Alkylamines Market Report Scope and Overview:

Get E-PDF Sample Report on Alkylamines arket - Request Sample Report

The Alkylamines Market Size was valued at USD 6.24 billion in 2023 and is expected to reach USD 11.11 billion by 2032 and grow at a CAGR of 6.62% over the forecast period 2024-2032.

The main driver of the alkylamines market is the increasing demand for water treatment. They are used in this process as chelating agents and flocculants, both of which are necessary for removing impurities from water. Since the global population is growing, and so are urban populations, the demand for clean and safe water is rising. Moreover, several environmental policies in several countries are focused on water quality. Alkylamines are employed to uphold these regulations be augmenting the efficiency of water purification. The importance of this fact is that the regulations would not be upheld without a means of achieving the necessary water quality. This shows the crucial role of alkylamines in water-related problems and meeting the standards.

For instance, according to the EPA’s 2023 report, the U.S. water treatment sector has seen increased investments in advanced treatment technologies, including the use of chelating agents like alkylamines. The report highlights a significant rise in funding for water infrastructure projects, aimed at enhancing water quality and safety.

Moreover, the alkylamines market is significantly influenced by the growth of the pharmaceutical sector since these compounds are essential to the production of many different types of medications. When creating medications to address respiratory problems, neurological diseases, and other medical illnesses, alkylamines are a necessary intermediary. The aging population, increased prevalence of chronic diseases, and improvements in medical research are driving the rise of the pharmaceutical industry. The need for alkylamines is fueled by this development since they are essential to the creation of novel, potent drugs. Furthermore, the pharmaceutical industry's continuous R&D endeavors investigate new uses for alkylamines, which enhances their market importance and propels the industry's overall expansion.

For instance, in 2024 Eastman Chemical company introduced a new line of high-purity alkylamines specifically designed for pharmaceutical and water treatment applications. This new product range emphasizes improved performance and adherence to stringent quality standards, addressing the evolving needs of these sectors.

Market Dynamics:

Drivers

-

Increasing focus on environmental sustainability use of bio biofuels and biodegradable products.

The increasing focus on environmental sustainability is significantly driving the demand for biofuels and biodegradable products, as governments and industries worldwide strive to reduce their carbon footprint and environmental impact. Policies and regulations promoting the use of renewable energy sources, such as the European Union's Renewable Energy Directive, which mandates that 32% of energy consumption come from renewable sources by 2030, are encouraging the adoption of biofuels.

Moreover, according to the U.S. Energy Information Administration, the use of biofuels in the United States is projected to grow by 18% by 2030, supported by government incentives like the Renewable Fuel Standard program. This push for sustainability is also evident in the growing market for biodegradable products, with governments implementing bans on single-use plastics and promoting the use of eco-friendly materials.

For instance, the Indian government has set a target to abolish single-use plastics by 2025, boosting the demand for biodegradable alternatives. These regulatory frameworks and initiatives are key drivers in the transition towards a more sustainable economy, fueling the growth of biofuels and biodegradable products globally.

Restrain

-

High cost of preserving safety and environmental standards in alkylamines

The high cost of maintaining safety and environmental standards in the alkylamines market is a significant challenge for manufacturers, impacting overall production costs and market dynamics. Alkylamines are hazardous chemicals, requiring stringent safety measures to prevent exposure risks, including specialized storage, handling, and transportation protocols. Compliance with environmental regulations, such as those imposed by the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), mandates that manufacturers invest heavily in pollution control technologies, waste management systems, and regular safety audits.

Market Segmentation

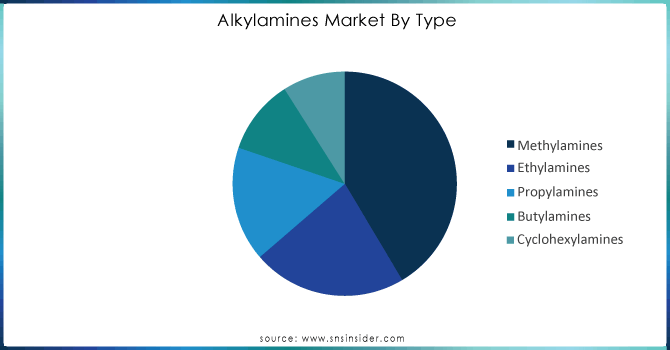

By Type

The methylamine, type held the largest market share around 41.45% in 2023. It is a crucial ingredient in the manufacturing of drugs, substances for water purification, and agricultural chemicals, all of which are in high demand worldwide. Methylamine plays a crucial role in agriculture as it is utilized in the production of pesticides and herbicides, especially in regions focused on increasing crop productivity. It is used in the pharmaceutical industry to produce drugs and active pharmaceutical ingredients (APIs). Its market dominance is also due to its widespread use in producing solvents, surfactants, and chemicals for synthesis. Due to its versatility, high demand in key sectors, and cost-effectiveness, methylamine remains the top choice among alkylamines available in the market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

