Ultrapure Water Market Report Scope & Overview:

Get more information on Ultrapure Water Market - Request Sample Report

The Ultrapure Water Market Size was valued at USD 8.8 billion in 2023, and is expected to reach USD 18.2 billion by 2032, and grow at a CAGR of 8.5% over the forecast period 2024-2032.

The Ultrapure Water Market is rapidly evolving, with soaring demand from high-tech industries such as semiconductors, pharmaceuticals, and power generation. These industries need waters of exceptionally high purity standards to ensure that their processes meet stringent quality controls. Indeed, as technology advances and industries continue to grow, the need for advanced technologies in water purification will only increase. Companies the world over are making serious investment in state-of-the-art systems for providing ultrapure water; this has assumed immense significance in maintaining superior standards in industrial applications.

The semiconductor industry is one of the biggest customers for pure ultrapure water. With this sector growing—especially within the emerging markets like India—the requirement for high-grade water is increasing. For instance, the strategic initiatives that the government of India has undertaken to foster domestic manufacturing of semiconductors have huge demand translating to ultrapure water. Indeed, at the close of June 2024, companies in India are significantly ramping up their infrastructure to support such demand, demonstrating a broader global trend of rising investments in Semiconductor Production Facilities. This growth also underlines the fact that ultrapure water is pivotal to precision and quality in semiconductor manufacturing processes.

Some of these notable developments are also happening in Europe, as manifested in Gradient's efforts in Germany. A leading global water treatment company set foot for a full project entryway to provide ultrapure water into a new manufacturing complex for the front end of advanced semiconductors in Germany by January 2024. This development shows the weight of the ultrapure water needs in the microelectronics industry and well mirrors its colossal global expansion and technological advances. Gradiant's actions underline how essential ultrapure water is in sustaining sophisticated manufacturing processes around the world.

Since many pharmaceutical industries require high-purity water in a number of critical processes, including formulation, dilution, and equipment cleaning, for safety and efficacy, this segment is likely to contribute immensely towards the market demand for ultrapure water. For example, the ultrapure water systems were upgraded at this leading U.S. pharmaceutical company in August 2024 with the latest filtration technologies in place to enhance their compliance with the regulatory standards and bring improvement in production efficiency. Secondly, concerns are now being raised about sustainability and environmental compliance by companies. Innovations by companies like Fronius Perfect Welding, which grew significantly in 2023 with new solutions that realize the perfect harmony of production efficiency with the burden on the environment, mirror the commitment of this sector to the bridge between high standards of production and the sustainability of practices.

Market Dynamics:

Drivers:

-

Growing adoption of ultrapure water in the nanoscience sector

The growing use of ultrapure water in the nanoscience industry is another major driving factor for the Ultrapure Water Market. This is due to the fact that the research and production methods for nanotechnology require water of very high purity. When nanoscience development became possible, an increased demand for ultrapure water in its use within synthesizing nanomaterials and fabricating nanoelectronics followed. For example, in March 2024, IBM Corporation announced its intention to extend its nanotechnology research facilities in New York, with ultrapure water used in the fabrication of the next generation of nanoelectronics. The latest and most state-of-the-art water purification systems will first be installed and then upgraded to conditions needed for the synthesis of nanomaterials. In July 2024, NanoTech Solutions, an international leader in the sphere of nanoscience, upgraded its California lab's ultrapure water systems to keep up with cutting-edge nanofabrication processes. It was imperative for ensuring precision and quality in the company's nanoscale devices and reflected a broader trend towards increasing investment in high-purity water systems for state-of-the-art research and applications in this field. Such developments serve to emphasize the ultrapure water needs of the pursuit of continued growth and innovation in the nanoscience sector.

-

The rapid adoption of desalination technology

Desalination technology is another key driver of the Ultrapure Water Market since it is rapidly adoptable. A growing global demand for high-quality water resources is created through desalination, which has developed as an important source of producing ultrapure water because freshwater sources are becoming ever scarcer. Veolia Water Technologies, the world leader in water treatment announced today that their most advanced Reverse Osmosis and Multi-Effect distillation technologies will be incorporated into a state-of-the-art Desalination plant in Abu Dhabi set for operation February 2024 capable of delivering ultrapure drinking water made from seawater. This plant will serve the region's local water demand and a supply of ultra-pure water for regional industries. Similarly, SUEZ Water Technologies & Solutions opened a state-of-the-art desalination plant in Sydney Australia also by August 2024. The reverse osmosis desalination plant was custom built to provide ultrapure water for high-tech industries in the pharmaceutical and electronics category.. The installation of desalination technology by such plants underlines a broader trend to embrace new water treatment technologies to fuel the growing ultrapure water demand in several industries and regions. This fast adoption thus underscores the critical role that desalination will play in sustaining global water supplies and supporting industrial applications requiring the highest purity standards.

