Powered Agriculture Equipment Market Key Insights:

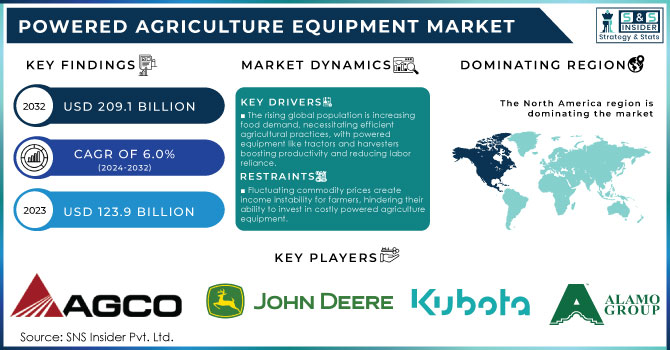

The Powered Agriculture Equipment Market Size was USD 123.9 billion in 2023 and will reach USD 209.1 billion by 2032 and grow at a CAGR of 6.0 % Over the Forecast period of 2024-2032. The Powered Agriculture Equipment Market is witnessing significant transformation driven by technological advancements and increasing demand for efficient farming solutions. In recent years, there has been a marked rise in the adoption of automated machinery, with over 60% of farmers in developed countries utilizing some form of powered equipment. This shift is largely attributed to the need for enhanced productivity and sustainability in agriculture, as farmers face the challenges of labor shortages and the demand to increase crop yields.

To Get More Information on Powered Agriculture Equipment Market - Request Sample Report

A notable trend within this market is the growing preference for precision agriculture tools, which utilize data analytics and GPS technology to optimize field-level management. Approximately 70% of agricultural professionals are reportedly integrating precision technologies into their operations, leading to more informed decision-making regarding resource allocation and crop management.

| Technology | Description | Commercial Products |

|---|---|---|

| Precision Agriculture | Utilizes GPS and IoT technologies to optimize field-level management regarding crop farming. | John Deere Precision Ag, Trimble Ag |

| Autonomous Tractors | Tractors that operate without human intervention using advanced sensors and AI. | Case IH Autonomous Tractor, AGCO Fendt |

| Drones for Agriculture | Unmanned aerial vehicles used for crop monitoring, spraying, and data collection. | DJI Agras MG-1, Parrot Bluegrass |

| Smart Irrigation Systems | Systems that automate and optimize irrigation based on real-time data and weather forecasts. |

Rain Bird Smart Irrigation, Hunter Pro-C |

| Crop Monitoring Sensors | Sensors that collect data on soil moisture, temperature, and crop health for better decision-making. | Agroop, CropX |

| Electric and Hybrid Equipment | Equipment designed to reduce emissions and fuel consumption in agricultural operations. | Mahindra e-Alpha, John Deere E100 |

| Variable Rate Technology (VRT) | Allows for the application of inputs (fertilizers, pesticides) at variable rates across a field. | Ag Leader Technologies, Trimble VRS |

| Integrated Farm Management Systems | Software solutions that integrate data from various sources to streamline farm operations. | Trimble Ag Software, AG Leader SMS |

The demand for electric and hybrid-powered agricultural equipment is also on the rise, with a reported growth rate of 25% in electric tractor sales alone over the last two years. This shift towards sustainable energy sources reflects a broader commitment to reducing greenhouse gas emissions within the agriculture sector. Additionally, the introduction of smart farming solutions, such as drones and automated irrigation systems, has gained traction, with market penetration projected to increase significantly in the coming years.

MARKET DYNAMICS

DRIVERS

- The rising global population is increasing food demand, necessitating efficient agricultural practices, with powered equipment like tractors and harvesters boosting productivity and reducing labor reliance.

The growing global food demand, fueled by a rising population, has placed immense pressure on agricultural systems worldwide. This demand surge is particularly pronounced in developing regions, where food security remains a major concern. Traditional farming methods, heavily reliant on manual labor, are insufficient to sustain the required productivity levels. This has driven the adoption of powered agricultural equipment, such as tractors, harvesters, and irrigation systems, which can significantly enhance efficiency in agricultural practices.

Powered equipment helps in increasing yield, reducing crop wastage, and shortening harvesting cycles, thereby meeting food production goals. Tractors and harvesters, for example, allow farmers to cultivate larger areas with less time and effort, increasing the overall productivity by up to 50% in some cases. The mechanization of agricultural processes also reduces dependency on labor, which is increasingly scarce in rural areas due to urban migration. Moreover, irrigation systems driven by advanced technology optimize water use, addressing water scarcity challenges while boosting crop output. According to estimates, modern mechanized farming can lead to a 20-30% increase in agricultural efficiency. As the world grapples with climate change, resource depletion, and population growth, the role of powered agricultural equipment becomes crucial in ensuring global food security and sustaining agricultural economies.

- Technological advancements, such as GPS, automation, and AI, improve operational efficiency and precision in agriculture, driving farmers to invest in powered equipment for higher yields.

