Barrier Systems Market Report Scope & Oveview:

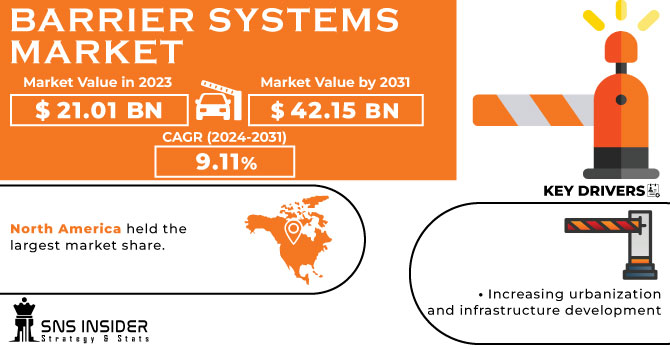

The Barrier Systems Market size is estimated to be USD 21.01 billion in 2023, which will reach USD 42.15 billion by 2031, and will grow at the growth rate of 9.11% between 2024 and 2031.

Rapidly increasing construction and vehicle production have contributed to the growth of the market, which has led to an increase in demand for a variety of safety solutions such as crash barrier systems, gates or fences. These systems, for instance, are an integral part of ensuring security at airports, smart road networks, retail buildings and car parks. These systems are capable of effectively managing vehicles and reducing their potential for unauthorised entry.

Get More Information on Barrier Systems Market - Request Sample Report

Market growth is projected to be driven by developments in commercial property and transport infrastructure changes worldwide over the forecast period. For the purpose of accurately rerouting pedestrians and vehicles on their right paths, barrier systems shall be put in place at railway stations, airports or roads. Moreover, market growth is anticipated to be driven by the increasing need for efficient traffic management throughout the world. In turn, it is expected that adoption of these systems in different end user sectors will be driven by very few substitutes available on the market.

To minimize vehicle crashes and to ensure pedestrian safety, barrier systems are globally adopted. It ensures that road transport is separated from the infrastructure, enabling optimized traffic flows and incident prevention. In addition, system suppliers focus on manufacturing sidewalk fencing, which is designed to protect the floors, walls and commercial infrastructure equipment of a building. Hence, this market is expected to grow during the forecast period.

Automated control panels for the efficient reduction of traffic congestion, which can be used more effectively on existing or newly constructed roads, are fitted to many barrier systems. This technology is used for construction applications and managed lanes to create safe highways that provide real-time pavement layout while maintaining a protective barrier between lanes.

It is expected that market growth will be restricted by the cost of repairs required for barrier systems. A high cost of reconstruction is needed in the case of a crash impact with fences and concrete blocks. Moreover, it is expected that market growth for barrier systems will be hampered by volatility in raw material prices needed to build them. The market is also anticipated to be impeded by improvements in the reliability of security systems.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing urbanization and infrastructure development

The demand for different barriers systems including those applied in traffic, such as road signs, guardrails and construction barricades, has been driven by urbanization and the increasing number of cities worldwide.

-

The key driver for adoption of intelligent traffic management systems incorporating barrier technology is the need to ensure efficient road transport in rapidly growing urban areas.

RESTRAIN:

-

High maintenance cost will restrict market growth

In order for barriers to function properly and give the desired level of protection, they should be regularly maintained and periodically repaired. The concern for businesses may be the cost of maintenance and interruptions.

OPPORTUNITY:

-

Emerging Markets can provide growth opportunities for the market

New business opportunities for barrier system operators can be created by increasing their presence in emerging markets, which are experiencing rapid infrastructure investment.

-

Barrier systems capable of interacting with automated and autonomous vehicles

CHALLENGES:

-

High costs of raw materials

The total production costs, profitability and affordability of the finished products may be influenced directly by the cost of materials for use in barrier systems.

IMPACT OF RUSSIAN UKRAINE WAR

War has created a new market for temporary fencing systems, as businesses and governments seek to rapidly deploy security measures. War also led to a growing need for specialized barrier systems, such as explosive barriers and vehicle improvised explosive device (VBIED) barriers. Warfare also accelerates the adoption of smart gate systems, which use sensors and other technologies to improve safety and efficiency.

War has caused an increase in demand for fencing systems as businesses and governments seek protection from potential attacks. The global barrier systems market is expected to grow 5% by 2023, due to the war in Ukraine. The European barrier systems market is expected to grow by 7% by 2023 as countries in the region invest in security measures to protect against future attacks.

The Asia-Pacific barrier system market is expected to grow by 4% in 2023 as countries in the region invest in infrastructure projects that require barrier systems. The war also led to disruptions in the barrier system supply chain, with Russian and Ukrainian manufacturers forced to stop production. This has caused the price of barrier systems to rise and this is expected to continue in the short term.

