Through-hole Passive Components Market Size Analysis

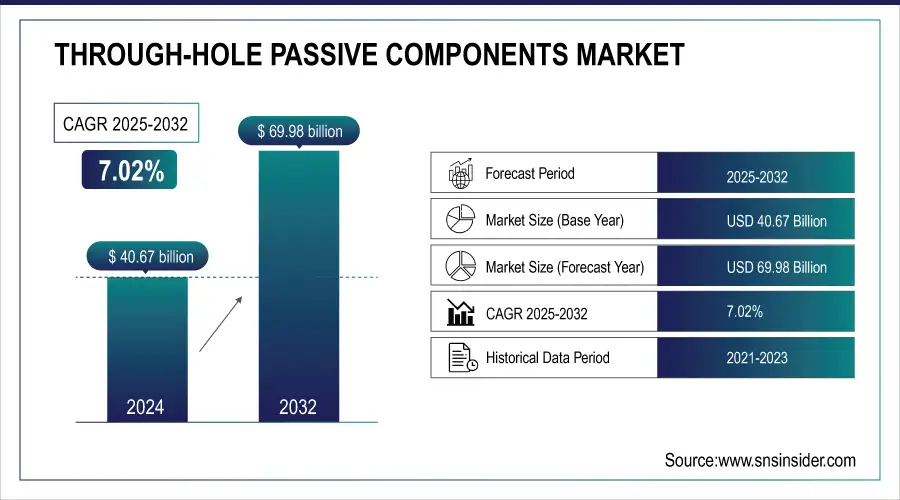

The Through-hole Passive Components Market Size was valued at USD 40.67 Billion in 2024 and is expected to reach USD 69.98 Billion by 2032 and grow at a CAGR of 7.02% over the forecast period 2025-2032. The growth in through-hole passive components is driven mainly by the element of reliability in high-performance applications. Resistors, capacitors, and inductors gain preference in aerospace, automotive, and industrial electronics industries where mechanical strength, along with robust performance, plays a significant role. Through-hole technology has more rigid contact on the circuit board. It is therefore more applicable to use in applications with requirements of high resistance to mechanical stress, especially those whose functionality depends on environmental factors such as extreme temperatures and vibrations. Another major driving force is the need for reliable and long-life electronic high-performance devices, which yield size for dependability and longevity. While SMT has improved dramatically, through-hole components are necessary for power supply circuits, and where repairability and replaceability suit the application better with these types of components.

To Get More Information on Through-hole Passive Components Market - Request Sample Report

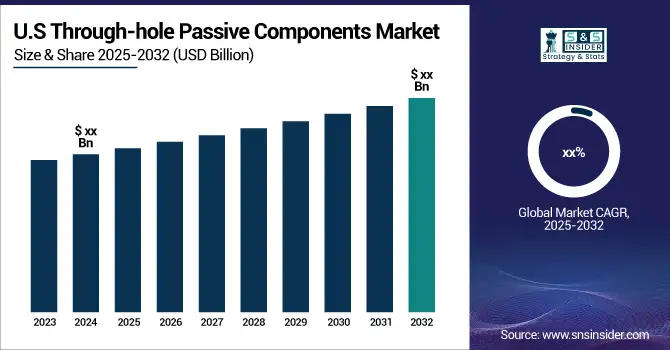

In 2023, U.S. production of through-hole passive components exceeded 1.5 billion units, driven by increased demand in the automotive and industrial sectors. Imports rose by 4%, with further growth expected in 2024 due to expanding electronics manufacturing. Through-hole passive components are highly utilized in educational and prototyping design because they are quite easy to assemble manually hence a favorite for the engineers and hobbyists. As industries such as the automotive and aerospace continue adopting more complex electronic systems, so will the demand for these reliable, durable components hence driving market growth further.