Technological advancements in agriculture have significantly transformed the landscape of farming, particularly through the adoption of GPS, automation, and artificial intelligence (AI) in powered agriculture equipment. These innovations enable farmers to operate with enhanced efficiency, precision, and productivity. GPS technology allows for accurate field mapping and real-time tracking of equipment, which optimizes planting and harvesting processes. This precision farming approach can lead to a reduction in input costs, as farmers can apply resources like fertilizers and pesticides more judiciously. Automation further streamlines operations by minimizing manual labor requirements; for example, autonomous tractors can operate around the clock, ensuring timely completion of fieldwork. Moreover, AI plays a crucial role in data analysis, enabling farmers to make informed decisions based on predictive analytics about weather patterns, soil health, and crop performance. Additionally, a survey by the American Farm Bureau Federation indicated that nearly 70% of farmers believe technology improves farm efficiency. As a result, the integration of these advanced technologies not only enhances crop yields but also contributes to sustainable farming practices by optimizing resource usage and minimizing environmental impact. The shift toward powered agriculture equipment driven by technological advancements represents a vital step in modernizing agriculture, ensuring food security, and meeting the demands of a growing global population.

RESTRAIN

- Fluctuating commodity prices create income instability for farmers, hindering their ability to invest in costly powered agriculture equipment.

Fluctuating commodity prices represent a significant challenge in the powered agriculture equipment market, impacting farmers' financial stability and investment capabilities. Agricultural commodities, such as grains, vegetables, and livestock, often experience price volatility due to various factors, including weather conditions, supply chain disruptions, geopolitical tensions, and changes in consumer demand. The price of wheat can fluctuate dramatically based on crop yields influenced by drought or flooding, while global events, like trade disputes, can affect soybean prices. According to the Food and Agriculture Organization (FAO), price swings for staple crops can vary by 30-50% within a single year. This volatility creates uncertainty for farmers, making it challenging to predict revenue from their harvests. Consequently, when commodity prices are low, farmers often face reduced incomes, limiting their financial resources for investing in advanced powered agriculture equipment. This restraint is particularly pronounced for smallholder farmers, who operate on tighter budgets and have less access to credit. Without adequate investment in modern machinery, which can enhance productivity and efficiency, farmers may struggle to compete in an increasingly globalized market. As a result, the inability to adopt advanced equipment due to fluctuating commodity prices can perpetuate a cycle of low productivity and income instability, ultimately hindering agricultural growth and development. This situation underscores the need for policies that stabilize commodity prices and provide financial support to farmers, enabling them to invest in the equipment necessary for sustainable agricultural practices.

KEY SEGMENTATION ANALYSIS

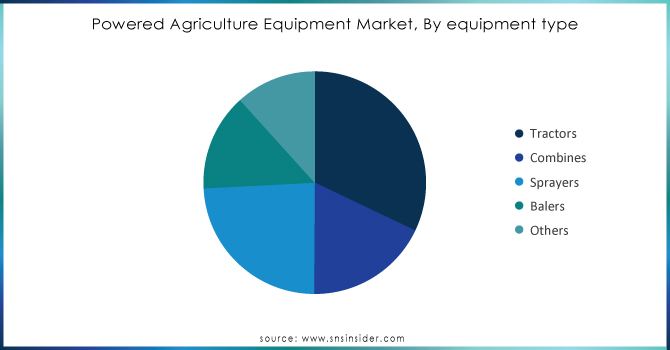

By Equipment Type

The tractors segment dominated the market share over 32.08% in 2023. Financial institutions have played a pivotal role, with agricultural loans growing by around 8% annually, providing easier access to essential equipment such as tractors and harvesters. On average, loan limits for small-scale farmers range from USD 50,000 to USD 500,000, while larger commercial entities can secure funding of up to USD 1 million. Conservation loan programs have further driven a 15% increase in investments in new tractor technologies and precision farming tools, significantly enhancing farming efficiency and productivity across the agricultural sector.

Do You Need any Customization Research on Powered Agriculture Equipment Market - Inquire Now

By Function

The Plowing & Cultivating segment dominated the market share over 32.04% in 2023. This category includes essential machinery used for soil preparation before planting, such as tractors, plows, harrows, and cultivators. This functional segmentation provides valuable insights for manufacturers, distributors, and farmers, aiding them in making strategic decisions within the market.

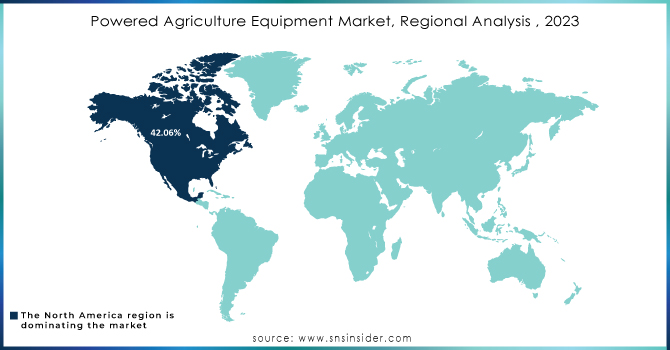

KEY REGIONAL ANALYSIS

North America region dominated the market share over 42.06% in 2023, driven by the widespread adoption of high-horsepower tractors, precision agriculture technologies, and automation solutions. The region's agricultural landscape is dominated by large, highly mechanized farms, which account for about 90% of farmland in the U.S., requiring advanced equipment to manage extensive fields efficiently. GPS-guided tractors, automated sprayers, and other high-tech machinery are common, boosting productivity and reducing labor dependence. Small and medium-sized enterprises (SMEs), although smaller players, utilize smaller or second-hand equipment, particularly in high-value or niche crops like organic produce. The push for increased labor productivity and the adoption of precision agriculture, which can reduce input costs by 15-20%, are key market drivers. Additionally, government initiatives support sustainability and farm modernization through grants for technology adoption and low-interest financing, making advanced machinery more accessible for both large and small farms.

