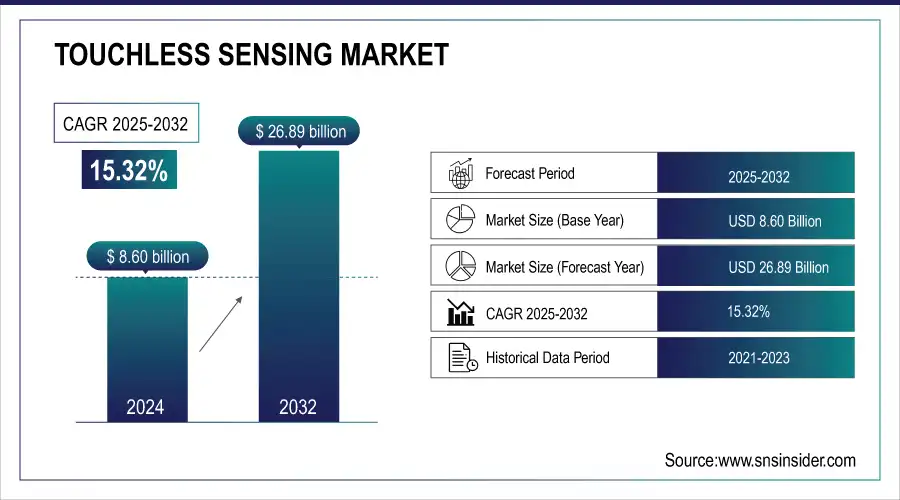

Touchless Sensing Market Size & Growth:

The Touchless Sensing Market size was valued at USD 8.60 Billion in 2024 and is projected to reach USD 26.89 Billion by 2032, growing at a CAGR of 15.32% during 2025-2032.

Global Touchless Sensing market is experiencing rapid growth driven by rising demand for hygiene, convenience, and automation across public, commercial, and healthcare spaces. Traditional infrared (IR) sensors, while widely used, face limitations such as sensitivity to ambient light and reflective surfaces, leading to inefficiencies and user dissatisfaction. Advanced Time-of-Flight (TOF) sensors are emerging as a superior solution, offering precise 3D distance measurement, reducing false activations, and improving resource management, particularly water conservation. Adoption of these technologies supports sustainability goals, operational efficiency, and enhanced user experience, making touchless solutions increasingly standard in high-traffic areas like airports, educational campuses, and commercial buildings.

Time-of-Flight (TOF) sensors are revolutionizing touchless public facilities by enhancing accuracy and reducing water waste, becoming a key feature in high-traffic and sustainable buildings (Eduardo Souza, August 14, 2025).

To Get more information on Touchless Sensing Market - Request Free Sample Report

Key Touchless Sensing market Trends

-

AI-Powered Gesture Control is driving adoption of neural and gesture-based interfaces across defense, enterprise, and consumer sectors

-

Wearable and neural input devices enhance operational efficiency, safety, and user experience in military and industrial applications

-

Multi-sensing technologies combining capacitive, inductive, and liquid-level sensing enable sleek, durable, and waterproof devices

-

Expansion in smart environments includes robotics, smart homes, and healthcare boosting market growth

-

Touchless sensing supports next-generation automation and seamless human-device interaction

-

Improved precision and reduced physical contact lead to operational efficiency and cost savings

