Animal Parasiticides Market Overview:

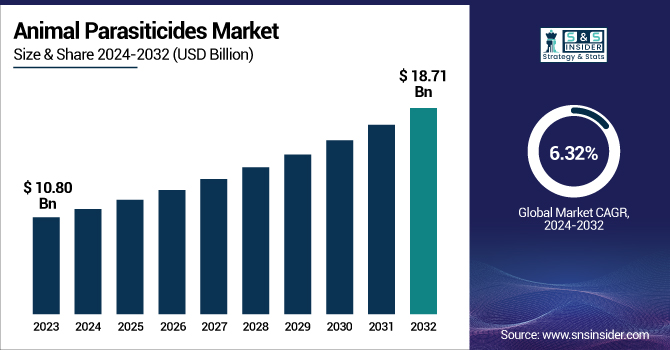

The Animal Parasiticides Market was valued at USD 10.80 billion in 2023 and is expected to reach USD 18.71 billion by 2032, growing at a CAGR of 6.32% during the forecast period of 2024-2032.

To Get more information on Animal Parasiticides Market - Request Free Sample Report

The report offers comprehensive statistical insights into the Animal Parasiticides Market, focusing on unique factors such as the incidence and prevalence of parasitic infections across different regions and animal categories. It provides regional prescription trends, analyzing veterinary recommendations and consumer preferences for various parasiticide formulations. Additionally, the study presents parasiticide volume consumption trends, detailing historical and projected demand across livestock and companion animals. A crucial aspect includes veterinary healthcare spending analysis, breaking down expenditures by government, commercial, private, and out-of-pocket sectors. These insights deliver a data-driven perspective, enabling stakeholders to understand market trends beyond traditional growth drivers.

U.S. Animal Parasiticides Market Size & Forecast

The U.S. Animal Parasiticides Market was valued at USD 1.88 billion in 2023 and is expected to reach USD 3.34 billion by 2032, at a CAGR of 6.32% from 2024 to 2032.

Animal Parasiticides Market Dynamics

Drivers

-

The increasing incidence of parasitic infections in companion and livestock animals is one of the most prominent drivers of the animal parasiticides market.

The World Organisation for Animal Health (WOAH) indicates that parasitic diseases like flea infestations, heartworms, and gastrointestinal nematodes remain a serious threat to animal health and result in enormous economic losses in livestock production. The necessity of efficient parasitic control has accelerated the use of antiparasitic drugs and therapies. On recent advancements, Zoetis broadened its Simparica Trio product lineup, which treats a wider category of parasites among companion animals. Elanco Animal Health is also working on developing Credelio Quattro, which guards against a large range of internal and external parasites. With increasing cognizance in pet owners as well as in veterinarians, the need for sophisticated parasiticides is rapidly increasing, pushing market growth upward.

-

Growing global pet ownership as well as expenditure on veterinary practice is driving market growth for animal parasiticides.

Pet ownership has also increased dramatically, as stated by the American Pet Products Association (APPA), with more than 66% of U.S. homes having pets in 2023. Pet healthcare spending has also risen, with preventive care, such as antiparasitic therapy, being increasingly spent on by owners. The same is observed in emerging markets, where growing disposable incomes are leading to more pet care expenses. Industry developments recently include the move by Merck Animal Health to expand its product line for its Bravecto for additional flea and tick control, as well as an investment by Ceva Santé Animale in emerging ectoparasiticides. With the continuation of pet humanization and rises in veterinary consultations, the demand for effective parasiticides should increase, backing market growth.

Restraint

-

The animal parasiticides market is also beset by the major challenge of strict regulatory needs and lengthy product approval times.

The regulatory agencies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other local health authorities mandate tight regulations regarding the safety, effectiveness, and environmental sustainability of parasiticides before they can be sold. These rules usually create lengthy approval times and added expense for producers, which restrains the entrance of new products in the marketplace. Moreover, worries about drug resistance and unintended effects in animals have led regulators to impose even tougher testing and post-market monitoring. Recent developments in the industry, like more stringent EU limits on residues of antiparasitic drugs in food animals, have contributed further to burdens of compliance and may hinder market growth.

Opportunities

-

Innovative parasiticides, such as long-acting injectables, oral chewables, and combination products, are a big market growth opportunity.

Manufacturers are looking to enhance product efficacy, convenience, and safety through new formulations of drugs that provide longer protection against parasites with fewer administration occasions. For example, recent technology in isoxazoline-based treatments has shown strong efficacy in flea and tick control for longer durations. Furthermore, increased demand for natural and organic parasiticides, especially in the companion animal market, is spurring research on plant-based and nonchemical solutions. As regulatory bodies urge the creation of safer and greener solutions, firms that are investing in new technologies will benefit from a competitive advantage. These new technologies not only enhance the efficacy of treatment but also promote compliance among pet owners and livestock, further fueling market growth.

