Ultrasonic Electrosurgical Devices Market Report Size Analysis:

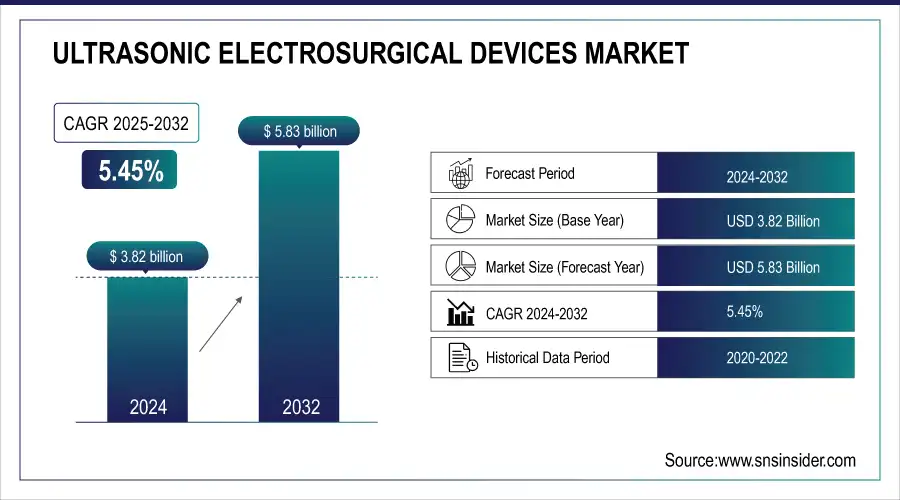

The Ultrasonic Electrosurgical Devices Market size was valued at USD 3.82 billion in 2024 and is expected to reach USD 5.83 billion by 2032, growing at a CAGR of 5.45% over the forecast period of 2025-2032.

The global ultrasonic electrosurgical market is projected to see significant progression on account of growing demand for minimally invasive surgeries, mounting prevalence of chronic diseases, and improvements in energy-based surgical devices. These technologies have become widely popular because of their accuracy, decreased operating time, limited thermal spread, and the rapid recovery of the patient. According to NIH-sponsored research, the use of ultrasonic surgical instruments in laparoscopic and robot-assisted surgery enhances clinical outcomes and operating room efficiency.

To Get more information on Ultrasonic Electrosurgical Devices Market - Request Free Sample Report

In 2024, Ethicon debuted a next-gen ultrasonic scalpel with adaptive tissue sensing, offering better precision and thermal safety in the ultrasonic electrosurgical space, expanding in the ultrasonic electrosurgical market share, and the bulk of the ultrasonic electrosurgical market analysis.

Surgeons use ultrasonic dissection instead of traditional techniques, e.g., in hysterectomy, thyroidectomy, or colorectal operations, referring to less blood loss and fewer complications. Favorable regulatory guidelines, such as the 510(k) pathway for general surgical devices by the FDA, also contributed to the growth of the ultrasonic electrosurgical market. Rapid growth in demand for ultrasonic electrosurgery devices is driven by heightened investments in healthcare infrastructure and growing expenditure on R&D activities, more so from ultrasonic electrosurgical systems providers such as Johnson & Johnson (Ethicon), Olympus, and Medtronic. In addition, favorable reimbursement policies in the U.S. ultrasonic electrosurgical market and increasing applications in gynecology and oncology are driving the adoption of these devices.

The U.S. Department of Health and Human Services recently announced that its federal investments in surgical devices grew to more than USD 4.3 billion for innovation and infrastructure, indicating the substantial government support in the global ultrasonic electrosurgical market.