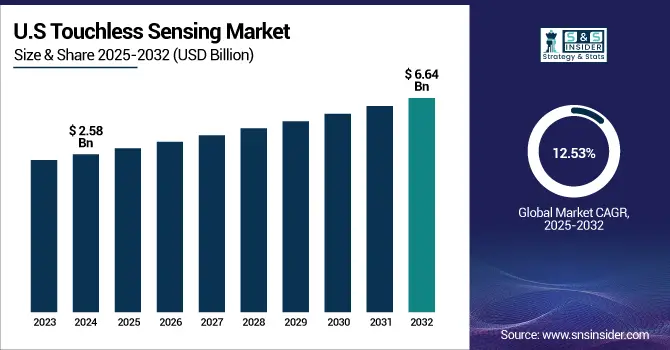

The U.S Touchless Sensing market size was valued at USD 2.58 Billion in 2024 and is projected to reach USD 6.64 Billion by 2032, growing at a CAGR of 12.53% during 2025-2032. Touchless Sensing Market growth is fueled by increasing adoption of touchless technologies in public, healthcare, and commercial spaces to enhance hygiene, convenience, and operational efficiency. Advanced sensors like Time-of-Flight (TOF) are driving superior accuracy and resource management, making touchless solutions standard in high-traffic areas while supporting sustainability and improved user experiences.

The Touchless Sensing market Trends include the rise of advanced sensors such as Time-of Flight (TOF), capacitive, and camera-based systems replacing traditional infrared; integration with IoT and AI for predictive analytics and resource optimization; growing adoption in public, commercial, healthcare, automotive, and retail sectors; emphasis on hygiene, water and energy conservation; sleek, user-friendly product designs; and increasing focus on sustainability, operational efficiency, and seamless, touch-free user experiences in high-traffic and smart environments.

Touchless Sensing Market Growth Drivers:

-

AI-Driven Gesture Control Accelerating Touchless Sensing Adoption Across Sectors

The Touchless Sensing market is the rising adoption of advanced human-machine interfaces (HMI) across defense, enterprise, and consumer applications. AI-powered touchless wearables and neural input devices allow users to control systems through intuitive gestures, enhancing operational efficiency, safety, and overall user experience. By reducing physical contact and enabling seamless interactions, these technologies are particularly valuable in high-stakes environments like military operations and immersive enterprise solutions. The integration of AI, gesture recognition, and touchless interfaces is expanding market opportunities and accelerating the shift toward contact-free, efficient, and intuitive human-device interactions.

In Aug 2025, Wearable Devices Ltd. launched AI-powered touchless neural wearables for military applications, enabling soldiers to control systems via intuitive gestures, enhancing safety and operational efficiency

Touchless Sensing Market Restraints:

-

High Implementation Costs and Technological Complexity Limit Touchless Sensing Adoption

High implementation costs and technological complexity are significant factors limiting the adoption of touchless sensing solutions across industries. Advanced AI-powered neural and gesture-based systems require substantial investment in research, development, and integration, which can be prohibitive for small and mid-sized enterprises. Additionally, these systems may face performance challenges in complex environments, such as fluctuating ambient light, reflective surfaces, or crowded spaces, leading to occasional inaccuracies. Coupled with concerns over data privacy and security in connected systems, these barriers slow large-scale deployment despite growing demand for contactless interaction and automation.

Touchless Sensing Market Opportunities:

-

Rising Demand for Advanced Interfaces Drives Growth in the Touchless Sensing Market

The Touchless Sensing market offers significant opportunities driven by the growing demand for advanced human-machine interfaces and multi-functional sensing solutions across consumer, industrial, and smart home applications. Combining technologies such as capacitive, inductive, and liquid-level sensing enables the development of sleek, durable, and waterproof devices with enhanced functionality. Applications in robotics, home appliances, healthcare, and wearable devices provide potential for cost savings, improved user experience, and operational efficiency. Increasing integration of AI and machine learning further expands capabilities, positioning touchless sensing as a key enabler of next-generation automation, smart environments, and innovative product designs.

In March 2025, Infineon Technologies launched PSOC™ 4 Multi-Sense in 2025, expanding capacitive sensing with inductive, liquid, and hover touch capabilities to enable advanced touchless HMI and sensing applications.