Through-hole Passive Components Market Highlights:

-

U.S. production of through-hole passive components exceeded 1.5 billion units in 2023, driven by automotive and industrial demand, with imports rising 4% and growth expected in 2024.

-

Aerospace, automotive, and industrial electronics favor through-hole components for their unmatched reliability, mechanical strength, and ability to withstand extreme environmental conditions.

-

Easy manual assembly makes these components popular in education, prototyping, and repair, supporting engineers and hobbyists in testing and modifying circuits.

-

Demand is growing in high-end electronic systems as industries adopt more complex designs requiring durable and high-performance components.

-

Market growth faces challenges from surface-mount technology adoption, which offers miniaturization, higher circuit density, and suitability for automated production.

-

Supply chain disruptions, fluctuating raw material costs, and labor-intensive assembly processes further restrain the through-hole components market.

Through-hole Passive Components Market Drivers:

-

Through-hole passive Components Gain Momentum in Aerospace, Automotive, and Industrial Electronics for Unmatched Reliability

The unmatched reliability in high-stress environments is the reason through-hole passive components are gaining ground. Aerospace, automotive, and industrial electronics have always relied on through-hole components, such as resistors, capacitors, and inductors, for their superior mechanical strength and their ability to withstand extreme conditions. These soldered connections to the circuit boards make them particularly suited for applications subjected to vibrations temperature stresses and other forms of environmental stresses. As these industries move more to high-end electronics, the demand for durable, high-performance components is growing at a fast pace.

-

Through-hole components Drive Growth in Education, Prototyping, and Repair Markets for Easy Assembly and Testing

Easy to hand assemble, they are best for engineers, hobbyists, and educational facilities whose learning emphasis is on "by-hand" techniques. Components are usually preferred to be through-hole for a project when it is easy to modify, test, or repair. They are thus useful when used in power circuits because they enable the circuit's development very easily. The demand for these versatile components continues growing in the design and prototyping environments, thus promoting them in the electronics industry, even as newer technologies keep arising.

Through-hole Passive Components Market Restraints:

-

Rising Challenges for Through-Hole Passive Components Amid SMT Growth, Automation, and Supply Chain Disruptions

The through-hole passive components market faces several challenges, primarily related to the increasing adoption of surface-mount technology (SMT). SMT has far superior miniaturization and circuit density, so is much more attractive for modern electronic designs. In addition, the laborious and time-consuming process of manual assembly of through-hole components is bound to increase the cost of production. Supply chain disruptions and fluctuating raw material prices also threaten manufacturers since these can influence the availability and pricing of through-hole components. Finally, through-hole technology can limit the rate of growth in areas where the move of industry will be towards automation and further Smart manufacturing techniques.

Through-hole Passive Components Market Segment Analysis:

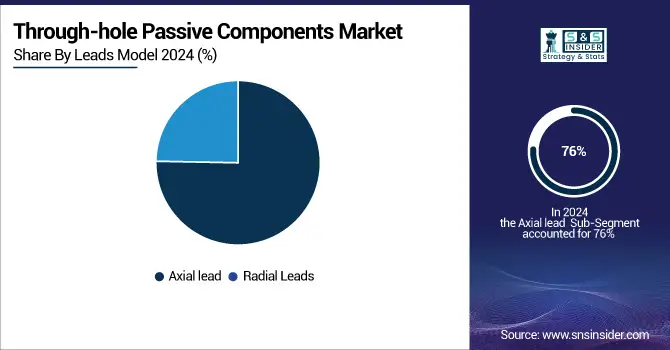

By Leads Model

Axial lead segment led the market and accounted for more than 76% of revenue share in 2024. By lead model segment, the market is divided into axial lead and radial lead. Axial lead components provide mechanical stability to the circuit board assembly. Leads are normally longer and cylindrical, therefore when soldered on the circuit board, they make for sturdy anchorage. This enables the components generally to be much tougher when subjected to mechanical stress with the confidence that any portion is always in place even under harsh conditions. The axial lead segment is also expected to witness the highest growth rate of 7.5% over the forecast period. The axial lead configuration has better heat management. The longer lead and cylindrical shape permit much dissipation of heat.