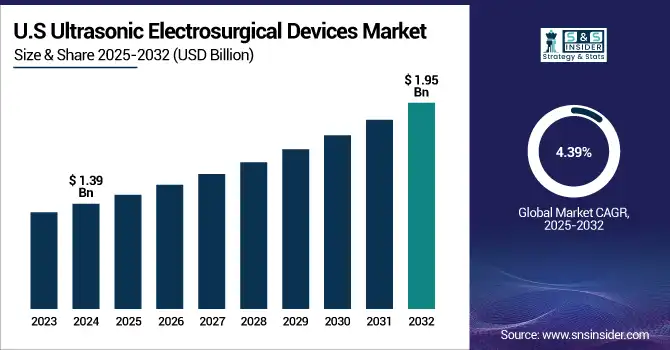

The U.S. ultrasonic electrosurgical devices market size was valued at USD 1.39 billion in 2024 and is expected to reach USD 1.95 billion by 2032, growing at a CAGR of 4.39% over the forecast period of 2025-2032.

Ultrasonic Electrosurgical Devices Market Dynamics:

Drivers:

-

Rising Surgical Demand, Technological Innovations, and Government Support Fuel the Market Expansion

Increasing preference for precision-based minimally invasive surgical procedures in oncology, gynecology, and GI applications is one of the most significant factors facilitating demand for the global ultrasonic electrosurgical device market. The U.S. has more than 15 million surgeries each year (ACS), and ultrasonic technology has grown in popularity, partially due to its impact on reducing intraoperative bleeding and thermal damage. With rising surgical volumes, there has been an increase in demand for modern electrosurgical instruments. The big ultrasonic electrosurgery companies, such as BOWA-electronic and Söring GmbH, have also launched significant research and development initiatives to develop high-frequency ultrasonic systems that offer more precise energy delivery and safer operation. In addition, the FDA has put forth expedited regulatory processes, such as revised technical guidance for ultrasonic devices, enabling more rapid approvals.

In July 2023, the FDA approved Innoblative for its Investigational Device Exemption (IDE) application, allowing clinical trials of its RF-based electrosurgical device designed for breast cancer treatment.

R&D investment is up as well, with companies such as Olympus reporting a 9.2% increase in R&D investment in 2023, with a particular focus on surgical innovations. Moreover, public health institutions like CMS and NIH are spending more money on surgical improvement and hospital improvements as well, which will, in turn, drive the growth of the market. Strategic partnerships, including Medtronic’s tie-ups with shoeless surgery robotics players, are driving technology convergence in this space run by tasselled loafers. Pushing the market towards wider acceptance are several factors that have integrated technology into the realm of clinical needs and parameters that will foster the ultrasonic electrosurgical market growth.

Restraints:

-

High Costs, Regulatory Barriers, and Limited Access in Low-Resource Settings Impede the Market Growth

A significant limitation is the high initial cost of the device, which restricts accessibility among low-income and underfunded health care systems. But procuring these devices has been a problem in public hospitals, as both harmonic scalpels and ultrasonic dissectors sell at 40% over conventional electrocautery units. There is also substantial regulation, and although the FDA offers a 510(k) clearance route for novel variants, it still requires extensive safety and effectiveness data, which slows time-to-market.

In the EU, market compliance becomes expensive for small players who need a clinical evaluation report that complies with the Medical Device Regulation (MDR). Furthermore, the global disruptions in the supply chain during the COVID-19 pandemic led to a lack of products, with operational backlogs in hospital inventories. Furthermore, in emerging markets, there is also a shortage of trained professionals in ultrasonic electrosurgery, which affects the utilization of the device. More than half the hospitals in low-resource settings continue to use traditional surgical techniques because of shortages of trained personnel and infrastructure, World Health Organization statistics show. All this collectively makes it a challenge for broad ultrasonic electrosurgical devices market analysis, limiting penetration and long-term scalability, albeit increasing demand.

