Ceramic Balls Market Report Scope & Overview

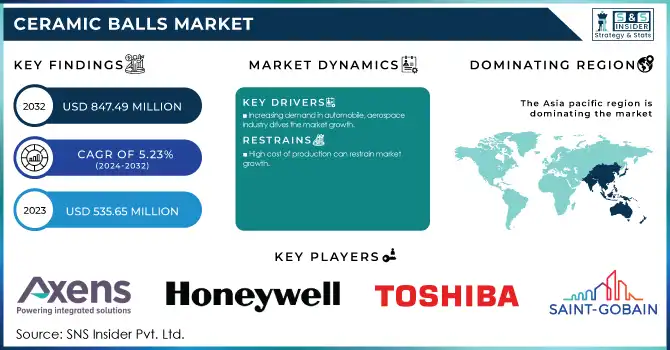

The Ceramic Balls Market was USD 535.65 Million in 2023 and is expected to reach USD 847.49 Million by 2032, growing at a CAGR of 5.23% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Ceramic Balls Market - Request Sample Report

In the chemical and petrochemical industries, the increasing demand for ceramic balls due to their oxide chemical resistance, capability to endure high temperatures, and wear-resistance is expected to boost the ceramic balls market. Since ceramic balls are the widely used catalyst bed support media in many petrochemical refineries and chemical processing plants, they provide superior stability in extreme conditions. Because of this, they make perfect candidates for reactors, absorbers, and separation processes due to their great resistivity to acids, alkaline, and extreme heat. They also reduce process contamination and increase equipment life relative to metal or polymer-based alternatives, thus increasing process efficiency. The growing global consumption of accidents and other specialty chemicals, ever-increasing economic development, and related demand for refined petrochemical products would drive the growth of ceramic balls, and with the help of the latest mechanical and thermal properties-enhancing material engineering techniques, the mechanical and thermal properties could be further improved, thereby providing a competitive edge over the market players.

Recent technological advancements in manufacturing techniques have enhanced the quality, performance, and cost-effectiveness of these products, and this has led to a wider adoption of ceramic balls across various industries. Advancements in precision engineering, material science, and automated production processes have led manufacturers to synthesis more mechanical strength, sphericity and wear resistance in ceramic balls for this industry. Development of hot isostatic pressing (HIP), and spark plasma sintering (SPS) techniques in advanced sintering technology have produced denser, tougher ceramics. Moreover, combining computer-aided design (CAD) with an artificial intelligence (AI)-based quality control system has improved production efficiency and lessened defect rates. These technological improvements have broadened the application of ceramic balls, in aerospace, medical and high-speed machinery industries where performance and durability are crucial. In an effort to continue developing more efficient and cost-effective solutions for industrial applications, further advances by R&D teams will develop ceramic balls through nanotechnology and additive manufacturing.

Additionally, the U.S. ceramics manufacturing industry has shown growth, with approximately 12,994 individuals employed across 1,887 businesses as of April 2023.

Ceramic Balls Market Dynamics

Drivers

-

Increasing demand in automobile, aerospace industry drives the market growth.

High strength, wear resistance, lower weight, and desirable mechanical properties of ceramic balls are the factors responsible for driving the automobile and aerospace industry, which in turn, will drive market growth. Automobile is one of the booming end-use industries, where ceramic balls are utilized in high precision components including bearings, valves and clutch system, presence of ceramic balls reduces the high temperature and extreme friction, hence, improving the efficiency and longevity of vehicle hardware. Their light weight further aids fuel efficiency, key in making cars green and powerful. Ceramic balls are used in key aerospace applications, such as turbine engines, bearings and other high-speed high precision components. They improve the reliability and performance of aerospace components, especially in severe service temperature and other adverse environments, due to their resistance to heat and corrosion. With both industries striving to provide even more performance and sustainability, the carrying capacity of advanced materials such as ceramic balls will increasingly need to drive market development.

Restraint

-

High cost of production can restrain market growth.