By Component

The capacitor segment led the market with a revenue share of more than 44% in 2024. By the component segment, the market is categorized into resistors, capacitors, inductors, diodes, transducers, sensors, and others. Increased demand for electronics and electrical products in applications such as medical and healthcare, industrial, telecommunication, and automotive industries is driving the increased popularity of the capacitor segment.

The sensors segment is projected to achieve the highest growth rate, with a compound annual growth rate (CAGR) of 7.61% during the forecast period. Sensors are responsive to changes in the surroundings and note the changes by producing output on the displays. Through-hole sensors are enabled to facilitate automation and control in various industries. With parameter monitoring and measurement, critical feedback is generated that controls the action cycle and system control.

By Application

The consumer electronics segment dominated the market by taking a revenue share of over 33% in 2024. Consumer electronics are particularly dependent on through-hole components such as resistors and capacitors for the massive demand for products like smartphones, TVs, and computers. High output volumes of such devices give them high demand for these components. Through-hole parts are preferred for easy repair and replacement, thereby reducing maintenance costs while improving customer satisfaction by reducing downtime and a reduction in repair expenses.

This industrial segment will likely be the largest growing segment, with 7.97% growth rates by the estimated period. Through-hole components are popularly known for their rugged design and reliability. These types of components are greatly suited for industrial applications. Those industries such as manufacturing, automation, energy, and transportation can also withstand extreme temperatures, vibrations, and electrical noise. These through-hole components with their strong soldered contacts as well as mechanical rigidity can easily withstand harsh conditions and, thus provide reliable long-term performance in industrial settings.

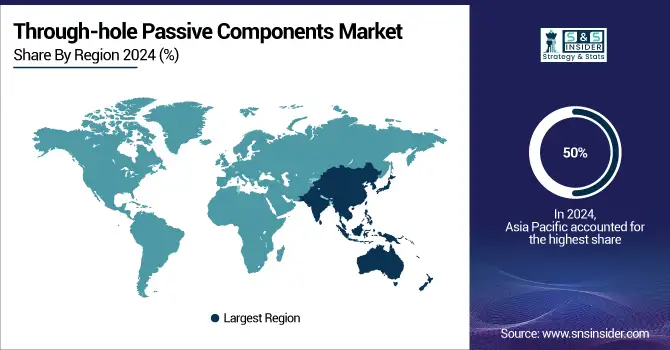

Through-hole Passive Components Market Regional Analysis:

Asia-Pacific Through-hole Passive Components Market Insights:

Asia Pacific dominated the market with a 50% revenue share in 2024 and is projected to grow at the fastest CAGR of 7.49%. Growth is driven by adoption in automotive, consumer electronics, and industrial sectors, along with government initiatives like India’s semiconductor incentive scheme. Rising electric vehicle demand, smart city projects, low-cost labor, raw material availability, and increased R&D investments further strengthen the region’s role in driving market expansion.

Do You Need any Customization Research on Through-hole Passive Components Market - Inquire Now

North America Through-hole Passive Components Market Insights:

North America holds a significant share in the through-hole passive components market, driven by strong demand from the automotive, aerospace, defense, and consumer electronics industries. The region benefits from advanced manufacturing capabilities, robust R&D investments, and the presence of leading electronics companies. Growing adoption of electric vehicles, IoT devices, and industrial automation further fuels market growth across the U.S. and Canada.

Europe Through-hole Passive Components Market Insights:

Europe represents a strong market for through-hole passive components, supported by its advanced automotive, industrial, and consumer electronics sectors. The region’s focus on sustainability, electric mobility, and renewable energy adoption drives component demand. Strong R&D infrastructure, stringent quality standards, and the presence of key electronics manufacturers further enhance growth opportunities across major economies such as Germany, France, and the U.K.