Key Touchless Sensing market Segment Analysis:

By Technology: Infrared (IR) dominates at 38.75% in 2024, Capacitive/Proximity grows fastest at 10.88% in 2024;

By Product Type: Touchless Biometric Devices dominate at 44.25% in 2024, Gesture-Recognition Controllers grow fastest at 10.50%;

By End-User Industry: Consumer Electronics dominate at 39.25% in 2024, Automotive grows fastest at 10.57%;

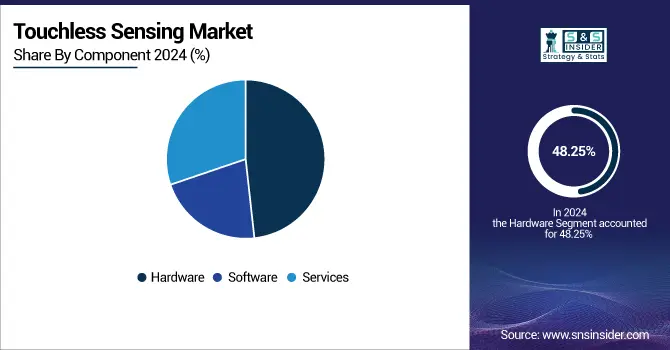

By Component: Hardware dominates at 48.25% in 2024, Software grows fastest at 21.53%.

By Component, Hardware Lead While Software Grow Fastest

In the Touchless Sensing market, Hardware leads as the primary component, powering sensors, controllers, and interactive devices across various applications. Meanwhile, Software is experiencing the fastest growth, driven by increasing integration of AI, machine learning, and advanced algorithms that enhance sensor intelligence, enable seamless human-machine interaction, and support the development of innovative, responsive, and efficient touchless solutions across industries.

By Technology, Infrared (IR) Leads Market While Capacitive/Proximity Registers Fastest Growth

Infrared (IR) technology dominates the Touchless Sensing market, widely adopted across consumer and industrial applications for reliable contactless interactions. At the same time, Capacitive/Proximity technology is experiencing the fastest growth, fueled by increasing demand for advanced human-machine interfaces and interactive devices that deliver precise, responsive, and seamless touchless experiences across various industries, enhancing usability and efficiency.

By Product Type, Touchless Biometric Devices Dominate While Gesture-Recognition Controllers Shows Rapid Growth

Touchless Biometric Devices dominate the market by product type, driven by their extensive use in security, healthcare, and consumer applications for seamless and hygienic user interactions. Meanwhile, Gesture-Recognition Controllers are showing rapid growth, fueled by increasing adoption in gaming, virtual reality, and smart home systems. These devices enable intuitive, contactless control, enhancing user experience and expanding the scope of touchless technology across industries.

By End-User Industry, Consumer Electronics Lead While Automotive Registers Fastest Growth

In the Touchless Sensing market, Consumer Electronics lead by end-user industry due to the widespread integration of touchless interfaces in smartphones, wearables, and smart devices. Meanwhile, the Automotive sector is registering the fastest growth, driven by rising demand for contactless controls, gesture recognition, and advanced in-vehicle user interfaces that enhance safety, convenience, and overall driving experience across modern vehicles.

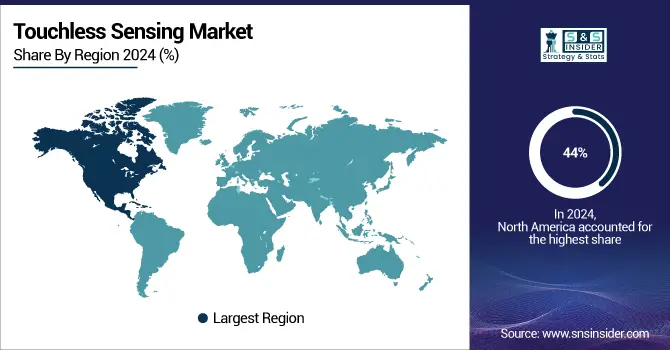

North America Touchless Sensing Market Insights

In 2024 North America dominated the Touchless Sensing Market and accounted for 44% of revenue share, The region’s leadership is driven by strong adoption of advanced technologies, presence of key industry players, and high demand for touchless solutions across consumer electronics, healthcare, and industrial applications. Rapid innovation and investments in AI-driven and contactless interfaces further strengthen its market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Touchless Sensing Market Insights

Europe is expected to witness the fastest growth in the Touchless Sensing Market over 2025-2032, with a projected CAGR of 17.12%, This growth is fueled by increasing adoption of smart devices, automation in industrial and healthcare sectors, and supportive regulatory frameworks. Rising investments in AI-driven touchless technologies and innovative human-machine interfaces further accelerate market expansion across the region.