Challenges

-

One of the biggest issues in the animal parasiticides market is the growing resistance of parasites to traditional medication.

Repeated exposure to the same active substances has developed drug resistance among fleas, ticks, and gastrointestinal parasites, making popular treatments less effective. This has been seen in both livestock and pets, where parasites have developed resistance to regular chemical treatments. To counter this, producers have to spend significantly on R&D to create next-generation parasiticides, which is time and money-consuming. Additionally, regulatory authorities are imposing tighter guidelines on the use of antiparasitic drugs to avoid excessive usage and further resistance building. As long as resistance keeps growing, veterinarians and livestock producers will find it difficult to choose from effective treatments, putting market growth in serious jeopardy.

Animal Parasiticides Market Segmentation Analysis

By Product Type

The Ectoparasiticides segment dominated the animal parasiticides market with a 43.26% market share in 2023, owing to the widespread occurrence of external parasites like fleas, ticks, lice, and mites infesting companion and livestock animals. Apart from bringing irritation and discomfort, the parasites also spread serious diseases like Lyme disease, anaplasmosis, and babesiosis; thus, parasite control is a vital element in animal health management. The extensive use of ectoparasiticides in the spot-on treatment, sprays, collars, and dips format helped them dominate the market. Growing pet adoptions and the surge in demand for over-the-counter and veterinarian-prescribed flea and tick control medicines enhanced market growth. The longer duration of action among formulations, combination therapy, and user-friendly application products, like chewables and topical applications, also enhanced segment growth. Growth in e-commerce websites dealing with pet care products was another key factor in boosting sales, thus making Ectoparasiticides the most prominent segment in 2023.

By Animal Type

The Livestock segment dominated the animal parasiticides market in 2023 because parasitic infections have a significant economic burden on the world's livestock industry. Sheep, cattle, poultry, and swine are the most vulnerable to internal and external parasites, and they can result in decreased weight gain, diminished milk production, compromised reproductive efficiency, and increased mortality. The increasing need for meat, milk, and other livestock products has compelled farmers and commercial producers to spend a lot of money on parasite control practices to maintain animal health and achieve high productivity. Moreover, government policies and regulations that support animal health and food safety have also encouraged the universal use of parasiticides in livestock production. The growth of large-scale commercial farms and the increasing occurrence of anthelmintic resistance among parasites have also supported the demand for effective parasiticides. Consequently, the Livestock segment was the leading segment in 2023.

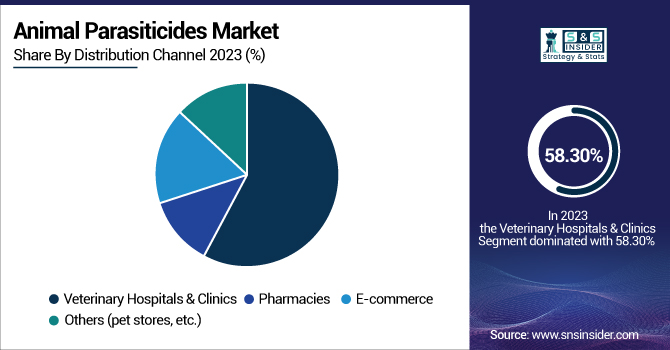

By Distribution Channel

The Veterinary Hospitals & Clinics segment dominated the animal parasiticides market with around 58.30% market share in 2023 because of the general preference for professional veterinary care in diagnosing and treating parasitic infections among animals. Veterinary hospitals and clinics are the main healthcare providers of livestock and companion animals, making sure that accurate prescriptions and appropriate administration of parasiticides are done. Increasingly, pet owners and livestock farmers are turning to veterinarians for preventive care, regular check-ups, and parasite control measures that work, enhancing the demand for parasiticides through this source. Regulatory controls and the prescription-only availability of select antiparasitic agents have maintained the market dominance of veterinary clinics and hospitals as the most reliable and regulated channel. The presence of sophisticated laboratory equipment, specialized care, and personalized parasite control programs in veterinary clinics has further entrenched them as the market leader segment.