Restraints:

-

High costs of purification technology hamper the growth of ultrapure water market

High purification technology costs are one of the major restraints to the growth of the ultrapure water market, as this eventually affects new entrants and existing players. For instance, in April 2024, Pall Corporation, a key filtration systems provider, was finding it difficult to build on its ultrapure water solutions due to the high capital expenditure required for advanced filtration and ion exchange technologies. The latest system of this company for semiconductor manufacturing involves ultrapure water equipment that includes advanced, multi-stage filtration and expensive reverse osmosis units, considerably increasing the overall investment. In September 2024, global water treatment firm Ecolab faced financial complications over upgrading its ultrapure water systems for a leading pharmaceutical client in Europe. The project involved massive installation of high-tech purification systems to achieve the highest industry standards, thus increasing the costs and negatively affecting the budget of the client. The above examples illustrate how high costs of cutting-edge purification technologies can constrain market growth. This is because, through reduced access for smaller companies and new entrants, the industry experiences a general constraint to growth in the area of ultrapure water.

Opportunities:

-

High investment in the R&D activities for ultrapure water

High investment in R&D activities is one of the major factors that will continue to fuel growth opportunities in the ultrapure water market, as it will act as an initiator for innovation and ultimately lead to developing advanced technologies in purification. For example, in May 2024, the multinational company Danaher Corporation announced a significant investment in research and development to improve its ultrapure water filtration systems. It's an investment in next-generation filtration technologies that will further drive efficiency and lower operating costs for industries needing high-purity water. On similar lines, in July 2024, the water treatment giant Pentair had broken ground for its new R&D lab in Singapore, which will spearhead breakthrough advancements in ultrapure water technology. Lab focus is on developing novel membranes and filtration techniques to help meet exacting demands of advanced semiconductor and pharmaceutical industries. Heavy investments in R&D work wonders not only in technological advances but also help in fashioning more cost-effective and efficient purification solutions, thereby certainly giving companies like Danaher and Pentair an edge over others in the ultrapure water market and raising their competitive advantage. This increasing focus on R&D drives home the fact that new technologies can fuel market growth and stay at par with changing requirements across various high-tech industries.

KEY MARKET SEGMENTS

By Equipment and Services

Filtration dominated the ultrapure water market in 2023, with an estimated share of about 55%. The dominance is due to the the fact that filtration plays a very critical role in achieving the highest levels of purity required by industries like semiconductors and pharmaceuticals. For instance, leading companies like Pall Corporation and Merck Group have reported increasing demand for advanced filtration systems due to high requirements from these cutting-edge industries. Pall Corporation says its newly developed high-efficiency filtration units, launched in early 2023, are being adopted in volume by leading semiconductor fabs to drive improvements in product quality and yield. Equally important, the innovations that Merck Group has made in filtration technologies have made a remarkable contribution to pharmaceutical manufacturing—areas in which required water quality impacts directly on the safety and efficacy of the drugs. This wide range of adoption underlines the fact that the segment has played a leading role in the market and has additionally served in guarding the integrity and performance of ultrapure water applications.

By Technology

In 2023, the Reverse Osmosis (RO) segment dominated the ultrapure water market and is projected to have a share of approximately 45%. This leading position stems from the fact that RO is able to rid a high number of contaminants and also attain very high purity levels required during semiconductor fabrication and pharmaceutical production. For instance, in March 2023, global water treatment company Dow Water & Process Solutions introduced a state-of-the-art RO membrane with significantly enhanced removal efficiency and reduced operational expenses, making it more favorable to the semiconductor manufacturers who need ultrapure water. Similarly, in August 2023, the France-based Veolia Water Technologies declared the commissioning of one of the most advanced RO systems at a flagship pharmaceutical facility in Switzerland, further raising the quality of water used for drugs based on stringent industry specifications. The rising adoption and continuous technology innovation in RO systems drive home the important role they play in serving the stringent demand of the ultrapure water market, thus cementing their lead in the technology segment.