Ultrasonic Electrosurgical Devices Market Segmentation Analysis:

By Type

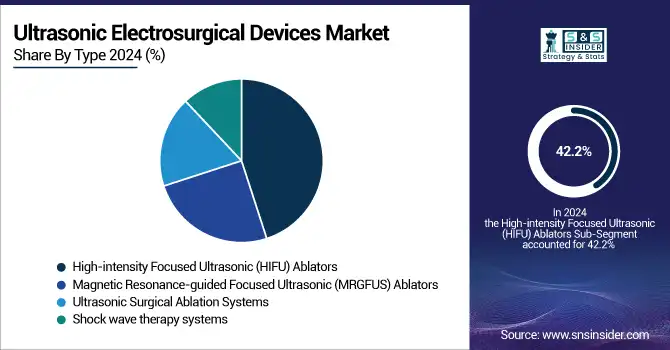

The high-intensity focused ultrasonic (HIFU) ablators segment dominated the market with a share of 42.2% in 2024, as they are widely used in non-invasive tumor ablation and cardiology, and oncology targeted therapy. Their capacity to focus energy within tissue and spare the surrounding areas has resulted in them becoming the technique of choice for clinicians.

The ultrasonic surgical ablation systems segment is projected to register the highest CAGR during the forecast period, primarily due to its increased adoption in minimally invasive procedures, such as laparoscopy and robot-assisted surgery. Advanced tissue dissection and coagulation abilities are making these systems essential for complex surgery, gynecology, and general surgery.

By Product

Ultrasonic electrosurgical consumables led the market in terms of revenue and ultrasonic electrosurgical devices market share in 2024, as a result of the high-volume utilization of blades, shears, and handpieces, which need to be replaced regularly. The need for these instruments in both simple and complicated surgical cases leads to consistent revenue for hospitals and manufacturers.

However, the ultrasonic electrosurgical generator segment is anticipated to grow at the highest CAGR owing to the increasing number of installations of advanced energy platforms in operating rooms. The growing need for multifunctional generators offering real-time feedback and control across surgeries is driving the penetration of this category.

By Application

Cardiology held the largest market share in 2024, accounting for 36.4%, due to the rising utilization of ultrasonics in electrosurgical procedures for atrial fibrillation ablation and vascular repair. Such devices facilitate accurate coagulation and limited bleeding, which are important in sensitive heart surgeries.

Gynecology is expected to register the fastest growth, as ultrasonics are rapidly being used in myomectomy and hysterectomy. Given the benefits in reducing uterine trauma and decreasing recovery time, there is a rapid uptake of such devices for women's health procedures.

By End-Use

Hospitals led the market in 2024 with a share of 56.5% owing to the high volume of surgeries, higher purchasing capability, as well as adoption of advanced surgical instruments. Their availability of skilled surgeons and developed infrastructure has led to them emerging as the key recipients who use ultrasonic electrosurgical systems.

On the other hand, ambulatory surgical centers (ASCs) are projected to be the fastest-growing end-use segment on account of the rising adoption of minimally invasive surgeries in ambulatory settings. Increased cost-effectiveness, reduced patient lengths of stay, and faster turnaround times are driving investment and increasing the use of portable, user-friendly ultrasonic systems in the ASC setting.

Regional Analysis:

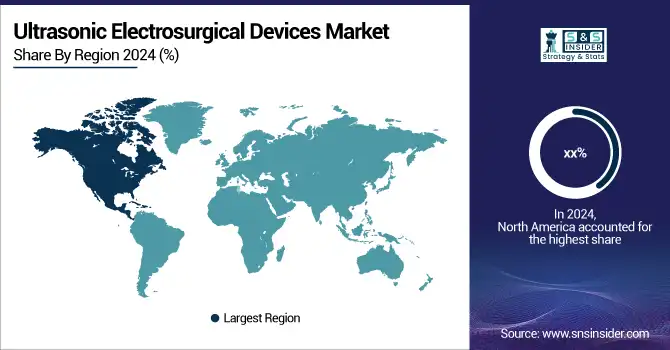

The North American region held the largest share of the global ultrasonic electrosurgical market in 2024, owing to the well-established healthcare system, increasing number of surgical procedures, and high R&D expenditure.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. is the largest contributor to this superiority due to its early acceptance of surgical techniques and a large number of prominent companies, such as Ethicon (Johnson & Johnson) and Medtronic. The U.S. alone held a market share of more than 68% of North America in 2024, and was driven by increasing demand for minimally invasive surgeries and regular FDA approvals. In Canada, adoption is also increasing thanks to growing investments in surgical care infrastructure. At the same time, Mexico is growing because of medical tourism and growing levels of public-private investment in health, although at a lower rate than the U.S.

