DRAM Module and Component Market Size:

Get more information on DRAM Module and Component Market - Request Sample Report

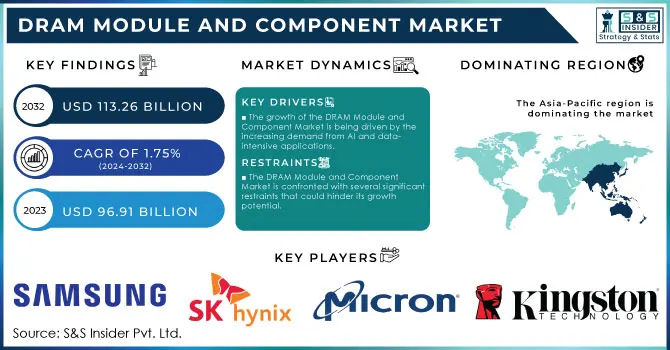

The DRAM Module and Component Market Size was valued at USD 96.91 Billion in 2023 and is expected to reach USD 113.26 Billion by 2032, and grow at a CAGR of 1.75% over the forecast period 2024-2032.

The DRAM Module and Component Market is positioned for robust growth, propelled by surging demands from sectors like big data, artificial intelligence (AI), and machine learning. As organizations increasingly depend on high-performance computing to manage extensive datasets, the need for advanced memory solutions is becoming critical. This growth trajectory underscores the essential role of DRAM in supporting data-intensive applications, particularly within AI and cloud computing environments. Major players are responding to this escalating demand by innovating their product offerings; for instance, Innodisk recently launched a DDR5 6400 64GB DRAM series tailored for edge AI and generative AI applications, exemplifying the industry's pivot towards memory solutions that meet sophisticated computational needs. Data center operators are intensifying investments to expand their facilities in response to increased workloads, highlighted by Microsoft's significant financial commitment to its data centers in Ohio to address rising power demands. In a landscape where performance and efficiency are vital, DRAM manufacturers are poised to leverage these trends, solidifying their position within the technology supply chain. As concerns around data privacy and ethical considerations gain traction, the memory market must navigate these challenges while delivering high-performance solutions. Compounding these dynamics, prices for DRAM and NAND flash are on the rise, with projections indicating a continuous upward trend throughout 2024. After a period of price declines, contract prices for DRAM are expected to climb by 13% to 18% in the first quarter, while NAND flash prices may increase by 18% to 23%. This suggests that buyers are locking in higher prices as demand escalates. As NAND flash buyers complete their inventory restocking, more modest price hikes of 3% to 8% are anticipated for the second quarter. Meanwhile, steady gains in DRAM prices are expected throughout the year, driven by the increasing adoption of DDR5 memory, further enhancing the market’s growth potential in a data-driven economy.

DRAM Module and Component Market Dynamics

Drivers

-

The growth of the DRAM Module and Component Market is being driven by the increasing demand from AI and data-intensive applications.

The DRAM Module and Component Market is experiencing robust growth driven by the escalating demand for data-intensive applications, particularly fueled by the rise of big data, artificial intelligence (AI), and machine learning. As organizations increasingly rely on high-performance computing to process and analyze vast amounts of data, advanced memory solutions have become essential. Reports indicate that the AI sector is rapidly expanding, with significant investments in data centers to accommodate rising workloads, as seen with DigitalBridge's acquisition of Yondr to enhance data center capacity amid growing AI demands. Furthermore, Innodisk's recent launch of a high-capacity DDR5 6400 DRAM series exemplifies the industry's shift towards providing specialized memory solutions for edge AI and other computationally intensive applications. The need for enhanced data processing capabilities aligns with the global transition towards cloud computing and the Internet of Things (IoT). The increasing reliance on real-time data analytics necessitates higher memory capacities, further driving demand for DRAM. Notably, rising electricity costs and concerns about sustainability are prompting data center operators to seek more efficient computing solutions, reinforcing the critical role of DRAM and module components in powering these technologies. With such trends indicating a sustained demand surge, the DRAM Module and Component Market is poised for significant growth, offering manufacturers opportunities to innovate and meet the evolving needs of a data-driven economy.

Restraints

-

The DRAM Module and Component Market is confronted with several significant restraints that could hinder its growth potential.

High production costs are a primary concern, stemming from the capital-intensive nature of DRAM manufacturing. Companies like Kioxia are innovating with advanced NAND technologies but face rising expenses for equipment and materials, particularly silicon, which have tightened profit margins. Additionally, supply chain disruptions continue to create obstacles, as seen in the financial struggles of firms like CommScope, which find it challenging to manage costs and inventory amid global uncertainties. These disruptions can lead to fluctuations in component availability, affecting production schedules and driving up prices for products. Rapid technological advancements further contribute to market volatility, resulting in shorter product life cycles, compelling companies to invest heavily in research and development to keep pace with innovations, especially in AI and machine learning. The rise of alternative memory technologies, such as NVMe and storage-class memory, also poses a threat to the traditional DRAM landscape. Lastly, the evolving regulatory framework focused on environmental sustainability adds compliance costs, complicating operational strategies. To navigate these challenges, stakeholders must adapt and devise strategies that respond to technological progress and regulatory demands.