By Treatment Process

The Polishing segment dominated and hold the largest share of the Ultrapure Water Market, at around 60% in 2023. This can be explained by the fact that polishing processes are indispensable to achieve the extremely high purification levels required for critical applications in industries such as semiconductor manufacturing and pharmaceuticals. Some of the key polishing treatments that follow primary pre-treatment and roughening stages are final-stage ion exchange and UV oxidation methods for the removal of residual impurities. For instance, in January 2023, Veolia Water Technologies and SUEZ Water Technologies & Solutions indicated higher investments made in polishing technologies to cater to advanced semiconductor fabs and pharmaceutical production facilities with stringent purity standards. It is in this regard that the polishing systems from Veolia, designed for semiconductor applications, have moved the benchmark in ultrapure water quality. Its counterpart, SUEZ, has also been contributing to polishing innovations for pharmaceutical processes, rendering them considerably more efficient in terms of productivity and compliance. This focus on polishing underlines its critical nature in delivering the final product with required purity, thus further establishing a leading position in the market.

By Application:

In 2023, the Process Feed segment dominated and hold around a 70% share of the Ultrapure Water Market. This can be accredited to the fact that ultrapure water plays a critical role as a process feed in various high-tech industries, such as semiconductors and pharmaceuticals, for ensuring the quality of products and efficiency during their respective production processes. For example, Intel Corporation, in April 2023, expanded Arizona semiconductor manufacturing facilities with the integration of cutting-edge ultrapure water systems for process feed applications as part of the production of high-performance microchips. In June 2023, Pfizer updated production lines at the North Carolina plant to ultrapure water use in process feeds, guaranteeing the highest standards in drug manufacturing and adhering to many rigidly controlled regulatory requirements. This high dependence on ultrapure water for process feed underlines the key role it plays in realizing the desired end-products of such complex and precision-driven production processes, hence further consolidating its lead in the market.

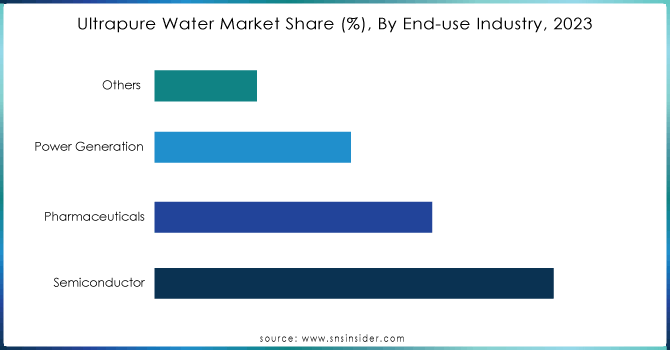

By End-use Industry:

In 2023, the semiconductors segment dominated capturing the largest market share of approximately 50% in the ultrapure water market. This could be attributed to the semiconductor industry being fully dependent on the use of ultrapure water as a necessary condition for the fabrication of integrated circuits and microchips. For example, in February 2023, TSMC (Taiwan Semiconductor Manufacturing Company) increased drastically its investment in ultrapure water systems for a new chip fabrication plant in Taiwan, further emphasizing the rising demand for high-purity water from high-end semiconductor manufacturing processes. Similarly, in July 2023, Samsung Electronics declared a significant upgrade to the water purification system of its semiconductor manufacturing facility in South Korea due to the stringent purity requirements used in the production of leading-edge semiconductor devices. This huge investment and reliance on ultrapure water by the leading semiconductor manufacturers will thus raise the importance of the category and the dominance in the ultrapure water market.

Get Customized Report as per your Business Requirement - Request For Customized Report