Animal Parasiticides Market Regional Insights

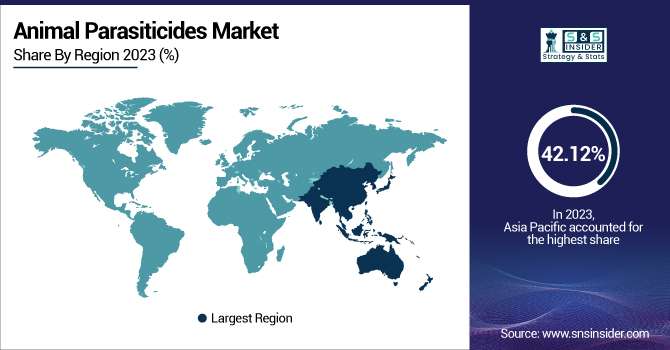

Asia Pacific dominated the animal parasiticides market with around 42.12% market share in 2023, given its huge population of livestock, growing pet adoption, and improved awareness about animal healthcare. Australia, China, and India lead the demand for parasiticides because of the high rate of parasitic infections in cattle, poultry, and companion animals. Government support for veterinary care, in addition to the growing livestock farming for meat and dairy purposes, is also fueling market growth. Also, the increasing middle-class population and disposable income of the region have resulted in heavy spending on pet care and veterinary treatment. The fact that major pharmaceutical firms are investing heavily in the research and development of novel parasiticides also assists the region in being at the forefront of the market.

North America is witnessing significant growth in the animal parasiticides market with 6.60% CAGR throughout the forecast period because of its robust regulatory environment, high incidence of pet ownership, and technological progress in veterinary healthcare. The U.S. and Canada both possess well-developed veterinary infrastructures, and thus, early adoption of new parasiticides like long-acting products and combination therapies has occurred. The growing emphasis on pet health and preventive care, underpinned by growing pet insurance coverage, has driven demand for efficient parasite control products. The region is also home to strong representation from top pharma players such as Zoetis, Elanco, and Merck Animal Health, which stimulates ongoing product development. The development of online veterinary pharmacies and e-commerce channels has also increased the availability of parasiticides for pet owners, thus driving the market further in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Animal Parasiticides Market

-

Boehringer Ingelheim (NexGard, Ivomec)

-

Zoetis Inc. (Revolution, Simparica)

-

Elanco Animal Health (Interceptor Plus, Credelio)

-

Merck Animal Health (Bravecto, Panacur)

-

Bayer Animal Health (Advantage, Seresto)

-

Ceva Santé Animale (Vectra 3D, Milbemax)

-

Virbac (Effitix, Iverhart Max)

-

Vetoquinol (Drontal, Clomicalm)

-

Norbrook Laboratories (Eprizero, Paramectin)

-

Dechra Pharmaceuticals (Methimazole, Selgian)

-

KRKA (Fypryst, Milprazon)

-

Phibro Animal Health Corporation (Aviax, Stafac)

-

SeQuent Scientific Ltd. (Fiprosit, Endex)

-

Neogen Corporation (StandGuard, Prozap)

-

Huvepharma (Tilmovet, Monovet)

-

Bimeda Inc. (Bimectin, Equimax)

-

Ourofino Saúde Animal (Biocid, Master LP)

-

Zydus Animal Health (Anashield, Vermiplex)

-

HIPRA (EVALON, Suiseng)

-

Ceva-Brovel (Brovatol, PetArmor)

Suppliers (These suppliers commonly provide key raw materials, active pharmaceutical ingredients (APIs), and chemical excipients essential for manufacturing animal parasiticides.) in Animal Parasiticides Market

-

BASF SE

-

Lonza Group

-

Solvay S.A.

-

Dow Inc.

-

Eastman Chemical Company

-

Merck KGaA

-

Evonik Industries AG

-

Ashland Global Holdings Inc.

-

Croda International Plc

-

Clariant AG

Recent Developments

-

In June 2024, Zoetis Inc. published its 2023 Sustainability Report, "Advancing Sustainability in Animal Health for a Better Future," highlighting the company's journey toward its Driven to Care long-term sustainability objectives. The report also includes updates on environmental, social, and governance (ESG) efforts.

-

August 2024 – Elanco Animal Health is looking forward to a robust market differentiation for Credelio Quattro and pursuing regulatory approval for additional indications, including fleas, ticks, heartworms, and internal parasites such as tapeworms. Concurrent with the approvals process, the company is completing its scale-up of production, positioning for a best-in-class launch in the first quarter of 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.80 billion |

| Market Size by 2032 | US$ 18.71 billion |

| CAGR | CAGR of 6.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ectoparasiticides, Endoparasiticides, Endectocides) • By Animal Type (Companion, Livestock) • By Distribution Channel (Veterinary Hospitals & Clinics, Pharmacies, E-commerce, Others [pet stores, etc.]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boehringer Ingelheim, Zoetis Inc., Elanco Animal Health, Merck Animal Health, Bayer Animal Health, Ceva Santé Animale, Virbac, Vetoquinol, Norbrook Laboratories, Dechra Pharmaceuticals, KRKA, Phibro Animal Health Corporation, SeQuent Scientific Ltd., Neogen Corporation, Huvepharma, Bimeda Inc., Ourofino Saúde Animal, Zydus Animal Health, HIPRA, Ceva-Brovel, and other players. |