g., fixation time, antigen retrieval, and reagent concentration, can bias results. These variations not only detract from diagnostic accuracy but also impede regulatory agencies' approval of new IHC assays and companion diagnostics. Moreover, inadequate access to comprehensive external quality assurance programs, particularly in developing countries, worsens reproducibility. AI image analysis and digital pathology both promise to limit human error but remain constrained by cost and integration considerations. Unless and until broad-scale harmonization of protocols and training occurs, the full clinical potential of IHC cannot be fulfilled, threatening significant market development and stakeholder confidence.

Immunohistochemistry Market Segmentation Analysis

By Product

In 2023, the antibodies segment was the dominant contributor to the global immunohistochemistry market, with a substantial 43.4% share of the total revenue. This is primarily due to the critical role played by antibodies in detecting and visualizing certain antigens in tissue samples. Monoclonal and polyclonal antibodies are key elements in both diagnostic and research-oriented IHC applications, especially in oncology, infectious diseases, and autoimmune diseases. The growing use of companion diagnostics and personalized medicine, especially among cancer patients, has further driven the need for antibody-based testing, solidifying the segment's leadership position in the market.

On the other hand, the kits segment is expected to have the highest growth during the forecast period. This growth is expected to be driven by the increasing demand for ready-to-use, standardized testing solutions that simplify workflow efficiency and reduce human error. Kits provide a time-efficient and convenient method for laboratories by bundling all required reagents and antibodies in one package, improving reproducibility and consistency of test outcomes. The growing automation of IHC processes and increased demand for point-of-care diagnostic solutions are also likely to promote kit use, especially in resource-limited regions and developing economies looking to enhance diagnostic capabilities.

By Application

The diagnostics segment led the immunohistochemistry market in 2023, with a revenue share of more than 73% globally. The dominant position owes much to the irreplaceable role of IHC in clinical diagnostics, especially in oncology, where it is a gold standard for tumor identification and classification. IHC finds widespread application in detecting certain tumor markers, facilitating cancer type differentiation, grading, and prognosis. As the global cancer burden continues to increase, the demand for accurate and quick diagnostic measures has fueled the adoption of IHC on a large scale by hospitals and diagnostic facilities. The increasing requirement of companion diagnostics and biomarker testing in specific therapies also complements the dominance of the segment.

The research segment, on the other hand, is projected to grow at the most rapid rate throughout the forecast period. The growth in this segment is driven by increased investments in biotechnology, translational research, and life sciences, where IHC is central to the identification of disease mechanisms, drug target validation, and tissue-based investigations. Pharmaceutical industries and research organizations are increasingly relying on IHC to investigate drug efficacy and the pathogenesis of disease, particularly during preclinical stages and early clinical trials. The increasing incorporation of IHC in experimental pathology continues to make it more relevant in academic and industrial research.

By End-use

Hospitals and clinical diagnostic laboratories comprised the largest end-use segment within the global market for immunohistochemistry in 2023, accounting for over 74.7% of the revenue. This was mainly due to the large volume of IHC tests performed within clinical settings to diagnose diseases, monitor them, and stratify patients. These facilities are dependent on IHC to make correct pathological interpretations, especially for oncology patients, where biomarker identification and tumor categorization are very important for treatment planning. The availability of sophisticated infrastructure, expert pathologists, and organized workflows add to the dominance of hospitals and diagnostic laboratories in the IHC industry.

Conversely, research institutions are expected to expand at the highest rate over the forecasting period. This growth is due to the rising focus on biomedical research and studies incorporating tissue-based analysis. Since research institutions keep probing molecular and cellular disease mechanisms, IHC has emerged as a critical tool in confirming discoveries at the level of protein expression. The increased government and private financing, together with the partnerships between academia and pharmaceuticals, is also helping to grow IHC applications in research. Moreover, developments in multiplex IHC and digital pathology are improving research productivity and analytical potential in this space.

Immunohistochemistry Market Regional Insights

North America was the leading region in the immunohistochemistry market in 2023 due to its highly developed healthcare infrastructure, high use of personalized medicine, and high cancer incidence. Strong R&D spending, early adoption of technology-enabled IHC platforms, and a high number of FDA-approved companion diagnostics are strengths for the region. The presence of prominent market players and well-established clinical laboratories also reflects the maturity of the market in the U.S. and Canada. Government and private initiatives toward early cancer detection and precision oncology have also increased the demand for IHC-based diagnostics in hospitals and diagnostic centers.

The Asia Pacific region, however, is expected to be the fastest-growing market in the forecast period. This expansion is driven by a rapidly growing patient base, increasing cancer screening awareness, and growing healthcare spending in the likes of China, India, and South Korea. The WHO states that more than 50% of the world's cancer deaths now happen in Asia, which points toward an increasing need for enhanced diagnostic capacity. Government-initiated healthcare reforms, increasing investments in life sciences research, and the emergence of local diagnostic laboratories are opening up new avenues for IHC adoption in the region. Additionally, strategic partnerships between international companies and regional healthcare providers are driving market penetration and access to sophisticated IHC technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Immunohistochemistry Market

-

Thermo Fisher Scientific Inc. – Lab Vision Antibodies, UltraVision Detection Systems, Histostain Kits

-

F. Hoffmann-La Roche Ltd. (Roche) – VENTANA BenchMark Series, VENTANA OptiView DAB IHC Detection Kit, VENTANA Primary Antibodies

-

Merck KGaA – Novocastra Antibodies, ImmunoDetector Detection System

-

Danaher Corporation – Bond IHC & ISH Stainers (via Leica Biosystems), Refine Detection Kits

-

PerkinElmer, Inc. – Opal Multiplex IHC Kits, TSA Detection Systems

-

Bio-Rad Laboratories, Inc. – StarBright Dyes, PrecisionAb Antibodies

-

Cell Signaling Technology, Inc. – IHC-validated Antibodies, SignalStain Detection Kits

-

Bio SB – PolyDetector HRP Systems, IHC Antibodies, SB-Multiplex Detection Kits

-

Agilent Technologies, Inc. – Dako Omnis, EnVision FLEX Detection Systems, Ready-to-Use Antibodies

-

Abcam plc – RabMAb Antibodies, SimpleStep ELISA Kits, IHC Primary Antibodies

Recent Developments in the Immunohistochemistry Industry

In Jan 2025, Roche received FDA approval for the label expansion of its PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody as the first companion diagnostic to identify patients with HER2-ultralow metastatic breast cancer eligible for ENHERTU treatment. This approval enables the detection of a newly defined HER2-ultralow category, expanding targeted therapy options for HR-positive breast cancer patients.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.49 billion |

| Market Size by 2032 | USD 4.15 billion |

| CAGR | CAGR of 5.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Antibodies, Equipment, Reagents, Kits] • By Application [Diagnostics, Research] • By End-use [Hospitals & Diagnostic Laboratories, Research Institutes, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd. (Roche), Merck KGaA, Danaher Corporation, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Cell Signaling Technology, Inc., Bio SB, Agilent Technologies, Inc., Abcam plc. |