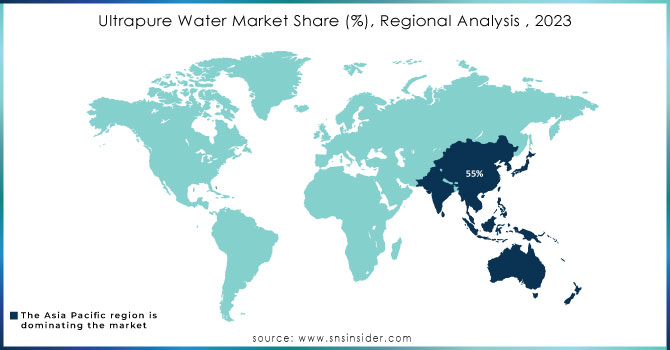

Regional Analysis

In 2023, the Asia-Pacific region dominated with a leading share of approximately 55% in the Ultrapure Water Market. One of the major drivers is the rapid growth in the high-tech industry; out of these, semiconductor manufacturing uses ultrapure water in huge quantities to assure accuracy and quality. For example, Taiwan and South Korea have emerged as the critical semiconductor production centers; the largest investments by leading companies like TSMC and Samsung Electronics in advanced ultrapure water systems are necessary to keep up with their increasing manufacturing capability. In March 2023, TSMC announced a substantial upgrade to its ultrapure water infrastructure in its Taiwan facilities to meet the increasing demands of its advanced chip production lines. Equally, in August 2023, Samsung Electronics fitted a new ultrapure water treatment system at its semiconductor plant in South Korea to try and raise purity levels for the next generation of microchips. The heavy investment and powerful demand for ultrapure water within these hi-tech centers both show the leading position taken by the Asia-Pacific region in this market. This clearly acts to the dominance of the region in the global technology supply chain and its contribution to overall ultrapure water sector growth.

Moreover, in 2023, North America was projected to be the fastest-growing region of the Ultrapure Water Market, accounting for a market share of approximately 25%. This is driven by huge investments in cutting-edge technology sectors and growing demand for high-quality water applications. The growth in the region was largely aided by the increasing semiconductor fabrication and pharmaceutical industries that make use of ultrapure water for their stringent quality specifications. For example, Intel Corporation announced in April 2023 the massive expansion of its semiconductor fabrication facilities in Arizona, citing integration with the latest ultrapure water systems as part of the setting up of state-of-the-art chip production lines. Another example is Pfizer's major upgrading of ultrapure water systems across its United States facilities back in September 2023 to boost the purity of waters for drugs in manufacture and also to meet very strict regulatory requirements. These investments underline the critical role North America has taken in developing technology and pharmaceuticals as industries driving high growth of the ultrapure water market within the region. Because it is a more consolidated effort at keeping high standards of water purity across various critical industries, it is quite explicable that North America will lead in terms of market growth, as this reflects a commitment to technological advancement and industry excellence.

Key Players

The major key players are Pall Corporation, Veolia, Evocus, Osmoflo, Ovivo, MANN+HUMMEL Water & Fluid Solutions, Pentair, Memstar USA, Kurita Water Industries Ltd., Synder Filtration, Inc., DuPont, Koch Separation Solutions, NX Filtration BV, Evoqua Water Technologies LLC.

Recent Developments

-

May 2024: Milli-Q Lab Water Solutions benchtop portfolio by Merck further expands, with solutions to meet ultrapure water requirements in every laboratory.

-

January 2024: Thermo Fisher Scientific introduced the Aquanex Ultrapure Water Purification System, with brilliant full-color touchscreen display, electronic data storage, automatic consumable identification, and digital liquid volume adjuster.

-

September 2023: LANXESS developed the UltraPure 1296 MD PLUS mixed-bed resin for semiconductor production, featuring extremely low metal content when compared to Lewatit UltraPure 1296 MD.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.8 Billion |

| Market Size by 2032 | US$ 18.2 Billion |

| CAGR | CAGR of 8.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment and Services (Filtration, Consumables/Aftermarket, and Others) • By Technology (Reverse Osmosis (RO), Ion Exchange, Ultrafiltration, Tank Vent filtration, Resin Trap filtration, Degasification, Electrode ionization, and Others) • By Treatment Process (Pre-Treatment, Roughening, and Polishing) • By End-use Industry (Semiconductor, Pharmaceuticals, Power Generation, and Others) • By Application (Washing Fluid and Process Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pall Corporation, Veolia, Evocus, Osmoflo, Ovivo, MANN+HUMMEL Water & Fluid Solutions, Pentair, Memstar USA, Kurita Water Industries Ltd., Synder Filtration, Inc., DuPont, Koch Separation Solutions, NX Filtration BV, Evoqua Water Technologies LLC. and other players |

| Key Drivers | •Growing adoption of ultrapure water in the nanoscience sector •The rapid adoption of desalination technology |

| RESTRAINTS | •High costs of purification technology hamper the growth of ultrapure water market |