High production cost is one of the major factors which restrains the growth of the ceramic balls market. The making of ceramic balls should take use of advanced materials and special production process with high temperature sintering, and precision machining, and they are expensive. Production costs are driven even higher by patented procedures to make ceramic balls using premium raw materials including silicon nitride, zirconia, and alumina which are necessary to achieve high strength and durability. Also, the processes involved to manufacture these high-end ceramic balls are quite complicated and energy-taking which in turn increases the costs. This can translate to a high-end product and make it of prohibitive expense compared to typical metal or plastic alternatives, preventing widespread acceptance, especially within price-sensitive industries or regions. Although ceramic balls provide marked improvements in performance and durability, the initial investment cost can be a significant barrier to widespread adoption and market growth, especially in the developing regions of the world where cost consideration can have an outsized impact on adoption.

Opportunity

-

Research and development activities for products are estimated to generate significant opportunities in the market

-

Raising demand from wind farm are creating new opportunities for market growth

Ceramic Balls Market Segmentation Analysis

By Material

Alumina held the largest market share 44% in 2023. It is owing to combination of excellent properties, availability, and cost-based challenges. Alumina is ideal for high strength, wear-resistant applications and is used in industrial applications such as bearings, valves, and catalytic supports. As a material, alumina is also durable and resistant to high temperatures, and corrosion which also makes it perfect to withstand harsh environments in the automotive, aerospace, and chemical industries. In addition, compared to other advanced ceramic materials, such as silicon nitride or zirconia, alumina is relatively abundant and inexpensive, and permeated by industrial ropes. Due to its versatile nature and its relatively low production costs, alumina has emerged as one of the leading materials in the ceramic balls market, thus continuing to maintain its prominent position in the market.

By Function

Inert function held the largest market share around 68% in 2023. Due to its resistance of high purity silicone to acids, bases, and other corrosive substances means they are ideal for applications where interaction of the reaction solution with any reactive chemical can alter the quality of products or the efficiency of the process. Characteristics like inert function of ceramic balls are highly attractive in high-temperature high-pressure applications, such as the refining of petrochemical products, where it is beneficial that the ceramic balls do not change form, or in many cases release contaminants into the process. The increasing demand for inert materials to meet sustainable, non-reactive material requirements in industrial processes reinforces this wide-ranging and fundamental applicability, which is expected to result in the largest share of the overall market for inert function segment.

By Application

Bearing held the largest market share around 42% in 2023.Due to these attributes, ceramic balls are often sought after in extreme applications in industries such as automotive, aerospace, and industrial machinery, where speed, low maintenance, and durability are all essential functions. Ceramic bearings are utilized in automotive applications, such as in the engine, transmission, and turbochargers, and help reduce friction and wear in order to improve fuel efficiency and lower emissions. Ceramic bearings play an essential role in turbine engines and other rotating parts in aerospace, where the needs for high-temperature and stress resistance are significant. The rising requirement for high-speed and energy-efficient systems in such industries has led to an increase in the adoption of ceramic bearings, thus having the largest application segment in this market.

