Type 2 Diabetes Market Size & Trends:

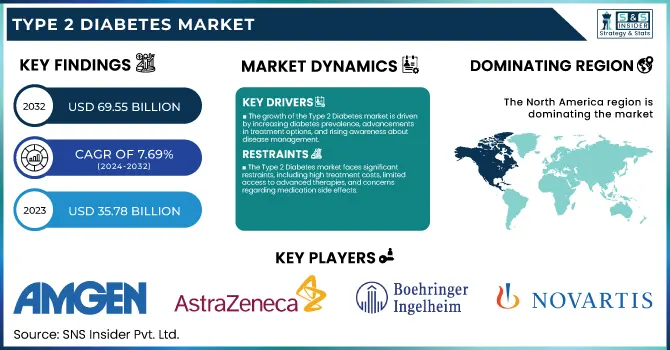

The Type 2 Diabetes Market size was estimated at USD 35.78 billion in 2023 and is projected to reach USD 69.55 billion by 2032 and grow at a CAGR of 7.69% over the forecast period 2024-2032.

This report emphasizes the prevalence and incidence of type 2 diabetes, focusing on regional discrepancies and increasing global disease burden. The research reflects prescription trends, highlighting the uptake of insulin and non-insulin therapy, as well as new treatment breakthroughs. It also delves into the expanding use of diabetes management through medical devices like continuous glucose monitors and insulin pumps and their potential to enhance patient outcomes. The report also examines disease progression and complications, discussing how early intervention and lifestyle change affect long-term health. Additionally, it evaluates the most recent clinical trials and pipeline advancements, with a focus on new drug formulations and customized treatment strategies. Patient awareness and lifestyle trends are also examined, with the increased demand for digital health solutions, dietary management programs, and prevention care strategies noted.

To Get more information on Type 2 Diabetes Market - Request Free Sample Report

Type 2 Diabetes Market Dynamics

Drivers

-

The growth of the Type 2 Diabetes market is driven by increasing diabetes prevalence, advancements in treatment options, and rising awareness about disease management.

As per the International Diabetes Federation (IDF), 537 million adults had diabetes in 2021, and this is projected to increase considerably. The use of new drug classes like GLP-1 receptor agonists (e.g., Ozempic) and SGLT2 inhibitors (e.g., Jardiance) has revolutionized treatment outcomes by providing benefits beyond glucose control, such as cardiovascular and renal protection. Moreover, advances in continuous glucose monitoring (CGM) systems and insulin delivery devices have improved patient compliance and glycemic control. The rising trend of obesity—a significant risk factor for Type 2 Diabetes—has also driven demand further, with more than 1 billion individuals globally designated as obese. Government and private programs, including the CDC's National Diabetes Prevention Program (DPP), are designed to enhance early detection and disease management. The increasing uptake of telemedicine and digital health technologies has also driven market growth by enhancing patient access to diabetes treatment, particularly in underserved communities. The ongoing R&D activities for new therapeutics, such as dual agonists and stem cell therapy, also favor the long-term growth of the market.

Restraints

-

The Type 2 Diabetes market faces significant restraints, including high treatment costs, limited access to advanced therapies, and concerns regarding medication side effects.

The expense of GLP-1 receptor agonists, like Ozempic and Trulicity, is prohibitive to most patients without full insurance coverage. The price of insulin has also been an issue, with research indicating that more than 25% of insulin users in the United States ration their medication because of the cost. Also, side effects of newer diabetes drugs, including gastrointestinal distress, ketoacidosis (SGLT2 inhibitors), and pancreatitis (GLP-1 agonists), restrict patient compliance. Patient unwillingness to use injectable therapies is another significant restraint, causing delayed switching to insulin or GLP-1 receptor agonists. Regulatory barriers also affect the market, as rigorous FDA and EMA approval procedures slow the introduction of new drugs. Additionally, ignorance and early diagnosis in most poor areas limit timely access to therapy, resulting in increased levels of associated complications like diabetic neuropathy and kidney disease. These issues provide barriers to maximum diabetes control and influence total market growth.

Opportunities

-

The development of personalized medicine, the expansion of digital diabetes management solutions, and increasing biosimilar adoption.