The solvent held the largest market share around 40.13% in 2023. Alkylamines, particularly methylamine and ethylamine, are commonly used as solvents in the production of agrochemicals, rubber processing, and pharmaceuticals. They assist in making different molecules stable and soluble. In sectors where precise chemical compositions are essential, their importance lies in their effectiveness in chemical processes such as the production of insecticides and dyes. The increasing demand for efficient and high-quality solvents in emerging industries like electronics and specialty chemicals continues to fuel the dominance of the alkylamine market in solvent applications. Alkylamines' versatility, efficiency, and widespread use as solvents help them to continue to hold a strong position in this sub-segment of the market.

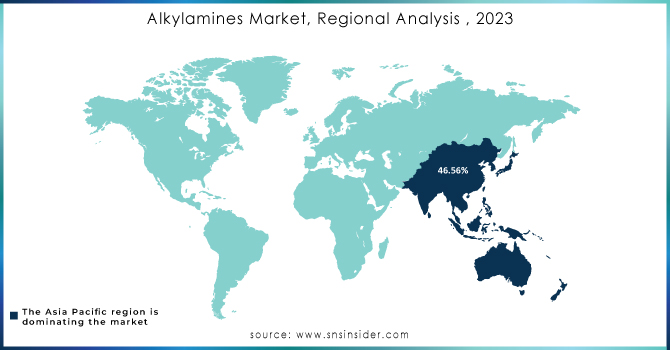

Regional Analysis:

Asia Pacific held the highest market share in the alkylamines market at about 46.56% in 2023. This is due to a combination of factors including growing chemical manufacturing, fast industrialization, and high demand from end-use sectors including water treatment, pharmaceuticals, and agriculture, the Asia-Pacific region is currently leading the global alkylamine market. Moreover, owing to their sizable populations, rapid urbanization, and strong economic growth, nations like China and India are leading the way in this expansion. The need to increase crop yields to address concerns related to food security, the agricultural sector in these nations has a particularly high demand for alkylamines, which are utilized in agrochemicals. The pharmaceutical sector in the area is also flourishing, and alkylamines are essential to the formulation and manufacture of many drugs. The Asia-Pacific region's leadership in the industry is further cemented by the presence of significant global manufacturers there, as well as advantageous government policies and infrastructural expenditures.

Key Players:

The major playes listed in the Alkylamines Market are Feicheng Acid Chemicals Co. Ltd., Alkylamines Chemicals Ltd., Koei Chemical Company, Luxi Chemical Group Co., Ltd., Arkema, Mitsubishi Gas Chemical Company, Eastman Chemical Co., BASF SE, Dow Inc., Balaji Amines, and others.

Recent Developments:

-

In 2023, BASF SE expanded its production capacity for alkylamines at its Ludwigshafen site in Germany. The expansion aimed to meet the increasing demand from industries such as pharmaceuticals, agrochemicals, and water treatment.

-

In 2023, Huntsman Corporation announced the acquisition of a leading Chinese alkylamines manufacturer.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.24 Billion |

| Market Size by 2031 | US$ 11.11 Billion |

| CAGR | CAGR of 6.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Solvents, Agrochemicals, Rubber Processing, Water Treatment, Feed Additives, Pharmaceuticals, Others) • By Type (Methylamines, Ethylamines, Propylamines, Butylamines, Cyclohexylamines) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Luxi Chemical Group Co., Ltd., BASF SE, Arkema, Dow Inc., Alkylamines Chemicals Ltd., Feicheng Acid Chemicals Co. Ltd., Koei Chemical Company, Eastman Chemical Co., Balaji Amines, Mitsubishi Gas Chemical Company |

| Key Drivers |

• Expanding wastewater treatment facilities worldwide. |

| RESTRAINTS | • Alkylamine's negative consequences and the high cost of maintenance • Varying costs for raw materials |