Asia-Pacific Touchless Sensing Market Insights

In 2024, Asia-Pacific emerged as a promising region in the Touchless Sensing Market, driven by rapid urbanization, rising disposable incomes, and growing adoption of smart consumer electronics. The region benefits from a strong manufacturing base, expanding industrial automation, and increasing investments in AI-powered touchless technologies. These factors collectively position Asia-Pacific as a key growth hub, attracting major market players and fostering innovation across multiple sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Touchless Sensing Market Insights

The Touchless Sensing Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, driven by increasing adoption of contactless technologies in healthcare, retail, and public infrastructure. Rising awareness of hygiene, gradual digitalization, and investments in smart devices and automation are supporting steady market expansion, creating opportunities for regional players and international technology providers.

Competitive Landscape for Touchless Sensing Market:

iProov, founded in 2012, is a leading provider of touchless biometric and liveness detection solutions, enabling secure, passwordless authentication across enterprise systems, devices, and facilities. Their technology enhances user experience, prevents identity fraud, and supports seamless access for employees, making it a key player in advancing touchless security and human-machine interaction.

-

On Dec 10, 2024, iProov integrated biometrics and liveness detection with Microsoft Entra ID to enable secure, passwordless workforce access across systems, terminals, and facilities, enhancing protection against identity fraud and improving user experience.

Apple Inc., founded in 1976 in Cupertino, California, is a global technology leader designing and manufacturing consumer electronics, software, and services. Renowned for its iPhone, iPad, Mac, and Apple Watch products, the company emphasizes innovation, user experience, and ecosystem integration, while advancing touchless sensing and biometric technologies for secure, intuitive device interactions.

-

In Sept 2024,Apple revealed plans for future iPhones and iPads with optical touch sensors that remain functional in the presence of moisture, enhancing usability and touch accuracy in wet conditions.

Touchless Sensing Companies are:

-

Apple Inc.

-

Google Inc.

-

XYZ Interactive

-

OmniVision Technologies, Inc.

-

Cognitech Systems GmbH

-

Microchip Technology Inc.

-

iPROOV Limited

-

Elliptic Labs

-

Lightricity Technologies

-

Sony Depth Sensing Solutions

-

Microsoft Corporation

-

Samsung Electronics

-

STMicroelectronics

-

Texas Instruments

-

Intel Corporation

-

Qualcomm Technologies, Inc.

-

Panasonic Holdings Corporation

-

Toshiba Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.60 Billion |

| Market Size by 2032 | USD 26.89 Billion |

| CAGR | CAGR of 15.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology(Infrared (IR), Ultrasound, Capacitive / Proximity, Camera-based and RFID / NFC) • By Product Type(Touchless Biometric Devices, Gesture-Recognition Controllers, Sanitary Equipment and Interactive Kiosks / Screens) • By End-User Industry(Consumer Electronics, Healthcare and Life-Sciences, Automotive and Transportation, BFSI and Retail and Industrial and Logistics) • By Component(Hardware, Software and Services) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Infineon Technologies AG, Apple Inc., Google Inc., XYZ Interactive, GestureTek, OmniVision Technologies, Inc., Cognitech Systems GmbH, Microchip Technology Inc., iPROOV Limited, Elliptic Labs, Lightricity Technologies, Sony Depth Sensing Solutions, Microsoft Corporation, Samsung Electronics, STMicroelectronics, Texas Instruments, Intel Corporation, Qualcomm Technologies, Inc., Panasonic Holdings Corporation, Toshiba Corporation. |