Personalized medicine, fueled by genetic studies and AI-driven predictive analytics, enables tailored treatment strategies based on unique patient profiles. This has enabled innovation such as dual GLP-1/GIP receptor agonists (e.g., Tirzepatide), which have demonstrated superior efficacy over current therapies. Increasing adoption of digital health technologies, including CGMs, AI-driven insulin dose advisors, and telemedicine platforms, offers a potential for enhancing real-time glucose monitoring and medication compliance. The launch of oral semaglutide (Rybelsus) provides a needle-free option, appealing to patients who are resistant to injectables. The expanding biosimilars market is also a significant opportunity, with biosimilar insulins such as Semglee providing affordable substitutes for high-priced branded insulins. Moreover, rising government interest in diabetes prevention programs and lifestyle interventions, including the WHO's Global Diabetes Compact, is fueling awareness and early diagnosis, creating new opportunities for preventive care. Increased use of AI in drug discovery even makes next-generation diabetes drugs emerge faster, securing market growth over the long term.

Challenges

-

low adherence to long-term treatment, lack of patient education, and the growing burden of diabetes complications.

Research indicates that more than 50% of diabetic patients do not follow recommended medications because of cost, adverse effects, and complicated dosing schedules. Despite the efficacy of available treatments, lack of disease progression awareness by patients results in delayed interventions and increased rates of complications. Diabetes-related complications like diabetic neuropathy, cardiovascular illnesses, and kidney failure are responsible for the growing burden on health systems, accelerating hospitalization and mortality. Yet another important challenge is physician resistance to the use of newer therapies, with most medical practitioners continuing to use older, more hypoglycemic-prone agents such as sulfonylureas. Even more significant issues are health disparities and unequal access to care, particularly in lower-income groups where patients may be without insurance or have to wait for extended periods for specialist evaluation. The increasing incidence of drug resistance, especially to insulin and oral antidiabetics, adds to the complexity of disease management. These issues can be addressed by improving patient education, access to low-cost therapies, and creation of less complicated yet more efficient treatment regimens.

Type 2 Diabetes Market Segmentation Insights

By Drug Class

In 2023, the segment of insulin had the largest market share in the Type 2 Diabetes market with 32.5% share of the overall revenue. It is because there is a strong prevalence of patients who are dependent on insulin, higher use of basal and ultra-rapid insulin, and increasing uncontrolled burden of diabetes due to insulin treatment. Furthermore, the improvement in insulin delivery equipment like smart insulin pens and insulin pumps has facilitated patient compliance more, leading the market growth forward.

The segment of SGLT2 inhibitors is the most rapidly growing, with growth fueled by growing use of oral antidiabetic drugs that provide cardiovascular and renal protection on top of glucose control. Doctors are now more frequently prescribing SGLT2 inhibitors because of their effectiveness in lowering the risk of heart failure and kidney disease in Type 2 Diabetes patients.

By Route of Administration

Oral segment generated the highest revenue contribution of 55.4% in 2023 owing to the prevalence of first-line oral antidiabetic drugs like metformin, SGLT2 inhibitors, and DPP-4 inhibitors. Patient preference is influenced by convenience, ease of use, and lesser requirements for injections leading to it being the most preferred mode of therapy for Type 2 Diabetes management.

The subcutaneous route is the most rapidly growing, since it is used more and more with GLP-1 receptor agonists and insulin therapy. Increasing demand for GLP-1 receptor agonists, which have substantial weight reduction advantages in addition to control of blood glucose, has led to this growth. The development of long-acting injectable products has enhanced patient compliance, leading to increased market growth as well.

By Distribution Channel

The retail pharmacies segment led the market with a 70.3% revenue share in 2023, as retail pharmacies are still the most convenient point of purchase for diabetes drugs. Most patients use retail pharmacies because they are convenient, have prescription refills, and pharmacist consultation services, especially in developed markets with established pharmacy networks.

The fastest-growing segment is the online and specialty pharmacies segment, driven by the growing trend toward digital health, mail-ordering prescriptions, and distribution of specialty drugs. Telemedicine and online pharmacy platforms have made it convenient for patients to obtain diabetes drugs, especially in remote locations, sustaining the growth of this segment.