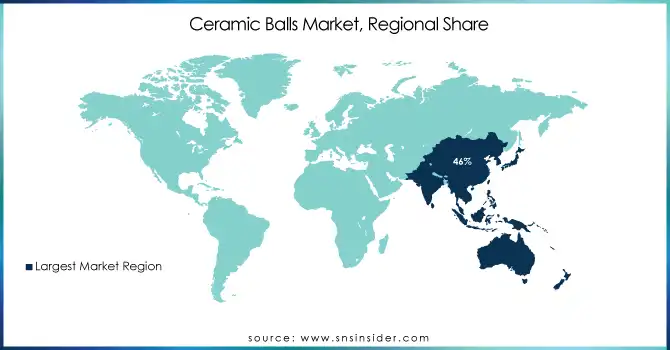

Ceramic Balls Market Regional Outlook

Asia pacific has the highest share of ceramic balls market share around 46% in 2023. Due to significant activities in some of the critical industrial sectors, including automotive, aerospace, manufacturing, and chemical processing, Asia-Pacific accounts for a lion's share of the global ceramic balls market. As one of the fastest developing areas of the world with huge manufacturing powers, China, Japan, and India speeding up industrialization for better development, the region will surely not allow this to happen. The rapid growth of the automotive and aerospace industries in the region (specifically China) repaired with the widespread use of ceramic balls in bearings, valves, and other components contributes significantly to the market growth in this region. Asia-Pacific also accounts for a most of the ceramic balls used in chemical and petrochemical industries, where they are used as catalyst supports and in other high-temperature and corrosion-resistant applications. Moreover, the region offers low-cost production capacity and high-scale manufacturing infrastructure supporting the ceramic balls to be more readily available and affordable for many industries. Another driver for market dominance by Asia-pacific is the ever-advancing technological processes in terms of manufacturing these ceramic materials, as well as the lower pricing.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Axens (Catalyst Bed Support, Reactor Internals)

-

Honeywell International (Aerospace Bearings, Catalysts)

-

Saint-Gobain (Ceramic Balls, Catalyst Supports)

-

Toshiba Materials Co. (Ceramic Ball Bearings, Wear-resistant Components)

-

Global Precision Ball & Roller (Precision Ceramic Balls, Steel Balls)

-

Fineway Ceramics (Grinding Media, Ceramic Balls)

-

Tsabuki Nakashima Co. Ltd (Ceramic Balls, Bearing Balls)

-

Topack Ceramics Pvt Ltd (Industrial Ceramic Balls, Grinding Media)

-

CoorsTek, Inc. (Alumina Ceramic Balls, Zirconia Balls)

-

SKF (Ceramic Ball Bearings, High-performance Bearings)

-

Ceramic Bearings (Silicon Nitride Bearings, Hybrid Ceramic Bearings)

-

NGK Spark Plug Co. (Ceramic Balls, Advanced Ceramics)

-

Kyocera Corporation (Alumina Ceramic Balls, Ball Bearings)

-

3M (Ceramic Balls, Grinding Media)

-

Rauschert (Ceramic Media, Porcelain Balls)

-

SinterBall (Sintered Ceramic Balls, Catalyst Carrier Balls)

-

Saint-Gobain Ceramic Materials (Ceramic Balls, Grinding Media)

-

Precision Ceramics (Silicon Nitride Balls, Zirconia Balls)

-

Morgan Advanced Materials (Ceramic Bearings, Catalyst Support Balls)

-

DuPont (Ceramic Ball Bearings, High-performance Ceramics)

Recent Development:

-

In 2023, Saint-Gobain announced the expansion of its ceramic materials division to enhance production capacity for advanced ceramic balls, aiming to meet the growing demand in the automotive and aerospace sectors.

-

In 2023, SKF introduced a new line of hybrid ceramic ball bearings designed to improve performance and energy efficiency in electric vehicles, addressing the increasing need for sustainable automotive solutions.

-

In 2023, CoorsTek expanded its manufacturing capabilities by opening a new facility dedicated to producing high-purity ceramic balls for medical applications, enhancing their presence in the healthcare sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 535.35 Million |

| Market Size by 2032 | USD 847.49 Million |

| CAGR | CAGR of 5.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Silicon, Zirconia, Alumina, Others) • By Function (Inert, Active) • By Application (Grinding, Valve, Bearing, Others) • By End-User (Chemical, Aerospace, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Axens, Honeywell International, Saint-Gobain, Toshiba Materials Co., Global Precision Ball & Roller, Fineway Ceramics, Tsabuki Nakashima Co. Ltd, Topack Ceramics Pvt Ltd, CoorsTek, Inc., SKF, Ceramic Bearings, NGK Spark Plug Co., Kyocera Corporation, 3M, Rauschert, SinterBall, Saint-Gobain Ceramic Materials, Precision Ceramics, Morgan Advanced Materials, DuPont |

| Key Drivers | • Increasing demand in automobile, aerospace industry drives the market growth. |

| Restraints | • High cost of production can restrain market growth. |