DRAM Module and Component Market Segment Analysis

by Memory

The DRAM module and component market analysis indicates that the 8GB memory module is the leading segment, capturing about 45% of market revenue in 2023. This dominance is driven by its ideal balance of performance and cost, making it a preferred choice for personal computers, laptops, and mobile devices. The 8GB module meets the demands for multitasking and high-speed processing while keeping system costs manageable. Recent innovations by companies like Samsung and Micron have further bolstered this trend, with new 8GB DRAM modules optimized for gaming, AI, and enterprise applications. As data-intensive tasks such as gaming, video editing, and AI become more prevalent, the 8GB module is increasingly seen as the minimum requirement for smooth operation. Additionally, the rise of cloud computing and virtualization ads to the demand for these modules. Overall, the 8GB segment is poised to remain strong, supported by ongoing product advancements and sustained market demand.

by End-User Industry

The analysis of the DRAM module and component market indicates that the mobile device sector is the leading revenue contributor, capturing about 35% of the market share in 2023. This leadership is largely driven by the rising demand for smartphones and tablets, which require high-performance memory solutions to support sophisticated applications and enhanced user experiences. As mobile technology advances, manufacturers are incorporating features such as high-resolution displays, augmented reality (AR), and artificial intelligence (AI), all of which demand significant memory resources. Major players like Samsung and SK Hynix are focused on developing DRAM solutions specifically for mobile applications, improving performance while also optimizing power efficiency. For example, Samsung recently launched LPDDR5X memory chips aimed at meeting the needs of 5G smartphones and AI applications, while SK Hynix unveiled mobile DRAM products that offer enhanced bandwidth and reduced latency.

DRAM Module and Component Market Regional Outlook

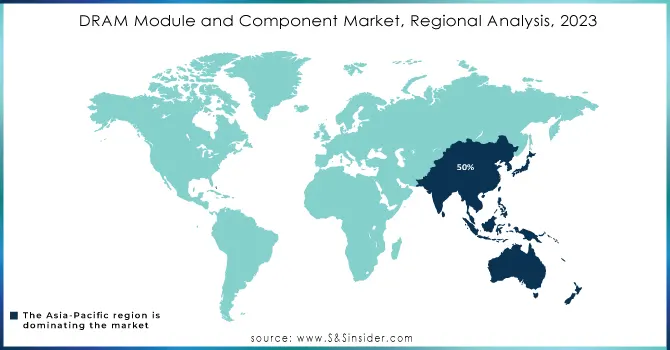

The Asia-Pacific region stands as the leader in the DRAM and module component market, capturing around 50% of the global market share in 2023. This commanding position is largely attributed to the concentration of major semiconductor manufacturers, cutting-edge production capabilities, and a rapidly expanding consumer electronics sector. Key countries such as South Korea, Japan, China, and Taiwan play crucial roles in this dynamic market, hosting industry giants like Samsung, SK Hynix, Micron Technology, and Nanya Technology.

South Korea continues to be a dominant force, with Samsung and SK Hynix at the forefront of DRAM production. Samsung recently unveiled advancements in its DDR5 DRAM technology designed to enhance performance for data centers and AI applications, while SK Hynix launched its next-generation LPDDR5X DRAM, optimized for high-performance mobile devices and gaming. In China, the semiconductor landscape is undergoing significant expansion, with companies like Yangtze Memory Technologies Co. (YMTC) heavily investing in DRAM production to lessen reliance on foreign suppliers. The Chinese government is also supporting initiatives aimed at strengthening domestic semiconductor manufacturing, which is expected to elevate the country’s standing in the global DRAM sector. Japan remains a hub of innovation, with firms such as Micron Technology introducing DRAM solutions that emphasize energy efficiency and processing speed across various applications, including automotive and enterprise sectors.

North America is the fastest-growing region in the DRAM Module and Component Market in 2023, largely due to technological advancements and rising demand across various sectors. The United States plays a crucial role, with industry leaders like Micron Technology, Intel, and AMD driving innovation in DRAM production. The increasing need for high-performance memory solutions in data centers, cloud computing, artificial intelligence (AI), and gaming fuels this growth. Micron, for instance, is enhancing its DRAM offerings to cater to the evolving requirements of AI applications and big data analytics. Additionally, the U.S. government is actively supporting semiconductor manufacturing through initiatives like the CHIPS for America Act, which aims to strengthen domestic supply chains and reduce dependence on foreign suppliers. This strategic focus on innovation and investment in memory technologies positions North America to maintain its momentum and further expand its presence in the global DRAM market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major key Players in DRAM Module and Component Market with product:

-

Samsung Electronics (DDR5 DRAM, LPDDR5, GDDR6)

-

SK Hynix (DDR4, LPDDR4X, HBM2E)

-

Micron Technology (DDR4, LPDDR5, 3D XPoint Memory)

-

Kingston Technology (ValueRAM, HyperX DDR4)

-

Nanya Technology Corporation (DDR3, DDR4 Modules)

-

Winbond Electronics (Low-Power DRAM, Mobile DRAM)

-

Powerchip Technology (DDR3, DDR4)

-

Intel Corporation (Optane Memory, Persistent Memory Modules)

-

ADATA Technology (XPG Gaming DRAM, Premier DDR4)

-

Crucial (Micron Brand) (Ballistix Gaming Memory, DDR5)

-

Transcend Information (JetRam, Industrial DRAM Modules)

-

Team Group (T-Force Gaming Memory, DDR4)

-

SMART Modular Technologies (DDR4, NVMe NVRAM)

-

Elpida Memory (Micron subsidiary) (Mobile DRAM, Embedded DRAM)

-

Toshiba Corporation (Flash Memory Modules, Embedded DRAM)

-

Apacer Technology (Industrial DRAM, Ruggedized Modules)

-

PNY Technologies (XLR8 Gaming DRAM, Performance DDR4)

-

Qimonda (now defunct, tech licensed) (GDDR3, Graphics DRAM)

-

Goldkey Technology (DDR3 Modules, DDR4 Modules)

-

Innodisk Corporation (Industrial DRAM, Wide-Temp DRAM Modules)

Some of the major suppliers providing key raw materials for DRAM and module components. These materials include silicon wafers, chemicals, photomasks, gases, and other semiconductor manufacturing essentials.

-

Shin-Etsu Chemical Co., Ltd.

-

SUMCO Corporation

-

Siltronic AG

-

Tokyo Ohka Kogyo Co., Ltd. (TOK)

-

JSR Corporation

-

Merck Group (EMD Electronics in the U.S.)

-

Mitsui Chemicals

-

Linde PLC

-

Air Liquide

-

Dow Chemical Company

-

BASF SE

-

Entegris, Inc.

-

Momentive Performance Materials

-

Toppan Photomasks, Inc.

-

Photronics, Inc.

-

Honeywell International Inc.

-

Sumitomo Chemical Co., Ltd.

-

Cabot Microelectronics (CMC Materials)

-

Showa Denko K.K.

-

GlobalWafers Co., Ltd.

Recent Development

-

August 6, 2024 Samsung has started mass production of the world's thinnest LPDDR5X DRAM packages, featuring 12 GB and 16 GB capacities, with a thickness of around 0.65 mm, which is 0.06 mm thinner than typical LPDDR5X packages. This new design improves airflow and thermal management in smartphones, crucial for high-performance application processors, including those with sophisticated on-device AI capabilities.

-

July 30, 2024 South Korean mobile phone module manufacturer Dreamtech Co. is expanding its operations in India by entering the memory semiconductor market in collaboration with Samsung Electronics. Starting in the fourth quarter of 2024, the company plans to produce new memory semiconductor modules at its newly opened factory in Greater Noida, which has been operational since June 2024.

-

January 23, 2024 A TrendForce report reveals that DRAM and NAND flash prices are sharply increasing, with predictions of further hikes throughout 2024. Following two years of declining prices, the analysis indicates that contract prices for DRAM could rise by 13 to 18 percent in the first quarter, while NAND flash prices may increase by 18 to 23 percent.

-

June 17, 2024 Samsung has introduced the Multi-Ranked Buffered Dual In-Line Memory Module (MCRDIMM), designed to enhance memory capacity and bandwidth without increasing server board slots. by combining two DDR5 components, MCRDIMM achieves data transmission speeds of up to 8.8 Gb/s, effectively doubling existing bandwidth.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 96.91 Billion |

| Market Size by 2032 | USD 113.26 Billion |

| CAGR | CAGR of 1.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by type (DDR2, DRAM, DDR3 DRAM, DDR4 DRAM, DDR5 DRAM, LPDRAM, GDDR, HBM, Others) • by memory (Up to 1GB, 2GB, 3-4GB, 6-8GB, >8GB) • by End-User Industry (Consumer Electronics, Mobile Devices, Servers, Computers, Automobiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, SK Hynix, Micron Technology, Kingston Technology, Nanya Technology Corporation, Winbond Electronics, Powerchip Technology, Intel Corporation, ADATA Technology, Crucial, Transcend Information, Team Group, SMART Modular Technologies, Elpida Memory, Toshiba Corporation, Apacer Technology, PNY Technologies, and Innodisk Corporation. |

| Key Drivers | • The growth of the DRAM and module component market is being driven by the increasing demand from AI and data-intensive applications. |

| RESTRAINTS | • The DRAM and module component market is confronted with several significant restraints that could hinder its growth potential. |