Type 2 Diabetes Market Regional Analysis

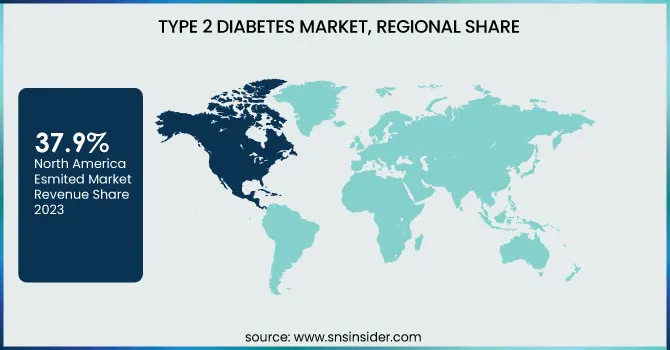

North America led the Type 2 Diabetes market in 2023 with a revenue share of 37.9%, fueled by the prevalence of diabetes, developed healthcare infrastructure, and high uptake of cutting-edge therapy solutions. The region is aided by high availability of insulin therapies, GLP-1 receptor agonists, and SGLT2 inhibitors due to positive reimbursement policies. Availability of prominent pharmaceutical players, research being carried out, and government policies focusing on awareness generation and early diagnosis of diabetes are also among the factors boosting the market's growth. Also, the rising usage of digital health solutions, such as continuous glucose monitoring systems and telemedicine-based diabetes management, has boosted the position of North America in the market.

The Asia-Pacific market is the region with the fastest growth rate, fueled by increasing prevalence of diabetes, improving healthcare spending, and rising awareness about advanced treatments. China and India are witnessing a swift increase in the incidence of Type 2 Diabetes because of changing lifestyles, urbanization, and eating habits. The growing population of the middle class and enhancing access to healthcare centers are further driving market growth. Moreover, the increasing usage of affordable generic medicines, diabetes management programs sponsored by the government, and rising demand for oral anti-diabetic drugs are supporting the region's high growth rate. The movement towards online pharmacies and digital healthcare is also serving to open up market access in Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Type 2 Diabetes Market

-

Amgen Inc.

-

AstraZeneca PLC – Farxiga, Xigduo XR, Bydureon

-

Boehringer Ingelheim International GmbH – Jardiance, Glyxambi

-

Daiichi Sankyo Co. Ltd – Nesina, Kazano

-

Eli Lilly and Co. – Jardiance, Trulicity, Efsitora (experimental)

-

Merck & Co. Inc – Januvia, Steglatro

-

Novartis AG – Galvus, Galvusmet

-

Novo Nordisk AS – NovoLog, Levemir, Tresiba, Fiasp, Ozempic, Rybelsus

-

Sanofi SA – Lantus, Toujeo, Apidra, Soliqua

-

Takeda Pharmaceutical Co. Ltd – Actos, Nesina, Kazano

Recent Developments

-

In March 2025, Sun Pharmaceutical announced its plans to launch Utreglutide, an experimental anti-obesity and Type 2 Diabetes drug, within the next four to five years, according to Managing Director Dilip Shanghvi. The company joined other Indian drugmakers in targeting the booming USD 150 billion weight-loss drug market expected by the end of the decade.

-

In Feb 2025, Tandem Diabetes Care received FDA clearance for its Control-IQ+ automated insulin delivery (AID) technology for Type 2 Diabetes in adults (18+ years). Previously approved for Type 1 Diabetes, the updated algorithm accommodates expanded weight and insulin ranges. The U.S. launch is expected in March 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.78 billion |

| Market Size by 2032 | USD 69.55 billion |

| CAGR | CAGR of 7.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class [Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, Others] • By Route of Administration [Oral, Subcutaneous, Intravenous] • By Distribution Channel [Retail Pharmacies, Hospital Pharmacies, Other] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Karl Storz, Boston Scientific Corporation, Olympus America, Endo Pharmaceuticals Inc., biolitec AG, Medifocus, Cook Medical, Teleflex Incorporated, Urotronic, Coloplast Corp, Richard Wolf GmbH, PROCEPT BioRobotics Corporation. |