Europe was the second-largest regional market for ultrasonic electrosurgical devices in 2024, owing to growing government-funded healthcare programs, increasing volume of surgical procedures, and government support for the same. Germany is at the forefront in the region with an advanced medical device industry and the presence of a high number of hospitals, which account for approximately 24% of the market share in Europe. New entrants, such as BOWA-electronic GmbH and Erbe Elektromedizin AG, also strengthen their market position. Other important markets are the U.K. and France, provided with strong public health care systems and an increasing use of ultrasonic instruments. Poland and Spain experience a great demand due to infrastructure modernization and increasing awareness. The highest growth market in Europe is Italy, with increasing investments in surgical centres and new reimbursement models.

The ultrasonic electrosurgical market in Asia Pacific is growing at the highest CAGR due to the rapidly growing healthcare infrastructure, rising number of surgical procedures, and the growing medical tourism in the region. China is the largest market by value across all APAC countries, through increasing government expenditures on healthcare and local manufacturing expansion, which combined represent approximately 31% of the APAC market size in 2024. India is the fastest-growing nation in the region, driven by the growth of private hospitals, government initiatives, and the increasing prevalence of chronic diseases that necessitate surgery. Japan, meanwhile, invests in high-tech surgical devices for its aging citizens. South Korea and Singapore are seeing moderate growth, underpinned by advanced healthcare technologies.

The LAMEA market is growing at a consistent pace, which is due to the increase in healthcare provision and awareness about minimally invasive surgical treatment. The Latin America bariatric surgery devices sector is dominated by Brazil as a result of growing investment in hospital facilities, coupled with a surging number of bariatric and general surgeries, covering 45% of the regional market. South Africa and the UAE are the major contributors to MEA owing to government initiatives and increasing private healthcare sectors. The market in Saudi Arabia is growing steadily, particularly with the increasing demand for gynecological and urological use. Qatar is the fastest-growing country in LAMEA owing to high per capita healthcare spending and increasing acceptance of state-of-the-art surgical technologies.

Ultrasonic Electrosurgical Devices Market Key Players:

Leading ultrasonic electrosurgical companies operating in the market include Ethicon Endo-Surgery, Olympus Corporation, Medtronic, Misonix Inc., BOWA-electronic GmbH, Söring GmbH, Advanced Instrumentations, Reach Surgical, ITALIA MEDICA SRL, SonaCare Medical, and Miconvey.

Recent Developments in the Ultrasonic Electrosurgical Devices Market:

-

In April 2024, Johnson & Johnson MedTech launched the Dualto electrosurgical generator, enhancing integration with advanced energy systems to support efficiency and precision across surgical procedures.

-

In April 2024, Johnson & Johnson’s Ottava program progressed alongside the Dualto launch, reinforcing the company’s commitment to innovation in electrosurgical platforms and robotic-assisted surgery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.82 Billion |

| Market Size by 2032 | USD 5.83 Billion |

| CAGR | CAGR of 5.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Generators, Consumables) By Type (High-Intensity Focused Ultrasonic (HIFU) Ablators, Magnetic Resonance-guided Focused Ultrasonic (MRGFUS) Ablators, Ultrasonic Surgical Ablation Systems, and Shock wave therapy systems) • By Application (Cardiology, Gynecology, General Surgery, Urology, Bariatric Surgery, and Others) • By End-Use (Hospitals, Ambulatory Surgical Centers, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ethicon Endo-Surgery, Olympus Corporation, Medtronic, Misonix Inc., BOWA-electronic GmbH, Söring GmbH, Advanced Instrumentations, Reach Surgical, ITALIA MEDICA SRL, SonaCare Medical, and Miconvey. |