The Asia Pacific region is witnessing a surge in the adoption of powered agriculture equipment. SMEs in countries like India and China are increasingly opting for smaller, cost-effective equipment such as power tillers, rice transplanters, and mini tractors. Government initiatives play a vital role in promoting farm mechanization, with subsidies and financing options facilitating equipment purchases. Rising labor costs and growing food demand driven by population growth are key factors pushing farmers toward mechanization to improve productivity. China’s labor costs have increased by over 60% in the past decade, making automation more attractive.

KEY PLAYERS

Some of the major key players of Powered Agriculture Equipment Market

- AGCO Corporation (Fendt Tractors, Massey Ferguson Combines)

- John Deere and Co. (John Deere Tractors, S-series Combines)

- Mahindra and Mahindra Limited (Mahindra Tractors, Mahindra Harvesters)

- CNH Industrial N.V. (Case IH Tractors, New Holland Combines)

- Kubota Corporation (Kubota Tractors, Kubota Mowers)

- CLAAS (CLAAS Tractors, Lexion Harvesters)

- Alamo Group Inc. (Alamo Mowers, Vegetation Management Equipment)

- Iseki and Co., Ltd. (Iseki Tractors, Iseki Mowers)

- SDF S.P.A. (Same Tractors, Deutz-Fahr Harvesters)

- AG Leader Technology (Ag Leader Displays, Seed Monitoring Systems)

- Trimble Inc. (Trimble GPS Guidance Systems, Ag Software)

- Yanmar Co., Ltd. (Yanmar Compact Tractors, Yanmar Harvesters)

- Bühler Industries Inc. (Buhler Tractors, Buhler Augers)

- Trelleborg AB (Trelleborg Tires, Agricultural Wheels)

- Kverneland Group (Kverneland Plows, Cultivators)

- Bauer Systems (Bauer Irrigation Equipment, Pumping Systems)

- Case IH (Magnum Series Tractors, Axial-Flow Combines)

- Pöttinger Landtechnik GmbH (Pöttinger Mowers, Tedders)

- Rabe Maschinenbau GmbH (Rabe Plowing Equipment, Cultivators)

- Krone North America, Inc. (Krone Hay Equipment, Forage Harvesters)

Suppliers for Offers a diverse range of agricultural machinery and equipment, focusing on innovative technology of Powered Agriculture Equipment Market:

- John Deere

- AGCO Corporation

- CNH Industrial

- Kubota

- Mahindra & Mahindra

- Claas

- Bucher Industries

- Trimble

- Raven Industries

- Trelleborg

RECENT DEVELOPMENTS

In July 2024: John Deere launched new UTVs, including the gas Gator XUV 845 and diesel Gator XUV 875. These utility vehicles are designed for diverse farm tasks, featuring larger customizable cargo boxes and enhanced comfort and convenience elements.

In 2024: BASF Digital Farming launched a new AI-powered spraying system on February 10, utilizing advanced cameras and sensors for precise application of crop protection products. This innovation aims to enhance efficiency in agricultural practices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 123.9 billion |

| Market Size by 2032 | USD 209.1 billion |

| CAGR | CAGR of 6.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, >250 HP) • By Drive Type (Two-wheel, Four-wheel) • By Function (Plowing & Cultivating, Sowing & Planting, Plant Protection & Fertilizing, Harvesting & Threshing, Others) • By Equipment Type (Tractors, Combines, Sprayers, Balers, Others) • By Propulsion (Hybrid Electric, Battery Electric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGCO Corporation, John Deere and Co., Mahindra and Mahindra Limited, CNH Industrial N.V., Kubota Corporation, CLAAS, Alamo Group Inc., Iseki and Co., Ltd., SDF S.P.A., AG Leader Technology, Trimble Inc., Yanmar Co., Ltd., Bühler Industries Inc., Trelleborg AB, Kverneland Group, Bauer Systems, Case IH, Pöttinger Landtechnik GmbH, Rabe Maschinenbau GmbH, Krone North America, Inc. |

| Key Drivers | • The rising global population is increasing food demand, necessitating efficient agricultural practices, with powered equipment like tractors and harvesters boosting productivity and reducing labor reliance. • Technological advancements, such as GPS, automation, and AI, improve operational efficiency and precision in agriculture, driving farmers to invest in powered equipment for higher yields. |

| RESTRAINTS | • Fluctuating commodity prices create income instability for farmers, hindering their ability to invest in costly powered agriculture equipment. |