Despite the challenges, the barrier system market is expected to remain strong in the long run. The growing threat of terrorism and other security threats is driving the demand for barrier systems and this trend is expected to continue.

IMPACT OF ONGOING RECESSION

The barrier system market is expected to remain strong in the long run, but the ongoing recession could create challenges in the short term. The market is likely to be most affected by companies and governments that are struggling financially. However, the market is also expected to benefit from the growing threat of terrorism and other security threats.

There is need of development of new technologies for barrier systems, such as smart barrier systems. The growth of the e-commerce market, this is driving the demand for fencing systems for warehouses and distribution centres. Rise in infrastructure is aging in many countries, creating a need for barrier systems to protect from accidents and other hazards.

An economic downturn may lead to a need for a lower barrier system, as businesses and governments may have less money to spend on security measures.

Recession may also lead to delays in new projects that require the barrier system, as businesses and governments can postpone or cancel these projects.

Overall, the impact of the recession on the barrier market is uncertain. However, the economic downturn will likely create challenges for the market such as lower demand and increased competition. The growing threat of terrorism and other security threats.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Wood

-

Metal

-

Concrete

By Type

-

Crash Barrier Systems

-

Fences, Bollards

-

Drop Arms

-

Others

By Access Control Device

-

Token & Reader Technology

-

Turnstile

-

Perimeter Security Systems & Alarms

-

Others

By Function

-

Active

-

Passive

By Application

-

Roadways

-

Railways

-

Commercial

-

Residential

-

Others

REGIONAL ANALYSIS

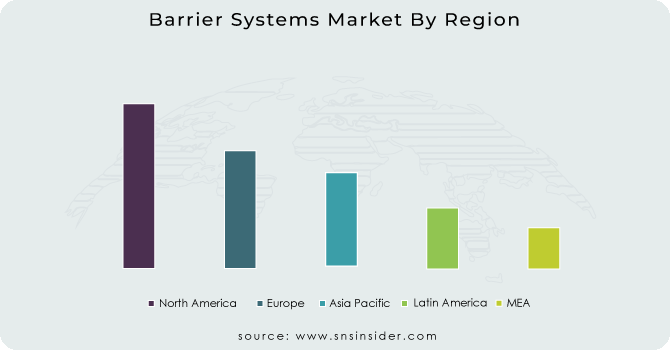

North America held the largest market share. Terrorist activities are a major concern in the region as a result, the military and defence industry in the region is largely adopting barrier systems in order to improve security and safeguard its citizens from cross-border war threats. Regional growth is expected to be driven by shifting consumer preferences for solid and durable construction materials, such as fences.

During the forecast period, Asia Pacific is projected to become the most rapidly growing market in the region. Rapidly increasing infrastructure in the region is likely to contribute to this growth. Furthermore, market growth opportunities are expected to be created by a growing number of constructions in countries like India and China. In addition, the region's market will be driven by increased government initiatives and investment in intelligent urban infrastructure projects to improve safety and security of its citizens.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Barrier Systems market are Valmont Industries, Inc, Senstar Corporation, Hill & Smith Holdings PLC, Betafence, Tata Steel Limited, Delta Scientific Corporation, Lindsay Corporation, Bekaert and other players.

Senstar Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

In November 2022, Halliburton Corporation introduced to their portfolio of high performance reduced Portland cement systems NeoCEM E+ and EnviraCemTM concrete barriers. The NeoCem E+ cement has a 50 % or greater reduction in mass, while the EnviraCem cement has a 70 % or greater reduction in mass. The reduction of Portland cement in barrier systems helps customers reduce their carbon emissions baselines and provides engineered systems with enhanced sheath performance.

-

March 2023, Finland has announced that it had begun building a barrier fence across its border with Russia. In order to test the barrier's abilities before completing the whole project, construction shall start on a pilot phase that will be 3 kilometres or 1.8 miles in length.

| Report Attributes | Details |

| Market Size in 2023 | US$ 21.01 Bn |

| Market Size by 2031 | US$ 42.15 Bn |

| CAGR | CAGR of 9.11 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Wood, Metal, Concrete) • by Type (Crash Barrier Systems, Fences, Bollards, Drop Arms, Others) • by Access Control Device (Biometric Systems, Token & Reader Technology, Turnstile, Perimeter Security Systems & Alarms, Others) • by Function (Active, Passive) • by Application (Roadways, Railways, Commercial, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Valmont Industries, Inc, Senstar Corporation, Hill & Smith Holdings PLC, Betafence, Tata Steel Limited, Delta Scientific Corporation, Lindsay Corporation, Bekaert |

| Key Drivers | • Increasing urbanization and infrastructure development • The key driver for adoption of intelligent traffic management systems incorporating barrier technology is the need to ensure efficient road transport in rapidly growing urban areas. |

| Market Restraints | • High maintenance cost will restrict market growth |