Latin America (LATAM) and Middle East & Africa (MEA) Through-hole Passive Components Market Insights

LATAM and MEA markets are witnessing steady growth in through-hole passive components, fueled by expanding automotive, telecom, and consumer electronics industries. Rising infrastructure development, increasing urbanization, and growing penetration of connected devices are boosting demand. Government initiatives to attract foreign investments and strengthen local manufacturing capabilities further support regional opportunities, particularly in Brazil, Mexico, the UAE, and South Africa.

Through-hole Passive Components Companies are:

-

Yageo Corporation (Resistors, Capacitors)

-

Vishay Intertechnology, Inc. (Resistors, Inductors)

-

Panasonic Corporation (Capacitors, Inductors)

-

Murata Manufacturing Co., Ltd. (Capacitors, Inductors)

-

Kemet Corporation (Capacitors, Resistors)

-

AVX Corporation (Capacitors, Resistors)

-

Würth Elektronik GmbH & Co. KG (Inductors, Capacitors)

-

TE Connectivity Ltd. (Resistors, Capacitors)

-

Bourns, Inc. (Potentiometers, Inductors)

-

Nexperia (Resistors, Capacitors)

-

ROHM Semiconductor (Resistors, Capacitors)

-

Schurter AG (Inductors, Capacitors)

-

Eaton Corporation (Capacitors, Resistors)

-

American Technical Ceramics Corp. (Capacitors, Inductors)

-

Taitien Enterprises Inc. (Resistors, Capacitors)

-

Vishay Dale (Resistors, Inductors)

-

Walsin Technology Corporation (Resistors, Capacitors)

-

Sumida Corporation (Inductors, Transformers)

-

Fenghua Advanced Technology (Resistors, Capacitors)

-

Kyocera AVX (Capacitors, Inductors)

Through-hole Passive Components Market Competitive Landscape:

The electronics manufacturing industry is urging the government to implement favorable policies, provide financial incentives, and enhance infrastructure support. These measures aim to boost domestic production, reduce dependency on imports, promote innovation, and strengthen India’s position as a global electronics manufacturing hub, driving economic growth and job creation.

-

In May 2024, the electronics manufacturing industry is urging the government for a Rs 30,000- Rs 35,000 crore production-linked incentive (PLI) scheme for components and sub-assemblies, along with capital expenditure support to back the rising exports of mobile phones and other electronics.

TDK Group, established in 1935, is a global leader in electronic materials, components, and recording media. The company specializes in capacitors, inductors, sensors, and magnetic products, serving automotive, industrial, and consumer electronics markets. TDK focuses on innovation, sustainability, and advanced technologies to support digital transformation worldwide.

-

At Embedded World 2024, TDK Group will showcase its latest electronic solutions for embedded technologies. The company will conduct a live demonstration of embedded machine learning development utilizing ARM Keil MDK and Qeexo AutoML during the presentation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 40.67 Billion |

| Market Size by 2032 | USD 69.98 Billion |

| CAGR | CAGR of 7.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Resistors, Capacitors (Resistors, Capacitors, Inductors, Diodes, Transducers, Sensors, Others), • by Leads Model (Axial Leads, Radial Leads), • by Application (Consumer Electronics, IT & Telecommunication, Automotive, Industrial, Aerospace & Defense, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Yageo Corporation, Vishay Intertechnology, Inc., Panasonic Corporation, Murata Manufacturing Co., Ltd., Kemet Corporation, AVX Corporation, Würth Elektronik GmbH & Co. KG, TE Connectivity Ltd., Bourns, Inc., Nexperia, ROHM Semiconductor, Schurter AG, Eaton Corporation, American Technical Ceramics Corp., Taitien Enterprises Inc., Vishay Dale, Walsin Technology Corporation, Sumida Corporation, Fenghua Advanced Technology, Kyocera AVX. |